The total amount of money in the world is difficult to pinpoint. Money exists in various forms like coins, notes, and digital currency. Estimates suggest trillions of dollars circulate globally across different currencies and financial instruments.

Every country has its central bank regulating money supply. Different measures like M0, M1, and M2 categorize money based on liquidity. The global M1 supply includes cash, travelers checks, and demand deposits.

Digital currencies are becoming more popular worldwide. Central banks are exploring their own digital currencies. This shift reflects a trend towards digital transactions over physical money.

Key Takeaways

- The total global money supply encompasses various forms, including physical cash, virtual currencies, and financial instruments like stocks and bonds.

- Different measures of money, such as M0, M1, and M2, provide insights into the liquidity and circulation of funds within economies.

- With the rise of digital transactions and central bank digital currencies, the landscape of money is evolving, but it remains a crucial aspect of economies worldwide.

- Money exists in diverse forms worldwide, including physical currency, electronic bank accounts, and cryptocurrencies.

- Measures like M0, M1, and M2 offer insights into the amount and liquidity of money circulating within economies.

- As digital transactions gain popularity and central banks explore digital currencies, the concept of money continues to evolve in the global economy.

The Different Types of Money

Money comes in various forms. Physical money includes coins and notes. Virtual money includes electronic bank accounts.

Economists classify money based on liquidity. M0 is the most liquid form. M3 is the least liquid and includes institutional money market funds.

Different countries have different central banks. These banks regulate and publish money supply data.

Narrow Money (M0)

Narrow Money, also known as M0, includes all physical currency in circulation. It consists of coins and notes held by individuals and businesses. M0 is the most liquid form of money, readily available for transactions.

In the economy, M0 serves as the foundation for financial transactions. It facilitates everyday purchases and transactions. M0 provides individuals and businesses with immediate purchasing power.

As a measure of the money supply, M0 is closely monitored by central banks. It reflects the level of currency in circulation and influences monetary policy decisions.

Broad Money

Broad money refers to the total money supply in an economy. It includes physical currency like coins and notes. Additionally, it encompasses various types of deposits in banks.

The concept of broad money is crucial for understanding the liquidity of an economy. It reflects the total amount of money available for spending and investment.

Governments and central banks closely monitor broad money to manage economic stability and inflation rates. They adjust monetary policies based on changes in broad money supply.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate independently of central banks and governments. Bitcoin, Ethereum, and Litecoin are popular examples.

Investors buy cryptocurrencies as a form of investment or to use in online transactions. Cryptocurrencies offer decentralized and secure transactions. However, their value can be volatile.

Blockchain technology underpins cryptocurrencies, providing transparency and security. Transactions are recorded on a distributed ledger, making fraud difficult. However, the technology is still evolving.

Who Controls How Much Money In The World There Is?

The amount of money in the world is controlled by central banks and governments. They regulate the money supply to stabilize economies and manage inflation. Financial institutions also play a significant role in influencing the circulation of money globally.

Additionally, individuals and businesses contribute to the money supply through transactions and investments. The decisions made by policymakers, investors, and consumers collectively impact the overall amount of money in circulation.

Overall, the control of money in the world is a complex interplay between various stakeholders, including governments, financial institutions, and individuals, shaping the global economy.

Central Banks

Central banks play a crucial role in regulating a country’s monetary policy. They control the money supply, interest rates, and inflation. Central banks also act as lenders of last resort during financial crises, providing liquidity to stabilize the economy.

These institutions are responsible for issuing currency and maintaining price stability. Through open market operations, central banks buy and sell government securities to influence interest rates. They also supervise and regulate commercial banks to ensure financial stability and protect consumers.

Moreover, central banks serve as advisors to governments on economic matters and implement policies to achieve sustainable growth. They monitor economic indicators such as GDP, unemployment, and inflation to make informed decisions for the overall health of the economy.

