The account name in banking identifies who owns the account. It’s like your name tag for your money. Whether it’s you or a business, the account name is what shows up on all the paperwork. Your account name is like a label for your money.

It’s crucial for making sure money goes where it’s supposed to. Without the right account name, transactions can get mixed up. So, it’s like your account’s personal identity.Think of it as your money’s passport. Without the right name, it can’t travel where you want it to go.

When you open an account, you’ll give your name. For businesses, it’s their official name. This helps banks keep everything straight and secure.Whether you’re an individual or a business, your account name is your financial identity.

Key Takeaways

- The account name identifies who owns the bank account.

- It’s crucial for transactions and verification.

- Personalizing it can make banking easier.

- Different accounts have specific naming formats.

- For individuals, it’s usually first and last name.

- Businesses use their legal name.

- Accuracy in naming is essential.

- Mistakes can lead to transaction issues.

- Always verify your account name.

- Account names are like labels for bank accounts.

- They help identify owners and prevent errors.

- Customizing them adds personal touch and convenience.

- Personal accounts use individual names.

- Joint accounts combine names of owners.

- Business accounts use legal entity names.

- Pay attention to spelling and format.

- Incorrect names can cause transaction problems.

- Double-check before making changes or transactions.

What Is The Account Name For a Bank Account?

The account name in a bank account refers to the name of the account holder. It is the name that appears on statements and other banking documents. This name helps identify the owner of the account.

Each account name is unique and corresponds to a specific individual or business. It serves as an essential identifier for conducting transactions accurately.

Account names are crucial for verifying payments and ensuring that funds are directed to the correct recipient. They play a vital role in maintaining the security and integrity of banking transactions.

Are You Looking To Boost Your Income? Earn Cash By Completing Surveys Through IPSOS iSA

Consider completing surveys with IPSOS iSAY. It’s an opportunity to earn cash quickly and easily. Many people find it a convenient way to supplement their income.

IPSOS iSAY pays cash rewards for your opinions. Simply share your thoughts and watch videos. It’s free to join and offers potential earnings of £5-£6 per hour. This flexibility makes it ideal for those seeking extra cash without committing to a traditional job.

Joining IPSOS iSAY allows you to earn money in your spare time. Whether you’re a student, stay-at-home parent, or working professional, it’s a simple way to boost your income. Plus, you can do it all from the comfort of your own home.

Are thinking about your benefit entitlement and working hours, but looking for some extra cash? Completing surveys is a great way to do it.

- Consider your benefit entitlement and working hours.

- Need some extra cash?

- Completing surveys is a great option.

- Surveys offer a simple way to earn money.

- You can do them in your spare time.

- No need for special skills or qualifications.

- Sign up for survey websites.

- Share your opinions and get paid.

- It’s a flexible and convenient way to boost your income.

- Exploring your options for additional income?

- Surveys could be the answer.

- Earn cash by sharing your opinions.

- Surveys are accessible to everyone.

- No need for specialized knowledge.

- Simply provide your honest feedback.

- Join reputable survey platforms.

- Complete surveys at your own pace.

- Start earning extra cash today.

IPSOS iSAY pay cash rewards for simply giving your opinion and watching videos. It’s free to join and you have the potential to earn £5-£6 an hour.

IPSOS iSAY offers cash rewards for sharing your opinions and watching videos. Joining is free, and you can earn £5-£6 per hour. Simply participate and get rewarded. It’s that easy!

Express your thoughts and earn cash with IPSOS iSAY. Membership is free, and you can start earning immediately. Your opinions matter, and they pay you for them.

Join IPSOS iSAY to earn money by sharing your opinions and watching videos. It’s a simple way to make extra cash, and it’s completely free to join. Start earning today!

