Accountant costs vary based on factors like the type of work needed, the size of the accounting firm, and your location. Some accountants charge hourly rates, while others offer flat fees for specific services. It’s essential to consider these factors when budgeting for accounting expenses.

When determining the cost of an accountant, it’s crucial to understand your business’s specific needs and financial situation. Whether you’re a sole proprietor or a small business owner, accounting fees can impact your bottom line.

To minimize accounting costs, consider outsourcing specific tasks or using accounting software to streamline processes. While hiring an accountant is an investment, it’s essential for maintaining accurate financial records and ensuring compliance with tax regulations.

What Does an Accountant Handle?

Accountants handle various financial tasks for businesses and individuals. They assist in preparing tax returns, managing budgets, and analyzing financial data. Their expertise ensures accurate and compliant financial records.

In addition to tax preparation, accountants provide valuable advice on financial planning. They help businesses make informed decisions to optimize profits and minimize expenses. Their guidance is essential for maintaining financial stability and growth.

Accountant cost includes fees for services rendered, such as tax preparation and financial consulting. Factors affecting cost include the complexity of the work, the accountant’s experience level, and the size of the business. It’s crucial to consider the value of professional accounting services for long-term financial success.

Accountant Cost Breakdown:

- Tax preparation: Accountants assist with filing tax returns accurately and on time.

- Financial consulting: They offer advice on budgeting, investment strategies, and risk management.

- Audit assistance: Accountants help businesses prepare for and navigate financial audits.

- Bookkeeping services: They maintain accurate financial records and reconcile accounts.

- Compliance support: Accountants ensure businesses adhere to tax laws and financial regulations.

- Ongoing support: Accountants provide ongoing assistance and guidance to support business growth.

How Accountant Costs Are Calculated?

Accountant costs are determined by various factors. These include the complexity of the work required, the accountant’s experience, and the size of the accounting firm. Understanding these factors helps in estimating the overall cost.

When calculating accountant costs, it’s important to consider the specific services needed. Whether it’s tax preparation, financial analysis, or bookkeeping, each service adds to the total cost. Additionally, the frequency of services required also impacts the final bill.

| Factor | Description |

| Complexity of Work | The intricacy and depth of the accounting tasks to be performed. |

| Experience of Accountant | The level of expertise and qualifications possessed by the accountant. |

| Size of Accounting Firm | Larger firms may charge higher rates due to overhead costs. |

By considering these factors, businesses can better understand and plan for their accountant costs.

Benefits of Hiring an Accountant

Hiring an accountant can provide numerous benefits for your business. From accurate financial records to expert tax preparation, their expertise can streamline your financial processes.

With an accountant on board, you can focus on growing your business while they handle the complexities of accounting. Their insights can help you make informed financial decisions and avoid costly mistakes.

Don’t overlook the value that an accountant can bring to your business. Investing in their services can lead to long-term financial stability and success. Consider the accountant cost as a worthwhile investment in the growth of your business.

Reduced Financial Stress

- Hiring an accountant alleviates the burden of financial tasks.

- They handle tax preparation, bookkeeping, and financial analysis.

- This reduces stress, allowing you to focus on growing your business.

Enhanced Financial Decision-Making

- An accountant provides valuable insights into your business finances.

- They offer advice on budgeting, cash flow management, and investment opportunities.

- With their expertise, you can make informed decisions to optimize profitability.

Compliance and Accuracy

- Accountants ensure compliance with tax laws and regulations.

- They maintain accurate records and file taxes correctly and on time.

- This minimizes the risk of audits, penalties, and financial discrepancies.

