Net Book Value (NBV) is the value of an asset after accounting for depreciation and amortization. It represents what an asset is currently worth on a company’s balance sheet. NBV is crucial for assessing the actual financial state of a business.

Understanding NBV helps you make informed decisions. If you want to gauge the true worth of your assets, NBV is key. By focusing on NBV, you can better manage and optimize your resources.

NBV is calculated by subtracting accumulated depreciation from the original cost of an asset. It provides a realistic view of an asset’s value over time. NBV is commonly used in financial reporting and analysis to reflect accurate asset valuation.

Demystifying Net Book Value in Real Estate

In the bustling world of real estate, understanding the true worth of a property is crucial. That’s where Net Book Value (NBV) comes into play. NBV is a powerful tool that helps investors, accountants, and property managers gauge the value of real estate assets. It’s not just a number on a balance sheet; it’s a key to unlocking insights into a property’s financial health.

Net Book Value is essentially the carrying value of an asset on a company’s books. In real estate terms, it’s the original cost of a property minus its accumulated depreciation. This concept is rooted in the historical cost principle, which is a cornerstone of accrual accounting standards. By using NBV, real estate professionals can make informed decisions about property investments, sales, and management strategies.

What is Net Book Value?

Net Book Value is a financial metric that represents the current value of an asset based on its original cost and subsequent depreciation. In the realm of real estate, NBV is particularly important for fixed asset valuation and bookkeeping purposes. It provides a snapshot of a property’s worth at a specific point in time, taking into account wear and tear, and market conditions.

For real estate investors and managers, understanding NBV is crucial for several reasons. It helps in assessing the true value of a property portfolio, making informed decisions about capital expenditure (Capex), and planning for future investments. Moreover, NBV plays a significant role in financial reporting and compliance with GAAP (Generally Accepted Accounting Principles).

Crunching the Numbers: NBV Calculation

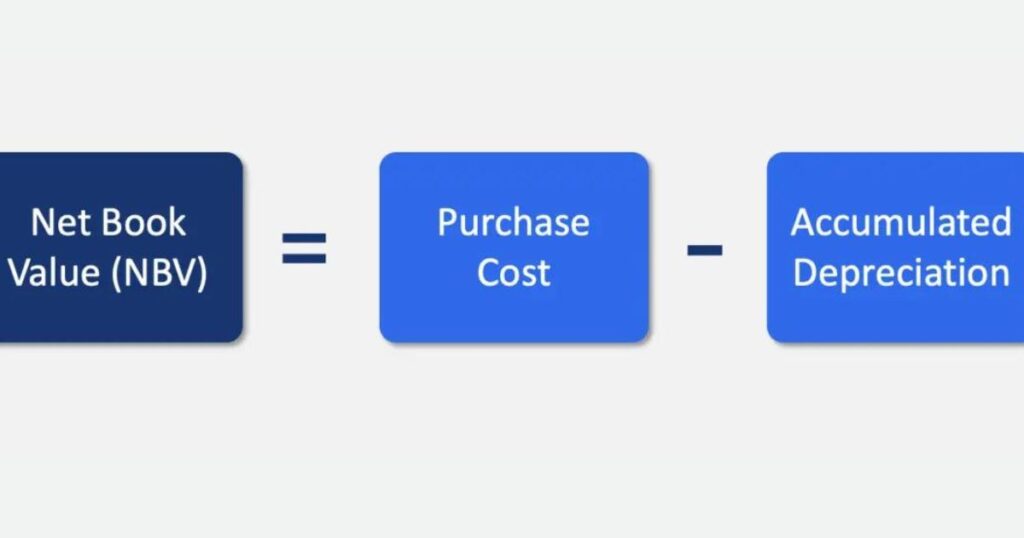

Crunching the numbers for NBV is straightforward. First, take the original cost of an asset, which is how much it was bought for. Next, subtract the accumulated depreciation, which is the total amount the asset’s value has decreased over time. The result is the Net Book Value, or NBV. This final number tells you what the asset is currently worth on the company’s books. By calculating NBV, businesses can understand the real value of their assets as they age and plan for future investments.

How to Calculate Net Book Value (NBV)?

Calculating NBV for real estate might seem daunting, but it’s actually quite straightforward. The process involves determining the original cost of the property and subtracting the accumulated depreciation. However, there are several factors to consider, such as the useful life of the asset, salvage value, and any asset impairment that may have occurred.

To calculate NBV accurately, you’ll need to gather information about the property’s purchase price, any improvements made, and the depreciation method used. It’s important to note that land typically doesn’t depreciate, so it’s treated separately in NBV calculations. Be wary of common pitfalls like forgetting to account for major renovations or misunderstanding the impact of asset write-downs.

Net Book Value Formula (NBV)

The Net Book Value formula is simple yet powerful:

NBV = Original Cost – Accumulated Depreciation

Let’s break this down with an example. Imagine you purchased a commercial building for $1,000,000 five years ago. The building has a useful life of 40 years and no salvage value. Using straight-line depreciation, the annual depreciation expense would be $25,000 ($1,000,000 / 40 years).

