Look no further! HighRiskPay.com has got you covered. With our specialized services, we cater to businesses facing challenges in payment processing.

Our streamlined application process makes it easy to get started. Simply apply online, our team will guide you through the approval process. Say goodbye to lengthy waits and complicated paperwork!

Experience fast approval and seamless credit card processing with HighRiskPay.com. Our dedicated support team is here to assist you 24/7, ensuring your business runs smoothly.

Choose High Risk Pay as your merchant account provider

High Risk Pay offers merchant account services tailored for high-risk industries. With our expertise, we can support businesses facing challenges with traditional processors. Our streamlined application process ensures quick approval, enabling you to start accepting credit card payments within 24-48 hours.

We specialize in high-risk merchant accounts, providing solutions for industries like e-commerce, adult entertainment, and travel. Our 99% approval rate means we can likely assist you even if you’ve been declined elsewhere. Plus, our dedicated customer support is available 24/7 to address any concerns you may have.

Choosing High Risk Pay means access to fast approval, low rates, and reliable service. We prioritize your satisfaction and aim to be a trusted partner for your business. Get started today and see how we can help your business thrive in the competitive market.

Instant Approval for High-Risk Merchant Account

Experience the ease of instant approval with our high-risk merchant accounts. Skip the wait and start processing payments right away. Get your business up and running with our quick and efficient approval process.

With our high-risk merchant accounts, approval is swift and straightforward. Say goodbye to long waiting periods and hello to immediate access to payment processing services. Get approved in minutes and start accepting payments today.

Don’t let delays hold your business back. Our high-risk merchant account approval process is designed for speed and efficiency. Get the green light instantly and unlock the benefits of seamless payment processing.

High-Risk Merchant Services for Any Credit History

High-risk merchant services cater to businesses regardless of credit history. These services specialize in industries deemed high-risk by traditional processors. They provide solutions for businesses with bad credit or those in risky sectors.

These services offer fast approval and flexible payment options. They also assist with chargeback prevention and fraud detection. High-risk merchant services ensure businesses can accept credit card payments securely and efficiently.