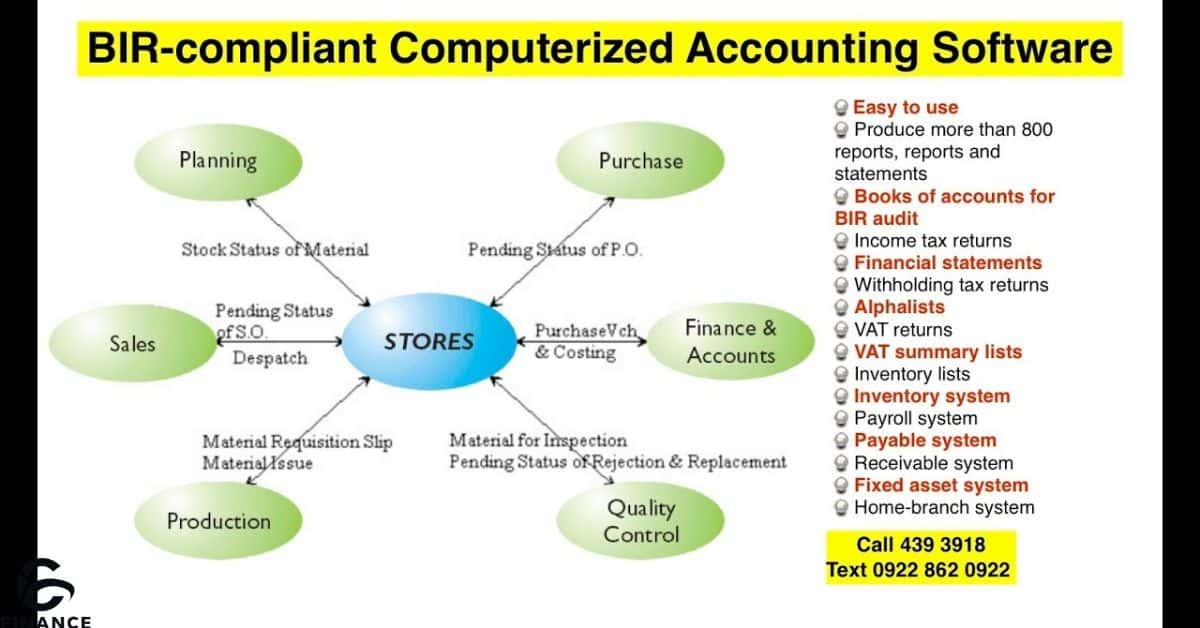

Alternative: Use Accounting Software

Accounting software presents a viable solution.Opting for accounting software over traditional methods can streamline financial processes.With accounting software, managing expenses becomes more efficient, ultimately reducing overall accountant costs.

Exploring Alternatives

- Accounting software serves as a cost-effective option for businesses.

- With various features, it handles financial tasks effectively.

- Businesses can save time and money by utilizing these tools.

Benefits of Accounting Software

- Accounting software reduces reliance on traditional accounting services.

- Cost savings on accountant fees.

- Efficient management of financial tasks.

- Improved accuracy and organization of financial records.

What services do accountants provide?

When businesses seek financial guidance, accountants are their go-to professionals. These experts offer a range of essential services to ensure financial health.

Accountant Services Overview:

Financial Analysis and Reporting:Accountants offer essential services like financial analysis and reporting. They help businesses understand their financial health and make informed decisions. With their expertise, accountants provide accurate and detailed financial reports.

Tax Preparation and Planning:Another vital service provided by accountants is tax preparation and planning. They ensure businesses comply with tax regulations while minimizing tax liabilities. Accountants help navigate complex tax laws and optimize tax strategies for maximum benefits.

Budgeting and Forecasting:Accountants play a crucial role in budgeting and forecasting for businesses. They assist in setting realistic financial goals and developing strategies to achieve them. By closely monitoring financial data, accountants help businesses plan for future growth and success.

How much do accountants cost?

Accountant costs can vary based on factors like business size and location. They provide essential financial services to ensure accuracy and compliance.

Understanding Accountant Costs:When considering accountant costs, it’s essential to factor in various elements. From the type of services required to the size of the accounting firm, these factors can influence pricing.

Factors Affecting Costs:Accountant costs are influenced by several factors. These include the complexity of the work needed, the size of the accounting firm, and the location of the business.

Costs and Business Size:For small business owners, understanding accountant costs is crucial. These expenses, while necessary, can vary depending on the business’s size and financial requirements.

How much do accounting services cost?

Navigating the expenses of accounting services is crucial for businesses. Knowing the costs involved can help in budgeting effectively.

