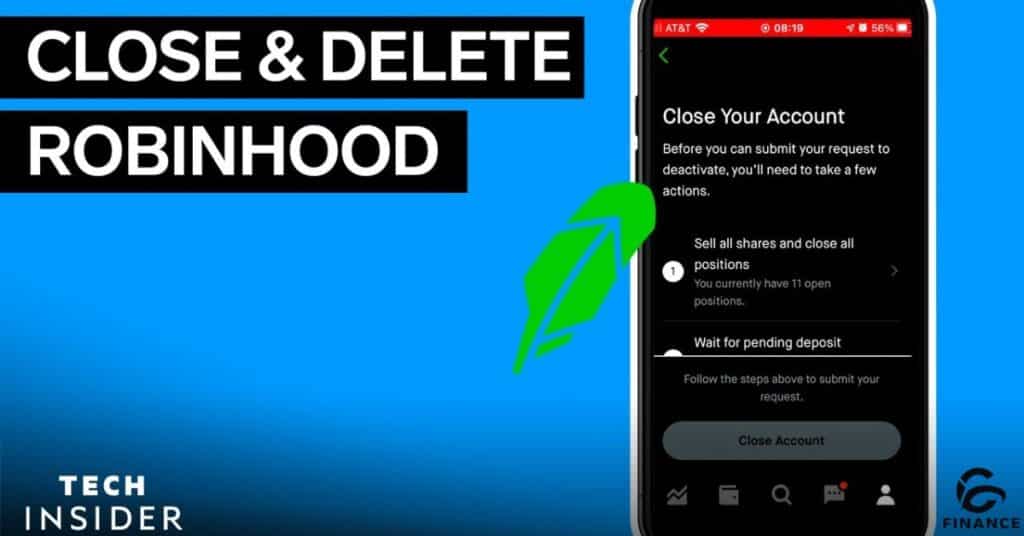

Closing a Robinhood account involves several straightforward steps. Firstly, ensure your account balance reaches $0 by selling off any remaining positions and withdrawing funds. Secondly, navigate to the account settings within the app to deactivate your account. Lastly, if desired, email a written request to Robinhood’s support team for account closure confirmation.

Concluding a Robinhood Account demands attention to detail. Begin by selling all investments and withdrawing any remaining balance. Next, proceed to deactivate the account through the app settings. Lastly, if opting for complete closure, contact Robinhood’s support team via email to finalize the process.

To conclude a Robinhood Account, follow these simple steps. Sell all your investments to bring your account balance to zero. Then, deactivate your account using the app settings. Finally, if you wish to close your account entirely, reach out to Robinhood’s support team via email for further assistance.

Why You Might Want to Close Your Robinhood Account

If you’re considering closing your Robinhood account, there are several reasons that might lead you to make that decision. Perhaps you’re looking to explore more day trading options, or maybe you prefer the stability of traditional brokerages..

Closing your Robinhood account could be driven by a desire to engage in more active day trading activities. Unlike traditional brokerages, Robinhood’s simplified platform may not offer the tools and features you need for this type of trading.

Some investors opt to close their Robinhood accounts in favor of traditional brokerages, seeking the guidance and support of professional financial advisors. With Robinhood, users are solely responsible for their investment decisions, which can be daunting for those who prefer a more hands-on approach.

You want to do more day trading

Robinhood Account might not be the right fit for you. With its simplistic platform, Robinhood Account limits your options for day trading. Consider switching to a brokerage that offers more advanced tools and features for day traders.

If you’re seeking less risk and more guidance, Robinhood Account may not meet your needs. Unlike traditional brokerages, Robinhood Account leaves you solely responsible for your investment decisions. Transitioning to a brokerage with professional guidance might be a better option for you.

Feeling restricted by Robinhood Account’s limitations? Many investors have found themselves seeking alternatives due to Robinhood Account’s controversial decisions. If you’re looking for a brokerage that aligns better with your investment values, it might be time to consider closing your Robinhood Account.

You want less risky, more traditional brokerages

Consider switching to more traditional brokerages for lower risk. Dive into the world of established investment firms for a steadier approach. Trade with confidence by exploring alternatives to the Robinhood platform.

Benefits of Traditional Brokerages

- Stability: Traditional brokerages offer a more stable investment environment.