High-Risk Merchant Account at Competitive Rates

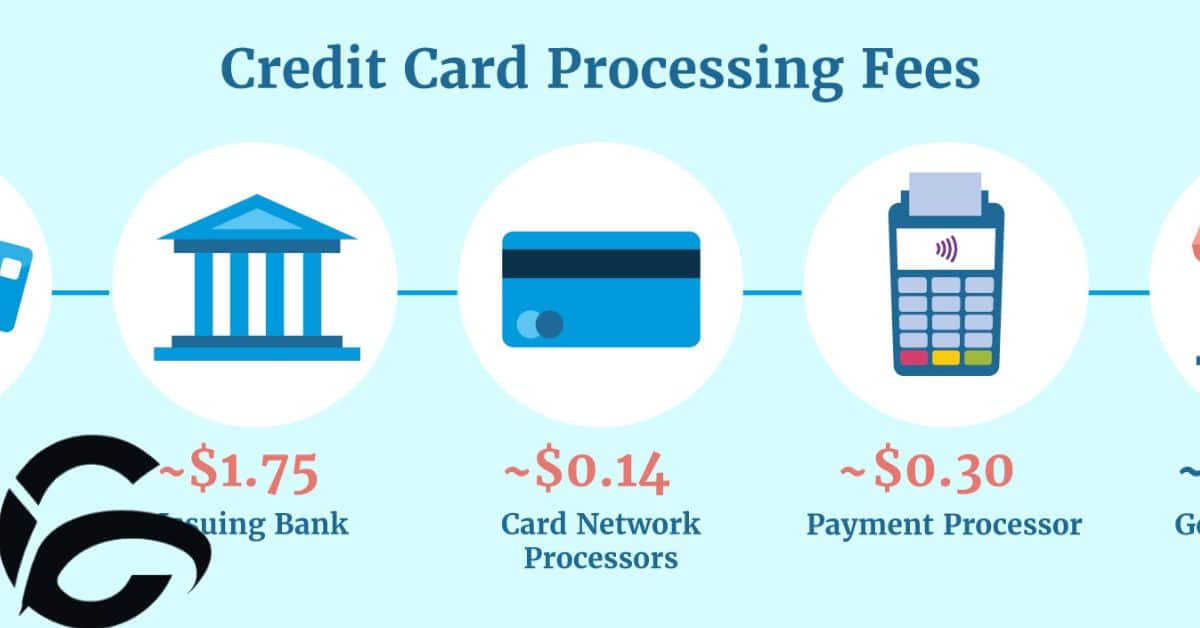

A high-risk merchant account provides payment processing solutions for businesses deemed risky by traditional banks. These accounts cater to industries prone to fraud or chargebacks. They offer competitive rates to help businesses manage financial risks effectively.

High-risk merchant accounts are essential for industries like online gambling or adult entertainment. They enable businesses to accept credit card payments securely. With competitive rates, these accounts provide a reliable payment processing solution.

Businesses with poor credit history or high chargeback rates often struggle to secure traditional merchant accounts. High-risk merchant accounts offer them a viable alternative. These accounts come with competitive rates, making them an attractive option for businesses in need of secure payment processing.

What exactly is a high-risk merchant account?

A high-risk merchant account is designed for businesses deemed risky by traditional banks. These accounts cater to industries prone to fraud or chargebacks. They offer payment processing solutions with higher fees and stricter terms.

These accounts are crucial for businesses with poor credit or operating in controversial sectors. They provide essential tools for processing credit card payments securely. However, they often come with higher fees and more stringent requirements.

High-risk merchant accounts help businesses expand their customer base and mitigate financial risks. Despite the higher fees, they offer valuable services for businesses in need of secure payment processing solutions.

How To Determine Whether My Business Is High-Risk

Determining whether your business is high-risk involves analyzing various factors. These include your industry type, transaction volume, and credit history. Additionally, consider any previous issues with chargebacks or fraud.

Another aspect to assess is the nature of your business operations. Look at whether you operate in controversial or heavily regulated industries. Also, evaluate your potential exposure to international markets and regulatory scrutiny.

It’s essential to review your financial stability and any past issues with payment processing. Evaluate whether your business model presents inherent risks and how you manage them.

Why choose High Risk Pay as your merchant services provider?

High Risk Pay stands out as your merchant services provider due to its expertise in high-risk merchant services in the USA. With a focus on high-risk industries, we offer specialized solutions tailored to your needs. Our efficient credit card processing services ensure smooth transactions for your business.

When you choose High Risk Pay, you benefit from our fast approval process and competitive rates. Our team understands the challenges faced by high-risk businesses and is dedicated to providing reliable support. With 24/7 customer service, we are always here to assist you.

With High Risk Pay, you can accept major credit cards within 24-48 hours, regardless of your credit history. Our streamlined application process and no setup fees make it easy to get started. Join us today and experience the difference in merchant services.

Traditional Credit Card Processors

Traditional credit card processors in the USA handle high-risk credit card processing with caution. They often have strict criteria for approving merchant accounts. Businesses in certain industries may struggle to obtain approval from these processors due to their risk profiles.

These processors typically prioritize low-risk merchants to minimize their own financial liabilities. As a result, high-risk businesses may face challenges in finding suitable payment processing solutions. Despite this, some traditional processors may work with high-risk industries, albeit with higher fees and stricter terms.

For businesses categorized as high-risk, alternative payment processing options may be necessary. These alternatives often specialize in serving high-risk industries, offering tailored solutions to meet their unique needs. However, these solutions may come with higher fees and more stringent requirements.

Other Kinds of Processors

High-risk credit card processing in the USA presents challenges for many businesses. Traditional processors often reject high-risk industries. Some businesses resort to opening multiple accounts, but this can harm their credit score.

