Have you ever noticed an unfamiliar charge on your debit card statement and felt a sense of confusion or concern? If you’ve encountered the term “WUVISAAFT,” you’re not alone.

This cryptic acronym has left many debit card users scratching their heads, wondering what it means and why it appears on their statements.

In this comprehensive guide, we’ll demystify the WUVISAAFT charge, empowering you to better understand and manage your debit card transactions.

Understanding the WUVISAAFT Charge on Your Debit Card Statement

WUVISAAFT stands for “Will Unconditionally Visa Automatic Funds Transfer.” It’s a charge initiated by merchants or service providers to temporarily hold funds on your debit card for pending transactions. This practice is a common security measure used by many retailers and businesses to ensure that sufficient funds are available for future payments.

When you make a reservation or place an order that requires payment at a later date, such as booking a hotel room or renting a car, the merchant may place a WUVISAAFT charge on your debit card. This charge is not an actual fee but rather a temporary hold on a certain amount of funds until the final transaction is processed.

What is the WUVISAAFT Fee and Why Am I Being Charged?

Contrary to popular belief, WUVISAAFT is not a fee charged by your bank or the merchant. It’s simply a temporary hold or deduction from your available debit card balance to secure funds for a future payment. You might encounter this charge in various scenarios, such as:

- Hotel Reservations: Hotels often place a WUVISAAFT charge on your debit card to cover the room cost, incidentals, and any potential damages during your stay.

- Rental Car Bookings: Car rental companies may initiate a WUVISAAFT charge to ensure you have enough funds to cover the rental cost, fuel, and any potential damages or fees.

- Online Purchases with Future Delivery: When you make an online purchase for an item that will be shipped or delivered at a later date, the merchant may place a WUVISAAFT charge to secure the payment.

It’s important to note that the WUVISAAFT charge is usually released once the final transaction amount is processed and paid. The held funds should then become available for use again in your account.

WUVISAAFT: Decoding the Mysterious Charge on Your Debit Card

While the term “WUVISAAFT” may sound confusing or even concerning if you’re unfamiliar with it, it’s a legitimate practice used by merchants to safeguard against insufficient funds or potential losses. The somewhat cryptic name is likely derived from the fact that it involves an automated funds transfer process initiated by Visa, one of the major debit card networks.

Despite its obscure name, WUVISAAFT is not a scam or fraudulent charge. It’s a standard security measure employed by reputable businesses to ensure smooth transactions and protect themselves from potential financial risks.

How to Identify and Handle WUVISAAFT Charges on Your Account?

WUVISAAFT charges can appear on your debit card statement or online banking portal under various descriptions, such as “Pending Charge,” “Temporary Hold,” or the specific merchant’s name. Here are some tips for identifying and handling these charges:

- Review Recent Transactions: If you notice a WUVISAAFT charge on your statement, review your recent transactions to determine which merchant or service provider initiated the hold.

- Check the Charge Amount: Verify that the WUVISAAFT charge amount aligns with the expected cost of the transaction or reservation you made.

- Monitor the Charge Duration: WUVISAAFT charges should typically be released within a few days to a week after the final transaction is processed. If the charge persists for an extended period, it may be time to take action.

- Contact the Merchant: If the WUVISAAFT charge seems excessive or remains on your account longer than expected, contact the merchant directly to inquire about the charge and request its release if appropriate.

- Escalate to Your Bank: If the merchant is unresponsive or unable to resolve the issue, reach out to your bank or debit card issuer for assistance. They can provide further guidance and potentially initiate a formal dispute process if needed.

By staying informed and taking prompt action, you can effectively manage WUVISAAFT charges and ensure that your debit card funds are correctly accounted for.

Everything You Need to Know About the WUVISAAFT Debit Card Fee

As mentioned earlier, WUVISAAFT is not a fee imposed by banks or merchants. It’s a temporary hold or deduction from your available debit card balance to secure funds for a future payment. This practice is distinct from actual fees or penalties that may be charged by financial institutions or businesses.

