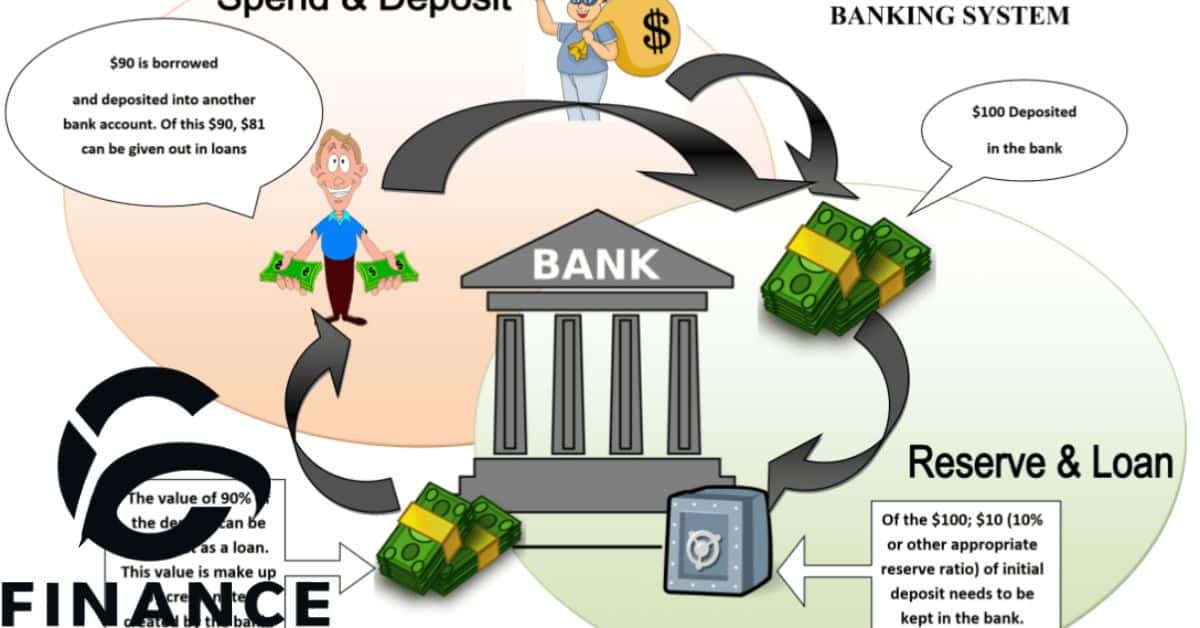

When you see “FM Deposit Hold See SM” in your bank statement, it means that a deposited check is pending clearance. The hold duration varies but usually lasts for about two business days. During this time, the bank confirms the validity of the check before releasing the funds. It’s important to wait patiently until the hold is lifted to access the deposited amount.

Encountering “FM Deposit Hold See SM” on your bank statement suggests that a deposited check is undergoing processing. The duration of this hold typically spans around two business days. During this interval, the bank conducts verification checks before releasing the funds.

Observing “FM Deposit Hold See SM” on your bank statement indicates that a deposited check is currently undergoing processing. Generally, this hold remains in place for about two business days. During this duration, the bank verifies the legitimacy of the deposited check before releasing the funds.

What does FM Deposit HOLD SEE SM mean?

When “FM Deposit HOLD SEE SM” appears on your bank statement, it indicates that a deposited check is pending clearance. This hold typically lasts for about two business days. During this time, the bank verifies the authenticity of the deposited check before releasing the funds.

It’s essential to be patient as the hold is lifted to access the deposited amount. If you require more information about the specific duration of the hold, contacting your bank directly can provide further clarity.

Understanding the meaning of “FM Deposit HOLD SEE SM” helps manage expectations and ensures smooth banking transactions .

What should I do if I find FM Deposit HOLD SEE SM on my bank statement?.

If you notice “FM Deposit HOLD SEE SM” on your bank statement, stay calm and patient. Reach out to your bank for guidance if the hold persists after two business days. Keep track of your funds and ensure you have enough to cover any pending transactions. Understanding how to handle “FM Deposit HOLD SEE SM” ensures smooth banking experiences.

When “FM Deposit HOLD SEE SM” appears on your bank statement, refrain from panicking. Take proactive steps by contacting your bank for assistance and clarity. Maintain awareness of your financial situation to manage any potential delays effectively. Keeping calm and seeking guidance ensures a smooth resolution to the hold.

If “FM Deposit HOLD SEE SM” is present on your bank statement, avoid unnecessary stress. Communicate with your bank promptly to address any concerns or uncertainties. Stay vigilant about your finances to navigate the situation with ease and confidence.

How long will it take for a held check deposit to release?

The duration for a held check deposit to release varies, typically within two business days. The bank conducts necessary verifications before releasing the funds for use. Patience is crucial during this period to ensure the deposit clears successfully.

In some cases, the hold may extend beyond two business days. Factors such as bank policies and additional checks can influence the release time.It’s essential to stay informed and wait for the deposit to become available for use.

If you encounter delays in the release of a held check deposit, reaching out to your bank for clarification is advisable.They can provide insights into the specific reasons for the hold and offer assistance in resolving any issues promptly.