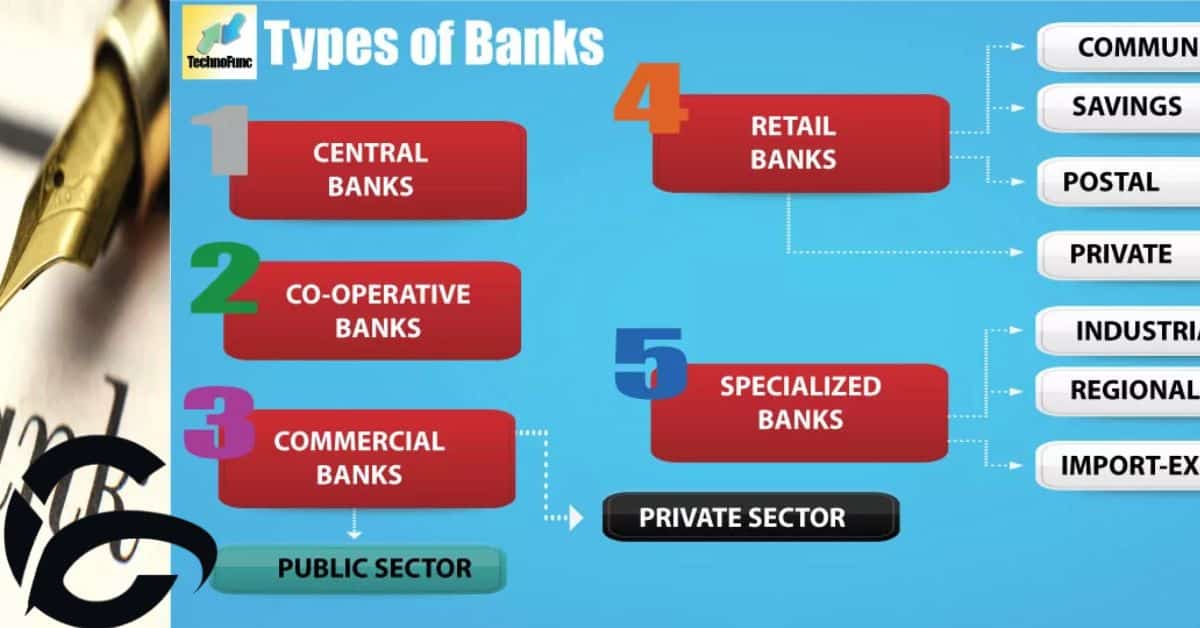

Different types of bank accounts in the UK

In the UK, various types of bank accounts cater to different needs. Personal current accounts offer basic banking services for daily transactions. Savings accounts help individuals save money and earn interest on their deposits.

Joint accounts are shared by two or more individuals, such as couples or business partners. Business accounts are designed for businesses and provide specialized services. Each type of account serves a specific purpose and comes with its own features and benefits.

Personal Current Accounts

Personal current accounts are basic bank accounts. They allow individuals to deposit and withdraw money. These accounts often come with a debit card.

You can use a personal current account for everyday expenses. They offer services like online banking and direct debits. Many banks provide these accounts with no monthly fees.

It’s important to compare different current accounts. Look at factors like interest rates and fees. Choose one that meets your financial needs.

Savings Accounts

Savings accounts are a smart way to grow your money. They offer a safe place to store funds while earning interest. Many people use them for emergency funds or long-term goals.

Opening a savings account is easy. Just visit your local bank or credit union. You’ll need some identification and an initial deposit to get started.

With a savings account, you can watch your money grow over time. It’s a simple yet effective way to build financial security for the future.

Joint Accounts

Joint accounts allow multiple individuals to share ownership of a single bank account. Each account holder has equal access and responsibility for managing the funds. Transactions made from a joint account typically require consent from all parties involved.

These accounts are commonly used by couples, family members, or business partners to manage shared finances. Joint account holders can deposit or withdraw money, write checks, and make online transactions together. It’s essential for all parties to communicate openly and agree on financial decisions to avoid conflicts.

While joint accounts offer convenience for shared expenses, they also come with potential risks. All account holders are liable for any overdrafts, fees, or misuse of funds. Therefore, it’s crucial to establish clear communication and trust among co-owners to maintain a healthy financial relationship.

