HFT ePay Charges are fees incurred for electronic transactions. These charges can appear on your bank statement unexpectedly. Understanding their origin is crucial for financial clarity.

This Charges may stem from transactions with Harbor Freight Tools.These fees cover the costs of electronic payment processing.It’s essential to monitor your statements for accuracy.

Government entities can contact ePAY for more information on signing up. Pricing options vary, with the choice to absorb or pass processing fees to constituents. Clarify any discrepancies with ePAY’s customer service.

Why do You get an HFT ePay Charge?

When you see an HFT ePay charge on your bank statement, it’s because you’ve used Harbor Freight Tools’ electronic payment system.This charge covers the cost of processing your transaction.The fee may be nominal, but it’s essential to understand its legitimacy and purpose.

The HFT ePay charge may appear if you’ve made purchases directly from Harbor Freight Tools or from affiliated companies.This charge reflects the use of their electronic payment system. It’s important to check your transactions carefully to ensure accuracy.

What to Do if You Receive an HFT ePay Charge?

If you receive an HFT ePay charge on your bank statement, first, review the transaction carefully. Check for any unfamiliar charges or discrepancies.

Contact your bank immediately to inquire about the HFT ePay charge and seek clarification. They can provide insights and assistance in resolving any issues with the transaction.

Consider reaching out to Harbor Freight Tools or the company associated with the ePay charge for further clarification or to dispute the charge. Keep records of your communication for reference.

Is HFT ePay Charge a Scam or Fraud?

Amidst scrutiny, questions arise about the legitimacy of HFT ePay charges. Some view them with suspicion, citing unauthorized debits and elusive customer support. Despite assurances, concerns linger over potential fraudulent activities.

Instances of unauthorized charges fuel skepticism surrounding HFT ePay transactions. Customers seek clarity amidst a maze of ambiguous fees and elusive resolutions. Doubts persist despite efforts to address concerns and assure authenticity.

Unraveling the mystery of HFT ePay charges reveals a web of confusion and discontent. Customers navigate murky waters, questioning the validity of transactions and seeking recourse. Amidst the fog of uncertainty, clarity and transparency remain elusive.

What Is High-Frequency Trading (HFT)?

High-Frequency Trading, or HFT, involves rapid execution of trades using advanced computer algorithms.Traders analyze market data and execute orders within milliseconds to capitalize on small price discrepancies. HFT contributes to market liquidity and efficiency but has drawn criticism for its potential impact on market stability.

Understanding High-Frequency Trading (HFT)

High-frequency trading (HFT) involves rapid transactions executed by powerful algorithms. It contributes to market liquidity and efficiency but faces criticism for potential risks.

Understanding HFT is essential for navigating modern financial markets.HFT relies on algorithms for lightning-fast trades, shaping today’s financial landscape.

HFT, driven by algorithms, executes trades swiftly, shaping market dynamics.HFT’s algorithm-driven trades shape market dynamics, demanding a nuanced understanding.HFT’s algorithmic approach revolutionizes trading, necessitating comprehension for investors.

Advantages and Disadvantages of HFT

Pros of High-Frequency Trading (HFT)

- Enhanced liquidity and reduced bid-ask spreads benefit market efficiency.

- Speedy transactions enable large volumes of trades within seconds.

- Improved market liquidity attracts more participants and enhances overall market activity.

Cons of High-Frequency Trading (HFT)

- Potential for major market disruptions due to rapid and automated trading.

- Criticized for favoring large companies and disadvantaging smaller traders.

- Concerns over the fleeting nature of liquidity provided by HFT, limiting its accessibility to traders.

How Does High-Frequency Trading Work?

