Filing GST/HST returns is a legal obligation for businesses in Canada with over $30,000 in annual taxable supplies.

This comprehensive guide covers everything you need to know, including registering for a GST/HST account, collecting financial data, calculating net tax, completing returns accurately, submitting on time, staying compliant with CRA regulations, and handling audits. Avoid penalties by understanding the process from start to finish.

Understanding GST/HST in Canada

The GST/HST is a value-added tax levied on most goods and services sold in Canada. The GST applies at a rate of 5% in all provinces, while the HST is a combined provincial and federal tax applied in five provinces: Nova Scotia (15%), New Brunswick (15%), Newfoundland and Labrador (15%), Prince Edward Island (15%), and Ontario (13%).

Businesses in the remaining provinces (Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon) collect only the 5% GST.

Any business engaged in commercial activities in Canada and whose annual taxable supplies (revenue from selling goods/services subject to GST/HST) exceed $30,000 is required to register for a GST/HST account and collect these taxes. Failure to comply can result in penalties and interest charges from the CRA.

Eligibility for Filing GST/HST Returns

You must file GST/HST returns if:

- Your annual taxable supplies (revenue from taxable sales) are over $30,000.

- You are a non-resident business conducting commercial activities in Canada.

- You are a public service body (universities, schools, hospitals, etc.) with taxable supplies over $50,000.

However, there are exceptions and special cases. For instance, taxi and limousine services must collect GST/HST regardless of their annual revenue. Consulting the CRA website or a tax professional is advisable if you’re unsure about your specific situation.

The GST/HST Filing Process

Registering for a GST/HST Account

The first step is to register for a GST/HST account with the CRA. This can be done:

- Online through the CRA’s “Register a Business” portal

- By mail by completing and mailing Form RC1 Request for a Business Number

You’ll need to provide information like your business name, address, legal structure, projected annual revenue, and more. The CRA will then issue you a Business Number (BN) and GST/HST account number.

Determining the Reporting Period

Your reporting period dictates how frequently you must file GST/HST returns and remit any amounts owing:

- Annual filers (under $1.5 million taxable supplies) file once a year

- Quarterly filers ($1.5 million to $6 million taxable supplies) file every 3 months

- Monthly filers (over $6 million taxable supplies) file every month

The CRA assigns your initial reporting period based on your estimated annual taxable supplies. However, you can request a change if your situation differs.

Collecting the Necessary Financial Information

Keeping meticulous records of your sales, purchases, expenses, and GST/HST collected or paid is essential. These records will allow you to accurately calculate your net tax owing or refund.

Best practices include:

- Using accounting software or a spreadsheet to track transactions

- Keeping invoices, receipts, and other supporting documents organized

- Recording GST/HST amounts separately from selling prices

- Reconciling records regularly to ensure accuracy

Calculating Net Tax

Your net tax is calculated by subtracting your Input Tax Credits (ITCs) from the GST/HST collected on your taxable sales.

ITCs are the GST/HST you paid on purchases and operating expenses used in your commercial activities. These can be claimed to offset the GST/HST you owe.

For example, if you collected $10,000 in GST/HST from sales but paid $2,500 in GST/HST on expenses, your net tax owing would be:

Net Tax = GST/HST Collected - ITCs

= $10,000 - $2,500 = $7,500If your ITCs exceed the GST/HST collected, you would receive a refund for the difference.

