These charges are a result of transactions made at Valvoline Instant Oil Change centers.They cover various car services such as oil changes and inspections. These charges are essential for maintaining your vehicle’s health and performance.

Amidst the sea of transactions, there lies a discreet charge, quietly marking a moment of care for your beloved vehicle.A mere blip on your statement, yet it speaks volumes about your commitment to its well-being.

When you check your credit card statement, you might spot charges from Valvoline Instant Oil Change (VIOC).These charges signify payments for services like oil changes and vehicle inspections at Valvoline outlets.They’re a straightforward indication of the maintenance tasks your vehicle has undergone at VIOC centers

What is the VIOC Charge?

At the end of each month, you may notice a mysterious charge on your bank statement. This charge, often abbreviated as “VIOC,” signifies a transaction related to your vehicle’s maintenance. It’s not just about paying a bill; it’s about ensuring your car runs smoothly.

You might be puzzled by the unfamiliar abbreviation on your financial statement. However, this charge isn’t just random; it’s directly tied to the health of your vehicle. Every time you see “VIOC” on your bank statement, it represents a commitment to keeping your car in top condition.

When you see “VIOC” listed on your bank statement, it’s not just another expense. It’s a reminder of the essential upkeep your vehicle requires. From oil changes to routine inspections, each charge reflects an investment in your car’s longevity and performance.

How VIOC Charges Appear on Bank Statements?

Spotting unfamiliar transactions on your bank statement can cause confusion. But understanding how VIOC charges appear offers clarity. It’s about decoding financial statements effortlessly.

Bank statements often contain cryptic abbreviations and descriptors. But grasping how VIOC charges manifest simplifies the process.It’s all about demystifying financial jargon.

Deciphering bank statements sometimes feels like solving a puzzle.Yet, comprehending how VIOC charges materialize provides insight.It’s akin to unraveling a mystery within your finances.

dentifying Legitimate vs Fraudulent Charges

Dentifying Legitimate

- Detecting legitimate charges on your credit card statement is crucial for financial security.

- Ensuring the authenticity of charges safeguards against fraudulent activity.

- By scrutinizing transaction details, you can confidently distinguish between legitimate and unauthorized charges.

- Legitimate charges reflect your spending patterns and align with your purchasing history.

- They include detailed merchant information, making them easily recognizable.

- Reporting any discrepancies promptly to your bank helps mitigate financial risks associated with unauthorized charges.

Fraudulent Charges

- Don’t fall victim to fraudulent activity lurking in your bank transactions.

- Shield yourself from financial harm with vigilance against unauthorized charges.

- Uncover the truth behind suspicious transactions hitting your account.

- Safeguard your hard-earned money from deceitful schemes and scams.

- Stay vigilant to protect your financial well-being and peace of mind.

- Take control of your finances by scrutinizing every line item on your statement.

- Act swiftly to dispute any unauthorized charges and prevent further losses.

- Empower yourself against fraudsters by staying informed and proactive.

What is Jiffy Lube?

Step into Jiffy Lube. With over 2,000 locations nationwide, Jiffy Lube offers fast and efficient service. Keep your vehicle running smoothly with Jiffy Lube’s expert care.

Jiffy Lube is your go-to for automotive convenience.Offering a range of services beyond oil changes, they ensure your car stays in top condition.Trust Jiffy Lube for all your car care needs.

When it comes to your car, trust the experts at Jiffy Lube. With their signature quick lube service, they provide efficient maintenance solutions. Experience the ease and reliability of Jiffy Lube today.

Well, the name stems from its roots – Valvoline Instant Oil Change. This moniker embodies the brand’s commitment to swift and efficient oil change services. It’s a simple yet powerful representation of their dedication to quick, quality automotive maintenance.

Why is it Called VIOC?

The term “VIOC” is more than just an acronym; it’s a reflection of Valvoline’s instant service ethos. By choosing this name, Valvoline emphasizes their focus on providing rapid yet thorough oil change solutions.It’s a name that encapsulates their mission to deliver efficient automotive care without compromising on quality.

So, when you see “VIOC,” remember, it’s not just a label; it’s a promise of instant, reliable service. It’s a reminder of Valvoline’s dedication to keeping your vehicle running smoothly, one oil change at a time.

What Does the VIOC Charge Cover?