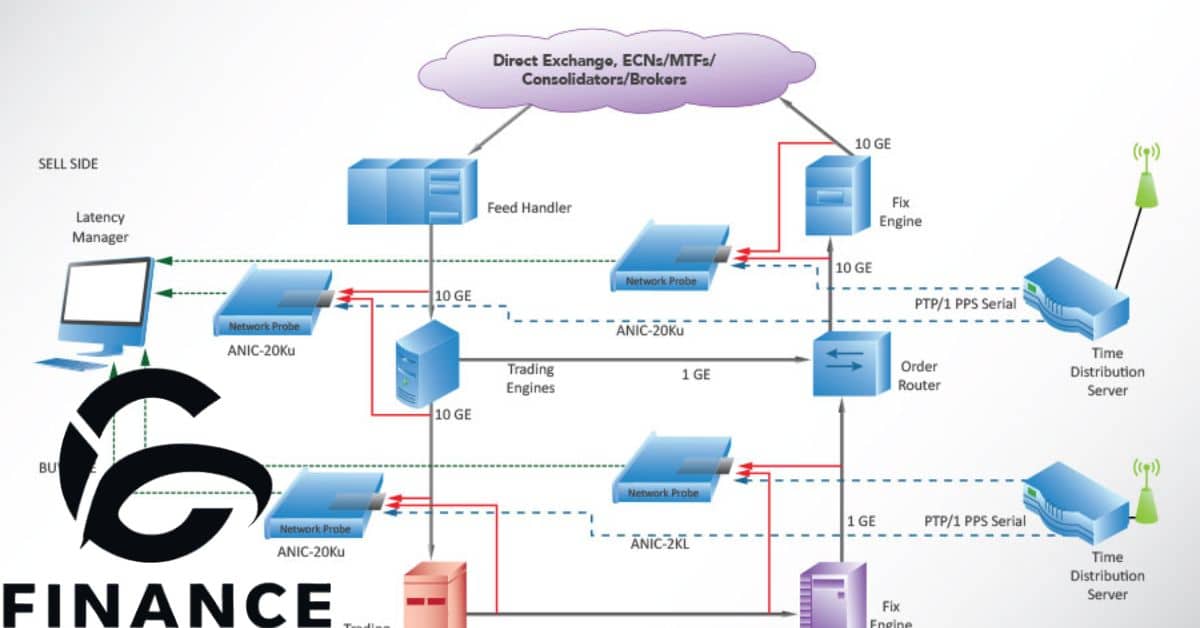

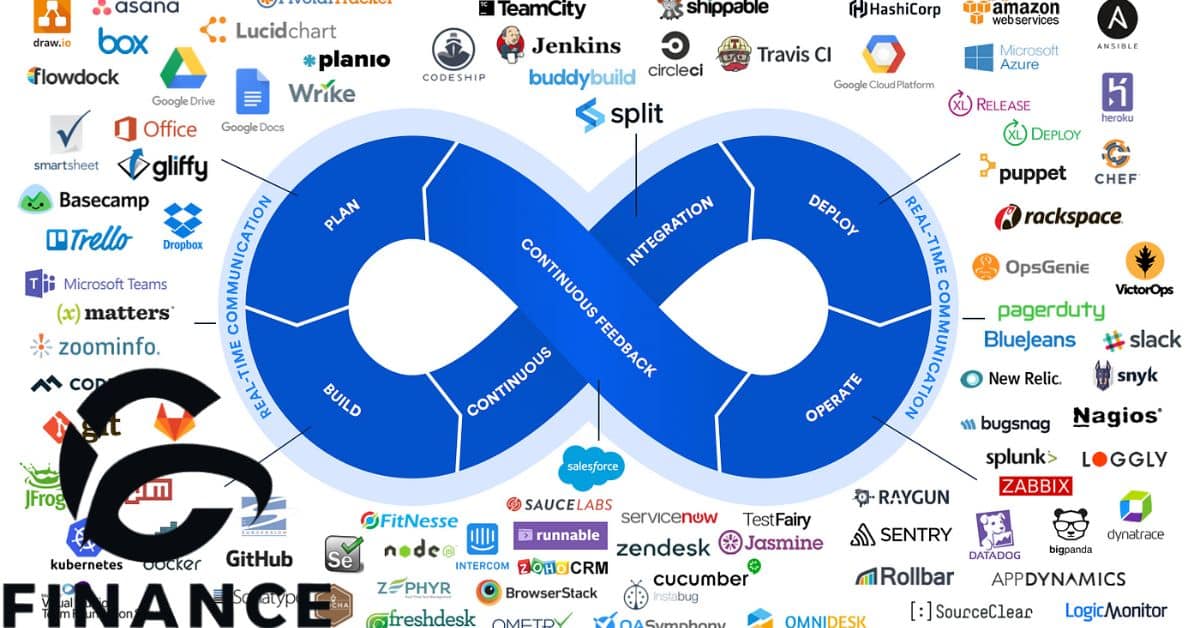

High-frequency trading involves using advanced algorithms to execute rapid transactions in financial markets. These algorithms analyze market data and identify trading opportunities in milliseconds. Traders aim to capitalize on small price discrepancies for profit.

The process relies on powerful computers and complex algorithms to execute trades at incredibly high speeds. These trades occur within fractions of a second, allowing traders to exploit fleeting market opportunities.

Through high-frequency trading, large volumes of trades are conducted swiftly, contributing to market liquidity. This method is favored by institutions seeking to capitalize on short-term market movements.

Does the Cryptocurrency Market Use High-Frequency Trading?

The cryptocurrency market relies heavily on rapid trading methods, known as high-frequency trading (HFT). These strategies involve sophisticated algorithms that execute trades within milliseconds.

HFT plays a significant role in cryptocurrency trading, facilitating large volumes of transactions in short timeframes. This rapid execution allows traders to seize fleeting opportunities and exploit market dynamics.

Read as:WHAT IS A P2 TRUEDLY TRANSACTION ON YOUR BANK STATEMENT?

How Fast Is a High-Frequency Trade?

High-frequency trading (HFT) operates at lightning speeds, executing trades in milliseconds. These rapid transactions enable large volumes of trades within seconds.HFT contributes to market liquidity and efficiency through its swift execution.

In the world of finance, HFT facilitates quick and automated trading processes. By analyzing market data instantly, HFT capitalizes on small price discrepancies. This speed allows for significant profits within short timeframes.

Overall, HFT plays a vital role in modern markets, leveraging technology to execute trades rapidly. Its high-speed transactions contribute to market liquidity and provide opportunities for profit.

Who makes the ePay software?

The ePay software is developed by skilled programmers. These professionals work diligently to ensure its functionality. Their expertise ensures seamless transactions for users.

The team behind ePay continually updates and improves the software.Their dedication ensures reliability and security.Users trust the ePay software for its efficiency and convenience.

