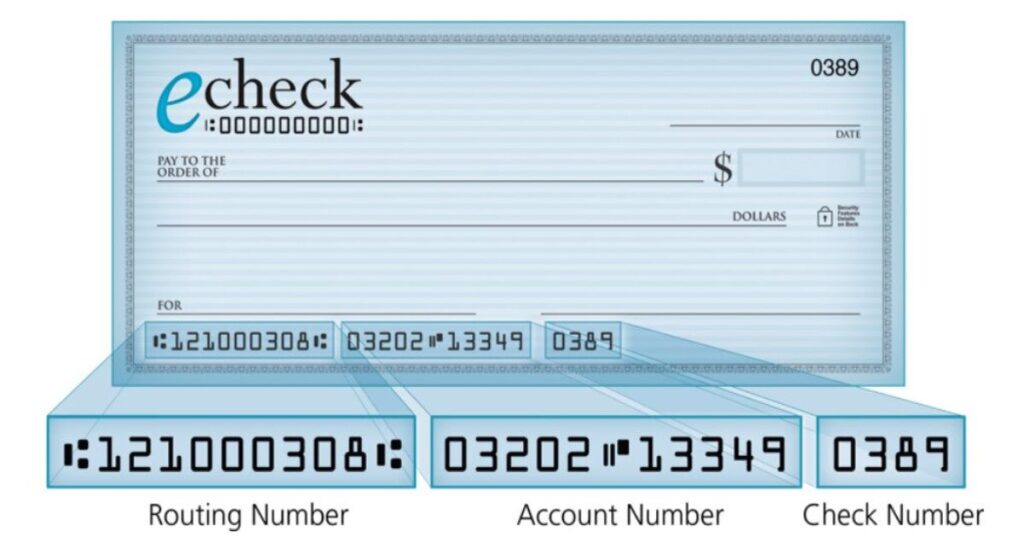

An eCheck (electronic check) is a digital version of a paper check that allows customers to transfer funds directly from their bank account to a merchant.

The eCheck process works by the customer providing their bank account and routing number. The merchant then initiates an electronic funds transfer to withdraw the payment amount from the customer account, facilitated by their payment processor through the ACH network.

Once the eCheck clears at the bank, usually within 3-5 business days, the funds are deposited into the merchant’s account.

TL;DR

An eCheck is an electronic version of a paper check that allows customers to transfer funds directly from their bank account to a merchant or business.

The eCheck payment process works by the customer providing their bank account and routing number, which the merchant then uses to initiate an electronic funds transfer from the customer’s account.

What is an eCheck?

An eCheck, also commonly referred to as an electronic check, online check, or e-check, is a digital alternative to traditional paper checks. Instead of a physical paper document, an eCheck is an electronic transfer of funds from the customer’s bank account to the merchant or business.

eChecks operate on the same fundamental principle as paper checks, allowing customers to pay for goods or services directly from their checking or savings account. However, eChecks streamline the process by eliminating the need for printing, mailing, and manually processing physical checks.

What is an eCheck on PayPal?

PayPal, one of the largest online payment processors, offers an eCheck option for transferring funds from a bank account to a PayPal account or merchant. The process works as follows:

- The customer logs into their PayPal account and selects the “Transfer Money” option.

- They then choose the “Transfer from Bank” method and enter their bank account and routing number.

- PayPal initiates an electronic funds transfer to withdraw the specified amount from the customer’s bank account and deposit it into their PayPal balance or send it to the recipient.

While convenient, PayPal eCheck process can take several business days to complete, similar to other eCheck payments.

What is the difference between an eCheck and an electronic payment?

It’s important to distinguish eChecks from other electronic payment methods like credit/debit cards or digital wallets. The key difference is that eChecks facilitate direct bank transfers from the customer’s checking or savings account.

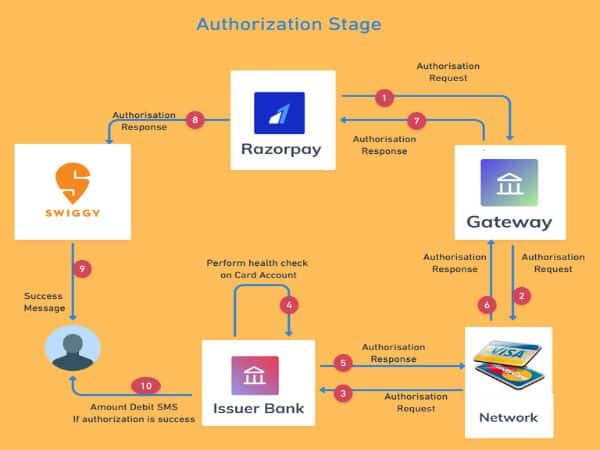

In contrast, electronic card payments process funds through the respective credit or debit card network (Visa, Mastercard, etc.) and involve the card issuer releasing funds to the merchant.