Aggregators like PayPal and Stripe promise fast approval but have drawbacks. They freeze accounts with suspicious activity, causing financial strain. Eventually, businesses hitting $100,000 in sales need a merchant account.

High-risk merchant accounts offer solutions for businesses facing rejection. They provide tailored services and higher approval rates. However, fees may be higher to mitigate risk for the processor.

High-Risk Merchant Account Benefits

High-risk merchant accounts offer specialized services tailored for businesses facing challenges.These accounts enable businesses to process credit card payments securely and swiftly.With features like fraud prevention tools and chargeback management, they help mitigate risks for merchants.

Account Benefits

- Swift and secure processing of credit card payments

- Specialized services tailored for high-risk businesses

- Fraud prevention tools to mitigate risks

- Chargeback management assistance

- Enhanced security measures for customer data protection

- Access to 24/7 customer support

- Flexible payment options for convenience

- Approval rates for businesses with bad credit or high chargebacks

- Ability to accept various payment methods

- Assistance in expanding customer base and boosting sales

HighRiskPay.com Has a Long History and Many Happy Clien

HighRiskPay.com boasts a long history of providing reliable merchant services. With many satisfied clients, it stands as a trusted choice in the industry. Its track record speaks volumes about its commitment to excellence.

Founded in 1997, HighRiskPay.com has earned an A+ rating from the BBB. It has won awards for its exceptional service and customer satisfaction. Clients trust it for their payment processing needs.

From telemarketers to travel agencies, HighRiskPay.com serves a wide range of industries. Its 99% approval rate reflects its dedication to helping businesses thrive.

Read As:BUILDING SOCIETY ROLL NUMBER: EVERYTHING YOU NEED TO KNOW

Why is a High-Risk Merchant Account Essential for Businesses?

High-risk merchant accounts are crucial for businesses facing challenges in payment processing. These accounts enable secure transactions for industries deemed high-risk. Without them, businesses may struggle to accept credit card payments and expand their customer base.

In today’s digital age, accepting credit card payments is essential for business growth. High-risk merchant accounts provide the necessary infrastructure for businesses to process transactions securely and efficiently. Without this capability, businesses risk losing out on sales opportunities and limiting their revenue potential.

By partnering with a high-risk merchant account provider, businesses gain access to specialized services tailored to their industry needs. These services include fraud prevention tools, chargeback management, and reliable customer support. With a high-risk merchant account, businesses can navigate the complexities of payment processing and focus on their core operations.

How to Secure a High-Risk Merchant Account at HighRiskPay.com?

Securing a high-risk merchant account at HighRiskPay.com is straightforward. Begin by gathering the necessary documentation. This includes bank statements, tax returns, and business details.

Next, submit your application online. HighRiskPay.com offers an easy application process. Once submitted, their team will review your application promptly.

Upon approval, you can start accepting credit card payments within 24-48 hours. HighRiskPay.com provides fast approval guaranteed, making it a reliable choice for high-risk businesses.

Easy Application Process

The application process is easy. It’s simple and straightforward. You can complete it quickly. Once you’ve applied, you’ll get a fast response. You’ll know if you’re approved within a short time. There’s no need to wait long.

Getting approval is easy too. Most applicants get approved. You have a high chance of approval. The process is efficient and streamlined. You won’t face unnecessary delays. It’s designed to be hassle-free.

With no setup fees, it’s convenient. You won’t have to pay any setup fees. There are no hidden charges. It’s a transparent process. You’ll know exactly what you’re getting. Apply now and experience the simplicity.

Securing Approval for A High-Risk Merchant Account

Securing approval for a high-risk merchant account can be challenging. Many traditional banks and credit card processors may hesitate to work with businesses deemed high-risk. However, specialized providers like HighRiskPay.com offer tailored solutions for such businesses, ensuring they can still accept credit card payments securely.

These specialized merchant accounts cater to industries like adult entertainment, online gambling, and CBD products. They provide essential tools for businesses facing higher risks of fraud and chargebacks. With a high-risk merchant account, businesses can expand their customer base and boost revenue while mitigating financial risks.