Completing the GST/HST Return

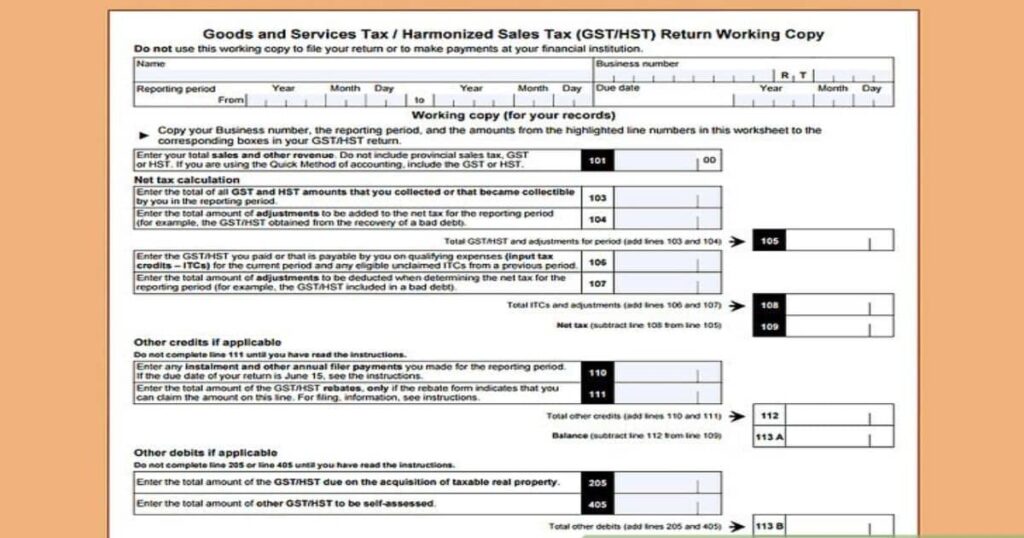

Filling Out the GST/HST Return Form

The GST/HST return is submitted using Form GST34 for annual filers or GST62 for quarterly/monthly filers. These forms require you to:

- Report your total taxable sales and GST/HST collected

- Claim eligible ITCs

- Calculate and report your net tax owing or refund amount

Be sure to complete the form accurately and provide all required information and supporting documents. Common errors include:

- Mathematical mistakes in calculations

- Forgetting to claim eligible ITCs

- Improperly classifying sales and expenses

Claiming Input Tax Credits

As mentioned, you can claim ITCs for the GST/HST paid on purchases and expenses used in your commercial activities. Some eligible ITCs include:

- Operating expenses (rent, utilities, office supplies)

- Capital property (computers, vehicles, equipment)

- Inventory for resale or use in manufacturing

- Imported goods

However, ITCs cannot be claimed for items used for personal purposes or in exempt activities. The rules around eligible expenses can be complex, so consult the CRA guidelines or a tax professional.

Calculating the Amount Owing or Refund

After reporting your total taxable sales, GST/HST collected, and eligible ITCs, the return form will calculate your net tax owing to the CRA or refund due to you.

If you owe tax, the amount must be paid by the return’s due date to avoid penalties and interest. If expecting a refund, the CRA will process it after your return is assessed.

GST/HST Return Submission Methods

Electronic Submission

The CRA strongly encourages businesses to file GST/HST returns electronically using their “My Business Account” portal or compatible software. Benefits include:

- Faster processing times

- Instant confirmation of receipt

- Pre-populated form information

- Ability to pay electronically

Setting up a “My Business Account” is free, secure, and allows you to manage all your GST/HST matters online. Compatible software options include popular accounting programs.

Submitting via Mail

For those still preferring paper returns, you can mail your completed GST34 or GST62 form to the appropriate CRA tax center address for your region. Be sure to:

- Use the correct CRA remittance form

- Include any additional schedules or documents required

- Allow sufficient mailing time to meet the due date

In-Person Submission

While less common, you may be able to submit your GST/HST return in person at a CRA tax services office or coordinating tax preparation service, depending on availability in your region.

Deadlines and Due Dates for GST/HST Returns

GST/HST return due dates depend on your assigned reporting period:

- Annual Filers: Must submit by June 15th after the end of the fiscal year.

- Quarterly Filers: Due one month after the end of each quarter.

- Monthly Filers: Due one month after the end of each month.

For example, an annual filer with a December 31st year-end must file by June 15th. A quarterly filer for Q1 (January – March) must file by April 30th.

Late returns are subject to penalties and interest charges, so mark the due dates on your calendar! The CRA can apply a penalty of 4% plus 1% for each full month the return is outstanding.

Payment Options and Procedures

Online Banking

If you owe GST/HST Rates in Canada, the simplest payment method for most businesses is through their financial institution’s online banking bill payment feature. You’ll need to add “Canada Revenue Agency” as a payee and use your 9-digit Business Number (BN) as the account number.

Telefile System

The CRA also offers the Telefile system, which allows you to pay by phone using your financial institution debit, credit card, or pre-authorized debit. After providing some identification details, you’ll receive a confirmation number as proof of payment.

Through Financial Institutions

Alternatively, you can pay at your bank or credit union in person by making a remittance through the teller. Request a stamped receipt as proof of payment.

Be sure to make your payment on or before the return due date! Late payments are subject to compound daily interest charges.

