They can assist you in reversing the payment through their online banking platform or by speaking with a customer service representative. Another option is to reach out directly to the recipient of the payment and request a refund. Many businesses have processes in place to handle refund requests and can reverse the payment through their payment processing systems.

If you need to reverse a bill payment, there are three straightforward methods you can consider. Firstly, contacting your bank or financial institution is a reliable option. They can guide you through the process either online or via customer service. Another approach is to directly request a refund from the recipient of the payment.

Another approach to reversing a bill payment is to use online banking or mobile banking platforms, where you can often find options to cancel or reverse recent transactions.This method is convenient and can be done quickly without the need to visit a physical bank branch.

What Is a Payment Reversal?

A payment reversal occurs when a transaction is undone, returning funds from the merchant back to the customer. It’s an essential process to address unsatisfactory purchases or resolve payment errors promptly.

One common form of payment reversal is a refund, where the merchant returns the purchase amount to the customer, often subtracting processing fees. This method helps maintain customer satisfaction and trust in the vendor.

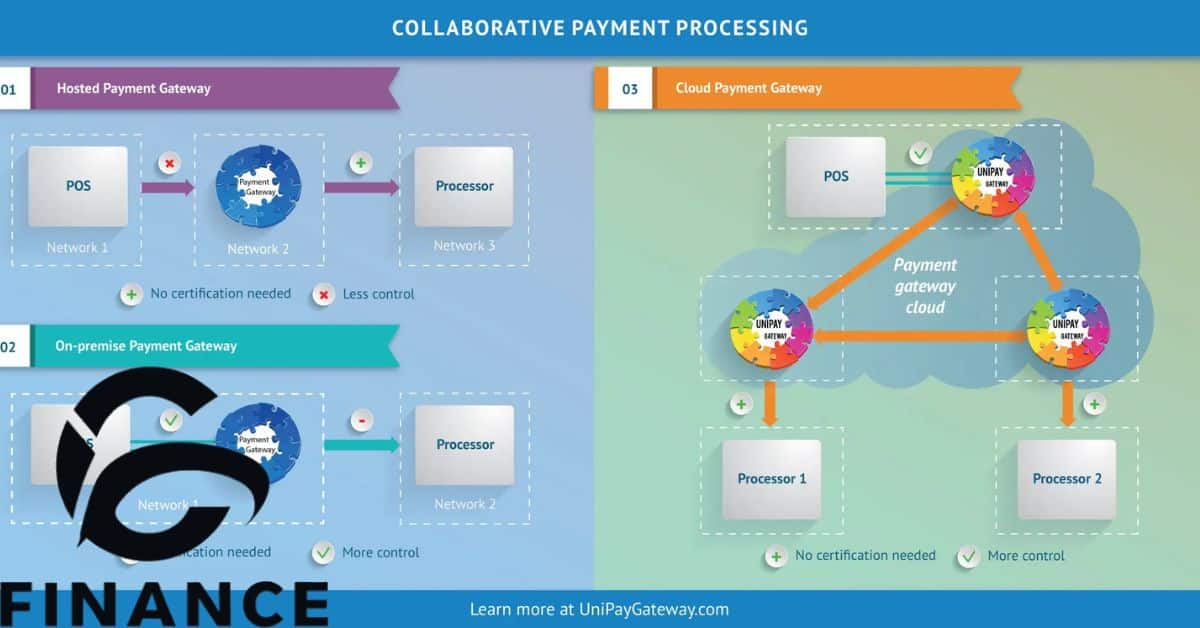

Another type is a chargeback, initiated by the customer through their bank, typically in cases of fraud or unresolved disputes with the merchant. Chargebacks can have significant financial implications for the merchant and are usually seen as a last resort by customers.

Read as:CUB BILL PAYMENT ONLINE & OFFLINE- HOW TO PAY YOUR BILL

Payment reversal definition

Payment reversal refers to the process of undoing a completed transaction, usually initiated by either the customer or the merchant. It is essential for maintaining trust between buyers and sellers in various financial transactions.