To secure approval for a high-risk merchant account, businesses must demonstrate their financial stability and creditworthiness. This often involves providing detailed documentation such as financial statements and processing history.

Why Do Need Risk Merchant Highriskpay.com?

Highriskpay.com provides essential solutions for businesses categorized as high-risk, offering specialized merchant accounts tailored to their needs. These accounts enable businesses to process credit card transactions securely and efficiently, despite facing challenges due to their industry or financial history.

Approval for a high-risk merchant account at Highriskpay.com hinges on various factors, including personal and business credit histories, as well as existing processing history within specific industry categories. By partnering with a payment processor specializing in high-risk merchants, businesses can navigate the complexities of payment processing and expand their operations.

High-risk merchant accounts come with higher fees and rates compared to traditional accounts, but they offer invaluable benefits for businesses that may not qualify for standard merchant accounts. With features like chargeback management and fraud prevention, Highriskpay.com helps high-risk businesses manage risks and process payments effectively.

Documentation Requirements

When applying for a merchant account, certain documents are needed. These include financial statements and processing history. Your credit score may also be evaluated.

Payment processors assess risk based on various factors. Industries like CBD and adult content are considered high-risk. Some providers specialize in high-risk businesses.

High-risk merchant accounts come with certain fees. These may include transaction fees and rolling reserves. Providers evaluate risk levels before approval.

Processing

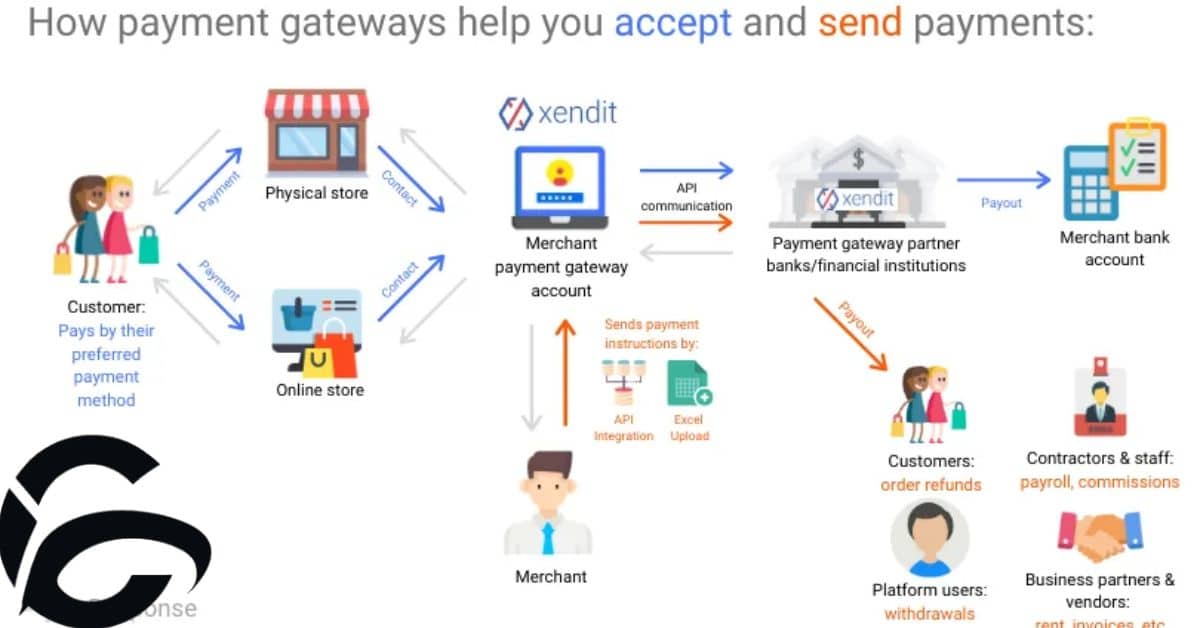

Processing of transactions involves the secure handling of payment data. It ensures that credit and debit card payments are processed accurately. This helps businesses receive payments from customers seamlessly.