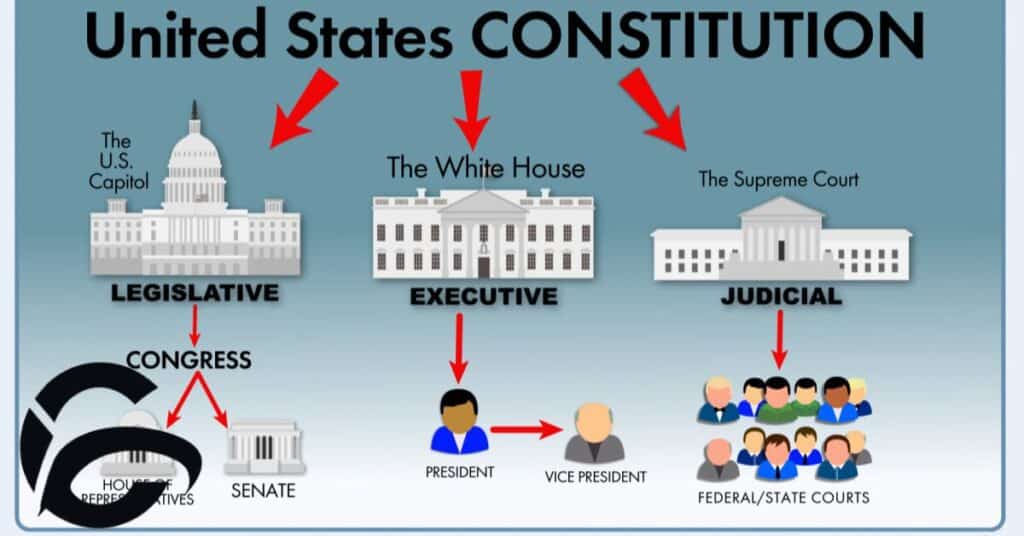

about Governments

Governments play a crucial role in society. They create and enforce laws to maintain order. Governments also provide essential services such as education and healthcare.

Governments collect taxes to fund their operations. They allocate resources to infrastructure projects and public welfare programs. Additionally, governments represent their citizens on the global stage through diplomacy and international relations.

Governments come in various forms, including democracies, monarchies, and dictatorships. Each type has its own system of governance and decision-making processes. Regardless of the form, governments aim to serve the needs and interests of their citizens.

Commercial Banks

Commercial banks are financial institutions that offer various services to individuals and businesses. They accept deposits, provide loans, and offer other financial products like savings accounts and credit cards. Commercial banks play a crucial role in the economy by facilitating the flow of money and providing essential financial services to customers.

These banks earn revenue through the interest they charge on loans and the fees they collect for services. They also invest in various assets to generate income and manage risks. Commercial banks are regulated by government authorities to ensure stability and protect consumers’ interests.

Customers rely on commercial banks for everyday banking needs such as depositing paychecks, paying bills, and accessing credit. These banks use advanced technology to offer convenient online and mobile banking services, making it easier for customers to manage their finances anytime, anywhere.

International Monetary Fund (IMF)

The International Monetary Fund (IMF) plays a vital role in global economic stability. It provides financial assistance and policy advice to member countries facing economic challenges. The IMF promotes international monetary cooperation and exchange rate stability.

Through its surveillance and research, the IMF helps identify economic vulnerabilities and risks. It offers technical assistance and training to improve economic governance and policymaking. By fostering economic stability, the IMF contributes to sustainable growth and poverty reduction worldwide.

Member countries contribute funds to the IMF, which are used to provide financial assistance to countries in need. The IMF’s lending programs aim to restore macroeconomic stability and promote structural reforms. By supporting countries during crises, the IMF helps prevent financial contagion and promotes global economic resilience.