Business Accounts

Business accounts are tailored for companies and organizations. They offer specialized services like invoicing and payroll. These accounts are crucial for managing business finances efficiently.

They provide a platform for businesses to conduct transactions. Business accounts often require documentation for verification. These accounts are essential for maintaining financial records accurately.

Opening a business account typically involves providing legal documentation. This ensures compliance with banking regulations and security measures.

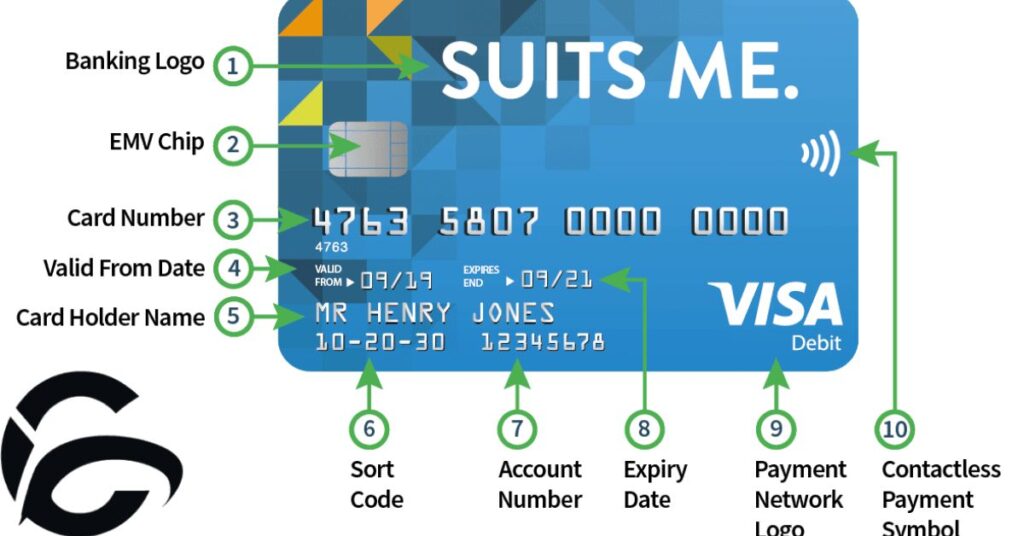

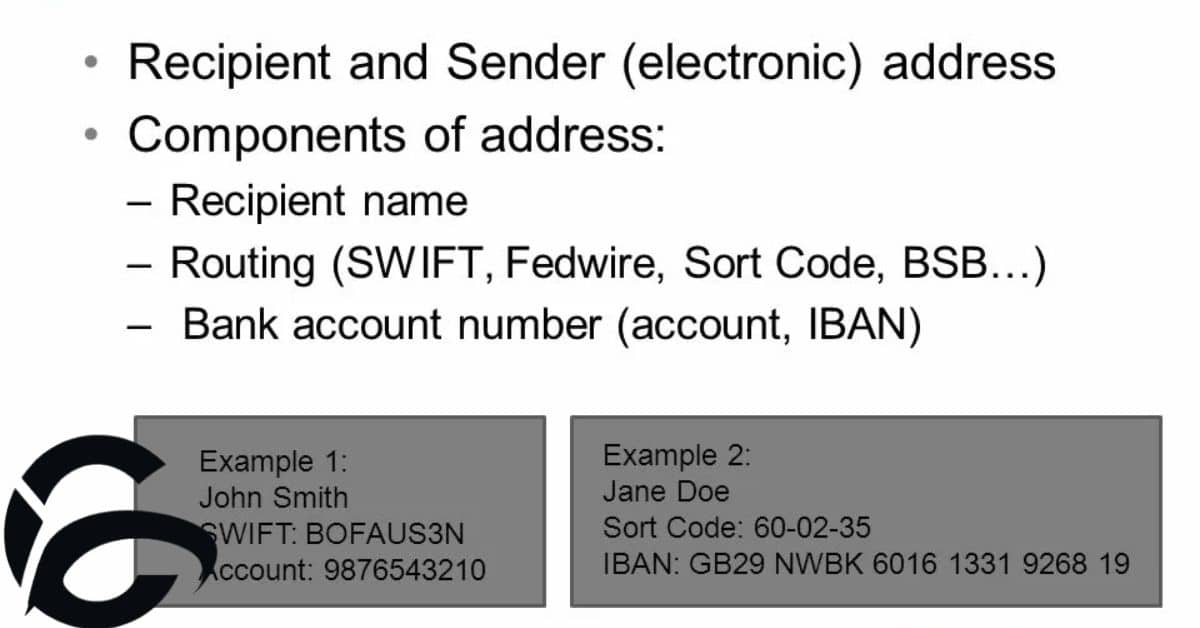

Components of a bank account name

The components of a bank account name typically include the first name and last name for individuals. For businesses, it comprises the legal name of the entity.