Your VIOC charge covers essential automotive services, from thorough oil changes to comprehensive vehicle inspections.It encompasses the costs of maintaining your vehicle’s performance and longevity, ensuring it runs smoothly on the road.

From routine maintenance tasks to additional services, the VIOC charge ensures your car receives the care it needs for safe and efficient operation.

How is the VIOC Charge Calculated?

The calculation of the VIOC charge hinges on various factors. From the type of oil change to additional maintenance tasks, each element contributes to the final amount. Taxes and fees may also play a role in determining your total bill.

Understanding the breakdown of the VIOC charge sheds light on your expenses. It’s not just about the oil change; it’s about the specific services received. Whether it’s a conventional or synthetic oil change, each detail influences the calculation.

Delving into the intricacies of the VIOC charge reveals a comprehensive process. It’s not simply a matter of tallying up numbers; it’s about evaluating the services rendered. By grasping how the charge is calculated, you gain insight into the value of the maintenance provided.

Can I Avoid the VIOC Charge?

Every penny counts when it comes to managing your finances.Discover how to sidestep those unexpected charges and keep more money in your pocket.

When it comes to saving, every little bit helps.Learn some savvy strategies to steer clear of those pesky charges and keep your budget on track.

It’s all about smart spending. Find out how to dodge those sneaky charges and make the most of your hard-earned cash.

Merchant Names May be Different on Your Bill

Don’t fret: it’s not always a case of mistaken identity. Merchants often appear under different names, leaving you puzzled about your purchases.

Your credit card statement may resemble a cryptic puzzle, with merchant names shrouded in mystery. But fear not! It’s common for businesses to show up under various aliases, adding a dash of confusion to your billing statements.

Picture this: You’re scrutinizing your credit card statement, and suddenly, there it is a perplexing merchant name you don’t recognize. But before you jump to conclusions, remember that merchants often go incognito on bills, leading to unexpected surprises.

Decode the mystery of your credit card bill with a simple truth: merchant names can play tricks on you. It’s not unusual for businesses to cloak themselves in different identities, leaving you puzzled about your spending.

What You Should Do If You Don’t Recognize a Charge?

Take a breath and dive into some detective work. Start by checking your recent purchases online.Sometimes, charges can be like secret agents, disguised in unfamiliar names. Don’t panic! A quick search might reveal the true identity of the culprit.

Stay proactive! If the charge still eludes recognition, reach out to your credit card provider. They’re your partners in this financial mystery, ready to help decode any cryptic transactions.

Don’t let unfamiliar charges throw you off balance. Instead, roll up your sleeves and embark on a mission to unravel the mystery. With a bit of sleuthing, you’ll soon have clarity on what’s really going on.

Try Online Research

Engage in efficient online research to unravel mysteries hidden within your bank statement. Dive into the digital realm to decode unfamiliar charges and reclaim control. Harness the power of the internet to unveil the secrets behind each transaction.

Unlock the treasure trove of information waiting at your fingertips through online exploration. Navigate cyberspace with precision to uncover the truth behind puzzling bank statement entries. Embrace the digital age to demystify financial mysteries and empower yourself.

Embark on a digital quest to demystify the enigmatic entries lurking on your bank statement. Harness the vast resources of the internet to shed light on obscure charges and regain financial clarity. Embrace the convenience of online research to unravel the complexities of your financial landscape.

Check Your Calendar

When managing your schedule, always take a glance at your calendar. It helps you stay organized and prepared for upcoming events. Make it a habit to check your calendar regularly to avoid missing important appointments.

Keeping track of dates on your calendar ensures you’re never caught off guard. Whether it’s a meeting, a deadline, or a social gathering, your calendar keeps you informed. By routinely checking your calendar, you can effectively plan your days and manage your time efficiently.

Your calendar serves as a reliable tool for staying on top of your commitments. It provides a visual overview of your schedule, making it easier to prioritize tasks. Take a moment each day to review your calendar and adjust your plans accordingly.

Ask Anyone Who May Have Access to Your Card

If you’re unsure about a charge on your card, ask those who might have used it.It’s essential to communicate openly with anyone who has access to your card. Clarifying purchases can prevent misunderstandings and ensure transparency.

Your family members or authorized users may have made the transaction.Discussing it with them can provide clarity. Open communication is key to resolving any discrepancies on your statement.

