Have you ever noticed a “Quick Card San Diego” charge on your bank statement and wondered what it was? Don’t worry, you’re not alone. Many consumers are puzzled by this unfamiliar line item on their statements. In this comprehensive guide, we’ll demystify the Quick Card San Diego charge, explaining what it is, how it works, and what you need to know about it.

Understanding the Quick Card San Diego Charge on Your Bank Statement

Quick Card San Diego is a service that allows customers to withdraw cash from certain ATMs without using a physical debit or credit card. Instead, you can request a one-time code from your bank’s mobile app or website, which you then enter into the ATM to access your cash.

The “Quick Card San Diego” charge appears on your statement because it’s the service provider that facilitates these cardless cash withdrawals at participating ATMs. While convenient, using this service often comes with a fee, which is reflected in the charge on your bank statement.

Quick Card San Diego: What You Need to Know About This Bank Charge

Here are some key details about Quick Card San Diego:

- How it Works: You request a code from your bank’s app or website, enter it at a participating ATM, and receive your cash without needing a physical card.

- Participating Banks/ATMs: Quick Card San Diego is available at ATMs owned by certain banks and ATM networks, including Chase, Bank of America, Wells Fargo, and others.

- Fees: Most banks charge a fee for using Quick Card San Diego, typically around $3-$5 per withdrawal. However, fees can vary depending on your account type and the ATM owner.

Decoding the Quick Card San Diego Transaction on Your Bank Account

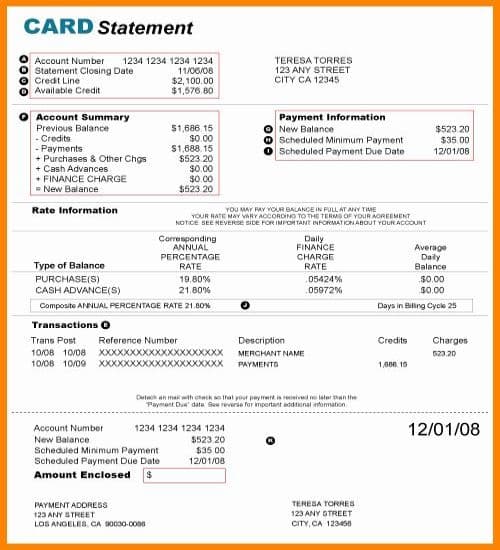

When you use Quick Card San Diego, the charge on your statement might appear as something like “Quick Card San Diego $X.XX” or “QC San Diego Withdrawal $X.XX.” The amount shown is the fee charged by your bank for the cardless cash withdrawal service.

It’s essential to distinguish this charge from regular ATM fees or cash withdrawal fees, which may appear separately on your statement.

Quick Card San Diego Charges Explained: A Comprehensive Guide

The fees associated with Quick Card San Diego can vary based on several factors:

- Account Type: Some banks may waive or reduce the fee for premium account holders or those with specific account types.

- ATM Owner: Withdrawing from an ATM owned by your bank may incur a lower fee than using an out-of-network ATM.

- Transaction Amount: In some cases, fees may be higher for larger cash withdrawal amounts.

Here’s a table comparing typical Quick Card San Diego fees from some major banks:

| Bank | Quick Card San Diego Fee |

| Chase | $3 |

| Bank of America | $3 |

| Wells Fargo | $3 |

| Citibank | $2.50 |

| PNC Bank | $3 |

It’s worth noting that these fees are generally lower than the fees charged for using an out-of-network ATM with your physical debit card.

Related Post: Decoding PAI ISO Charges on Your Bank Statement: What You Need to Know

What Is Quick Card San Diego? Identifying This Charge on Your Statement

As mentioned earlier, Quick Card San Diego is a service that allows you to withdraw cash from participating ATMs without a physical debit or credit card. You simply request a one-time code from your bank mobile app or website and enter it at the ATM to access your cash.

This service can be particularly useful in situations where you’ve misplaced your card, it’s been lost or stolen, or you find yourself in an emergency cash need. However, it’s crucial to be aware of the potential fees involved and check your statements carefully for any unfamiliar charges like “Quick Card San Diego.”

The Quick Card San Diego Bank Charge: An Overview for Consumers

In summary, here are the key points to remember about the Quick Card San Diego charge:

- Convenience: Quick Card San Diego offers the convenience of cordless cash withdrawals, especially in emergencies or when you’ve misplaced your card.

- Fees: Using this service often incurs a fee charged by your bank, typically around $3-$5 per withdrawal.

- Alternatives: If you want to avoid fees, consider using mobile wallets, cash back rewards, or withdrawing cash from your bank’s ATMs when possible.