A separator, such as a space or comma, is used to distinguish between the components of the account name.

It is essential to provide the correct account name to ensure accurate processing of transactions and to avoid any potential issues with banking activities.

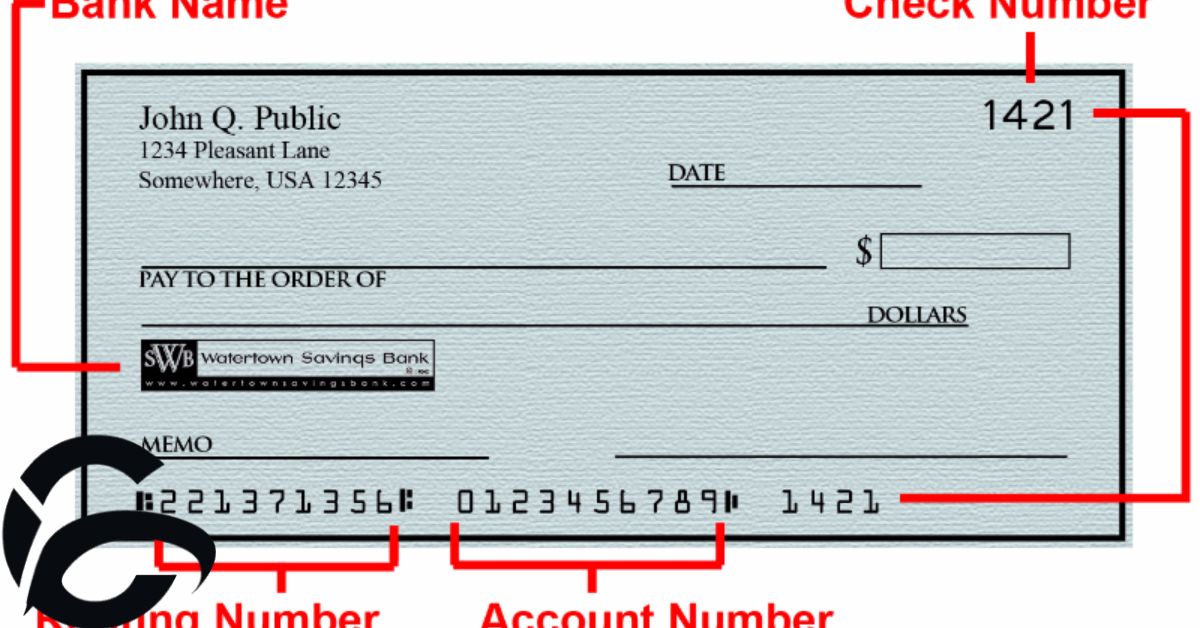

How to find your account name

To locate your account name, check your bank statements, checks, or online banking portal. It’s typically displayed prominently on these documents. If you’re opening a new account, the bank will ask for your account name during the application process. Make sure to provide accurate information to avoid any issues.

If you already have a bank account, your account name can be found on your account statements, checks, or online banking portal. It’s important to ensure that the name provided matches your legal identification. In case of any discrepancies, contact your bank for assistance.