Sometimes, a forgotten conversation or accidental purchase might explain the charge.Reach out to those who could shed light on the situation. Honest dialogue can resolve uncertainties and avoid future confusion.

Contact the Merchant

When you need clarity about a charge, reaching out to the merchant is key. It’s best to contact them directly for information. They can provide details about the transaction and their services.

Reaching out to the merchant can clear up any confusion about charges. Direct communication often leads to swift resolution. Most merchants are happy to assist with any inquiries.

Contacting the merchant is the first step in resolving billing discrepancies. They can offer insights into the charge in question. It’s a proactive approach to managing your finances.

Find the Best Identity Theft Protection Services of 2024 Learn more

How to Dispute a Transaction?

To dispute a transaction on your credit card, start by reviewing your statement carefully. Look for any unfamiliar charges or errors in billing. If you spot something suspicious, gather evidence such as receipts or emails to support your case.

Next, contact your card provider as soon as possible to report the disputed transaction. Provide them with all relevant details, including the date, amount, and description of the charge. Be prepared to explain why you believe the transaction is incorrect or unauthorized.

Finally, follow up with your card provider regularly to check on the status of your dispute. They may require additional information or documentation to process your claim. Stay proactive and persistent until the matter is resolved to your satisfaction.

Contact the Retailer

When you need clarification on a charge, reach out to the retailer directly. They can provide insight into the transaction in question. Simply locate their contact information on your statement or online.

If a charge appears unfamiliar, it’s wise to initiate communication with the retailer. Direct contact allows for swift resolution of any discrepancies. Most retailers are readily available to address customer inquiries.

Connecting with the retailer is the first step in understanding unfamiliar charges. By reaching out, you can gain clarity and resolve any billing concerns efficiently.

Contact Your Card Provider

When in doubt about a charge, reach out to your card provider directly. They can provide insights and assistance regarding any unfamiliar transactions.Keeping open communication with your card provider ensures clarity and security for your finances.

If you’re uncertain about a transaction, don’t hesitate to contact your card provider. They can offer guidance and support in understanding and resolving any discrepancies.Trusting your card provider for assistance can help maintain peace of mind regarding your finances.

In case of any doubts or concerns, your card provider is just a call away. Reach out to them promptly for clarification and resolution regarding any unexpected charges. Your card provider’s support ensures you’re well-equipped to address any financial uncertainties.

Contact Your Card Provider

If you’re unsure about a charge on your credit card, reaching out to your card provider is essential. They can offer insights and assistance regarding unfamiliar transactions. Keep an eye on your account activity to catch any discrepancies early.

Contacting your card provider allows you to address any concerns promptly. They can help clarify the nature of the charges and guide you through the next steps. Don’t hesitate to get in touch if you notice any suspicious activity.

Your card provider is your ally in navigating potential billing errors or fraudulent charges. They have the resources to investigate and resolve any issues efficiently. Reach out to them as soon as you spot something amiss on your statement.

How To Stay on Top of Future Charges?

Staying ahead of future charges on your credit card is essential for financial peace of mind. Begin by regularly monitoring your bank statements for any unfamiliar transactions. Utilize online banking tools or apps to track your spending effortlessly.

Additionally, consider setting up transaction alerts to receive instant notifications of any new charges. This proactive approach helps you catch any unauthorized transactions early. Finally, review your credit card statements diligently each month to spot any discrepancies and ensure accuracy.

Track Your Expenses

Tracking your expenses is crucial for financial awareness. By monitoring your spending, you gain insight into where your money goes. This allows you to make informed decisions about budgeting and saving.

Keep a detailed record of your purchases each month. This helps you identify areas where you may be overspending. With this information, you can adjust your budget accordingly to meet your financial goals.

Utilize budgeting apps or spreadsheets to streamline the process. These tools categorize expenses and provide visual representations of your spending habits. With easy access to this data, you can stay on top of your finances effortlessly.

Take Steps to Protect Your Card

To shield your card, first, safeguard your details. Keep them secure and avoid sharing them carelessly. Regularly review your statements for unfamiliar charges.

Consider opting for cards with robust fraud protection. These features can help detect and prevent unauthorized transactions. Stay vigilant by setting up instant notifications for your transactions.