It’s always a good idea to review your bank statements carefully and be aware of any charges you don’t recognize, like Quick Card San Diego. If you’re unsure about a charge, don’t hesitate to contact your bank for clarification.

Why Is Quick Card San Diego Appearing on My Bank Statement?

If you’ve noticed a “Quick Card San Diego” charge on your bank statement, it’s likely because you’ve used the cardless cash withdrawal service at a participating ATM.

This service is provided by Quick Card San Diego, which facilitates these transactions and charges a fee to your bank, who then passes it on to you.

While the charge may seem unfamiliar at first, it’s a legitimate service and not a cause for concern regarding fraud or unauthorized activity.

However, if you do not recall using Quick Card San Diego or have any doubts about the charge’s authenticity, it’s always best to contact your bank and verify the transaction.

Related Post: How to Start a Bank: The Ultimate Guide

Quick Card San Diego: A Detailed Look at This Common Bank Charge

The Quick Card San Diego charge is becoming increasingly common as more banks offer cardless cash withdrawal services for added convenience. However, it’s essential to understand the details and potential costs involved.

Here’s an in-depth look at some key aspects of Quick Card San Diego:

How It Works:

- You request a one-time code from your bank’s mobile app or website.

- The code is valid for a limited time (typically 30-60 minutes).

- You enter the code at a participating ATM to access your cash without needing a physical card.

Advantages:

- Convenient option when you’ve misplaced your card or find yourself in an emergency cash need

- Can be more secure than carrying a physical card, as the code is only valid for a short time

- Available at many major bank ATMs and ATM networks

Potential Drawbacks:

- Fees charged by your bank for using the service

- Limited availability at non-participating ATMs

- Risk of forgetting or mistyping the one-time code, rendering it invalid

Fees and Policies:

As mentioned earlier, fees for Quick Card San Diego typically range from $2.50 to $5 per withdrawal, depending on your bank’s policies and the ATM owner. Some banks may waive or reduce fees for premium account holders or specific account types.

It’s essential to review your bank’s fee schedule and policies regarding Quick Card San Diego to understand the potential costs involved.

Spotting and Understanding Quick Card San Diego Transactions

To help you identify Quick Card San Diego charges on your statement, here are some common examples of how they might appear:

- “Quick Card San Diego $3.00”

- “QC San Diego Withdrawal $4.50”

- “Cardless Cash Withdrawal Fee (QC San Diego) $2.75”

These charges will typically be separate from any standard ATM fees or cash withdrawal fees you may incur.

If you’re unsure about a charge, don’t hesitate to contact your bank for clarification. They can provide more details on the specific transaction and help you understand why the charge was applied.

Everything You Need to Know About the Quick Card San Diego Charge

Throughout this comprehensive guide, we’ve covered all the essential aspects of the Quick Card San Diego charge:

- What it is and how the cardless cash withdrawal service works

- Key details about participating banks and ATMs

- Typical fee structures and factors that affect the fees

- How to identify the charge on your bank statement

- Advantages and potential drawbacks of using Quick Card San Diego

- Tips for understanding and verifying these transactions on your statement

By familiarizing yourself with this service and the associated charges, you can make informed decisions about whether to use Quick Card San Diego or explore alternative options for accessing cash.

Remember, being an educated and informed consumer is crucial when it comes to managing your finances and understanding the various charges and fees that may appear on your bank statements.

Case Study: Using Quick Card San Diego in an Emergency

One scenario where Quick Card San Diego can be particularly useful is during an emergency cash need. Imagine you’re out running errands, and your wallet gets lost or stolen. Without your debit or credit cards, accessing cash can be a challenge.

This is where Quick Card San Diego can come in handy. By requesting a one-time code from your bank’s mobile app or website, you can quickly withdraw cash from a participating ATM without needing your physical card.

Here’s how the process might play out:

- The Situation: You realize your wallet is missing, and you need cash for transportation or essentials.

- Requesting the Code: Using your smartphone, you log into your bank’s app and request a Quick Card San Diego code.

- Finding an ATM: You locate a nearby ATM that accepts Quick Card San Diego transactions, often indicated by signage or stickers on the machine.

- Entering the Code: You enter the one-time code provided by your bank into the ATM.

- Withdrawing Cash: After verifying your identity and account information, the ATM dispenses the requested cash amount.

- Reviewing the Charge: A few days later, you notice the “Quick Card San Diego” charge on your bank statement, reflecting the fee for the cardless withdrawal.

While the fee may be an added expense in an emergency situation, the convenience of accessing cash without a physical card can be invaluable.