How do I avoid TD Bank holds in future?

To prevent TD Bank holds in the future, consider depositing checks on weekdays early in the week. Aim for Monday mornings to ensure quicker processing times. If depositing later in the week, such as on Thursdays or Fridays, anticipate longer hold periods, especially over weekends.

Additionally, staying informed about your bank’s policies regarding check holds can help you plan ahead effectively. Utilize online resources or speak with a bank representative to understand the specific hold durations and any factors that may affect them.

Should I worry about FM Deposit HOLD SEE SM on my account?

Encountering “FM Deposit HOLD SEE SM” on your account may cause concern, but it’s generally nothing to worry about. It’s a standard procedure for banks to hold funds temporarily for verification. Understanding this helps alleviate unnecessary anxiety about the hold.

These holds are put in place to ensure the security of your account and prevent fraudulent activity. They’re a precautionary measure taken by banks to safeguard your finances.

However, if the hold persists longer than expected or if you have any specific concerns, don’t hesitate to contact your bank. They can provide clarity on the situation and offer assistance if needed.

Things to do when find FM hold deposit SEE SM

When you encounter “FM hold deposit SEE SM” in your bank statement, remain calm and assess the situation. Contact your bank’s management team to inquire about the pending deposit and explore options. Consider requesting upfront funds if approved by your bank to address immediate financial needs.

Understanding what to do when encountering “FM hold deposit SEE SM” ensures a proactive approach. Communicating with your bank and exploring potential solutions can help alleviate any concerns. Stay informed and proactive to manage your finances effectively during this period.

Required time to release Cash Deposit hold

When it comes to releasing a hold on cash deposits, the time frame varies based on the deposit method. For cash deposits made directly at the bank, the hold is typically released within one business day.

The time required to release a hold on cash deposits also depends on the specific policies of the bank. Factors such as the time of day the deposit is made and any additional verification processes can impact the hold duration.

Required time to release cheque deposit hold

When it comes to releasing a hold on cheque deposits, the duration can vary depending on several factors. Typically, banks impose a one-day hold on cheque deposits, but this timeframe can be extended up to nine business days. The bank holds the funds to verify the legitimacy of the cheque and ensure there are no issues with the deposit.

What is FM hold deposit SEE SM?

The time required to release a hold on cheque deposits may also be influenced by the type of cheque being deposited. Personal cheques usually have shorter hold periods compared to other types of cheques. Understanding the timeframe for releasing a hold on cheque deposits is crucial for managing finances effectively.

When you encounter “FM hold deposit SEE SM,” it indicates a temporary hold on deposited funds. This hold appears in your bank statement when a check deposit is awaiting clearance. It signifies that the deposited amount is not yet available for use.

The FM hold deposit SEE SM typically occurs when checks are deposited using mobile banking apps or ATMs. During this hold period, the bank verifies the validity of the deposited checks. It’s essential to be patient as the hold is lifted to access the deposited funds. Understanding the meaning of FM hold deposit SEE SM helps manage expectations and ensures smooth banking transactions.

How long can it take for a bank to release a pending deposit?

The duration for a bank to release a pending deposit varies based on several factors. Typically, funds from an eligible payee are released immediately instead of being held. However, for other deposits, it can take up to two business days for the funds to become available.

Some factors influencing the release time include the source of the deposit and the bank’s individual policies. If the deposit is made through a non-network ATM, it may take up to five business days for the funds to be released. It’s important to be aware of these factors when expecting a pending deposit to clear.

Is there any hold on mobile deposit?

When using mobile deposit, holds may apply to deposited funds. Typically, deposited checks through mobile apps are subject to holds. These holds ensure the legitimacy of the deposited checks and may vary in duration based on bank policies.

The duration of holds on mobile deposits varies depending on factors such as check amount and account history. Banks may impose holds ranging from one to several business days on mobile deposits. It’s essential to check with your bank to understand their specific hold policies for mobile deposits.

Understanding the potential for holds on mobile deposits helps manage expectations and ensures timely access to funds.

How long does a bank hold on to a check last?

The duration of a bank hold on a check varies depending on several factors. Typically, a bank may hold a check for one to nine business days to ensure its validity. However, in most cases, the hold lasts around three business days.

The length of the hold on a check can be influenced by factors such as the amount of the check, the account history, and the type of deposit. Banks may also extend the hold period if they have reason to suspect fraud or if the check is from an out-of-state account.

How long does a deposit hold last?

The duration of a deposit hold varies depending on several factors. Generally, for check deposits, the hold can last from one to nine business days. However, cash deposits typically have shorter hold periods, ranging from one to two business days.

The specific length of a deposit hold is determined by the policies of the bank where the deposit is made. Understanding how long a deposit hold lasts helps individuals anticipate when deposited funds will become available for use.

Read as:SETTLERS LIFE INSURANCE: A COMPREHENSIVE GUIDE TO POLICIES, PREMIUMS, AND PAYMENT FAQS

How long can funds be on hold?

The duration for which funds can be on hold varies depending on several factors. Typically, funds may be held for up to two business days, but this can extend based on the bank’s policies. Cash deposits usually have shorter hold periods compared to check deposits.