Update your personal information promptly. Ensure your contact details are current to receive timely alerts. Strong passwords are crucial for online accounts, preventing unauthorized access to your card information.

Review Your Statement Regularly

Regularly reviewing your bank statements is essential. It helps you stay on top of your finances. You can catch any unfamiliar charges early.

By checking your statements frequently, you ensure accuracy. It’s a proactive step towards financial security. You’ll spot any discrepancies promptly.

Taking the time to review your statements is prudent. It safeguards against unauthorized transactions. Stay vigilant to protect your finances.

Find charges for Google products

When checking your bank statement, look for charges related to Google products. These charges typically start with “GOOGLE*” followed by the specific product or service. For instance, “GOOGLE *Play Store” indicates a purchase from the Google Play Store.

Here’s how some common Google purchases might appear on your bank statement.

| Statement item | Google product |

| GOOGLE *Ads Chile only | Google Ads |

| GOOGLE *ADWS*DL Colombia only | Google Ads |

| GOOGLE *ANDROID TEMP | Android (Autofill) |

| GOOGLE *CHROME TEMP | Google Chrome (Autofill) |

| GOOGLE *{Company} | Google Play Store for Apps |

| GOOGLE *CLOUD_{BAID} | Google Cloud |

| GOOGLE *Commerce Ltd | Google Play Music |

| GOOGLE *{Developer} | Google Play Store for Apps |

| GOOGLE PLAY JAPAN Japan only | Google Play Store for Apps |

| GOOGLE *Devices | Google Store |

| GOOGLE *GOOGLE | YouTube Premium |

| GOOGLE *Google, Inc. | Google Play Music |

| GOOGLE *Google Music | Google Play Music |

| GOOGLE *Google Play | Google Play Movies & TV |

| GOOGLE *Google Storage | Google Drive |

| GOOGLE *Google Store | Google Store |

| GOOGLE *Google Surveys | Google Analytics |

| GOOGLE *GoogleShopping | Google Shopping |

| GOOGLE *GPAY TEMP | GPay (Pay Online with GPay) |

| GOOGLE *Music | Google Play Music |

| GOOGLE* Google Storage | Google One |

| GOOGLE *PAYMENTS TEMP | Google Payments |

| GOOGLE *Play Store Chile only | Google Play Store for Apps |

| GOOGLE *Youtube Chile only | YouTube Premium YouTube Music YouTube Member YouTube Super |

| GOOGLE *PLAY-YOUTUBE*DL Colombia only | Google Play Store for Apps YouTube Premium YouTube Music YouTube Member YouTube Super |

| GOOGLE *Play Credit | Google Play gift cards and other transfers to a Google Play balance |

