Expense accounts are used to track and claim business expenses for tax purposes. Common expense accounts include travel, meals, entertainment, office supplies, and vehicle costs.

However, certain expenses don’t qualify as deductible business expenses, such as personal expenses, capital expenses, and expenses related to hobbies or lobbying activities.

Understanding which expenses can’t be included in an expense account is crucial for accurate bookkeeping and tax compliance.

What is an expense account?

An expense account tracks spending for specific purposes within a business. It is not a savings account or an investment account. Accounts provide transparency and control over company expenditures.

Not an Expense Account

- Savings account

- Investment account

- Personal checking account

Account Functionality

Expense accounts categorize spending, such as travel or office supplies, aiding in budget management. They are managed by designated personnel within the company. Proper usage ensures accurate financial tracking.

Not an Expense Account

- Savings account

- Investment account

- Personal checking account

How to know if something is an account?

An expense account tracks business expenses. It is not a savings account. Nor is it a checking account or an investment account.Expense accounts detail business spending. They are distinct from savings, checking, or investment accounts. Their purpose is to manage costs efficiently.

Expenses like travel and office supplies are tracked. Savings accounts accumulate funds, unlike accounts. Checking accounts handle daily transactions, not expenses.Investment accounts grow wealth, unlike accounts. Accounts ensure transparency in spending. They’re essential for financial management in businesses.

Which is the following is not an expense?

In financial management, it’s crucial to discern what qualifies as an expense.An account, for instance, pertains to categories distinct from those intended for expenditure tracking. The term “not an account” signifies entities or transactions that do not fall under the ambit of expenses.

Understanding the distinction between expense and non-expense categories aids in accurate financial record-keeping. Not an account delineates items or activities not earmarked for expenditure monitoring. Recognizing what doesn’t constitute an account streamlines financial management processes.

Which item is not an expense?

Cost accounts play a crucial role in managing business finances efficiently. Understanding what constitutes an account is essential for effective financial tracking. In this article, we’ll delve into the concept of disbursement accounts and clarify what items do not qualify as expenses.

Expense accounts are designed to categorize specific costs incurred by a business. They provide transparency and aid in budgeting and decision-making processes. However, it’s important to recognize what falls outside the realm of an account.

When considering expenses, it’s vital to distinguish between ordinary costs and those that don’t qualify as expenses. By understanding what doesn’t belong in an account, businesses can maintain accurate financial records and make informed financial decisions.

Read More About : HOW TO CLOSE A ROBINHOOD ACCOUNT?

Which of the following are expense accounts?

Expense accounts are crucial for managing business finances effectively. They help track various costs incurred by a company. Understanding what constitutes an account is essential for accurate financial reporting.

The not an Expense Account

- Savings accounts are designed for accumulating funds, not tracking expenses.

- Checking accounts facilitate day-to-day transactions, distinct from expense tracking.

- Investment accounts aim to grow wealth, differing from the purpose of expense financial records.

Not an Expense balance sheet Account

- Expense accounts are specifically designated to record business-related expenditures.

- They serve the purpose of providing transparency and control over company spending.

- Unlike savings, checking, or investment accounts, they focus solely on tracking expenses.

Not an Expense balance sheet Account

- Effective expense management involves categorizing costs into appropriate accounts.

- Savings, checking, and investment accounts are not suitable for expense tracking.

- By distinguishing between expense the books and other financial instruments, businesses ensure accurate financial management.

which is not an expense account indeed

Expense accounts are crucial for managing business costs efficiently. However, it’s essential to understand what doesn’t qualify as an account. Not every financial instrument serves the same purpose.

The not an Expense Account: Savings accounts, for instance, are designed for accumulating funds rather than tracking expenses. They serve a different financial function altogether.

The not an Expense Account: Checking accounts facilitate day-to-day transactions and are not meant for categorizing expenditures. Their primary role is to enable easy access to funds.

Not an Expense Account: Investment accounts focus on growing wealth through various financial instruments, contrasting with the purpose of expense accounts. Their goal is long-term financial growth, not expense tracking.

Expense balance sheet are vital components in accounting, delineating various business costs. The not an expense account: Savings accounts, checking accounts, and investment accounts differ in function. However, not an expense account, these accounts serve distinct financial purposes.

Which is not an expense account in accounting?

Savings accounts are designated for accumulating funds over time. Not an expense account, a savings account emphasizes wealth preservation rather than expenditure tracking. Such accounts provide a secure repository for surplus funds, distinct from expense tracking mechanisms.

Checking accounts facilitate daily financial transactions and cash flow management. Not an expense account, a checking account caters to immediate financial needs. These accounts enable seamless payments, withdrawals, and transfers, distinct from expense categorization.