Importance of correct account names

Customizing your account name is an option provided by many banks. This allows you to personalize your banking experience and make it easier to identify your accounts. The process usually involves logging into your online banking platform and selecting the option to customize your account names.

Correct account names are crucial for smooth banking transactions. They help ensure that payments go to the right person. Incorrect names can lead to confusion and delays.

Using the right account name verifies your identity with the bank. It prevents unauthorized access to your funds. Always double-check your account name for accuracy.

Customizing account names can add personalization to your banking experience. It makes managing multiple accounts easier. Take advantage of this feature for clarity and convenience.

Common mistakes to avoid when entering account names

When entering account names, it’s important to double-check for spelling errors. Using incorrect separators can cause confusion and processing errors. Avoid using nicknames or abbreviations as they may not match official records.

Ensure that you update your account name if there are any changes to your personal or business name. Spelling errors can lead to failed transactions or delays in processing. It’s essential to provide accurate information to avoid any issues or delays.

Always pay attention to detail and avoid common mistakes like missing or incorrect separators. Using the wrong separator can cause confusion and processing errors. Double-check the spelling of the account name before submitting any forms or making transactions.

The Role and Purpose of Account Names

Account names are crucial identifiers in banking. They help distinguish one account from another. Each name is unique and tied to a specific customer or entity.

Account names facilitate smooth financial transactions. They verify the identity of the recipient. Without accurate names, errors in payments may occur.

Customizing account names offers advantages. It adds clarity and personalization to banking. With customized names, managing multiple accounts becomes easier.

Importance of Account Names in Financial Transactions

- Account names are crucial for verifying payments, ensuring funds reach the correct recipient.

- They serve as identifiers, aiding in bank verification processes for added security.

- Personalizing account names provides clarity and organization, making it easier to manage multiple accounts.

- Account names play a vital role in distinguishing between different accounts within a bank.

- Customizing account names adds a personal touch and makes banking more familiar.

- Utilizing account names correctly ensures accuracy and security in financial transactions.

Customizing Bank Account Names

Customizing bank account names is a simple process. You can do it online or at your local branch. Just log in, choose the account, and enter the new name.

This feature allows for personalization and organization. You can add a personal touch to your accounts. It makes it easier to manage multiple accounts.

With customized names, banking becomes more convenient. No need to remember long account numbers. Just use the name you’ve chosen.

Advantages of Customization

- Customizing account names offers clarity and organization.

- Personalization allows for a unique touch in labeling accounts.

- Ease of use is enhanced through customized names, simplifying identification.

- Customization provides a personalized banking experience.

- It helps in distinguishing between various accounts easily.

- Users can avoid confusion by customizing their account names.

- Personalized names add a touch of familiarity to banking.

- It simplifies the management of multiple accounts.

- Customization ensures accurate identification of accounts.

How to Customize Bank Account Names

Customizing bank account names is simple. Log into your online banking. Select the account you want to customize. Enter the new desired name. It’s that easy.

Using online banking, navigate to account management. Look for the option to edit the account name. Input your preferred name. Save the changes. Your account is now personalized.

Customized account names offer clarity. They make it easier to manage multiple accounts. Personalization adds a touch of familiarity. It enhances your banking experience.

How can I find my bank account name?

To find your bank account name, log in to your online banking portal. Look for your account details section. Your account name will be listed there. If you’re unsure, contact your bank for assistance.

Another way to locate your bank account name is by checking your bank statements. Your account name is usually displayed prominently on these documents. If you receive paper statements, check the top of the page for your name.

If you still can’t find your bank account name, visit your bank in person. Speak with a customer service representative who can help you locate the information you need. They may ask for identification to verify your identity.

What is account name called?

An account name, often referred to as the account holder’s name, is a unique identifier associated with a bank account. It distinguishes one account from another within the same bank. This name appears on account statements, checks, and other banking documents.