| GOOGLE *Play Newsstand | Google Play Newsstand |

| GOOGLE *PROJECT FI | Google Project Fi |

| GOOGLE *SERVICES | Google Fiber YouTube TV |

| GOOGLE WORKSPACE {first_7_letters_of_domain_name} | Google Workspace |

| GOOGLE STORE {store_location} | Google Store |

| GOOGLE *Voice | Google Voice |

| GOOGLE *WALLET | Google Wallet |

| GOOGLE *WALLET TEMP | Google Wallet |

| GOOGLE *YouTube Videos | YouTube Movies |

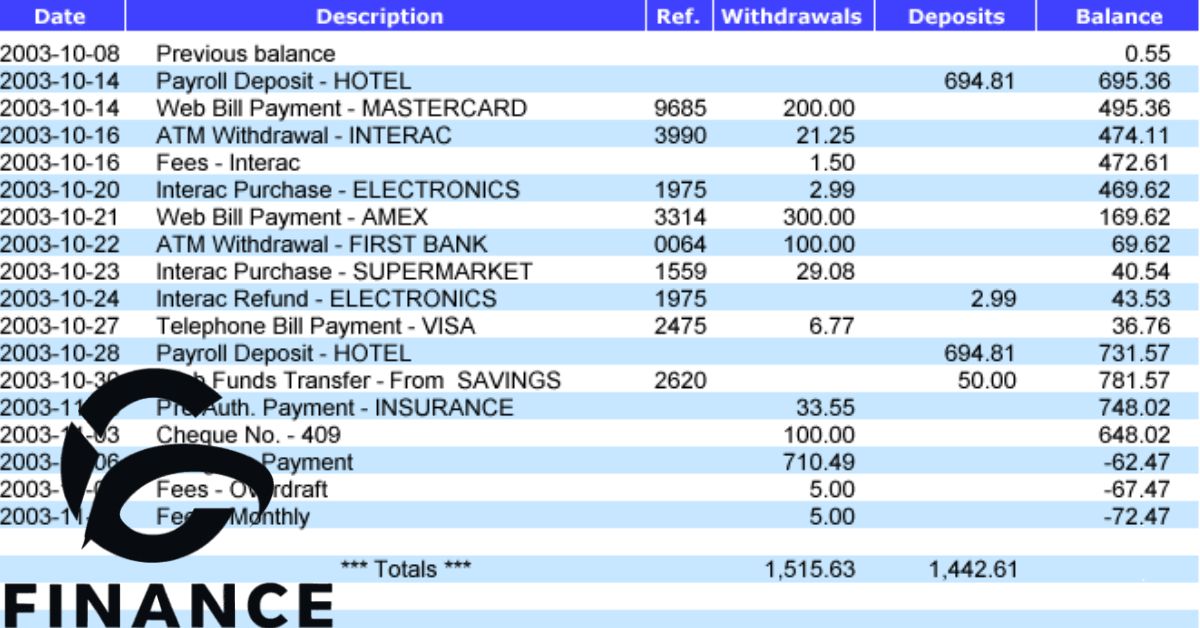

Pending transactions

Pending transactions are temporary holds on your account. They occur when a transaction is authorized but not yet completed.

These transactions may not immediately reflect in your available balance. It’s essential to keep track of them to avoid overdrawing your account.

Pending transactions can include purchases, payments, or deposits that are awaiting final processing. Be mindful of them to ensure accurate financial management.

Find the Best Credit Cards for 2024 Learn more

Find charges for non-Google products

When examining your bank statement, look for charges that don’t begin with “GOOGLE*.” These charges likely originate from purchases made outside of Google’s ecosystem. Contact the specific retailer if you’re unsure about a charge to clarify the transaction details. Keeping track of these non-Google charges helps you manage your expenses effectively.

For charges not associated with Google products, review the retailer’s brand name listed on your bank statement. If any unfamiliar charges appear, reach out to the retailer directly for clarification. By staying vigilant and monitoring your transactions, you can quickly identify and address any discrepancies or unauthorized purchases.

To identify non-Google charges, scan your bank statement for any descriptors unrelated to Google products or services. If any charges seem unfamiliar, contact the respective retailer for further information. Regularly reviewing your statements ensures you’re aware of all transactions and can promptly address any discrepancies.

What is this charge on my credit card statement?

Your credit card statement may show charges that seem unfamiliar at first glance.It’s not uncommon to feel puzzled by certain entries. However, understanding these charges is vital for financial awareness.

Sometimes, the merchant name on your statement may differ from what you expected.This discrepancy can lead to confusion about the nature of the charge. In such cases, a bit of investigation is warranted.

Don’t panic if you encounter a mysterious charge. Instead, take proactive steps to identify it.A quick online search or checking with your credit card provider can often shed light on the situation.