Payment reversal can occur when a customer requests a refund for a purchase they made, often due to dissatisfaction with the product or service received. This can be facilitated through various channels such as customer service or online refund requests.

Merchants may initiate payment reversal in cases like accidental overcharges, inability to fulfill an order, or processing errors. This helps rectify mistakes and ensures a positive customer experience, fostering long-term relationships.

What Is an Authorization Reversal?

An authorization reversal is a process where a previously approved transaction is canceled before it is settled. This reversal ensures that the funds initially held for the transaction are released back to the cardholder’s account. It’s commonly used in situations like canceled orders or when a transaction cannot be completed as originally intended.

One way authorization reversals occur is when a merchant pre-authorizes a card for a certain amount but doesn’t complete the transaction.This ensures the funds are temporarily held but not transferred until the transaction is finalized. This process helps prevent unnecessary charges and provides flexibility for both customers and merchants.

What Is a Refund?

A refund is a financial transaction where a customer receives reimbursement for a purchase they made. It’s typically initiated by the merchant or seller in response to a customer’s request due to various reasons such as dissatisfaction with the product, accidental overcharge, or inability to fulfill an order.

The process of obtaining a refund usually involves the customer contacting the merchant or seller to request the return of their money.This can be done through various channels such as customer service hotlines, email, or online refund request forms provided by the seller.

Once the request is made, the merchant assesses the validity of the refund request and processes the transaction to return the funds to the customer’s original payment method. This completes the refund process, providing resolution to the customer’s issue and restoring their financial balance.

What Is a Chargeback?

A chargeback is a reversal of a credit card transaction initiated by the cardholder’s issuing bank. It occurs when a customer disputes a charge on their statement, often due to fraud, unauthorized transactions, or dissatisfaction with the product or service.

The process begins when the cardholder contacts their bank to dispute the charge, providing reasons for the dispute and supporting evidence if required. The issuing bank then investigates the claim, determining its validity based on the provided information and card network regulations.

If the dispute is found to be legitimate, the bank reverses the transaction, crediting the cardholder’s account and debiting the merchant’s account for the disputed amount.The merchant may have the opportunity to respond to the chargeback and provide evidence to dispute the claim, but ultimately, the bank’s decision is final.

How Do You Prevent Payment Reversals?

To prevent payment reversals, ensure clear communication and transparent policies regarding refunds and returns. Provide detailed product descriptions to manage customer expectations and reduce the likelihood of dissatisfaction.

Regularly monitor transactions and customer interactions for any suspicious activity or signs of potential fraud. Promptly address customer concerns and inquiries to resolve issues before they escalate into payment reversals..

Continuously review and update your payment processing systems and protocols to stay ahead of evolving fraud tactics and technological advancements.Educate your staff about the importance of fraud prevention and provide training on how to identify and respond to potential red flags.

The Role of Communication in Preventing Payment Reversals

Effective communication is crucial in preventing payment reversals by ensuring clarity between merchants and customers. Initially, merchants should clearly articulate their refund and return policies, making them readily available to customers.

Subsequently, providing timely updates on order status and any potential issues can manage customer expectations and reduce disputes.Furthermore, offering multiple communication channels, such as email, phone, or live chat support, encourages direct interaction between customers and merchants.

Clear Transaction Descriptorst

Clear transaction descriptors are crucial for ensuring transparency and reducing confusion in financial transactions. Merchants should succinctly describe transactions on statements, avoiding vague or unfamiliar descriptors that may lead to disputes or chargebacks.

Clear transaction descriptors are vital for avoiding confusion and preventing payment reversals. Merchants should ensure that descriptors on bank statements accurately represent purchased goods or services. This clarity helps customers recognize transactions easily.

Concise descriptors, including merchant names and purchase details, aid in identifying transactions for customers and financial institutions. Regularly reviewing and updating descriptors maintains alignment with business changes.