When a merchant initiates a WUVISAAFT charge, the held funds are essentially earmarked for the upcoming transaction. Once the final payment is processed, the WUVISAAFT charge should be released, and the held funds should become available for use again in your account.

It’s crucial to understand that WUVISAAFT charges are not intended to generate additional revenue for merchants or banks. Instead, they serve as a security measure to protect against insufficient funds or potential losses during pending transactions.

Unexpected WUVISAAFT Charge? Here’s What You Should Do

Despite the legitimate purpose of WUVISAAFT charges, there may be instances where you encounter an unexpected or prolonged charge on your debit card statement. In such cases, it’s important to take prompt action to resolve the issue. Here’s a step-by-step guide on how to address unexpected WUVISAAFT charges:

- Review the Charge Details: Carefully review the WUVISAAFT charge on your statement, including the merchant’s name, the charge amount, and the date it was initiated.

- Contact the Merchant: Reach out to the merchant or service provider that initiated the charge. Inquire about the reason for the charge and request its release if it appears to be erroneous or if the transaction has already been completed.

- Provide Relevant Information: Be prepared to provide details about your transaction or reservation, such as confirmation numbers, dates, and any supporting documentation.

- Escalate to Your Bank: If the merchant is unresponsive or unable to resolve the issue, contact your bank or debit card issuer. Explain the situation and request their assistance in investigating and resolving the charge.

- File a Dispute: If the merchant and your bank are unable to resolve the issue satisfactorily, you may need to file a formal dispute or chargeback request. Be sure to provide all relevant documentation and follow the required procedures outlined by your bank.

- Monitor Your Account: Continuously monitor your debit card statement and account activity to ensure that the disputed charge is correctly resolved and that no further unauthorized charges appear.

By taking a proactive approach and following these steps, you can effectively address unexpected WUVISAAFT charges and protect your financial interests.

WUVISAAFT Charges Explained: A Guide for Debit Card Users

To summarize, WUVISAAFT (Will Unconditionally Visa Automatic Funds Transfer) charges are temporary holds placed on your debit card by merchants or service providers to secure funds for pending transactions. Here are the key points you should keep in mind:

- WUVISAAFT charges are not fees but rather temporary deductions from your available balance.

- These charges are commonly used for hotel reservations, car rentals, and online purchases with future delivery.

- The held funds should be released once the final transaction amount is processed and paid.

- WUVISAAFT charges are a legitimate practice used by reputable merchants as a security measure.

- If you encounter an unexpected or prolonged WUVISAAFT charge, contact the merchant and your bank promptly to resolve the issue.

By understanding the purpose and nature of WUVISAAFT charges, you can better manage your debit card transactions and avoid unnecessary confusion or concern when these charges appear on your statement.

Read More About: WHAT IS THE WUVISAAFT CHARGE ON BANK STATEMENT?

Is the WUVISAAFT Charge Legitimate or a Scam?

One common concern among debit card users is whether WUVISAAFT charges are legitimate or potentially a scam or fraudulent activity. It’s important to note that WUVISAAFT charges are a legitimate and widely used practice by reputable merchants and businesses.

These charges serve a specific purpose: to temporarily hold funds on your debit card to ensure sufficient balance for a future payment. They are not intended to generate additional revenue for merchants or banks but rather to protect against potential losses or insufficient funds during pending transactions.

While WUVISAAFT charges may seem confusing or raise suspicions due to their obscure name, they are a standard security measure employed by numerous retailers, hotels, car rental companies, and other service providers worldwide.

However, it’s still essential to remain vigilant and carefully review your debit card statements to identify any potentially fraudulent or unauthorized charges. Here are some tips to help distinguish legitimate WUVISAAFT charges from potential scams:

- Recognize Familiar Merchant Names: If the WUVISAAFT charge is associated with a merchant or service provider you recently made a reservation or purchase with, it’s likely a legitimate charge.

- Match Charge Amounts: Verify that the WUVISAAFT charge amount corresponds to the expected cost of the transaction or reservation you made.

- Check Charge Timing: Legitimate WUVISAAFT charges typically appear on your statement shortly before or after making a reservation or placing an order for future delivery.