In banking, the account name plays a vital role in identifying the rightful owner of the funds. It ensures that transactions are processed accurately and securely. The account name typically includes the first name and last name for individuals or the legal name of the business for business accounts.

Understanding the importance of the account name is crucial for managing finances effectively. It helps in verifying the account holder’s identity and maintaining accurate financial records. Providing the correct account name is essential to avoid any issues or delays in banking transactions.

Is my name the bank account name

our bank account name is the title given to your specific account. It helps identify your account among others in the bank. It’s not the same as your personal name but is associated with it.

Account names are crucial for transactions and verification. They ensure funds go to the right person. You can customize your account names for clarity and personalization.

To find your account name, check your bank statements or online banking portal. It’s important to provide the correct account name for accurate transactions.

What is bank account name title?

Bank account name refers to the title assigned to a specific bank account. It helps identify and differentiate one account from another. This title is unique to each account holder or entity.

The name is essential for conducting various banking transactions accurately. It ensures that payments are directed to the correct recipient. Providing the correct account name is crucial for verifying transactions.

Customers can often customize their account names for easier identification. This feature allows for personalization and makes managing multiple accounts more convenient.

What is the account holder name?

The account holder name is the title given to a specific bank account. It helps distinguish one account from another within the same bank. This name is unique to each account and associated with a particular customer or entity.

Account names are essential for personal identification. They verify the recipient when making or receiving payments. Moreover, they play a significant role in bank verification processes.

Customizing account names is a common practice. It allows customers to personalize their banking experience. This feature enhances clarity and organization, making it easier to manage multiple accounts.