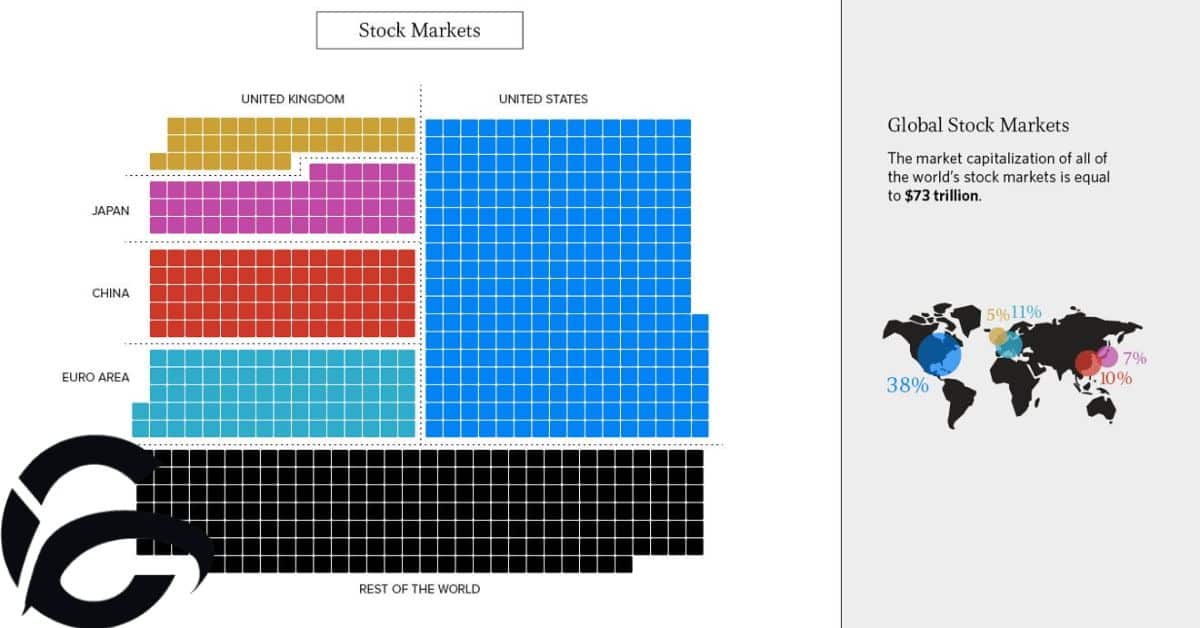

Financial Markets

- Financial markets are where people buy and sell assets like stocks and bonds.

- These markets help businesses raise capital and investors make profits.

- Understanding financial markets is essential for managing personal finances and investing wisely.

- Investors trade stocks and bonds in financial markets.

- Prices fluctuate based on supply and demand.

- Financial markets play a crucial role in global economies.

Global Financial System

The global financial system is complex. It involves various institutions and markets.Banks play a crucial role in this system.Investors rely on financial markets. They buy and sell assets like stocks and bonds. These transactions affect the economy.

Central banks regulate monetary policy.They control interest rates and money supply.Their decisions impact economic stability.