“I was so relieved to have the Quick Card San Diego option when my wallet went missing. It allowed me to get the cash I needed without any additional hassle.” – Sarah T., Quick Card San Diego user

Alternatives to Quick Card San Diego

While Quick Card San Diego offers a convenient solution for cardless cash withdrawals, it’s not the only option available. Here are some alternatives to consider:

- Mobile Wallets and Digital Payments: Services like Apple Pay, Google Pay, and Samsung Pay allow you to make contactless payments using your smartphone, eliminating the need for physical cards or cash in many situations.

- Cash Back Rewards: Some credit cards and debit accounts offer cash back rewards or incentives for making qualifying purchases. This can be a way to accumulate cash without needing to visit an ATM.

- Peer-to-Peer Payments: Apps like Venmo, Cash App, and Zelle enable you to request or receive money from friends and family digitally, which can then be transferred to your bank account or used for online purchases.

- Bank Branch Visits: If you have a nearby branch location for your bank, you may be able to withdraw cash from a teller or use their ATMs without incurring additional fees.

- Cardless ATM Access: Some banks offer their own cardless ATM access solutions, which may have different fees or policies than Quick Card San Diego.

It’s always a good idea to explore and compare the various options available to you, taking into account factors like convenience, fees, and security.

Expert Insight: Tips for Managing Quick Card San Diego Transactions

To provide additional perspective on Quick Card San Diego charges, we reached out to personal finance expert Emily D. Harper, who shared some valuable tips:

“Quick Card San Diego can be a lifesaver in certain situations, but it’s important to be mindful of the fees involved,” says Harper. “My advice is to carefully review your bank’s policies and fee schedules for this service, and consider whether the convenience outweighs the cost.”

Harper also recommends setting up account alerts or notifications to stay informed about any Quick Card San Diego transactions on your statement.

“Being proactive and monitoring your accounts closely can help you catch any unauthorized or erroneous charges quickly,” she adds.

Additionally, Harper suggests exploring alternatives like mobile wallets or peer-to-peer payment apps, which may offer more cost-effective options for certain situations.

“While Quick Card San Diego serves a purpose, it’s always wise to explore all your options and choose the most cost-effective and secure method for accessing funds,” Harper concludes.

By following expert advice and staying informed about services like Quick Card San Diego, you can make more confident financial decisions and manage your accounts effectively.

Quick Card San Diego: Striking a Balance Between Convenience and Cost

As we’ve explored throughout this comprehensive guide, Quick Card San Diego offers a convenient solution for cardless cash withdrawals, but it’s essential to weigh the costs and potential fees involved.

On one hand, the ability to access cash without a physical card can be invaluable in emergencies or situations where you’ve misplaced your wallet. It provides peace of mind and a secure way to obtain the funds you need.

However, the fees charged by banks for using Quick Card San Diego can add up, especially if you rely on the service frequently. It’s crucial to review your bank’s policies and understand the fee structures to make informed decisions.

Ultimately, the choice to use Quick Card San Diego comes down to finding the right balance between convenience and cost for your specific needs and financial situation. In some cases, the added expense may be worth the peace of mind and accessibility it provides. In others, exploring alternative options like mobile wallets or peer-to-peer payments may be more cost-effective.

By staying informed, monitoring your accounts, and considering expert advice, you can navigate the world of cardless cash withdrawals and make decisions that align with your financial goals and priorities.

Remember, knowledge is power when it comes to managing your finances, and understanding services like Quick Card San Diego is an important step in taking control of your money.

Read This Post: Comn Cap Apy F1 Autopay Charge

Conclusion

In conclusion, understanding the Quick Card San Diego charge on your bank statement is essential for effective financial management. This comprehensive guide has explored the details of this cardless cash withdrawal service, including how it works, fees involved, and potential alternatives.

By staying informed and vigilant about such charges, you can make informed decisions that align with your financial goals. Remember, convenience and security come at a cost, but with the right knowledge, you can strike the perfect balance for your needs.

FAQ’s

What is quick card transaction San Diego?

Quick Card San Diego is a service that allows cardless cash withdrawals from ATMs using a one-time code provided by your bank. It appears as a fee charged by the service provider on your statement.

What is quick card payment?

Quick card payment refers to the ability to make cardless cash withdrawals from ATMs by entering a temporary code instead of using a physical debit or credit card.

How do I find out where a charge came from?

Contact your bank directly to inquire about any unfamiliar charges on your statement. They can provide details on the transaction source and verify its legitimacy.

Why is there a charge on my card I didn’t make?

Unauthorized charges could be due to fraud or mistakes. Promptly report any charges you didn’t make to your bank for investigation and potential refunds.

Can a bank take money from your account without permission?

Banks can deduct money from accounts for legitimate reasons like fees, loan payments, or court orders. However, they cannot take funds without proper authorization or notification.

Do banks refund scammed money?

If you’ve been a victim of fraud or scams, banks may refund the stolen money after investigating the unauthorized transactions, provided you report them promptly.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.