“Accounting service costs can vary depending on the complexity of the tasks involved and the expertise of the accountant. Small businesses may find value in investing in accounting services to ensure accurate financial management.” John Smith, Certified Public Accountant

“As a small business owner, I’ve found that accounting service costs are a worthwhile investment in maintaining financial accuracy and compliance. It’s essential to compare quotes and find a balance between quality and affordability.”Mary Johnson, Small Business Owner

“When considering accounting service costs, businesses should prioritize the value of accurate financial management. While costs may vary, the benefits of avoiding costly errors and maximizing financial efficiency far outweigh the initial investment.”David Lee, Financial Consultant

When considering accounting services, it’s crucial to understand the associated costs. These costs can vary depending on factors such as the complexity of your financial needs and the size of the accounting firm you choose.

What are the factors affecting how much accountants charge?

Accountants’ fees vary based on factors like experience, services offered, and location. Rates may differ between newly qualified accountants and those with years of experience. Additional certifications like CPA or CMA can also impact the cost.

Factors Affecting Accountant Costs

Experience and Expertise:Accountant costs can vary based on the level of experience and expertise they bring to the table. More seasoned accountants with specialized certifications may charge higher fees due to their advanced knowledge and skills.

Scope of Services:The range of services required by your business can also impact accountant costs. From basic bookkeeping to complex financial analysis and tax planning, the more comprehensive the services, the higher the associated costs may be.

Business Size and Complexity:Larger businesses with intricate financial structures and higher transaction volumes typically incur higher accountant costs. The complexity of your business operations directly influences the time and effort required from the accountant, thus affecting the overall cost.

The size of your business

Accountants’ fees vary based on factors like experience, services offered, and location. Rates may differ between newly qualified accountants and those with years of experience. Additional certifications like CPA or CMA can also impact the cost.

Small Business Size:For small businesses, accounting costs vary based on factors like the firm’s size and annual revenue.

Smaller businesses may pay less for accounting services compared to larger enterprises.

Consider your business’s specific needs and budget when determining accounting expenses.

Medium Business Scale:Medium-sized businesses often face moderate accounting costs, balancing affordability with comprehensive services.

Accounting fees for medium businesses typically depend on factors such as the complexity of financial transactions and reporting requirements.

Leverage accounting services tailored to your business size and financial goals for optimal value.

Large Enterprise Scope:Large enterprises encounter higher accounting costs due to complex financial operations and regulatory compliance needs.

Accounting fees for large enterprises reflect the scale of operations and the depth of financial analysis required.

Invest in accounting services that provide strategic insights and support growth initiatives for your large enterprise.

Being a limited company

As a limited company, your accounting needs may vary based on your business structure and financial activities.Understanding the costs associated with accounting services is crucial for budgeting and financial planning.

Limited Company Basics

- Limited companies offer legal protection to their owners, shielding them from personal liability for business debts.

- These companies are separate legal entities, distinct from their owners, allowing for easier access to funding and potential tax benefits.

- Choosing to operate as a limited company requires registration with the appropriate government authorities, ensuring compliance with regulations.

Advantages of Limited Company Status

- Limited companies often enjoy enhanced credibility and trust in the eyes of customers, suppliers, and potential partners.

- The structure allows for greater flexibility in distributing profits, potentially resulting in tax advantages for shareholders.

- Additionally, limited liability status can provide peace of mind to owners, safeguarding their personal assets from business-related risks.

Considerations for Limited Company Owners

- Despite the benefits, maintaining a limited company requires adherence to strict regulatory requirements and ongoing administrative responsibilities.

- Owners must file annual financial statements, maintain accurate records, and fulfill tax obligations to remain in good standing.

- Seeking professional advice and assistance can help navigate the complexities of operating as a limited company and maximize its advantages.

One-off or continuous service

Accounting services can be structured as either one-off or continuous arrangements.With a one-off service, you pay for specific tasks as needed, such as tax preparation or financial analysis.On the other hand, continuous service involves ongoing support, including regular bookkeeping and financial advice.

One-off Accounting Services:When it comes to one-off accounting services, businesses can expect to pay varying rates based on the complexity of the task. Whether it’s tax preparation, audit assistance, or financial consulting, these services typically incur a one-time fee. Businesses should consider their specific needs and budget before opting for one-off accounting services.

Continuous Accounting Support:For businesses seeking ongoing accounting support, a monthly or annual package may be more suitable. These packages often include a range of services such as bookkeeping, tax planning, and financial analysis..