- Expert Guidance: Benefit from professional advice and support.

- Diverse Options: Explore a wide range of investment opportunities tailored to your risk tolerance.

Transitioning Away from Robinhood

- Evaluate Your Options: Research and compare traditional brokerage firms.

- Transfer Assets: Easily transfer your investments from Robinhood to your new brokerage.

- Secure Your Future: Take proactive steps to safeguard your financial portfolio.

Considerations Before Making the Switch

- Account Closure: Ensure a $0 balance before closing your Robinhood account.

- Potential Fees: Be aware of any transfer fees or charges associated with moving your assets.

- Future Prospects: Plan for continued growth and success with your new brokerage partner.

Read As: WHAT IS CHARTERED PROFESSIONAL ACCOUNTANT?

Steps to Take Before Closing Closing Your Account

Closing your Robinhood account requires careful consideration and preparation. Before taking any steps, it’s essential to understand the process and its implications fully. Here’s what you need to know:

Steps to Take Before Closing Your Account

- Ensure a $0 Balance: Sell all your positions and withdraw the balance to your bank account to bring your Robinhood account balance to zero.

- Deactivate Account: Use the Robinhood app to deactivate your account. Follow the prompts to close all positions and confirm your deactivation request.

- Transfer Assets: If you prefer not to sell your positions, you can transfer them to another brokerage. Initiate an ACATS transfer request with your new brokerage to seamlessly move your assets.

By following these steps, you can effectively close your Robinhood account while considering your financial strategy and preferences.

How to Transfer My Robinhood Account to Another Broker?

Transferring your Robinhood account to a new broker is straightforward.Begin by initiating an ACATS transfer request with your chosen brokerage.Ensure all your Robinhood Account assets and funds are ready for the transfer.

Your new brokerage will guide you through the transfer process smoothly.Provide them with your Robinhood Account number and necessary details.Expect a seamless transition of your investments from Robinhood to your new brokerage.

Once the transfer is complete, your Robinhood Account will automatically close.Enjoy the benefits of your new brokerage platform and services.Rest assured, your assets are now securely managed by your chosen broker.

Does Robinhood Have a Cancellation Fee?

Closing your Robinhood account is hassle-free. Rest assured, there are no pesky cancellation fees involved. Whether you’re moving to a different brokerage or taking a break from trading, you can do so without any financial penalties.

No Cancellation Fee: Rest Assured Closing a Robinhood Account: Simplified Process Robinhood Account: Easy Closure Without Fees

- No charges for closing your Robinhood account

- Simple process to close your Robinhood account hassle-free

- Closure of a Robinhood account incurs no fees

Transferring Assets: Alternative Option Explore Account Transfer from Robinhood Moving Your Investments: Robinhood Account Transfer

- Consider transferring your assets to another brokerage

- Transfer your assets from Robinhood to another brokerage

- Robinhood offers the option to transfer your investments

Financial Implications: Understanding Costs Know the Financial Impact of Closing a Robinhood Account Considerations Before Finalizing Robinhood Account Closure

- Understand any potential costs involved in closing your Robinhood account

- Be aware of the financial implications of closing your Robinhood account

- Consider all factors before proceeding with closing your Robinhood account

How much does it cost to close a Robinhood account?

Closing a Robinhood account incurs costs depending on the method chosen. Selling positions and withdrawing funds to reach a $0 balance is the primary step. Alternatively, transferring assets to another brokerage is another option.

To close a Robinhood account, ensure a $0 balance by selling positions and withdrawing funds. Another option is transferring assets to another brokerage. Robinhood does not charge a closure fee, but SEC and FINRA charges may apply.

To finalize closing a Robinhood account, confirm a $0 balance by selling positions and withdrawing funds. Alternatively, transfer assets to another brokerage. While Robinhood doesn’t charge a closure fee, SEC and FINRA charges may be incurred.

Is deactivating the same as deleting Robinhood?

Deactivating your Robinhood account involves temporarily disabling it, while deleting it means permanently removing it. When you deactivate your Robinhood account, you can still access certain information, but when you delete it, all your data is permanently erased. It’s important to consider your options carefully before deciding which action to take regarding your Robinhood account.