Responsive Customer Service

Responsive customer service plays a vital role in satisfying customers. Quick response times show dedication to addressing concerns promptly.

Efficient handling of customer inquiries and complaints demonstrates commitment to resolving issues effectively.

Additionally, proactive communication and personalized assistance can turn negative experiences into positive ones, fostering long-term loyalty.

Educate Customers on Refund Policies

Educating customers on refund policies is essential for clarity and transparency in transactions.

Clearly outlining the terms and conditions helps customers understand their rights and obligations.

Providing examples and FAQs can simplify complex policies and empower customers to make informed decisions.

Offering accessible channels for inquiries and assistance ensures customers feel supported and valued.

Creating user friendly guides and visuals can aid in comprehending refund processes and requirements.

Utilize Fraud Prevention Toolsplease

Utilizing fraud prevention tools is essential for safeguarding your business against fraudulent activities. These tools employ advanced algorithms to detect suspicious transactions and behavior patterns.

Effective utilization of fraud prevention tools enhances the security posture of businesses by identifying and blocking fraudulent activities in real-time. These tools offer comprehensive insights into transaction data, enabling businesses to detect anomalies and irregularities.

Combat Friendly Fraudvery

Combatting friendly fraud is essential for protecting businesses from financial losses.Educating customers about the consequences of fraudulent claims can deter such behavior.Implementing stringent verification processes can help identify and prevent fraudulent chargeback requests.

Furthermore, investing in fraud detection technology can provide real-time insights into suspicious transactions. Combatting friendly fraud is crucial in safeguarding businesses against financial losses.

Educating customers about the repercussions of fraudulent claims can act as a deterrent.Implementing robust verification procedures helps identify and prevent deceptive chargeback requests.

How to avoid payment reversals

Avoiding payment reversals is crucial for maintaining a healthy financial status.Ensuring transparent and accurate product descriptions can reduce customer dissatisfaction.Moreover, providing exceptional customer service can resolve issues promptly, preventing customers from seeking chargebacks.

Regularly monitoring transactions for suspicious activity helps detect potential fraud early. Establishing clear refund policies and streamlining the refund process can also help minimize the risk of chargebacks and maintain positive customer relationships.

Analyse reversal trends

Analyzing reversal trends is essential for understanding payment patterns and potential risks.By identifying common reasons for reversals, businesses can implement preventive measures.Regularly reviewing reversal data helps businesses adapt their strategies to minimize losses.

Understanding the root causes of reversals enables businesses to address underlying issues effectively.Tracking reversal trends allows businesses to anticipate and mitigate future challenges.Implementing proactive measures based on reversal analysis can enhance overall financial stability.

Ensuring the security of payments is paramount in safeguarding sensitive financial information.Implementing encryption protocols adds an extra layer of protection to payment transactions.

Make sure payments are secure

Regularly updating security software helps address potential vulnerabilities and strengthens payment systems.Verifying the legitimacy of payment gateways and processors enhances the overall security of transactions.

Educating employees and customers about best practices in cybersecurity reduces the risk of fraudulent activities.Employing multi-factor authentication methods adds an additional barrier against unauthorized access to payment data.

Be attentive

Being attentive is essential in various aspects of life, including work, relationships, and personal development. It involves actively listening and observing to gain a better understanding of situations and people’s needs.

It helps individuals stay vigilant and prepared to respond to emergencies effectively. Overall, practicing attentiveness in various aspects of life leads to better outcomes, improved relationships, and personal growth.

Being attentive also plays a crucial role in learning and acquiring new skills. By paying close attention to instructions, feedback, and demonstrations, individuals can grasp concepts more effectively and apply them in practice.

10 ways to reduce payment reversals

Reducing payment reversals is essential for business success.Ensuring robust security measures protects against unauthorized transactions.Implementing effective fraud detection tools can help identify and block suspicious activities promptly.