Choosing the Right Option:Whether opting for one-off services or continuous support, businesses should carefully evaluate their accounting needs and budget constraints. It’s essential to select a reputable accounting firm or professional with expertise in the relevant areas.

Read As:HOW TO DELETE TEMU ACCOUNT

Can you get accounting services for free?

Consider free options available! With cloud-based software and DIY methods, managing your finances is more accessible than ever. Save money while ensuring your financial records are accurate.

Exploring Free Accounting Services: In today’s digital age, small businesses have access to a myriad of resources, including free accounting services. These services can help entrepreneurs manage their finances without breaking the bank.

Benefits of Free Accounting Services:Utilizing free accounting services offers numerous benefits for small businesses. From simplified bookkeeping to basic tax preparation, these platforms provide essential tools to streamline financial tasks.

Choosing the Right Free Accounting Software:When selecting free accounting software, it’s essential to consider factors such as user-friendliness, features offered, and customer support. By exploring various options, businesses can find the perfect fit for their financial needs.

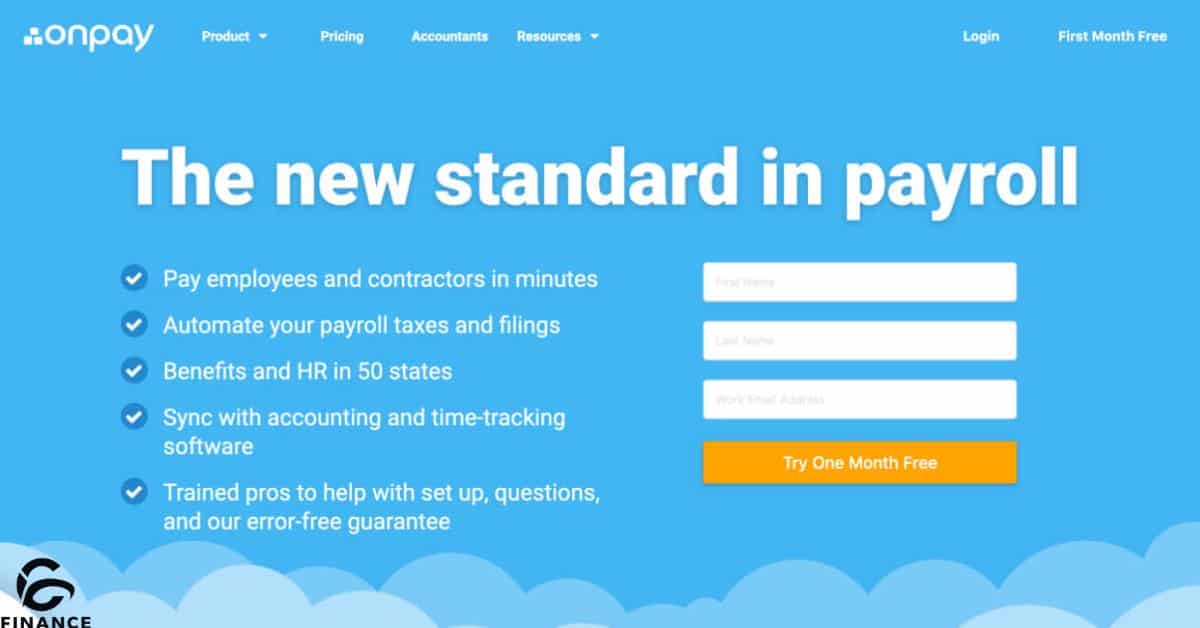

Free payroll software

Introducing free payroll software: Say goodbye to costly payroll solutions and hello to efficiency. With free payroll software, managing payroll becomes a breeze. No more manual calculations or expensive subscriptions

Efficient Payroll Management:Streamline your payroll processes with free payroll software. Simplify payroll calculations and ensure timely payments to your employees.

Cost-effective Solution:Save money on payroll expenses by utilizing free payroll software. Enjoy essential payroll features without the financial burden of expensive software subscriptions.

Enhanced Business Productivity:Boost productivity and focus on core business activities with user-friendly free payroll software. Reduce administrative burdens and improve overall efficiency in managing payroll tasks.

DIY accounting

The DIY accounting offers businesses a cost-effective way to manage their finances.By handling tasks like bookkeeping and tax preparation in-house, businesses can save money.With the right software and guidance, DIY accounting can streamline financial processes efficiently.