- Monitor Charge Resolution: Authentic WUVISAAFT charges should be released within a reasonable timeframe after the final transaction is processed.

- Contact the Merchant: If you’re unsure about a WUVISAAFT charge, don’t hesitate to contact the merchant directly for clarification and verification.

By exercising caution and following these guidelines, you can effectively identify legitimate WUVISAAFT charges and distinguish them from potential fraudulent activities on your debit card account.

Steps to Dispute a WUVISAAFT Charge on Your Debit Card

Despite the legitimate nature of WUVISAAFT charges, there may be instances where you need to dispute a charge that appears erroneous or unauthorized. In such cases, it’s essential to act promptly and follow the proper procedures to resolve the issue. Here are the steps you can take to dispute a WUVISAAFT charge on your debit card:

- Contact the Merchant: As a first step, reach out to the merchant or service provider that initiated the WUVISAAFT charge. Explain the situation and request a resolution, such as the release of the hold or a refund if the charge is deemed invalid.

- Gather Supporting Documentation: Collect any relevant documentation related to the transaction or reservation, such as confirmation numbers, receipts, or communication with the merchant.

- File a Claim with Your Bank: If the merchant is unresponsive or unable to resolve the issue, file a claim or dispute with your bank or debit card issuer. Provide them with the details of the charge, supporting documentation, and any correspondence with the merchant.

- Follow Your Bank’s Dispute Process: Each bank or card issuer has specific procedures for disputing charges. Follow their guidelines closely, which may include completing dispute forms, providing written statements, or submitting additional documentation.

- Remain Persistent: If your initial dispute is denied or you encounter resistance, don’t hesitate to escalate the matter or pursue further action through regulatory agencies or consumer protection organizations.

- Monitor Your Account: Continuously monitor your debit card statement and account activity to ensure that the disputed WUVISAAFT charge is correctly resolved and that no further unauthorized charges appear.

It’s important to act promptly when disputing a WUVISAAFT charge, as there are often time limitations imposed by banks and card issuers for filing disputes. By following the proper procedures and providing thorough documentation, you can increase your chances of successfully resolving the issue and protecting your financial interests.

Preventing Unwanted WUVISAAFT Charges on Your Debit Card

While WUVISAAFT charges are a legitimate practice, excessive or unnecessary holds can still be frustrating and inconvenient for debit card users. To minimize the occurrence of unwanted WUVISAAFT charges, consider implementing the following proactive strategies:

- Use Credit Cards for Certain Transactions: For transactions that may result in significant temporary holds, such as hotel reservations or car rentals, consider using a credit card instead of a debit card. Credit card holds are typically released more quickly, and you won’t have your available debit card funds tied up.

- Set Spending Limits on Your Debit Card: Many banks allow you to set daily or monthly spending limits on your debit card. By setting appropriate limits, you can reduce the impact of WUVISAAFT charges on your available funds.

- Monitor Account Activity Regularly: Make a habit of regularly reviewing your debit card statement and account activity. This will help you identify any unexpected or prolonged WUVISAAFT charges promptly and take action accordingly.