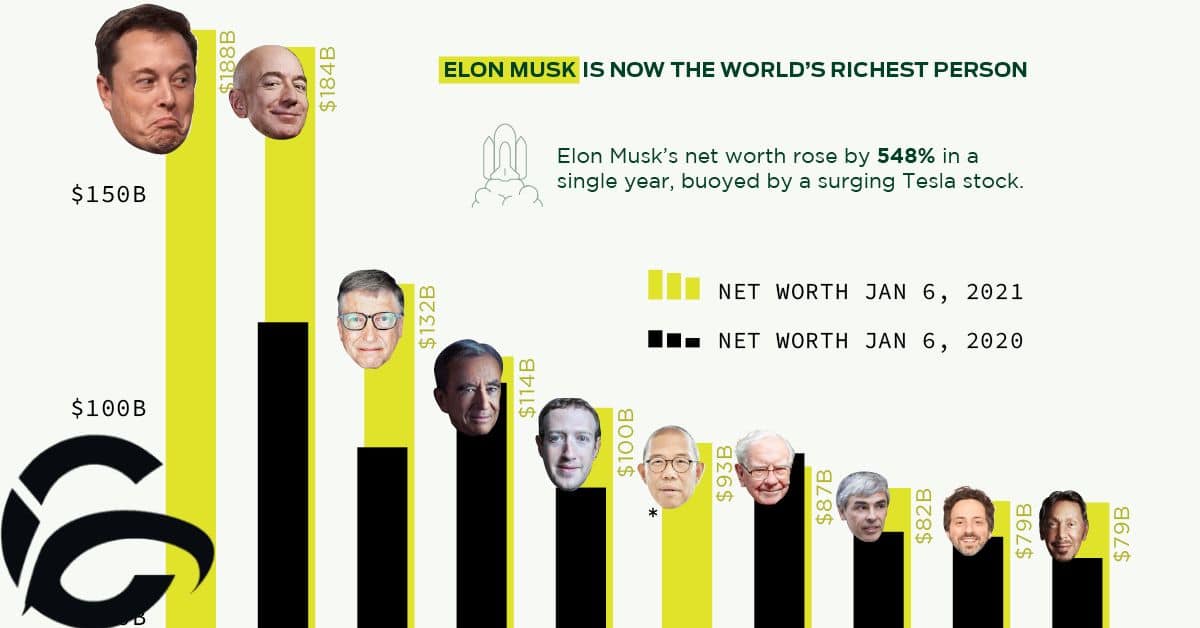

Is Money Shared Equally?

Money is not shared equally among people.Some individuals have a lot, while others have very little. This inequality is influenced by factors like income, wealth, and access to resources.

Those with higher incomes tend to have more money to spend and invest.Meanwhile, those with lower incomes struggle to meet basic needs and save for the future.

Additionally, systemic factors such as economic policies and social structures contribute to disparities in wealth distribution. These inequalities can have significant impacts on individuals’ opportunities and quality of life.

How Much Money Per Person is in the World?

The total amount of money in the world is difficult to determine accurately. It exists in various forms like coins, notes, and digital currencies. Each country has its own central bank regulating the money supply.

Money is categorized into different types based on its liquidity. These categories range from M0 to M3, with M3 being the broadest. Each level includes the levels preceding it, indicating the progression from narrow to broad measures of money.

Understanding the global money supply involves considering various factors. This includes the circulation of notes and coins, as well as digital transactions and investments.Despite challenges in quantifying exact figures, economists continue to study and analyze the world’s money supply.

How Much Money, in Dollars, Per Person is in the World?

The total amount of money in the world is difficult to calculate exactly.It exists in various forms, including physical cash and digital currency.Economists estimate that there are trillions of dollars circulating globally.

Each person’s share of this money depends on many factors. It varies greatly between countries and regions. Wealth distribution and economic development play significant roles in determining individual financial resources.

Despite challenges in measurement, understanding global money supply is essential for policymakers. It helps them manage economic stability, financial systems, and monetary policies effectively.

Read as:WHAT ARE THE VIOC CHARGES ON YOUR CREDIT CARD STATEMENT OR BANK STATEMENT?

How Much Money Is Spent Each Day?

Each day, billions of dollars are spent globally on various goods and services.People use money to purchase necessities like food, clothing, and shelter.Additionally, money is spent on leisure activities such as dining out, entertainment, and travel.

Businesses also contribute to daily spending by investing in supplies, equipment, and employee wages. Moreover, governments allocate funds for infrastructure, healthcare, education, and other public services. Overall, the daily flow of money plays a crucial role in driving economic activity and improving living standards worldwide.

How much money is in the world in USA currency?

The total amount of money in the world, specifically in U.S. currency, is challenging to determine due to its various forms. Money exists in physical and virtual forms, such as coins, notes, electronic bank accounts, and cryptocurrencies. Economists categorize money into different types based on liquidity, ranging from M0 to M3.

In the United States, the Federal Reserve System regulates and publishes data on the money supply. This includes measures such as M0, M1, and M2, which represent different levels of liquidity. M0, also known as the monetary base, includes all money in circulation and bank reserves.

Globally, estimates suggest that the total value of notes and coins in circulation is around $8.28 trillion. Additionally, the global M1 supply, which includes all money in circulation plus travelers’ checks and demand deposits, is estimated to be $48.9 trillion.

Why Is It A Ticking Timebomb

A ticking timebomb looms over our heads because of the uncertainty surrounding global economic stability. The ever-growing reliance on digital currencies poses a threat to traditional monetary systems. Central banks’ trials of digital currencies signal a potential shift away from physical money.

As countries experiment with digital currencies, the future of cash hangs in the balance. The gradual decline in physical money usage raises concerns about financial security and accessibility. These developments highlight the need for careful consideration and preparation for potential changes in the global monetary landscape.