Investment accounts are tailored for growing wealth through various financial instruments. Not an expense account, an investment account focuses on asset appreciation rather than expense tracking. These accounts offer avenues for capital growth, distinct from expense management tools.

which is not a temporary account?

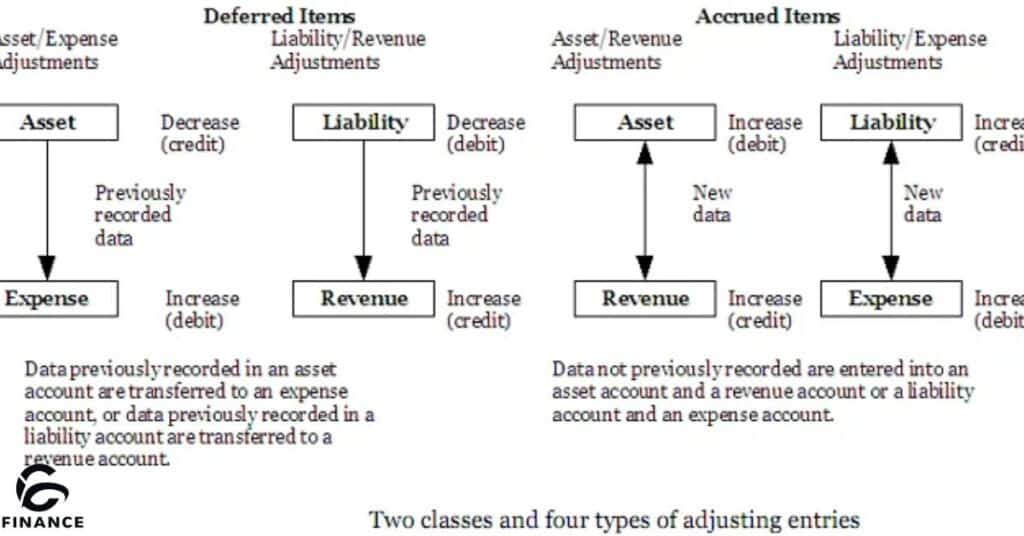

Expense financial statement play a vital role in managing business finances, but it’s essential to understand what they are not. Not an expense account, a temporary account serves a different purpose in financial record-keeping.

Not an Expense Account: Temporary accounts, unlike expense accounts, are used to track income and expenses over a specific accounting period. They include revenue, expense, and dividend accounts, which are closed at the end of each period.

an Account: These temporary accounts help calculate the company’s net income or loss for a particular period, contributing to accurate financial reporting. They serve as a bridge between consecutive accounting periods, ensuring a clear picture of financial performance.

Not an Expense Account: Unlike expense financial records, which focus solely on tracking expenses, temporary accounts encompass a broader scope, incorporating both revenue and expenses to determine the company’s profitability over time. They provide crucial insights into financial health beyond mere expenditure tracking.

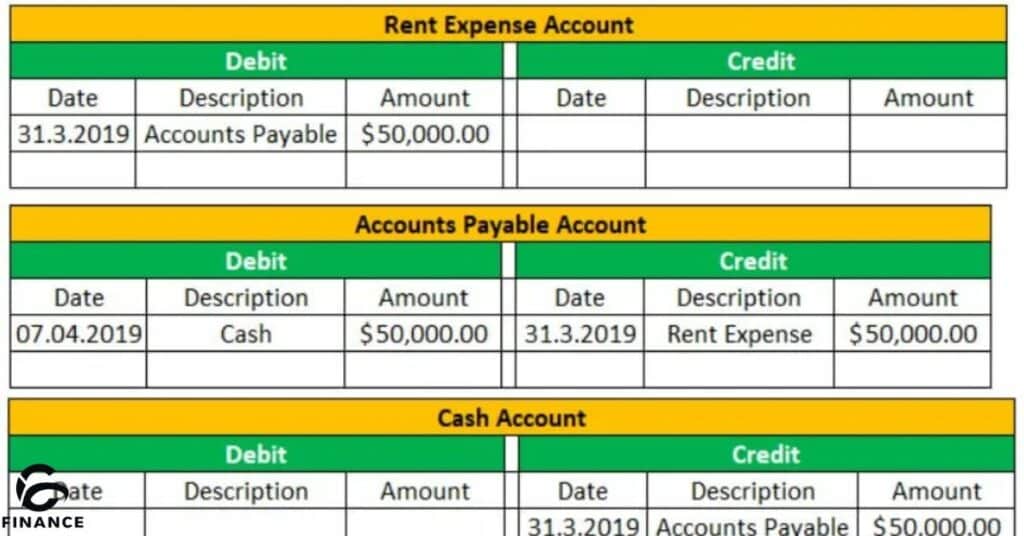

which is not an expense account accrued expense?