This distinction means eCheck transactions typically have lower processing fees for merchants compared to card payments. However, the trade-off is that eChecks take longer to complete the bank transfer.

How Does eCheck Payment Processing Work?

The eCheck payment process follows these basic steps:

- Customer Provides Bank Info: The customer enters their bank account and routing number, either on the merchant’s website, over the phone, or through a payment terminal.

- Merchant Submits eCheck Request: The merchant sends the eCheck transaction details (customer’s bank info, payment amount, etc.) to their payment processor.

- Processor Initiates Bank Transfer: The payment processor directly debits the funds from the customer’s bank account through the Automated Clearing House (ACH) network.

- Funds are Transferred: Once the eCheck clears at the customer’s bank (typically 3-5 business days), the funds are electronically deposited into the merchant’s bank account.

Here’s a simple diagram visualizing the eCheck payment flow:

Customer Merchant Payment Customer's Merchant's

Bank Info --> Website --> Processor --> Bank --> Bank

<-- Request <-- Transfer <-- Debit <-- DepositHow Long Does an eCheck Take to Process?

One key difference from credit/debit card payments is that eChecks are not instantaneous transactions. The typical timeframe for an eCheck payment to fully process is 3 to 5 business days.

The reason for this delay is that an eCheck must go through the ACH (Automated Clearing House) bank transfer system, which can take several days to verify funds and complete the transaction.

Some payment processors may offer accelerated or “next-day” eCheck processing options, but these often come with additional fees. For standard eCheck payments, merchants and customers should expect a 3-5 day waiting period before funds are available.

Read Related Post: What Time Do DWP Payments Go Into Your Bank? A Complete Guide

What Do Businesses Need to Accept eChecks?

To start accepting eCheck payments, businesses primarily need:

- A Payment Processor that Supports eChecks: Many major payment gateways and processors like PayPal, Authorize.Net, and due.com offer eCheck processing capabilities.

- Way to Collect Customer Bank Info: This could be an online payment form, virtual terminal, or payment field that prompts customers for their bank account and routing numbers.

- Compliance with Regulation Requirements: Businesses must follow regulations like Regulation E for electronic funds transfers and provide customers with proper disclosures.

Additionally, merchants will need a commercial bank account capable of receiving ACH credits and deposits from their payment processor.

What banks accept eChecks?

Nearly all major banks and credit unions in the United States, Canada, and other countries accept and support the use of eCheck transactions for their consumer and business accounts. Some of the largest banks that process eChecks include:

- Chase Bank

- Bank of America

- Wells Fargo

- Citibank

- PNC Bank

- U.S. Bank

- TD Bank

- And most local/regional banks and credit unions

As long as the bank is part of the ACH network and allows electronic funds transfers from consumer checking/savings accounts, eChecks can be accepted.

What Type of Business Transactions Use eChecks?

eCheck payments can be utilized in a variety of business transactions and payment scenarios, such as:

- E-commerce purchases: Online retailers can offer eChecks as a payment option during checkout.

- Bill payments: Utility companies, telecom providers, etc. accept eCheck payments for monthly bills.

- Invoicing and payments: Service providers can request eCheck payments against digital invoices.

- Payroll and direct deposit: Some employers use eChecks for paying employees and contractors.

- Rent and housing payments: Property managers may accept eCheck rent payments from tenants.

- Large purchases: Customers often prefer eChecks over credit cards for big-ticket items to avoid high processing fees.

- Any transaction where cash/card isn’t convenient: Situations where a bank transfer is easier than other payment methods.

Overall, eChecks provide a useful electronic alternative to paper checks for any business that needs to accept payments directly from a customer’s bank account.

What are the Benefits of Accepting eChecks?

Offering eCheck payments can provide several key advantages to businesses:

More Convenient

By accepting eChecks, businesses eliminate the hassle and delay of handling physical paper checks. Customers can quickly and easily initiate payments online or over the phone using just their bank account information.

Cost-Effective

One of the biggest benefits of eChecks for businesses is the potential cost savings compared to accepting credit/debit card payments. eCheck transactions typically have significantly lower processing fees, around 0.5% to 1.5% versus up to 3% for card payments.

