MMBILL.com charges on your bank statement signify subscriptions to various online services. The charge indicates authorized deductions for dating, streaming, or gaming services. These charges occur monthly, as agreed upon by the user and the associated company.

Transactions processed through MMBILL.com involve recurring payments for online services. The appearance of MMBILL.com charges is common for users of platforms like Chaturbate and other similar websites. These charges are reflected regularly on bank statements for subscribed services.

It’s essential to review your subscriptions to understand MMBILL.com charges. Cancelling unnecessary subscriptions can prevent recurring deductions. Stay vigilant and monitor your bank statements regularly for any unfamiliar charges or discrepancies.

How does the MMBILL.COM charge appear?

The MMBILL.COM charge on your bank statement signifies subscriptions to various online services. It appears as a recurring payment processed by MMBILL, a payment processor. You authorize the associated company to deduct funds from your account monthly.

Transactions using MMBILL as the payment processor reflect on your bank statement. The appearance of the MMBILL.COM charge may vary depending on factors such as transaction names and bank policies.

MMBILL.COM charges could indicate subscriptions or purchases through websites using MMBILL as the payment processor. Unauthorized charges should be addressed promptly to maintain control over your finances.

How to prevent unauthorized MMBILL.COM bank charge?

Unauthorized MMBILL.COM bank charges can be prevented by regularly reviewing your bank statements. Check for any unfamiliar charges and investigate them promptly.

If you discover unauthorized charges, contact your bank immediately to report and dispute them. Provide any relevant information and follow up until the issue is resolved.

Additionally, consider canceling your credit card if unauthorized charges persist. This can help prevent further incidents and protect your financial security.

Check recurring services

Recurring services should be checked regularly to avoid unexpected charges. If you notice unfamiliar charges, it’s essential to take immediate action. Contact the company associated with the charge for clarification.

Filing a dispute with your bank is crucial for unauthorized charges. Prompt action can help recover contested funds. Consider canceling your credit card if necessary.

MMBILL.com charges may appear due to subscriptions on various online platforms. It’s important to monitor transactions closely for any discrepancies. Take proactive steps to address unauthorized charges promptly.

Contact the company

MMBILL.COM charges on your bank statement signify subscriptions or purchases through various online services. The transactions appear as recurring payments processed by MMBILL, a payment processor. You authorize the associated company to deduct funds from your account monthly.

To address concerns or discrepancies, contacting the company linked to the charge is essential. It enables clarification of transaction details and prompt resolution of any issues.

If you suspect unauthorized or fraudulent charges, filing a dispute with your bank is crucial. This initiates an inquiry to recover contested funds for financial security.

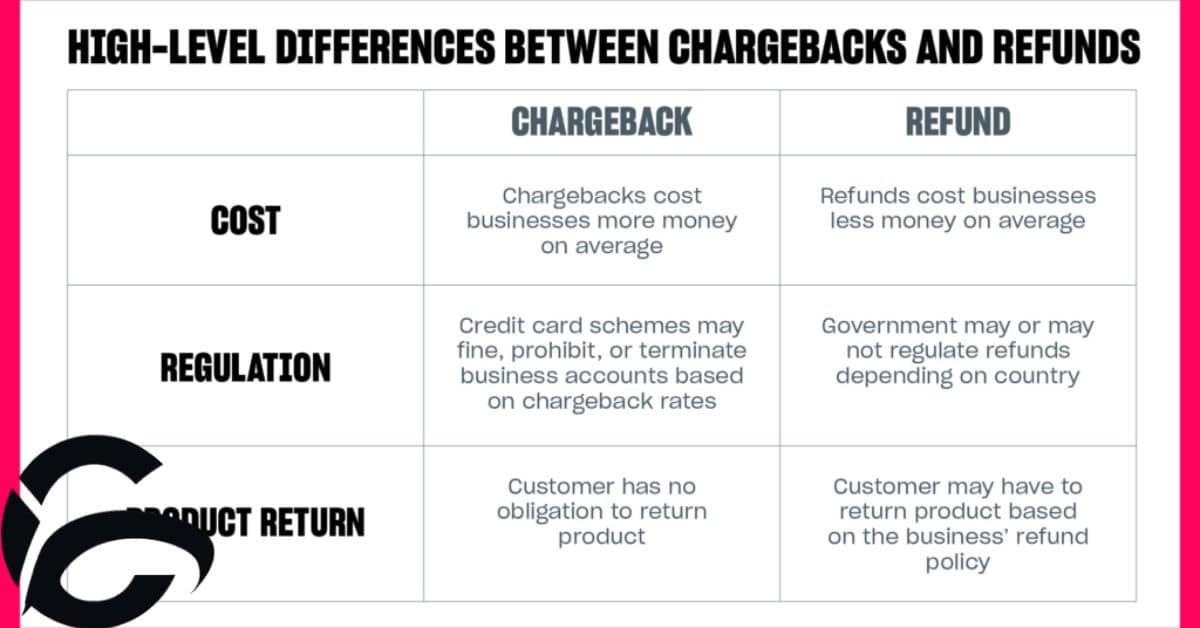

File a dispute

To resolve an issue with an unauthorized charge, you can file a dispute with your bank. Provide them with details of the transaction and explain why you believe it’s unauthorized. The bank will investigate and take appropriate action.