After five years, the accumulated depreciation would be $125,000 ($25,000 x 5 years). Therefore, the NBV of the building would be:

NBV = $1,000,000 – $125,000 = $875,000

This calculation gives you a clear picture of the property’s book value, which is essential for accurate financial reporting and decision-making in real estate management.

NBV vs. FMV: What is the Difference?

While Net Book Value is crucial, it’s not the only valuation metric in real estate. Fair Market Value (FMV) is another important concept that often comes into play. FMV represents the price a property would sell for on the open market between a willing buyer and seller. Unlike NBV, which is based on historical cost and depreciation, FMV reflects current market conditions.

The key difference lies in their purpose and calculation. NBV is used primarily for accounting and financial reporting, adhering to GAAP standards. FMV, on the other hand, is more relevant for real estate transactions and market analysis. For instance, a property with a low NBV due to years of depreciation might still have a high FMV if it’s in a desirable location. Understanding both NBV and FMV is crucial for making well-rounded decisions in real estate investment and management.

Leveraging Technology: Net Book Value Calculator (NBV)

In today’s digital age, calculating NBV doesn’t have to be a manual process. Net Book Value calculators have become indispensable tools for real estate professionals. These calculators streamline the process of determining NBV, saving time and reducing the risk of errors. They can handle complex calculations involving multiple properties, different depreciation methods, and various asset valuation techniques.

Some popular NBV calculator tools for US real estate professionals include:

- Real Estate NBV Pro

- PropertyValue Calculator

- AssetWise NBV Tool

These tools not only calculate NBV but often provide additional features like depreciation schedules, asset impairment analysis, and integration with accounting software. By leveraging these technologies, real estate professionals can focus more on strategic decision-making and less on number-crunching.

Real-World Applications: NBV in Action

1. Fixed Asset (PP&E) Assumptions

In real estate, Property, Plant, and Equipment (PP&E) is a significant category on the balance sheet. PP&E assumptions play a crucial role in determining NBV. These assumptions include the useful life of assets, depreciation methods, and potential asset impairment. For example, a commercial building might be assumed to have a useful life of 40 years, while the HVAC system within it might have a shorter lifespan.

Understanding PP&E assumptions is vital for accurate NBV calculations. In the US real estate market, these assumptions can vary based on property type, location, and intended use. For instance, a luxury hotel in New York City might have different PP&E assumptions compared to a warehouse in rural Texas. Real estate professionals must stay informed about industry standards and local market conditions to make appropriate assumptions.

2. Purchase Cost and Accumulated Depreciation Calculation Example

Let’s dive into a practical example of calculating purchase cost and depreciation for a real estate asset. Suppose you’ve acquired an office building for $5,000,000. The building has a useful life of 30 years and an estimated salvage value of $500,000. You decide to use the straight-line depreciation method.

First, calculate the depreciable amount:

Depreciable Amount = Purchase Cost – Salvage Value

$4,500,000 = $5,000,000 – $500,000

Now, determine the annual depreciation expense:

Annual Depreciation = Depreciable Amount / Useful Life

$150,000 = $4,500,000 / 30 years

After 10 years, the accumulated depreciation would be:

Accumulated Depreciation = Annual Depreciation x Years

$1,500,000 = $150,000 x 10 years

This accumulated depreciation is a crucial component in calculating the NBV. It’s important to note that in the US, different depreciation methods can have varying tax implications. The choice of method can affect both the NBV and the non-cash expense reported on financial statements.

3. Net Book Value Calculation Example (NBV)

Now, let’s put it all together with a comprehensive NBV calculation for a commercial property. We’ll use the office building from our previous example. After 10 years, we want to determine its Net Book Value.

Original Purchase Cost: $5,000,000

Accumulated Depreciation (after 10 years): $1,500,000

NBV = Original Cost – Accumulated Depreciation

NBV = $5,000,000 – $1,500,000

NBV = $3,500,000

This NBV of $3,500,000 represents the book value of the office building after 10 years of depreciation. It’s crucial to understand that this value may differ significantly from the property’s market value. For instance, if the building is in a rapidly developing area, its Fair Market Value (FMV) could be much higher than its NBV.

The NBV plays a vital role in real estate investment decisions. It affects various financial metrics, including return on assets and asset turnover ratios. A low NBV compared to FMV might indicate a good investment opportunity, while a high NBV relative to market value could signal overvaluation.

The Bottom Line: Why NBV Matters in Real Estate

Net Book Value is more than just an accounting concept; it’s a crucial tool in the real estate professional’s arsenal. By providing a standardized method for valuing assets, NBV enables fair comparisons between properties and helps in making informed investment decisions. It’s essential for accurate financial reporting, tax planning, and strategic asset management.

Looking ahead, the role of NBV in real estate is likely to evolve. With the rise of big data and AI in property valuation, we might see more sophisticated models that combine NBV with other metrics for a more holistic view of property value. Additionally, as sustainability becomes increasingly important, factors like energy efficiency and environmental impact may start to influence NBV calculations.

For real estate professionals, mastering NBV is not just about compliance; it’s about gaining a deeper understanding of asset value and making smarter business decisions. Whether you’re an investor, property manager, or accountant, incorporating NBV into your analysis can provide valuable insights and help you stay ahead in the competitive real estate market. This is some basic, sample markdown.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.