DIY Accounting: Simplify Your Finances

Efficiency at Your Fingertips:Take control of your finances with DIY accounting. Manage your books, track expenses, and prepare taxes easily.

Cost-Effective Solutions: Save money by handling accounting tasks yourself. With DIY accounting software, you can streamline processes without breaking the bank.

Empower Your Business: DIY accounting puts the power in your hands. Gain insights, make informed decisions, and propel your business forward with confidence.

Accounting costs for sole proprietors

Accounting costs for sole proprietors can vary based on the complexity of services required. These costs typically include tax preparation, bookkeeping, and financial reporting. It’s essential for sole proprietors to budget for these expenses to ensure accurate financial management.

Accounting Costs for Sole Proprietors

Navigating Tax Season:Sole proprietors often face the daunting task of managing their taxes alone. With complex forms like Form 1040 and Schedule C to navigate, hiring an accountant can provide peace of mind and ensure accurate filings.

Avoiding Costly Mistakes:The average cost of hiring an accountant for tax preparation is $457, but the investment can save sole proprietors from potential penalties due to incorrect or incomplete filings. Additionally, accountants can help organize financial records to streamline the process.

Maximizing Deductions:An accountant can help sole proprietors claim deductions for business-related expenses, ensuring they pay the correct amount of income tax. With expert guidance, sole proprietors can optimize their tax returns and minimize financial burdens.

How much is an accountant for your business?

Hiring an accountant for your business is essential for financial management. Their expertise ensures accuracy and compliance with regulations. Accountant fees vary based on factors like the type of work and firm size.

Accountant Cost Overview:Accountants play a crucial role in managing finances for businesses. Understanding their costs is essential for budgeting.

Factors Affecting Costs:Several factors influence accountant fees, such as the type of services required and the size of the accounting firm.

Considerations for Small Businesses:For small businesses, accounting costs should be seen as an investment in financial accuracy and compliance. It’s important to weigh the benefits against the expenses.

Is it worth hiring an accountant for your small business?

An accountant can help ensure your financial records are accurate. They can also provide guidance on tax planning and compliance.

Streamlining Financial Operations:Hiring an accountant for your small business can streamline financial operations. They meticulously manage your books, ensuring accuracy and compliance.

Maximizing Tax Deductions:Accountants specialize in maximizing tax deductions. With their expertise, you can navigate complex tax laws and claim all eligible deductions.

Ensuring Financial Stability:An accountant provides invaluable insights into your business’s financial health. Their guidance enables you to make informed decisions and ensure long-term stability.

how much does an accountant cost for a small business per month?

For small businesses, hiring an accountant comes with a monthly expense. These costs vary based on factors like the size of the business and the services needed. Accountant fees typically range from $150 to $400 per month.

Understanding Accountant Costs for Small Businesses

- Accountants for small businesses charge varying fees based on factors like services needed and the size of the business.

- Costs typically range from $150 to $400 per month, but can be higher for more comprehensive services or larger businesses.

- It’s essential for small business owners to budget for accounting expenses to ensure financial accuracy and compliance.

Navigating Accountant Fees for Small Businesses

- For small businesses, accountant costs per month can vary widely depending on the complexity of financial needs and the level of service required.

- While some businesses may pay around $150 per month for basic services, others may invest upwards of $400 for more extensive accounting support.

- Regardless of the exact cost, hiring an accountant is crucial for small businesses to maintain financial health and compliance with tax regulations.

Determining Accountant Expenses for Small Businesses

- Understanding the monthly cost of hiring an accountant is vital for small business owners to manage their budgets effectively.

- By assessing the specific accounting needs of the business and comparing quotes from different firms, owners can make informed decisions about their financial management strategy.

- Ultimately, investing in professional accounting services ensures accurate financial reporting and helps small businesses thrive in a competitive market.

How much does an accountant cost per month?

Accountant costs per month vary based on factors like the size of your business and the services required.Small businesses may pay between $150 to $400 per month for accounting services.Understanding these costs can help you budget effectively and choose the right accounting solution for your business.

Accountant Costs Explained:Accountant fees can vary widely based on factors such as the type of services needed, the size of the accounting firm, and your location.