Accrued expenses, unlike expense accounts, represent costs incurred but not yet paid. These expenses accumulate over time and are recorded in financial statements. They reflect obligations a company owes and impact its financial health.

In contrast to expense accounts, accrued expenses are not immediately deducted from revenue. Instead, they are recognized when incurred, irrespective of payment timing. This accounting method ensures accurate financial reporting.

Accrued expenses, distinct from expense balance sheet, include items like wages, taxes, and utilities owed but not yet settled. Recognizing them is vital for portraying a company’s true financial obligations.

which is not a temporary account?

Expense financial statement serve to manage business costs efficiently, yet it’s crucial to discern what isn’t an account. Not an expense version, a temporary account entails temporary financial transactions. Recognizing what isn’t an expense account aids in accurate financial tracking.

Not an expense justification, temporary accounts include income and expense items. These accounts capture financial activities over a specific period. Understanding what isn’t an account clarifies financial categorization.

Not an expense account, temporary accounts serve a distinct purpose in financial reporting. These accounts facilitate the calculation of net income for a defined period. Recognizing what isn’t an account enhances financial clarity.

Not an expense reason, temporary accounts encompass revenues, expenses, gains, and losses. These accounts are integral for accurate financial statements. Understanding what isn’t an account fosters sound financial management.

Frequently Asked Questions

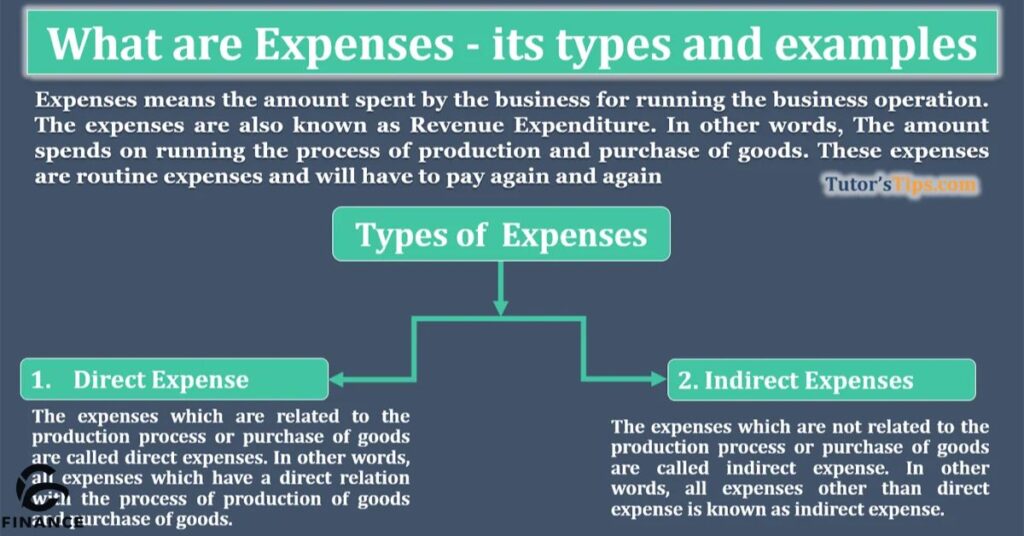

What are the 4 types of expenses in accounting?

The four types of expenses in accounting include variable, fixed, accrued, and periodic expenses.

Is interest an expense balance account?

Yes, interest is typically categorized as an expense account, reflecting the cost of borrowing money.

Is depreciation an expense or income?

Depreciation is considered an expense in accounting as it reflects the decrease in value of assets over time.

Is advertising an expense sheet account?

Yes, advertising is generally classified as an expense explanation, representing costs incurred to promote products or services.

Is repairs an expense sheet?

Yes, repairs are typically recorded as an account, reflecting expenditures to restore assets to their operational state.

final thoughts

Expense accounts are designed for tracking business expenditures, not for saving or investing funds. They serve to monitor costs like travel expenses, office supplies, and marketing expenditures. It’s essential to understand that savings, checking, and investment accounts are not expense accounts.

Remember, an expense version is distinct from savings, checking, or investment accounts. These accounts are meant for tracking business expenses, not for accumulating or growing funds.

Always differentiate between expense accounts and other types of financial instruments. Keep in mind that not all accounts are expense accounts; savings, checking, and investment accounts serve different purposes.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.