With the rise of digital transactions, the role of physical money diminishes, paving the way for new challenges and opportunities. The ongoing trials of central bank digital currencies indicate a significant shift in how we perceive and utilize money. As we navigate this evolving landscape, it’s crucial to adapt and innovate to ensure financial stability and inclusivity for all.

How Much Money Is in the World Right Now?

Money exists in various forms like coins, notes, and digital accounts. Each country regulates its money supply through central banks. The total amount of money globally is challenging to determine precisely.

Different measures categorize money, from the narrowest to the broadest. These include M0, M1, M2, and M3. Each level encompasses the previous one, reflecting the liquidity of assets.

Estimates suggest that the global money supply is substantial. It includes physical currency, digital transactions, investments, and derivatives. Despite challenges in quantifying it precisely, money plays a crucial role in economies worldwide.

How Money Supply Is Measured

Money supply is measured in different ways. Central banks use categories like M0, M1, and M2. M0 includes all money in circulation. M1 adds money held in travelers’ checks and demand deposits. M2 expands to include mutual funds and other deposits.

Each category of money serves a purpose. M0 is the narrowest and most liquid. M1 includes M0 and adds to it. M2 is broader and less liquid. Together, they give a picture of the economy’s liquidity.

Understanding money supply is vital for economic analysis. It helps policymakers make informed decisions. It also gives insight into the health of the financial system.

Future of Money: Is Cash Going to Be Replaced?

In the future, cash might be replaced by digital currencies.Many countries are exploring central bank digital currencies.Digital transactions are becoming more popular worldwide.

These currencies are virtual and exist only electronically.They offer convenience and security for transactions. Some countries have already launched official digital currencies.

However, the transition from physical to digital money will take time.People and businesses need to adapt to new technologies.

What happens if you can’t complete after exchange?

If you can’t complete after exchange, it’s serious. Sellers may keep your deposit. Legal action could happen for compensation. It’s essential to consult your solicitor.

Delays may occur due to various reasons. These include property condition issues or financing problems. It’s crucial to have contingency plans in place.

Communication with all involved parties is key. Regular updates can help navigate potential issues smoothly. Being proactive is essential for a successful transaction.

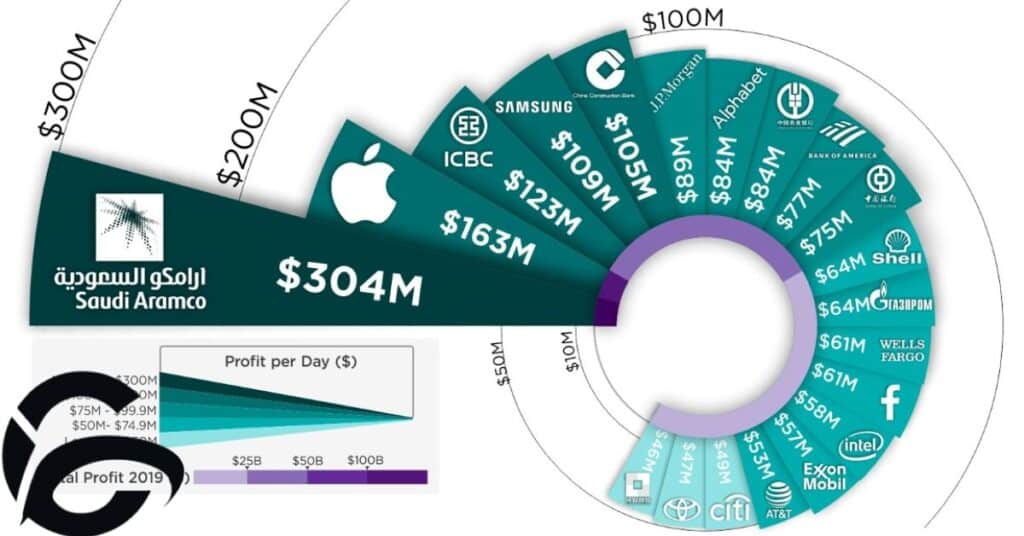

Which is the richest bank?

The richest bank in the world is Industrial and Commercial Bank of China (ICBC). ICBC tops the list with assets worth billions of dollars. It is known for its extensive network and diverse financial services.