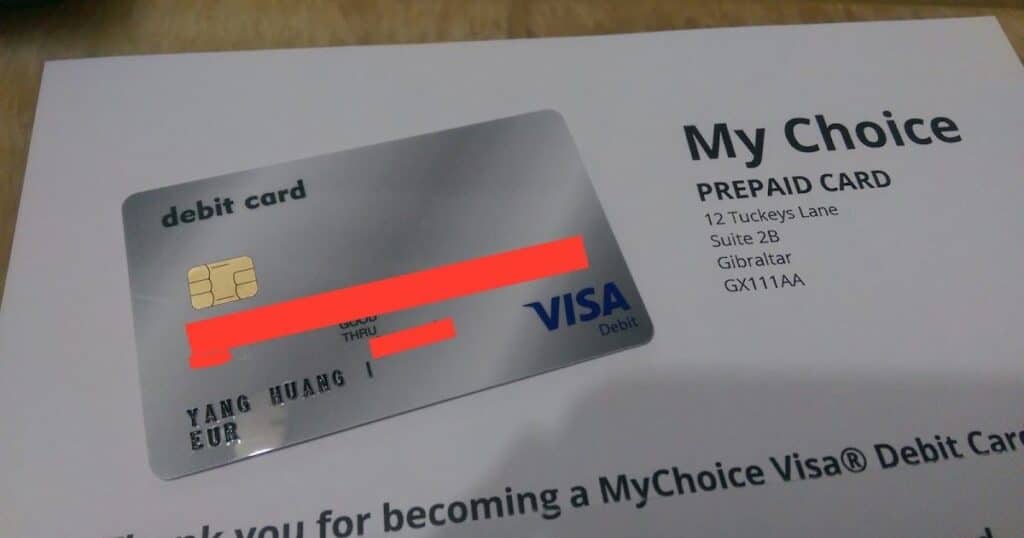

- Consider Alternative Payment Methods: For certain types of transactions or purchases, explore alternative payment methods that may not result in temporary holds, such as prepaid cards, mobile wallets, or online payment platforms.

- Be an Informed Consumer: Educate yourself about the policies and practices of merchants, hotels, and rental companies regarding temporary holds and WUVISAAFT charges. This knowledge can help you make informed decisions and plan accordingly.

By being proactive and implementing these strategies, you can minimize the impact of WUVISAAFT charges on your debit card account and maintain better control over your available funds.

Why You Might See a WUVISAAFT Charge on Your Debit Card?

WUVISAAFT charges typically appear on your debit card statement in various scenarios where a merchant or service provider needs to secure funds for a future payment. Here are some common reasons why you might encounter a WUVISAAFT charge:

- Hotel Reservations: Hotels often place a WUVISAAFT charge on your debit card to cover the cost of your stay, as well as any potential incidentals or damages during your visit.

- Car Rental Bookings: When renting a car, rental companies may initiate a WUVISAAFT charge to ensure you have sufficient funds to cover the rental cost, fuel expenses, and any potential damages or fees.

- Online Purchases with Future Delivery: If you make an online purchase for an item that will be shipped or delivered at a later date, the merchant may place a WUVISAAFT charge to secure the payment until the item is received.

- Utility or Service Deposits: Some utility companies or service providers may temporarily hold funds on your debit card as a deposit or security measure when establishing a new account or service.

- Restaurant or Bar Tabs: When you start a tab at a restaurant or bar, the establishment may place a WUVISAAFT charge on your debit card to cover the anticipated bill, including a gratuity.

- Event or Ticket Reservations: If you purchase tickets for an event or make reservations for activities in advance, a WUVISAAFT charge may be placed to ensure you have sufficient funds for the final payment.

In each of these scenarios, the WUVISAAFT charge serves as a temporary hold to ensure that sufficient funds are available for the final transaction amount. Once the payment is processed, the WUVISAAFT charge should be released, and the held funds should become available for use again in your account.

Investigating the WUVISAAFT Debit Card Charge: What You Should Know

If you encounter a WUVISAAFT charge on your debit card statement and need to investigate further, it’s essential to follow a thorough process to ensure a prompt and satisfactory resolution. Here’s a checklist of steps you should take:

- Review Recent Transactions: Carefully review your debit card statement and recent transactions to identify the merchant or service provider associated with the WUVISAAFT charge.

- Gather Relevant Documentation: Collect any documentation related to the transaction or reservation that may have triggered the WUVISAAFT charge, such as confirmation emails, receipts, or reservation numbers.

- Contact the Merchant: Reach out to the merchant or service provider directly and inquire about the WUVISAAFT charge. Provide them with the relevant details and documentation, and request an explanation or resolution if the charge appears incorrect or excessive.

- Keep Records: Maintain a detailed record of your communications with the merchant, including the dates, times, and names of any representatives you spoke with, as well as the information they provided.

- File a Formal Dispute: If your bank is unable to resolve the issue directly with the merchant, you may need to file a formal dispute or chargeback request. Follow your bank’s procedures carefully, provide all relevant documentation, and adhere to any time limitations or deadlines.