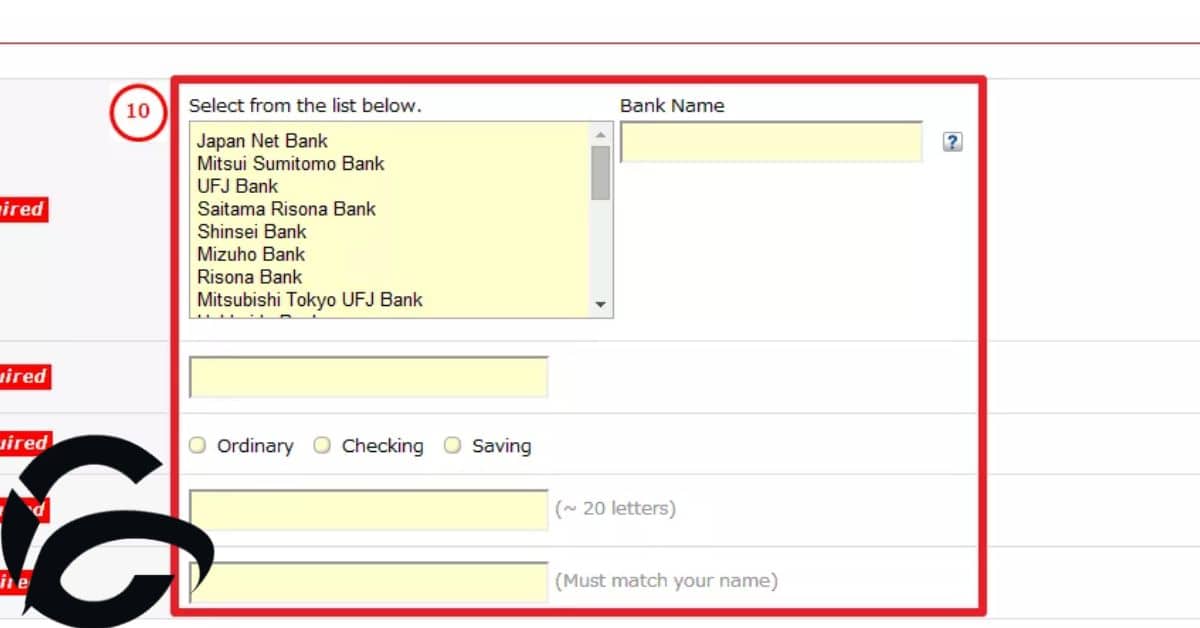

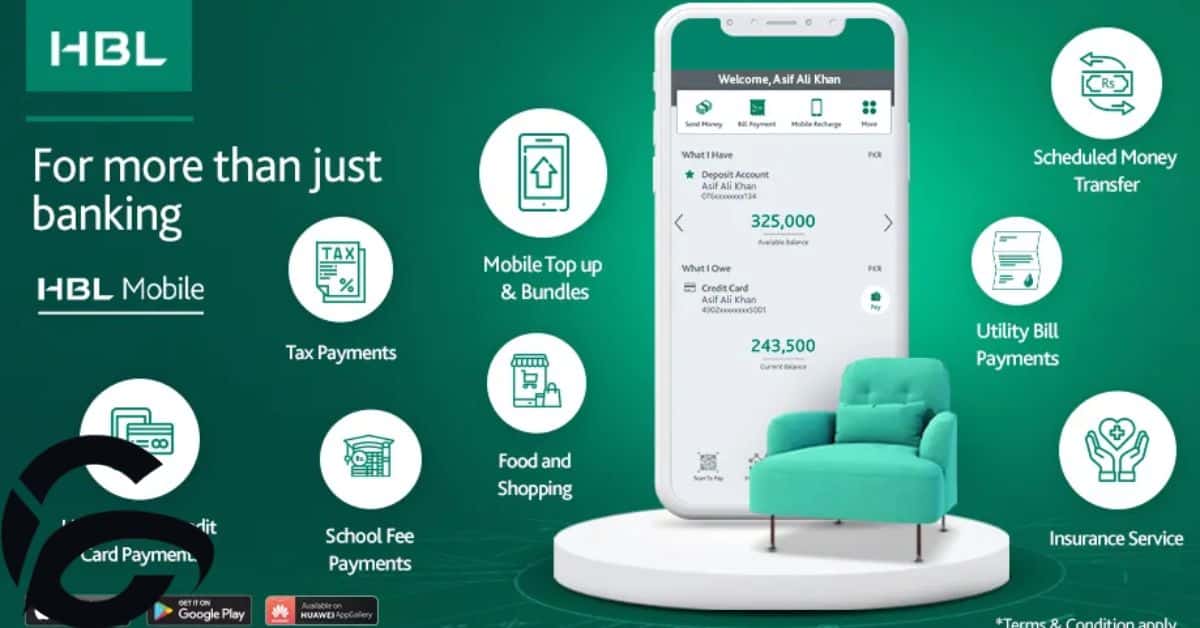

What is account type in HBL?

Account type in HBL refers to the specific category of bank account you have with the Habib Bank Limited. It distinguishes between various types of accounts offered by the bank. These may include savings accounts, current accounts, or specialized accounts tailored to meet specific financial needs.

Understanding your account type is essential as it determines the features, benefits, and limitations associated with your HBL account. For example, a savings account may offer interest on deposits, while a current account may provide convenient transactional services without interest accrual.

To find out your account type in HBL, you can refer to your account statements, visit your local branch, or check your online banking portal. It’s important to know your account type to make informed decisions about managing your finances and maximizing the benefits offered by HBL.

What is the normal bank account type?

The most common type of bank account is the personal current account. It allows individuals to deposit and withdraw money as needed. These accounts typically come with features like a debit card and online banking.

Another popular type of bank account is the savings account. It’s designed for individuals who want to save money and earn interest on their deposits. Savings accounts may have requirements like a minimum balance or limited withdrawal options.

Joint accounts are also common in banking. They are opened and operated by two or more individuals, often couples or family members. Joint accounts allow for shared finances and equal access to funds.