Deactivating a Robinhood account allows users to temporarily disable their account, whereas deleting it removes all data permanently. When you deactivate your Robinhood account, certain information remains accessible, but deleting it erases all data.

Deactivating your account temporarily disables it, while deleting it permanently removes all data. Keep in mind that deactivating allows for future reactivation, whereas deletion erases everything. It’s crucial to think through your decision regarding your Robinhood account.

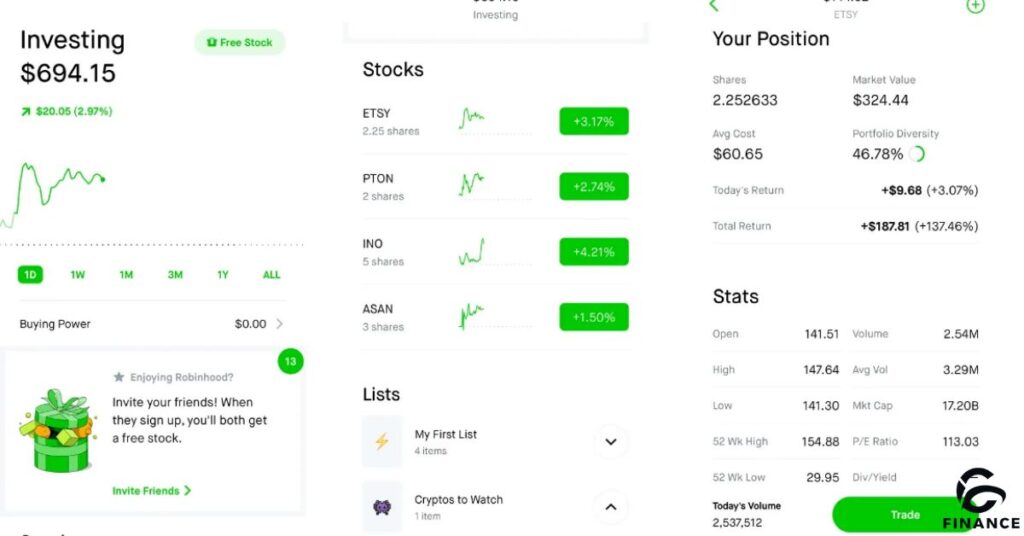

How do I cash out my Robinhood account?

If you’re wondering how to cash out your Robinhood account, here’s what you need to know. Cashing out your Robinhood account involves selling all your positions and withdrawing the balance to your bank account.

Closing your Robinhood account requires ensuring a $0 balance by selling positions and withdrawing funds or transferring assets to another brokerage. Robinhood doesn’t charge an account closure fee, but SEC and FINRA sales charges may apply. If you’re considering closing your Robinhood account, follow these steps to complete the process smoothly.

How do I close my position on Robinhood?

Looking to close your position on Robinhood? Here’s how: Ensure your balance hits zero by selling all holdings and withdrawing funds. Email support@robinhood.com to finalize account closure. Remember, Robinhood doesn’t charge for account closure, but keep an eye on SEC and FINRA charges.

Ready to part ways with your Robinhood Account? First, sell off all your holdings and withdraw funds. Then, tap “Deactivate Account” in the app’s settings. Finally, contact Robinhood to confirm closure and avoid any lingering charges.

Closing your Robinhood Account is straightforward. Sell all holdings, withdraw funds, then deactivate through the app. Reach out to support@robinhood.com for final confirmation. Keep in mind any SEC and FINRA charges during the process.

Are There Any Tax Implications for Closing My Robinhood Account?

Closing your Robinhood account may have tax implications, as selling investments can incur capital gains taxes. Ensure all debts are settled before finalizing the account closure. You can find more information about tax implications on the Robinhood website.

Robinhood Account closure involves selling all investments and withdrawing the balance. Once your account balance is $0, you can request closure through the app. Remember to transfer any remaining funds to your linked bank account.

Transferring your assets to another brokerage instead of closing your Robinhood Account is also an option. Initiate an ACATS transfer request with your new brokerage firm. Robinhood’s customer service can assist you with any questions regarding the transfer process.

Can I Reopen My Robinhood Account After Closing It?

The Robinhood Account reopening might be a possibility after closure. Robinhood Account closure necessitates selling all investments. Robinhood Account transfers to other brokers are also feasible.