Additionally, the reason for the hold and the source of the funds can influence the hold duration. Banks may impose longer holds for checks to ensure their validity and prevent fraud. It’s essential to check with your bank for specific information regarding hold durations and policies.

Understanding how long funds can be on hold allows individuals to plan their finances accordingly.

How long does a bank have to hold a deposit?

Banks typically have a maximum hold period for deposits, which varies depending on the type of deposit. For checks, the hold period can range from one to nine business days, with most banks holding them for around three business days. However, holds on cash deposits are usually shorter, often released within one or two business days.

The specific hold period for a deposit is determined by various factors, including the amount and type of deposit, as well as the bank’s policies. Larger deposits or those from unfamiliar sources may require longer hold periods to mitigate risk.

How long is money on hold by bank?

When banks place funds on hold, the duration can vary depending on several factors. Typically, the hold lasts for a few business days. However, this timeframe can be extended based on the bank’s policies and the type of deposit made.

The length of time funds remain on hold is influenced by various factors, including the type of deposit and the bank’s internal procedures. Deposits made via check may have longer hold periods compared to cash deposits.

How do I remove a hold from my bank account?

To remove a hold from your bank account, first identify the reason for the hold by checking your account statement or contacting your bank. Once you understand the cause, take action accordingly, such as providing additional documentation if required or addressing any outstanding issues.

If the hold is due to a deposited check, ensure that the check clears and the funds become available in your account. Communicate with your bank if the hold persists beyond the expected timeframe, as they can provide guidance on resolving the issue.

Regularly monitor your account and stay in touch with your bank to ensure prompt resolution of any holds. By staying proactive and informed, you can effectively manage and remove holds from your bank account as needed.

Why is there a 7 day hold on my check?

A seven-day hold on a check may be imposed by the bank for various reasons. One reason could be to ensure the check clears without any issues. The hold period allows the bank to verify the legitimacy of the check and protect against potential fraud.

Another reason for the seven-day hold is to manage risk and ensure sufficient funds are available to cover the check. By holding the funds for a specified period, the bank mitigates the risk of overdrawing the account or bouncing the check.

Understanding the reasons behind a seven-day hold on a check helps account holders plan their finances accordingly. It’s important to be aware of the hold duration and its implications to avoid any unexpected delays or complications.

Can a bank remove a hold on a check?

Banks have the authority to remove holds on checks under certain conditions. Once a check has been verified and cleared, the bank can release the hold on the funds. Communication with the bank regarding the status of the check and any necessary documentation can expedite the process.

It’s important to note that banks may impose holds on checks for various reasons, such as insufficient funds or potential fraud. However, if the bank determines that the check is legitimate and there are no issues, they can remove the hold.

Why is my check I deposited on hold?

Your deposited check might be on hold due to standard bank procedures. Holds are placed to ensure the check clears and to prevent fraud. Factors like check amount, account history, and check origin can influence the hold duration.

Banks often hold checks to verify funds and prevent potential issues. The hold allows the bank time to confirm the legitimacy of the check and ensure sufficient funds are available. Understanding this process can help manage expectations and avoid frustration.

If your check is on hold, it’s important to wait patiently for it to clear. Contacting your bank for clarification on the hold duration can provide peace of mind. By staying informed and patient, you can navigate the hold process smoothly and access your funds once the hold is lifted.

Can a bank legally hold your money?

Banks can legally hold your money under certain circumstances. These circumstances typically involve issues such as suspicious activity, insufficient funds, or legal obligations like court orders.

One common reason for a bank to hold funds is when a check you deposited hasn’t cleared yet. This hold is meant to protect the bank from potential fraud or insufficient funds on the check.

Frequently Asked Questions

Why is my check on hold for 5 days?

Your check may be on hold for five days to allow the bank time to verify its legitimacy and ensure sufficient funds are available.

Why is my deposit hold negative?

A negative deposit hold indicates that funds have been reserved for a pending transaction, reducing your available balance until the hold is released.

What is a permanent hold on a bank account?

A permanent hold on a bank account typically occurs due to unresolved issues like outstanding debts or legal obligations, restricting access to funds indefinitely.

How long does it take to release a hold on a bank account?

The time to release a hold on a bank account varies depending on factors such as the bank’s policies and the reason for the hold, but it typically ranges from one to several business days.

Why is my transaction on hold?

Transactions can be placed on hold for various reasons, including potential fraud concerns, insufficient funds, or pending verification by the bank to ensure the security of the transaction.

Final Thoughts

encountering “FM Deposit Hold See SM” on your bank statement signifies that a deposited check is undergoing processing and is pending clearance. While it may cause temporary inconvenience, understanding this message is crucial for managing your finances effectively.

The hold typically lasts for about two business days as the bank verifies the authenticity of the deposited check before releasing the funds. Patience is key during this period, and contacting your bank for further clarification can provide peace of mind.

By staying informed about the meaning and duration of holds, you can navigate banking transactions smoothly and ensure access to your funds when needed. Overall, while seeing this message may raise questions, it’s part of the standard banking process aimed at maintaining security and integrity in financial transactions.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.