Some payment processors even offer a flat per-transaction rate for eChecks. Larger merchants processing a high volume of payments can realize substantial cost reductions by accepting eChecks.

Sustainable

By going digital with eCheck payments, businesses cut down on the paper waste and environmental impact of printing and mailing physical checks. This supports corporate sustainability goals while still allowing bank transfers.

Reversible

Similar to regular checks, the recipient of an eCheck payment has recourse if there are insufficient funds or potential fraud. The customer can dispute and reverse eCheck charges if needed through regulations like Regulation E.

Security

Unlike card payments where businesses must securely handle and store sensitive credit card data, eCheck transactions only require the customer’s bank account and routing numbers. This reduces PCI compliance scope for merchants.

Additionally, modern payment gateways use encryption and secure data transmission to protect customer bank account details during eCheck processing.

What are the drawbacks of eChecks?

Despite the compelling advantages, eCheck payments do have some potential downsides to consider:

- Longer processing times: The 3-5 business day delay for eCheck transactions to clear can be a hindrance for businesses needing faster access to funds.

- No option for instant/same-day payments: eChecks cannot faciliate real-time or instantaneous bank transfers, unlike options like debit card payments or wire transfers.

- Potential for insufficient funds: If the customer lacks sufficient funds in their checking/savings account to cover the eCheck amount, the payment may be rejected or declined by the bank.

- Need customer’s bank account info: To process an eCheck payment, the merchant must obtain the customer’s bank account and routing numbers, which some may be hesitant to provide compared to just using a credit/debit card.

- Limited acceptance for international payments: While eChecks are common for domestic transactions, they may have limited use cases or additional fees for cross-border or international payments.

So while eChecks provide cost-effective benefits for businesses, the trade-off is largely on processing times and potential payment failures that merchants need to weigh.

Related Post: Unlock the Power of Bill Payments web with ACHMA VISB

Increasing Your Payment Options with eCheck Payment

By understanding what an eCheck is and how the eCheck payment process works, businesses can make a more informed decision about adding this capability to their checkout flow.

Offering eChecks enables merchants to expand the payment choices available to customers. This can appeal to those who prefer to pay directly from their bank account instead of using a credit/debit card.

eChecks also provide a more affordable option for merchants compared to higher credit card processing fees, especially for large-ticket transactions where those fees can really add up.

Of course, eCheck functionality is best used in conjunction with accepting traditional payment methods like cards and digital wallets. This allows businesses to cater to the full spectrum of customer payment preferences.

By giving customers convenient eCheck and electronic bank transfer alternatives, businesses can increase sales, reduce costs, and create a better overall user experience.

FAQs About eChecks

Q: What is an eCheck?

An eCheck, short for electronic check, is a digital version of a paper check that allows customers to transfer funds directly from their bank account to a merchant or business electronically.

Q: How long does it take for an eCheck to process?

Most standard eCheck payments take 3 to 5 business days to fully process and clear through the ACH bank transfer system before the funds are available.

Q: Can businesses accept eCheck payments?

Yes, businesses can absolutely accept eCheck payments from customers by using a payment processor that supports eCheck transaction processing capabilities.

Q: What are the benefits of using eChecks?

Key benefits of eChecks include:

- More convenient than paper checks

- Lower processing fees compared to credit/debit cards

- Reducing paper waste and environmental impact

- Ability to reverse fraudulent or incorrect eCheck charges

- Secure processing of bank account information

Q: Are eCheck payments safe?

eChecks are a secure method of payment processing as modern payment gateways use encryption and secure data transmission to protect a customer’s sensitive bank account details during the transaction.

Q: What are the drawbacks of using eChecks?

Potential downsides of eChecks include longer processing times of 3-5 business days, no option for instant payments, possibility of insufficient funds in the customer’s bank account, and the need to collect bank account information.

Q: What is an eCheck on PayPal?

PayPal offers an “eCheck” functionality that allows users to transfer funds directly from their bank account to their PayPal account balance or send a payment to another party.

Q: Can businesses benefit from accepting eCheck payments?

Yes, businesses can benefit greatly by adding eCheck as a payment option. eChecks provide lower processing costs, appeal to customers wanting to pay from their bank account, and increase overall sales by offering more choices.

Q: Are there any sustainability benefits for businesses using eChecks?

Absolutely. By allowing digital eCheck payments, businesses reduce paper waste compared to accepting physical checks, supporting environmental sustainability initiatives.

I hope this in-depth guide has provided all the key details you need to understand what eChecks are and how eCheck payment processing works! Let me know if you have any other questions.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.