The Robinhood Account revival entails reinitiating the application process. The Robinhood Account balances must reach $0 for closure. Robinhood Account preservation involves accessing statements and tax documents.

The Robinhood Account migration involves transferring assets to another brokerage. Robinhood Account termination necessitates a written request. Robinhood Account closure does not incur additional fees.

What Should I Do With Dividends or Earnings Received After Requesting Account Closure?

After requesting account closure, consider what to do with dividends or earnings received. Withdrawing remaining funds from the Robinhood Account is crucial. Ensure all dividends or earnings are processed before finalizing closure.

When closing a Robinhood Account, selling investments is necessary. Be aware of potential tax implications related to closing a Robinhood Account. Transfer assets to another brokerage if not selling them.

Closing a Robinhood Account involves selling all investments. Review the process for transferring assets to another brokerage. Ensure all funds are withdrawn before finalizing the closure of your Robinhood Account.

Will Closing My Robinhood Account Affect My Credit Score?

Closing your Robinhood account will not impact your credit score directly. When you close your Robinhood account, it’s important to ensure all debts or margin balances are settled. After closing your Robinhood account, you’ll still have access to your account statements and trade confirmations.

Closing your Robinhood account is a straightforward process. Ensure your account balance is $0 before initiating the closure. If you choose to transfer your assets to another brokerage, Robinhood will automatically close your account once the transfer is complete.

Robinhood does not charge a fee for closing your account. However, be mindful of potential tax implications from selling investments. If you decide to reopen a closed Robinhood account, you may need to go through the account setup process again.

Can I Transfer My Investments to Another Broker Instead of Selling Them?

You have the option to transfer your investments from Robinhood to another brokerage instead of selling them outright. This process allows you to maintain your investment portfolio while transitioning to a new platform.

When transferring your investments to another broker, such as Charles Schwab or Fidelity, you’ll initiate an ACATS (Automated Customer Account Transfer Service) request. This enables the seamless transfer of your assets and funds from your Robinhood account to your chosen brokerage.

It’s important to note that while transferring your account, Robinhood will automatically close your account once all of your assets have been successfully transferred to the new brokerage. This ensures a smooth transition to your new investment platform.

What Happens to My Investments When I Close My Robinhood Account?

When you close your Robinhood account, your investments undergo a specific process. Robinhood account holders need to understand what happens to their investments during account closure. Knowing the fate of your investments is crucial when closing a Robinhood account.

Once you initiate the account closure process, your investments within the Robinhood account will be handled accordingly. It’s essential to grasp the implications of closing your Robinhood account on your investments. Ensure you’re fully informed about the fate of your investments in your Robinhood account.

Closing a Robinhood account affects the status of the investments held within the account. It’s imperative to comprehend how closing your Robinhood account impacts your investments. Familiarize yourself with the procedures and consequences associated with closing your Robinhood account.

Frequently Asked Questions

How Do I Close My Robinhood Account?

To close your Robinhood account, ensure your balance is $0 by selling positions and withdrawing funds. Then, submit a closure request through the Robinhood app or contact support.

Can I Close My Account If I Have Open Positions or Funds?

No, you cannot close your Robinhood account if you have open positions or funds remaining. Sell all investments and withdraw any balance before initiating the closure process.

Are There Any Fees for Closing a Robinhood Account?

Generally, Robinhood does not charge fees for closing an account. However, consider potential tax implications from selling investments before closing.

How Long Does It Take to Close a Robinhood Account?

After submitting a closure request, it can take several days to weeks for Robinhood to complete the process. Timing depends on transaction settlements and fund withdrawals.

Final Thoughts

Closing your Robinhood account is straightforward. First, ensure your account balance is $0 by selling all positions and withdrawing funds. Then, you can deactivate your account through the app. Remember, if you choose to close your account, you’ll lose access to trading features.

However, you can still view account statements and tax documents. Alternatively, you can transfer your assets to another brokerage to avoid selling positions. Keep in mind any potential fees involved in transferring.

Whether you’re deactivating or closing, ensure you’ve understood the implications and follow the necessary steps carefully. Lastly, if you have any questions or need assistance, don’t hesitate to reach out to Robinhood’s customer support.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.