- Monitor Account Activity: Continuously monitor your debit card statement and account activity to ensure that the disputed WUVISAAFT charge is correctly resolved and that no further unauthorized charges appear.

- Seek Further Assistance: If you encounter significant resistance or your dispute is denied, consider escalating the matter to regulatory agencies, consumer protection organizations, or seek legal counsel if necessary.

By following this comprehensive investigation process and taking a proactive approach, you can increase your chances of successfully resolving any issues related to WUVISAAFT charges on your debit card account.

Common Reasons for a WUVISAAFT Charge on Your Statement

While WUVISAAFT charges can appear mysterious at first glance, they typically stem from common situations where merchants or service providers need to secure funds for a future payment. Here are some of the most common reasons why you might see a WUVISAAFT charge on your debit card statement:

- Hotel Reservations: Hotels often place a WUVISAAFT charge to cover the cost of your stay, as well as potential incidentals like room service, minibar charges, or damages.

- Car Rentals: Car rental companies initiate WUVISAAFT charges to ensure you have sufficient funds to cover the rental cost, fuel expenses, and any potential damages or fees.

- Online Purchases with Future Delivery: When you make an online purchase for an item that will be shipped or delivered at a later date, merchants may place a WUVISAAFT charge to secure the payment.

- Utility or Service Deposits: Some utility companies or service providers temporarily hold funds as a deposit or security measure when establishing a new account or service.

- Restaurant or Bar Tabs: Restaurants and bars may place a WUVISAAFT charge on your debit card to cover your anticipated bill, including a gratuity, when you start a tab.

- Event or Ticket Reservations: If you purchase tickets for an event or make reservations for activities in advance, a WUVISAAFT charge may be initiated to ensure you have sufficient funds for the final payment.

- Subscription or Recurring Services: Some subscription-based services or recurring payments may result in a WUVISAAFT charge to verify the availability of funds before processing the payment.

- Travel Bookings: Airlines, tour operators, or travel agencies may place WUVISAAFT charges on your debit card when booking flights, accommodations, or packages in advance.

While this list is not exhaustive, it covers some of the most common scenarios that can trigger a WUVISAAFT charge on your debit card statement. Understanding the reasons behind these charges can help you identify legitimate transactions and take appropriate action if needed.

How to Avoid Future WUVISAAFT Charges on Your Debit Card?

While WUVISAAFT charges are a legitimate practice used by merchants and service providers, excessive or unnecessary holds can still be frustrating and inconvenient for debit card users. To minimize the occurrence of unwanted WUVISAAFT charges in the future, consider implementing the following strategies:

- Use Credit Cards for Certain Transactions: For transactions that may result in significant temporary holds, such as hotel reservations or car rentals, consider using a credit card instead of a debit card. Credit card holds are typically released more quickly, and you won’t have your available debit card funds tied up.

- Set Spending Limits: Many banks allow you to set daily or monthly spending limits on your debit card. By setting appropriate limits, you can reduce the impact of WUVISAAFT charges on your available funds.

- Monitor Account Activity Regularly: Make a habit of regularly reviewing your debit card statement and account activity. This will help you identify any unexpected or prolonged WUVISAAFT charges promptly and take action accordingly.

- Explore Alternative Payment Methods: For certain types of transactions or purchases, consider alternative payment methods that may not result in temporary holds, such as prepaid cards, mobile wallets, or online payment platforms like PayPal.

- Be an Informed Consumer: Educate yourself about the policies and practices of merchants, hotels, and rental companies regarding temporary holds and WUVISAAFT charges. This knowledge can help you make informed decisions and plan accordingly.

- Maintain a Buffer: Consider maintaining a financial buffer in your debit card account to accommodate potential WUVISAAFT charges without significantly impacting your available funds.

- Communicate with Merchants: When making reservations or purchases that may result in a WUVISAAFT charge, communicate with the merchant or service provider to understand their policies and procedures regarding temporary holds.

By implementing these strategies, you can minimize the impact of WUVISAAFT charges on your debit card account and maintain better control over your available funds.