Record Keeping for GST/HST

Maintaining thorough and accurate records related to your GST/HST obligations is not only a legal requirement but also crucial for ensuring compliance and avoiding potential audits or penalties from the CRA. Here are some key points on record keeping:

What Records to Keep:

- Copies of all GST/HST returns filed

- Sales invoices showing GST/HST collected

- Purchase receipts/invoices to support ITCs claimed

- Import documents for goods imported into Canada

- Financial statements, books, and ledgers

- Any backup information or calculations for amounts reported

How Long to Keep Records:

The CRA requires businesses to retain all GST/HST related records for a period of 6 years from the end of the year to which they relate. This 6-year period restarts from the date of any CRA reassessment.

Storage Methods:

Physical paper records must be kept in Canada, unless approved by the CRA. However, electronic records stored on computers or digital storage devices are permitted as long as they are retained in an accessible and readable format even after updating software or hardware.

Regular backups of electronic data are highly recommended to prevent loss. Cloud storage solutions can provide an added layer of security and accessibility.

Failure to Keep Proper Records:

Inadequate record keeping can lead to significant penalties and interest charges from the CRA. In case of an audit, you may be required to pay taxes owing based on the CRA’s estimate if you cannot substantiate your claims and calculations.

Establishing a robust record keeping system from the start and reviewing it regularly will ensure you remain GST/HST compliant while streamlining the process of filing returns.

Handling Audits and Compliance

While the CRA aims to provide information and clarify rules upfront, audits are still a possibility to ensure businesses are accurately reporting and remitting GST/HST.

Audits can be triggered by factors such as:

- Math errors or discrepancies on returns

- Failure to file on time

- Sudden changes in annual revenue patterns

- Specific sectors or industries targeted for review

If selected for a GST/HST audit, the key is to remain prepared, organized, and fully cooperative. This includes:

- Having all relevant books, records, and documentation readily available

- Responding promptly to any inquiries or requests for information

- Allowing CRA auditors access to business premises if required

- Clearly explaining any adjustments or corrections made

While audits can be stressful, maintaining GST/HST compliance and having solid record keeping practices in place will make the process much smoother.

The CRA also has Fairness provisions that may grant relief from penalties or interest in certain circumstances, such as extraordinary events beyond your control.

By understanding your obligations, carefully calculating and remitting GST/HST owing, and continuously monitoring compliance, your business can avoid potential audits and associated penalties down the line.

Following this comprehensive guide, you’re now equipped with the knowledge to confidently file your GST/HST returns accurately and on time. Consistent compliance will ensure your business remains in good standing while avoiding unnecessary fees or scrutiny from the Canada Revenue Agency.

FAQ’s

How do I claim HST tax back in Canada?

You can claim HST paid on business expenses as input tax credits (ITCs) when filing your GST/HST return. Keep all receipts and records to substantiate your ITC claims.

How do I file a return with GST?

To file a GST return, you must register for a GST/HST account with the CRA, collect financial data, calculate net tax owed, complete the appropriate GST return form, and submit it electronically or by mail before the due date.

Who pays HST tax in Canada?

Businesses and consumers in the provinces of Nova Scotia, New Brunswick, Newfoundland and Labrador, Prince Edward Island, and Ontario pay the Harmonized Sales Tax (HST), which combines the 5% federal GST with a provincial sales tax component.

Do foreigners pay GST in Canada?

Yes, non-residents must pay the 5% GST on most goods and services purchased in Canada, except in the HST-participating provinces where they would pay the combined HST rate instead.

Can foreigners get a tax refund in Canada?

Visitors to Canada may be eligible for GST/HST rebates on certain goods purchased and taken home, but generally cannot recover taxes paid on services or short-term accommodation. Refund criteria and processes vary by province.

How to claim VAT refund in Canada?

Canada does not have a VAT (Value Added Tax) system. However, some countries allow claiming back the Canadian GST/HST paid as a VAT refund if certain conditions are met. Check with your home country’s tax authority.

Can you claim back tax paid in Canada?

Businesses can claim back GST/HST paid on eligible expenses as input tax credits. Visitors can get GST/HST rebates on certain goods exported from Canada within specific time limits, but not for services consumed in Canada.

Final Thought About GST/HST Return in Canada

Accurately filing your GST/HST returns is crucial for maintaining compliance and avoiding penalties from the Canada Revenue Agency.

By following the detailed steps outlined in this guide, you can confidently navigate the entire process – from registering for a GST/HST account and determining your reporting period, to calculating net tax owed, completing all required forms, and submitting returns on time.

Establish robust record keeping practices to streamline filing and be prepared for any potential audits. With some upfront effort to understand the rules and your obligations, consistently and accurately filing GST/HST returns will become a routine matter for your business.

Stay compliant, avoid costly mistakes, and operate confidently knowing you have mastered this important responsibility.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.