If the dispute is successful, you may receive a refund for the unauthorized charge. Be sure to follow up with your bank to ensure the matter is fully resolved. Keep an eye on your bank statements to detect any further unauthorized activity.

In some cases, it may be necessary to cancel your credit card to prevent future unauthorized charges. Contact your bank to discuss your options and take steps to protect your financial information.

Cancel your credit card

MMBILL.COM charges on your bank statement often indicate subscriptions to various online services. These charges result from authorizing associated companies to deduct funds monthly. Review your subscriptions to identify the source and consider canceling if necessary.

To prevent unauthorized MMBILL.COM charges, regularly review your bank statements and avoid sharing payment information on unfamiliar websites. If you notice unfamiliar charges, contact the company to clarify or file a dispute with your bank.

Canceling your credit card is a crucial step to halt unauthorized charges and safeguard your finances. If you encounter any unauthorized charges, take proactive steps to resolve the issue promptly and protect your financial well-being.

How to stop MMBILL charge, Is it refundable

MMBILL.COM charges on your bank statement signify subscriptions to various online services. These charges are recurring payments processed by MMBILL, a payment processor for dating, streaming, or gaming platforms. You authorize these deductions monthly by subscribing to the associated services.

To stop MMBILL charges, unsubscribe from the service or contact MMBILL customer support. Refunds for charges may depend on individual circumstances and are not always guaranteed. It’s essential to monitor transactions closely and take action promptly if unauthorized charges occur.

When dealing with MMBILL charges, it’s crucial to review your bank statements regularly and cancel any subscriptions you no longer use. Contact the company for assistance if needed, but refunds may not always be possible. Stay vigilant to protect your finances from unauthorized transactions.

What is your feeling about mmbill.com?

MMBILL.com is a payment processor for online services. It facilitates transactions for various websites. Refunds may be available through MMBILL.com. Contact MMBILL via email for assistance.

Transactions through MMBILL.com appear on bank statements. Charges may signify subscriptions or purchases. Review your statements regularly for accuracy.

To terminate MMBILL charges, unsubscribe from associated services. Contact MMBILL for refund inquiries. Monitor your bank statements for unauthorized charges.

Read As:HIGHRISKPAY.COM: YOUR ULTIMATE SOLUTION FOR HIGH RISK MERCHANT ACCOUNTS

Why does mmbill.com have a low trust score?

MMBILL.com is a payment processor used by various online services. Charges from MMBILL.com may appear on bank statements for transactions on associated websites. Consumers may encounter unauthorized charges or disputes regarding these transactions.

Refunds for MMBILL.com charges depend on individual circumstances and may not be guaranteed. It is essential for users to monitor their transactions and take appropriate action if they encounter issues with MMBILL.com charges. MMBILL.com trust score could be low due to negative reviews, unauthorized charges, and suspicious practices.

To stop MMBILL charges, unsubscribe from the associated service or contact MMBILL customer support for assistance. Refunds may be possible but differ in each case. It is crucial to be vigilant and proactive in managing MMBILL transactions to ensure financial security and well-being.

Consumer reviews about mmbill.com

Consumer reviews about MMBILL.com vary. Some express satisfaction with the service, while others report issues. It is essential to consider different perspectives.

Several websites use MMBILL for subscription-based services. These include dating, streaming, and gaming platforms.

To cancel MMBILL charges, unsubscribe from associated services or contact MMBILL customer support for assistance. Refunds may be possible but vary depending on individual circumstances.

Facts about mmbill.com

MMBILL.com is a payment processor used by various online services. It facilitates transactions for subscriptions to dating, streaming, or gaming services. The charges from MMBILL.com may appear on bank statements for transactions on associated websites.

Users may encounter unauthorized charges or disputes regarding transactions processed by MMBILL.com. It’s important to monitor bank statements regularly and take action if any issues arise. Refunds for MMBILL.com charges depend on individual circumstances and may not be guaranteed.