Consumer Guide: Dealing with WUVISAAFT Charges on Debit Cards

Navigating the world of debit card charges can be confusing, especially when it comes to unfamiliar terms like “WUVISAAFT.” To help you effectively deal with these charges, here’s a concise consumer guide:

What is WUVISAAFT? WUVISAAFT stands for “Will Unconditionally Visa Automatic Funds Transfer.” It’s a temporary hold placed on your debit card by merchants or service providers to secure funds for a future payment.

Common Scenarios for WUVISAAFT Charges:

- Hotel reservations

- Car rentals

- Online purchases with future delivery

- Utility or service deposits

- Restaurant or bar tabs

- Event or ticket reservations

Key Points to Remember:

- WUVISAAFT is not a fee; it’s a temporary deduction from your available balance.

- These charges are a legitimate practice used by reputable businesses as a security measure.

- The held funds should be released once the final transaction amount is processed and paid.

Steps to Take If You Encounter a WUVISAAFT Charge:

- Review your recent transactions and identify the associated merchant or service provider.

- Contact the merchant directly to inquire about the charge and request its release if appropriate.

- If the merchant is unresponsive, escalate the issue to your bank or debit card issuer.

- Provide relevant documentation and follow the dispute procedures outlined by your bank.

- Monitor your account activity and ensure the charge is correctly resolved.

Proactive Strategies to Minimize WUVISAAFT Charges:

- Use credit cards for transactions that may result in significant holds.

- Set spending limits on your debit card.

- Monitor account activity regularly.

- Explore alternative payment methods.

- Be an informed consumer and understand merchant policies.

- Maintain a financial buffer in your account.

- Communicate with merchants about their hold policies.

By following this consumer guide, you can better understand WUVISAAFT charges, take appropriate action when needed, and implement strategies to minimize their impact on your debit card account.

Frequently Asked Questions (FAQ)

To address common concerns and queries, let’s explore some frequently asked questions about WUVISAAFT charges:

Q: How long can a WUVISAAFT charge remain on my debit card? A: Typically, WUVISAAFT charges should be released within a few days to a week after the final transaction is processed and paid. However, the exact timeframe can vary depending on the merchant’s policies and practices. If a WUVISAAFT charge persists for an extended period, it’s advisable to contact the merchant and your bank for resolution.

Q: Can I dispute a WUVISAAFT charge if I believe it’s incorrect? A: Yes, you can dispute a WUVISAAFT charge if you believe it’s erroneous or unauthorized. Contact the merchant first to inquire about the charge and request its release if appropriate. If the merchant is unresponsive, you can escalate the issue to your bank and follow their dispute procedures.

Q: Will a WUVISAAFT charge affect my credit score? A: No, WUVISAAFT charges are temporary holds on your debit card funds and do not impact your credit score. However, if a WUVISAAFT charge results in an overdraft or other account issues due to insufficient funds, it may indirectly affect your credit score.

Q: Can I avoid WUVISAAFT charges altogether? A: While it’s challenging to completely avoid WUVISAAFT charges, you can minimize their occurrence by using credit cards for certain transactions, setting spending limits on your debit card, and exploring alternative payment methods. Being an informed consumer and understanding merchant policies can also help you plan accordingly.

Including an FAQ section addresses common concerns and provides concise answers to frequently asked questions, further enhancing the comprehensiveness and usefulness of the blog post.

Conclusion

As we’ve explored in this comprehensive guide, WUVISAAFT charges can be confusing and concerning for debit card users unfamiliar with the term. However, by understanding their purpose, common scenarios, and proper handling procedures, you can navigate these charges with confidence and ease.

Remember, WUVISAAFT stands for “Will Unconditionally Visa Automatic Funds Transfer” and represents a temporary hold placed on your debit card by merchants or service providers to secure funds for a future payment. These charges are a legitimate practice used by reputable businesses as a security measure and should be released once the final transaction amount is processed and paid.

While WUVISAAFT charges are not intended to generate additional revenue or cause inconvenience, it’s important to monitor your debit card statements regularly, contact merchants promptly if you encounter any discrepancies, and follow proper dispute procedures if necessary.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.