Providing transparent and detailed product information minimizes misunderstandings and disputes.Offering responsive customer support resolves issues quickly and fosters trust.Optimizing the checkout process streamlines transactions and reduces errors.

Regularly updating payment systems and protocols helps stay ahead of evolving fraud tactics.Educating customers about safe online practices empowers them to recognize and avoid fraudulent schemes.

The bottom line on payment reversals

Understanding payment reversals is crucial for businesses to protect their finances.Merchants must be aware of various reasons for payment reversals, including fraudulent transactions and customer dissatisfaction.

It’s essential to have robust systems in place to handle reversals promptly and efficiently.To mitigate the impact of chargebacks, merchants should prioritize customer service and transparent refund policies.

Efficient record-keeping and fraud prevention measures are vital to combat payment reversals effectively.Continuous monitoring of transaction activities can help identify and prevent potential issues before they escalate.Educating both merchants and customers about payment reversal processes can foster better communication and trust.

reverse transaction meaning

Understanding the meaning of a reverse transaction is essential in finance.A reverse transaction refers to the reversal of a previously completed financial transaction.

This reversal can occur due to various reasons such as errors, disputes, or fraud.For example, if a customer mistakenly pays for a product twice, they may request a reverse transaction to refund the extra payment.

Similarly, if a payment was made for a service that was not provided, a reverse transaction may be initiated to recover the funds.In cases of fraudulent activity, financial institutions may also reverse transactions to prevent further loss.

what is a payment reversal on a credit card

A payment reversal on a credit card is when a previously authorized transaction is canceled or refunded.This could happen due to various reasons such as fraud, disputes, or errors in processing.

Customers might request reversals for unauthorized charges or if they are dissatisfied with a purchase.Merchants may initiate reversals for reasons like stock unavailability or processing mistakes.

In some cases, banks may automatically reverse payments suspected of fraudulent activity.Such reversals can impact both the merchant’s revenue and the customer’s credit balance.To prevent payment reversals, merchants should ensure accurate transaction processing and clear communication with customers.

difference between refund and reversal transaction

Refund

Initiated by the merchant or seller.

Customer receives the money back into their account.

Typically occurs after the product or service has been returned.

A separate transaction from the original payment.

Usually includes processing fees deducted from the refund amount.

Reversal

Initiated by the customer’s bank or payment provider.

Returns the funds to the customer’s account.

Often happens due to an error or unauthorized transaction.

Can occur shortly after the initial payment is made.

May involve the cancellation of the original transaction.

The key difference between a refund and a reversal lies in who initiates the process and under what circumstances it occurs. Refunds are typically initiated by the seller, often after a product return, while reversals are initiated by the customer’s bank or payment provider, often due to errors or unauthorized transactions.