Another wealthy bank is China Construction Bank (CCB). CCB boasts significant assets and a strong presence in both domestic and international markets. It offers a wide range of banking products and services.

JPMorgan Chase & Co. is also among the richest banks globally. With a massive asset base, JPMorgan offers comprehensive financial solutions to individuals, businesses, and institutions.

Who owns the World Bank?

The World Bank is owned by its member countries. These countries are shareholders. They provide funds and resources for the bank’s operations. Each member country has a certain number of shares based on its economic size.

Shareholders include both developed and developing nations. They work together to address global development challenges. The World Bank’s main goal is to reduce poverty and promote sustainable development. Through loans, grants, and technical assistance, it supports projects in various sectors worldwide.

Who runs the IMF?

The International Monetary Fund (IMF) is run by a Managing Director. This position is currently held by Kristalina Georgieva. The Managing Director oversees the day-to-day operations and represents the IMF globally.

The IMF is governed by its member countries. These countries appoint an Executive Board to make decisions on major policy issues. Each member country has a designated representative on the Executive Board.

The IMF was established in 1944 at the Bretton Woods Conference. Its primary purpose is to promote international monetary cooperation, exchange stability, and balanced growth.

What bank is the largest in the world?

The largest bank in the world is the Industrial and Commercial Bank of China (ICBC). It holds the top position based on total assets and market capitalization. ICBC serves millions of customers globally and operates a vast network of branches and subsidiaries.

Following ICBC, other major banks like China Construction Bank and Agricultural Bank of China also rank among the largest in the world. These Chinese banks have grown significantly in recent years, reflecting China’s economic growth and global influence.

Apart from Chinese banks, American institutions like JPMorgan Chase, Bank of America, and Wells Fargo also feature prominently among the world’s largest banks based on various metrics such as assets, revenue, and market capitalization.

How many countries are in IMF?

The International Monetary Fund (IMF) comprises 190 member countries. Each country has a say in IMF decisions and policies. Member countries contribute funds to the IMF’s resources.

The IMF provides financial assistance to countries facing economic difficulties. It aims to promote global economic stability and growth. IMF programs often include conditions for policy reform.

Membership in the IMF is voluntary for countries seeking financial support. The IMF plays a crucial role in addressing global economic challenges.IMF policies impact countries’ economic policies and growth prospects.

Which currency is the most valuable in the world?

The most valuable currency in the world is the Kuwaiti Dinar (KWD), with an exchange rate higher than any other currency.

What’s the total value of cryptocurrencies?

The total value of cryptocurrencies exceeds $2 trillion, comprising various digital assets like Bitcoin, Ethereum, and others.

What is the world’s total wealth?

The world’s total wealth encompasses a wide range of assets and resources, making it challenging to provide a precise figure.

Why is it important to have home insurance before the exchange of contracts?

Home insurance before the exchange of contracts is crucial as it protects against unexpected events like floods or accidents, providing financial security for both buyers and sellers.

What happens if a buyer’s mortgage is declined between exchange and completion?

If a buyer’s mortgage is declined between exchange and completion, it could lead to significant delays or even cancellation of the transaction, emphasizing the importance of maintaining communication with mortgage advisors and having contingency plans.

How can sellers prepare for potential delays in the completion date?

Sellers can prepare for potential delays in the completion date by discussing alternative completion dates with the buyer, preparing for potential renegotiations of price, and ensuring all necessary documentation is in order to expedite the process.

Final Thoughts

Understanding the complexities of global money circulation is crucial. It involves various forms of currency, from physical notes to digital transactions.By grasping these nuances, individuals can navigate the financial landscape more effectively.

Moreover, the concept of money extends beyond mere cash in hand. It encompasses investments, derivatives, and other financial instruments.Recognizing this broader perspective is essential for managing wealth and making informed financial decisions.

Ultimately, staying informed about the evolution of money is paramount. With the rise of digital currencies and ongoing economic changes, adaptability is key.By understanding the intricacies of the “money maze,” individuals can better position themselves for financial success in the modern world.

comprehending the dynamics of money supply is vital. It encompasses various measures, from M0 to M3, reflecting different levels of liquidity. This understanding enables individuals to gauge economic trends and make informed financial choices.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.