Innovative technology powers the ePay software.It streamlines payment processes for businesses and individuals.The software’s creators prioritize user experience and satisfaction.

Who uses ePay?

- Government entities in Illinois utilize ePay for efficient payment processing.

- Businesses across various industries rely on ePay for secure transactions.

- Financial institutions and institutional investors leverage ePay for seamless fund transfers.

What are the rates charged for processing through ePAY?

The rates charged for processing through ePAY vary depending on the chosen option. Government entities can pass the processing fee to constituents or absorb fees themselves.ePAY also offers bundled equipment costs with processing fees to lower overall fees.

These rates aim to accommodate the preferences and budget constraints of government entities. Options include passing fees to constituents or bundling costs with processing fees.Each approach has its advantages, allowing flexibility in managing transaction expenses.

Understanding the rates charged for processing through ePAY is essential for government entities. Options range from passing fees to constituents to bundling costs with processing fees.Flexibility ensures tailored solutions for efficient fund management.

How does my organization sign up for ePAY services?

- To sign up for ePAY services, contact our team at (855) 226-7337.

- Government entities in Illinois can join ePAY by submitting a request.

- Rates for processing through ePAY depend on various factors.

Who do I contact if I am having trouble reconciling my funds against the ePAY Dashboard?

If you encounter issues reconciling your funds on the ePAY Dashboard, reach out to ePAY directly at (855) 226-7337.Their dedicated customer service team can assist you promptly.Don’t hesitate to contact them for timely resolution.

What is the hft epay charges on your bank statement online

The HFT ePay charges on your bank statement represent fees for electronic payments made through Harbor Freight Tools.These charges cover the costs of processing transactions using the ePay system. It’s essential to review your statement carefully to understand any fees associated with HFT ePay transactions.