reversal transaction example

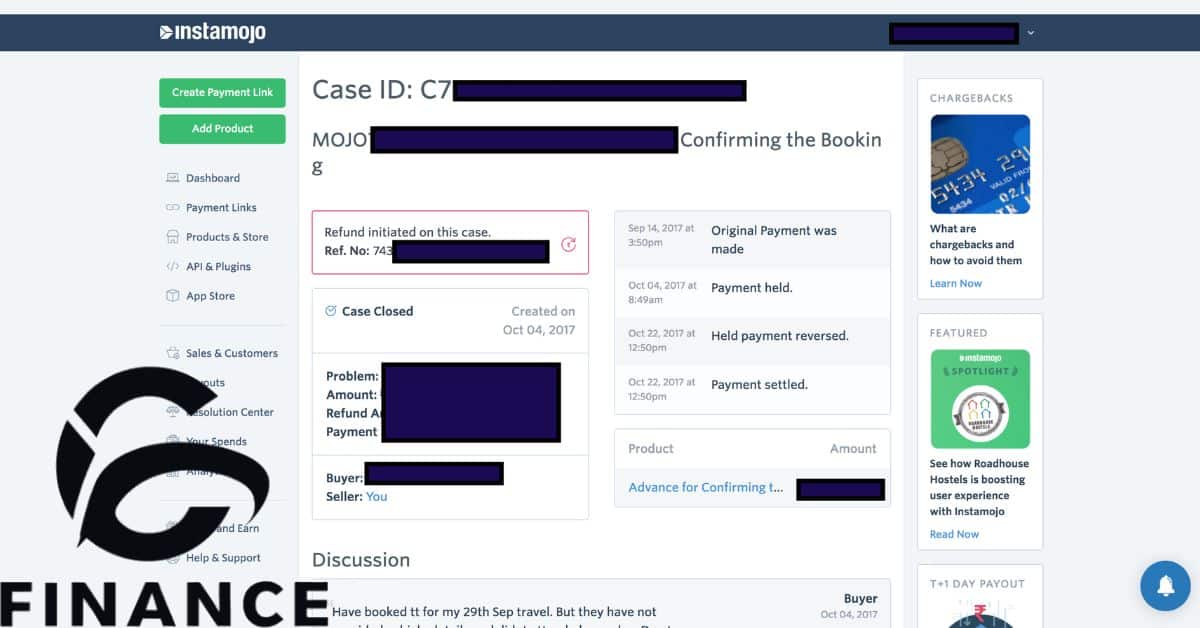

In a reversal transaction example, consider a scenario where a customer accidentally pays twice for the same purchase.The customer contacts the merchant to rectify the error, requesting a refund for the duplicate payment.

Upon verifying the transaction details, the merchant initiates the reversal process to return the excess amount to the customer.Another instance could involve a customer disputing a charge due to receiving damaged or faulty goods.

In this case, the customer contacts their bank to request a chargeback, prompting an investigation into the transaction.If the bank determines the customer’s claim to be valid, they reverse the payment and debit the merchant’s account.

can a bank reverse a payment

Banks possess the ability to reverse payments under certain circumstances.In cases of fraudulent transactions, banks can reverse payments to protect customers.If an error occurs during the transaction process, banks may reverse payments to rectify the mistake.

This capability provides an additional layer of security for account holders.However, reversing payments is typically subject to specific policies and regulations.Customers should contact their bank promptly if they suspect unauthorized transactions.

Banks may require evidence or documentation to support payment reversal requests.Overall, the ability of banks to reverse payments helps safeguard against financial losses and fraud.

Final Thoughts

Reversing bill payments is essential for resolving issues and keeping customers satisfied. Understanding the methods like authorization reversals, refunds, and chargebacks is crucial. Authorization holds can prevent unnecessary charges, while refunds and chargebacks address customer concerns.

Clear communication and efficient processes streamline reversals. Responsive customer service and transaction descriptors enhance transparency and trust. Prioritizing these strategies minimizes disputes and improves the payment experience for all involved parties.

Navigating bill payment reversals demands vigilance and strategic action. Implementing effective reversal strategies, such as authorization holds and swift refund processes, safeguards against potential losses. Prioritizing robust communication and customer service further fortifies businesses against payment disputes, fostering long-term loyalty and satisfaction.

Frequently Asked Questions

Is a chargeback a reversal?

Yes, a chargeback is a type of payment reversal initiated by the cardholder through their bank to dispute a transaction.

How long do pending authorizations take?

Pending authorizations typically last for a short duration, often ranging from 1 to 7 business days, depending on the policies of the issuing bank or financial institution.

Can a cardholder cancel a pre-authorization?

Yes, a cardholder can request to cancel a pre-authorization, but it’s important to note that the merchant may still need to release the hold on funds, which could take additional time.

Can an EFT be reversed?

Yes, an Electronic Funds Transfer (EFT) can be reversed under certain circumstances, such as errors in processing or fraudulent activity. However, the process and requirements for reversing an EFT may vary depending on the specific situation and the policies of the involved financial institutions.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.