To stop MMBILL charges, users should unsubscribe from associated services or contact MMBILL customer support for assistance. It’s essential to be proactive in managing subscriptions and financial transactions to maintain control over finances and prevent unauthorized charges.

Here you will find all the information MMBILL: who, what, how and about why?

MMBILL is a payment processor utilized by various online services. It facilitates transactions for subscriptions, purchases, and recurring payments. Based in Malta, MMBILL processes transactions for websites like Chaturbate and other online platforms.

Transactions processed through MMBILL appear on bank statements with various identifiers. These identifiers include MMBILL.COM, MB * MMBILL.COM, and other variations. Users may encounter these charges for services they’ve subscribed to or transactions made on associated websites.

Consumers may sometimes encounter unauthorized charges or disputes related to MMBILL transactions. While refunds are possible in certain cases, it’s important for users to monitor their transactions closely and take prompt action if they encounter any issues.

Why am I seeing MMBILL debits on my account statement?

MMBILL debits on your account statement suggest transactions from websites using MMBILL as their payment processor. These charges may appear for various online services you’ve subscribed to. To clarify, review your bank statement for transaction details or contact your bank for assistance.

Understanding these charges is essential for managing your finances effectively. You can take proactive steps to address any concerns or discrepancies promptly. By staying informed, you can ensure that your transactions are legitimate and authorized.

How to terminate MMBILL charges? Is a refund possible?

To terminate MMBILL charges, consider unsubscribing from associated services.Contact MMBILL customer support for assistance.Refunds depend on individual cases and may not be guaranteed.

MMBILL.com serves as a payment processor for online services. Charges may appear on bank statements for associated transactions. Reviews about MMBILL.com vary among consumers.

Refunds for MMBILL.com charges are possible but subject to individual circumstances. Users should monitor transactions closely and address any issues promptly.

Legal or MMBILL fraud: what does the law say?

Legal implications of MMBILL transactions depend on individual circumstances. It’s vital to address any concerns promptly. Understanding consumer protection laws is crucial.

MMBILL charges might raise concerns about fraud. However, legality varies based on situations. It’s essential to report suspicions promptly.

For consumers encountering MMBILL charges, proactive steps are necessary. Understanding transaction details and legal implications is key. Taking prompt action safeguards financial well-being.

mmbill com what is it on bank statement

MMBill.com appears on bank statements for online services. It’s a recurring payment handled by MMBill, a payment processor. You authorize deductions for services monthly. If needed, review and cancel subscriptions.

Transactions via MMBill display differently on statements. They may appear as MMBILL, MMBILL.COM, or similar. Ensure clarity by verifying transactions. Cancel unused subscriptions to prevent future charges.

MMBill charges signify subscriptions to various services. They’re authorized deductions from accounts. Verify transactions for clarity. Cancel unnecessary subscriptions to avoid future charges.

what is mmbill.com lake forest ca

MMBill.com is a payment processor based in Lake Forest, CA. It facilitates transactions for various online services such as dating, streaming, and gaming platforms. The company processes recurring payments authorized by users for monthly subscriptions.

MMBill.com charges may appear on your bank statement if you’ve subscribed to websites that utilize MMBill as their payment processor. These charges signify ongoing subscriptions to services like online gaming, streaming entertainment, or dating platforms.

It’s important to monitor your bank statements for MMBill.com charges to ensure they align with your authorized subscriptions. If you have any concerns about unauthorized charges, you should promptly contact your bank or financial institution for assistance.

Frequently Asked Questions

What is MMBILL.COM, and why do I see its charges on my bank statement?

MMBILL.COM is a payment processor used by online services. Its charges on your bank statement indicate transactions from associated websites.

How do I find out where a charge came from?

You can find out by reviewing your bank statement for transaction details or contacting your bank for assistance.

Can I receive a refund for MMBILL.COM charges?

Refunds for MMBILL.COM charges are possible but depend on individual circumstances.

Are MMBILL.COM charges legal, and what should I do if I suspect fraud?

Legality varies, but report any suspicions of fraud to authorities or financial institutions promptly.

Why am I seeing MMBILL debits on my account statement?

MMBILL debits on your account statement usually suggest transactions from websites using MMBILL as their payment processor.

Final Thoughts

MMBILL.com charges on your bank statement signify subscriptions to various online services. Monitoring these charges is crucial for financial awareness. If unauthorized charges occur, prompt action is necessary.

Understanding MMBILL.com transactions ensures control over your finances. Regular scrutiny of bank statements aids in identifying any discrepancies. Addressing concerns swiftly maintains financial security. Stay vigilant to prevent unauthorized charges.

Taking proactive steps safeguards against potential fraud. Engage with your bank for any inquiries or disputes. Remember, your financial well-being is paramount.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.