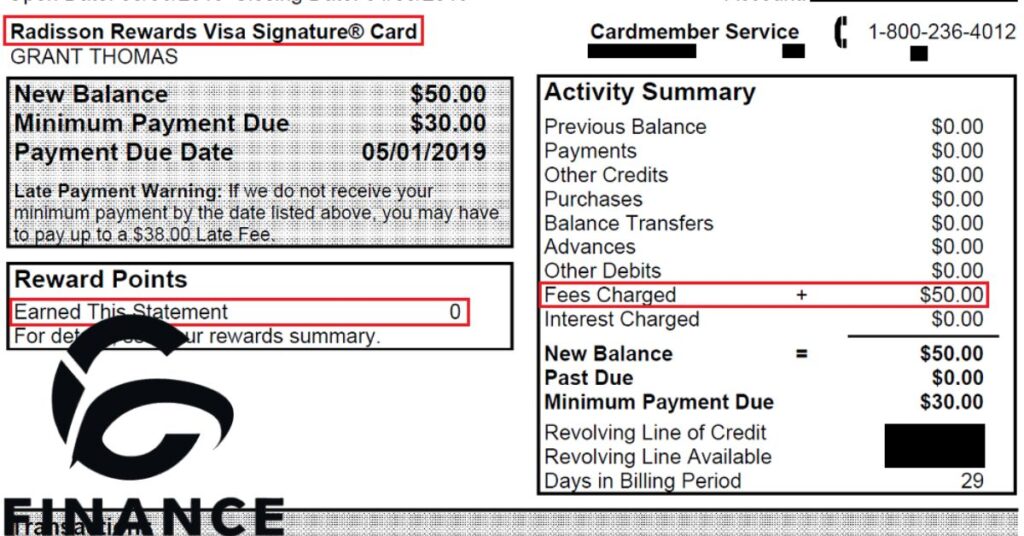

What types of fees are included on this customer’s credit card statement for the month?

On this customer’s credit card statement for the month, you’ll find various types of fees listed. These fees encompass a range of charges related to different transactions and services. From interest fees to late payment penalties, each fee serves as a reminder of the costs associated with credit card usage.

The customer’s credit card statement lists various fees incurred during the month.These fees may include transaction fees, annual fees, and interest charges.Understanding these fees is essential for managing personal finances effectively.

What are the transactions on a credit card statement?

Credit card statements display transactions made using the card. These transactions detail purchases, payments, and other financial activities. Each entry shows the date, merchant name, and amount spent.

Reviewing a credit card statement helps track spending habits. It provides insights into where money is being spent. Understanding these transactions is crucial for budgeting and financial planning.

In addition to purchases, credit card statements may include fees and interest charges. It’s essential to scrutinize these to ensure accuracy. Monitoring transactions regularly helps detect any unauthorized or fraudulent activity.

Read as:WHAT IS THE HFT EPAY CHARGES ON YOUR BANK STATEMENT?

How do I find out who charged my credit card?

If you spot unfamiliar charges on your credit card statement, start by checking recent purchases. Look for receipts or invoices that match the amount and date of the charge. If you can’t find a match, try researching the merchant’s name online for more information.

Another option is to log into your credit card account online. Many providers offer detailed transaction histories with merchant names and contact information. You can also call the phone number on the back of your card for assistance in identifying the charge.

In case you suspect fraudulent activity, contact your credit card issuer immediately. They can help you dispute the charge and investigate any unauthorized transactions. It’s essential to act swiftly to protect your financial security. How can I prevent unauthorized VIOC charges in the future?

To prevent unauthorized VIOC charges, regularly monitor your credit card statements, safeguard your card information, and consider setting up transaction alerts for immediate notification of any suspicious activity.

Frequently Asked Questions

What are my rights if I dispute a VIOC charge and it’s found to be fraudulent?

If a VIOC charge is disputed and found to be fraudulent, you have the right to have the charge removed from your account, receive a refund for any unauthorized transactions, and potentially obtain compensation for any related damages or losses.

How long do I have to report a suspicious or fraudulent VIOC charge?

The timeframe to report suspicious or fraudulent VIOC charges varies depending on your credit card issuer’s policies. However, it’s generally recommended to report any unauthorized charges as soon as possible to mitigate potential financial losses and protect your account.

Who can I contact for more information about a specific VIOC charge?

For more information about a specific VIOC charge, you can contact your credit card issuer’s customer service department or reach out directly to Valvoline Instant Oil Change centers for clarification on the transaction details.

Where can I find more resources on understanding and managing bank statement charges?

You can find more resources on understanding and managing bank statement charges by visiting your credit card issuer’s website, accessing online banking tools and educational materials, or consulting with financial advisors for personalized guidance and assistance.

Final Thoughts

Understanding VIOC charges on your credit card statement is essential for financial awareness and security. Regularly monitoring your statements, clarifying unfamiliar transactions promptly, and taking proactive steps to prevent unauthorized charges are crucial practices.

Should you encounter any discrepancies, don’t hesitate to reach out to your credit card issuer or Valvoline Instant Oil Change centers for clarification.By staying vigilant and informed, you can effectively manage your finances and protect yourself against potential fraud.

Remember, timely reporting of suspicious activities and maintaining open communication with relevant parties are key to resolving any issues swiftly. Ultimately, maintaining a proactive approach to managing your credit card statements ensures transparency, accountability, and peace of mind in your financial transactions.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.