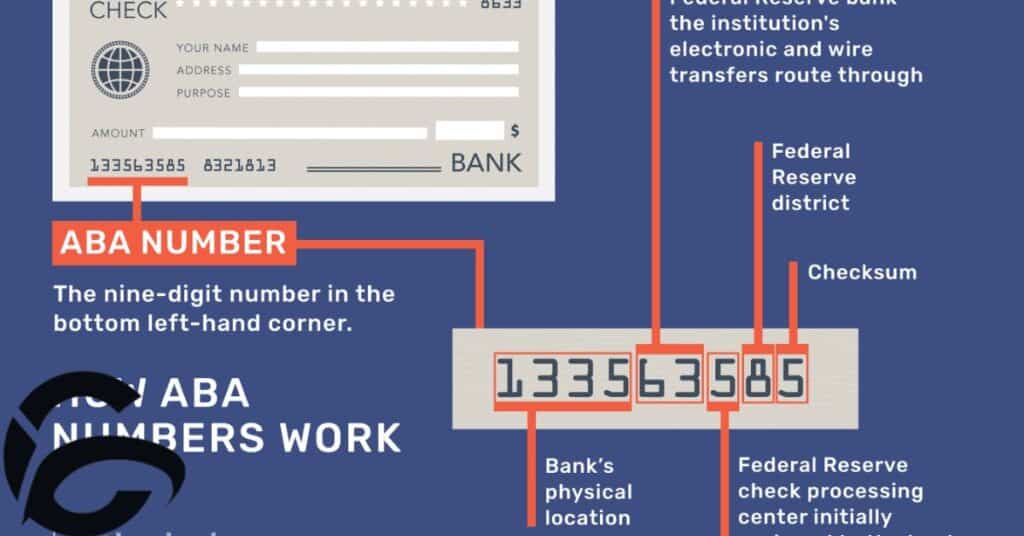

How do I write my HBL account number?

To locate your HBL account number, access your online banking account. Look for the “Account Summary” or “Account Details” section. Your HBL account number will be displayed there. If you’re unable to find it online, contact HBL customer service for assistance.

Alternatively, refer to your HBL checkbook. The account number is typically printed at the bottom of each check. It is a series of digits unique to your account. You can use this number for various banking transactions, including transfers and payments.

Additionally, if you have received any correspondence or statements from HBL via mail or email, your account number may be mentioned there. It’s essential to keep your account number confidential and only share it with trusted parties for authorized transactions.

Read as:HOW MUCH MONEY IS IN THE WORLD?

Which bank account is best?

When choosing a bank account, consider your financial needs. Look for accounts with low fees and high interest rates. Compare different banks to find the best option for you.

Consider whether you need a checking or savings account. Checking accounts are good for everyday transactions. Savings accounts help you save money over time.

Look for additional features like online banking and mobile apps. These can make managing your account easier.

Frequently Asked Questions

Can I change my account name?

Yes, you can generally change your account name by contacting your bank.

Can I have multiple account names for the same bank account?

No, each bank account can only have one associated account name.

Can I have a different account name for my online banking?

Your online banking account name will typically match your account name used for other banking services.

Can I use a business name for a personal bank account?

No, personal bank accounts should be registered under an individual’s name.

What should I do if my account name is misspelled?

If your account name is misspelled, contact your bank to have it corrected.

Can I change my account name if it’s misspelled?

Yes, you can typically request a correction from your bank with proper documentation.

Is it possible to have multiple account names for the same bank account?

No, each bank account can only have one associated account name.

Can I use a business name for a personal bank account?

No, personal bank accounts should be registered under an individual’s name, not a business name.

Final Thoughts

The account name for a bank account serves as a fundamental identifier, crucial for seamless financial transactions and secure management of funds. It represents the title or label given to a specific account, distinguishing it from others within the same financial institution.

Understanding the significance of account names empowers individuals and businesses to navigate their banking experiences confidently. It ensures accurate payments, aids in bank verification processes, and facilitates effective account management.

Customization options allow for personalization, enhancing clarity and ease of use. However, it’s essential to adhere to formatting requirements and avoid misspellings to prevent complications. Ultimately, the account name is not just a label; it’s a vital component that connects individuals and businesses to their finances, ensuring smooth operations and fostering trust in the banking system.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.