Factors Influencing Costs:Services like end-of-month bookkeeping or tax preparation can range from $150 to $400 or more per hour, depending on the complexity of the work.

Consider Your Business Needs:Before hiring an accountant, consider the specific financial tasks your business requires assistance with and budget accordingly.

how much does a personal accountant cost?

Hiring a personal accountant can be a wise investment for managing your finances. The cost of a personal accountant varies depending on factors like location, services needed, and the accountant’s experience. It’s essential to consider the value they bring to your financial well-being.

Understanding Personal Accountant Costs:When considering hiring a personal accountant, it’s essential to budget wisely. Fees can vary based on factors like experience and location.

Factors Influencing Costs:Personal accountant fees may depend on your specific financial needs and the complexity of your tax situation. It’s crucial to discuss pricing upfront to avoid surprises.

Benefits of Hiring a Personal Accountant:While the cost of a personal accountant may seem daunting, the benefits often outweigh the expenses. They can provide valuable financial guidance and help you save money in the long run.

how much does an accountant cost per year?

Understanding the annual cost of hiring an accountant is crucial for businesses.Accountant fees vary depending on factors such as business size and services needed.It’s important to consider the investment in accounting services for financial accuracy and compliance.

Understanding Accountant Costs

Average Annual Expenses:Accountants typically charge businesses an average of $1,000 to $10,000 per year for their services, depending on the complexity of the work required and the size of the business.

Factors Influencing Costs:The cost of hiring an accountant can vary based on factors such as the business’s annual revenue, the type of services needed, and the accountant’s level of experience and expertise.

Considerations for Budgeting:When budgeting for accounting expenses, businesses should carefully consider their financial needs, the value of accurate financial management, and the potential cost savings and benefits of hiring a professional accountant.

How much does an accountant cost per hour?

Consider the type of work you require. For basic services, expect to pay around $150 per hour. However, more specialized tasks can increase the rate to $400 or more.

Accountant Hourly Rates: Accountants typically charge per hour for their services, with rates varying based on factors such as location, experience, and the complexity of the work required.

Factors Affecting Hourly Rates:The cost per hour can range anywhere from $150 to $400 or more, depending on the accountant’s expertise and the specific needs of your business.

Considerations for Budgeting:When budgeting for accounting services, it’s essential to factor in the hourly rate along with the projected number of hours needed to complete the tasks at hand.

how much does an accountant cost to file taxes?

Accountants can help. They handle tax preparations. Prices vary depending on services. Hiring an accountant? Expect to pay. They ensure accurate filings. Don’t miss out on deductions. Get expert help today.

Understanding the Cost of Hiring an Accountant for Tax Filing

Exploring Accountant Costs :Accountant fees for filing taxes vary based on factors such as complexity and location. They typically range from $150 to $400 per hour.

Factors Influencing Costs :The type of work required, the size of the accounting firm, and the location all impact accountant fees.

Considering the Investment :While hiring an accountant for tax filing incurs costs, it can prevent errors and ensure compliance, ultimately saving time and money.

Frequently Asked Questions

Can I prepare my company’s taxes myself?

Yes, you can prepare your company’s taxes yourself, but it can be complex. Consider hiring a professional for accuracy.

How can I verify a CPA’s credentials?

Verify a CPA’s credentials by checking their license status with the state board of accountancy.

Does hiring an accountant really save you money?

Yes, hiring an accountant can save you money by maximizing deductions and minimizing errors.

What does an accountant do?

An accountant manages financial records, prepares taxes, offers financial advice, and more.

Who needs an accountant most?

Individuals or businesses facing complex financial situations or potential IRS audits benefit most from hiring an accountant.

How do I find a reputable accountant?

Find a reputable accountant by checking online reviews, credentials, and asking for referrals from trusted sources.

Final Thoughts

Accountant costs vary based on factors like the complexity of services needed and the accountant’s experience. Generally, fees range from $150 to $400 per hour. For small businesses, accounting services may cost $1,000 to $20,000 annually, depending on needs.

While hiring an accountant may seem like an expense, it’s an investment in financial accuracy and compliance. With their expertise, accountants can help maximize deductions, minimize errors, and save time. Ultimately, the cost of hiring an accountant is offset by the benefits they provide in ensuring financial health and peace of mind for your business.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.