When you see HFT ePay charges, it signifies payments made through Harbor Freight Tools’ electronic payment system.These charges are legitimate and cover processing costs.If you have any concerns about the charges, contacting Harbor Freight Tools’ customer service can provide clarification.

Understanding HFT ePay charges is crucial for managing your finances. These charges may appear nominal but are associated with electronic payment processing.Ensure you’re aware of any fees on your bank statement and reach out to Harbor Freight Tools or your bank for further information if needed.

hft epay harbor freight

Harbor Freight Tools offers an electronic payment system called ePay. This system facilitates fast and convenient transactions. Customers may encounter ePay charges on their bank statements.

The ePay charges cover processing fees for electronic payments.They are a nominal amount, typically around $0.35. It’s important to verify the legitimacy of these charges with Harbor Freight Tools.

Customers can contact Harbor Freight Tools’ customer service for clarification. Ensuring transparency and understanding regarding ePay charges is essential.

hft hft epay

High-Frequency Trading (HFT) utilizes advanced algorithms for rapid transactions. It operates with lightning speed in financial markets, executing numerous orders within seconds.HFT enhances market liquidity but faces criticism for potential market disruptions.

HFT ePay Charges are fees associated with electronic payments for transactions.They facilitate quick and efficient payment processing for businesses and consumers alike. Understanding and managing these charges is essential for financial transparency and efficiency.

what is this charge on my bank statement?

The charge on your bank statement might be unfamiliar. It could appear as “HFT ePay Charge.” This charge signifies electronic payment processing. It’s crucial to understand its origin and legitimacy.

Understanding the HFT ePay charge is essential.It represents electronic payments made.This charge reflects transactions with certain companies.

If you notice the HFT ePay charge, don’t panic.It’s a legitimate fee. Ensure you’re aware of recent transactions.

Who should I get in touch with to find out more about ePay?

To find out more about ePay, reach out to the designated contact provided by the service provider. They can offer comprehensive information and guidance regarding ePay services and its benefits.

Contacting the designated representative ensures you receive accurate and detailed insights into the functionality and advantages of ePay. It’s essential to connect with the right person to address any queries or concerns effectively.

Engaging with the appropriate contact point ensures clarity and transparency regarding ePay features, facilitating informed decisions about its implementation within your organization.

Is there an ePay mailing list?

- Yes, an ePay mailing list exists.

- It provides updates and information.

- Stay informed about ePay services.

- Receive updates and announcements.

- Stay connected with ePay news.

- Get important information promptly.

Frequently Asked Questions

What country uses EPAY?

EPAY is used globally by individuals and businesses worldwide for electronic payments.

What company is EPAY?

EPAY is a financial technology company that provides electronic payment solutions and services to individuals and businesses.

How do I cancel an EPAY transaction?

To cancel an EPAY transaction, contact EPAY’s customer support and follow their cancellation process.

How do I cancel an EPAY payment?

You can cancel an EPAY payment by accessing your EPAY account or contacting EPAY’s customer service for assistance.

Is EPAY services safe?

EPAY prioritizes security by employing encryption and other safety measures to ensure the safety of transactions and user data.

Does ePay charge a fee?

ePay may charge nominal fees for certain transactions or services, depending on the specific terms and conditions of use.

Final Thoughts

Navigating HFT ePay charges necessitates clarity and caution. Understanding these charges is crucial for financial transparency. Verify transactions promptly to mitigate potential discrepancies.

Stay vigilant against fraudulent activities and promptly report any suspicious charges.Utilize available resources like customer service for clarification and dispute resolution. Balancing convenience with vigilance ensures a secure financial experience.

Remember, HFT ePay charges are legitimate fees associated with electronic transactions. By staying informed and proactive, you can effectively manage and understand these charges.

In the dynamic landscape of electronic payments, awareness is key to financial empowerment. So, approach HFT ePay charges with diligence and confidence, ensuring your financial well-being in every transaction.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.