For high-risk businesses, processing fees may be higher due to increased risks. However, specialized services cater to their needs. They offer fraud prevention tools and reliable payment processing solutions.

Choosing the right processing service is essential for businesses to operate smoothly. It ensures efficient handling of transactions and minimizes risks associated with payment processing.

Reliability

Reliability is crucial when it comes to choosing a service provider. You want to be able to count on them for consistent and dependable performance. This reliability ensures that your business operations run smoothly and efficiently.

When you have a reliable service provider, you can trust that they will be there when you need them. This peace of mind allows you to focus on other aspects of your business without worrying about interruptions or delays.

A reliable service provider also helps build trust with your customers. When they know they can rely on you to deliver consistently, they are more likely to return for repeat business and recommend your services to others.

Flexibility

Flexibility is essential for success in any endeavor. It allows for adaptation to changing circumstances and opportunities. Without flexibility, progress can be hindered and goals may become unreachable.

In today’s dynamic world, flexibility is more important than ever. With rapid advancements in technology and shifting market trends, businesses and individuals must remain agile. Those who can pivot quickly in response to challenges and seize new opportunities are more likely to thrive.

Embracing flexibility empowers individuals and organizations to navigate uncertainty with confidence. By fostering a mindset of adaptability, one can stay resilient in the face of adversity and continue moving forward towards their objectives.

Security

Security is paramount for any business. It ensures protection against threats. Implementing robust security measures safeguards sensitive information.

A secure system prevents unauthorized access. It shields against cyberattacks and data breaches. Maintaining security protocols is essential for business continuity.

Regular security audits identify vulnerabilities. They allow for timely remediation. Proactive measures mitigate potential risks.

24/7 Customer Support

High-risk payment gateway in the USA offers 24/7 customer support. Assistance is available round-the-clock for any inquiries or issues. This ensures continuous help for merchants using the service.

The high-risk payment gateway in the USA prioritizes customer satisfaction. With 24/7 support, merchants can get assistance at any time. This enhances reliability and trust in the service.

With 24/7 customer support, the high-risk payment gateway in the USA ensures smooth operations. Merchants can rely on timely assistance for any payment processing needs.

Highriskpay com your ultimate solution for high risk merchant accounts reviews

Highriskpay.com is your ultimate solution for high-risk merchant accounts. Trusted by businesses across industries, we specialize in providing secure payment processing solutions tailored to your needs.

With our high-risk payment gateway in the USA, you can accept credit card payments seamlessly, even in challenging industries. Our efficient services ensure quick approval and hassle-free transactions.

Join countless satisfied customers who have benefited from our reliable and transparent approach to high-risk merchant accounts. Experience peace of mind knowing that your business is in capable hands with Highriskpay.com.

Highriskpay com your ultimate solution for high risk merchant accounts phone

Highriskpay.com is the ultimate solution for high-risk merchant accounts. With our efficient payment gateway in the USA, we cater to businesses facing challenges in processing credit card payments. Our streamlined process ensures fast approval, allowing you to start accepting major credit cards within 24-48 hours, regardless of your credit history.

Our specialized services are designed to meet the needs of businesses in high-risk industries. We understand the unique challenges you face and are here to help you navigate them. With our expertise and dedication to customer satisfaction, we provide reliable merchant account solutions that empower your business to thrive.

At Highriskpay.com, we prioritize simplicity and efficiency. Our user-friendly platform and dedicated customer support team make it easy for you to manage your merchant account. Trust us to be your partner in success, providing secure payment processing solutions tailored to your business needs.

highriskpay.com reviews

HighRiskPay.com reviews reveal its reliability in providing high-risk payment gateway solutions in the USA. With a focus on security and efficiency, businesses trust HighRiskPay.com for their credit card processing needs. Its fast approval process and 24/7 customer support make it a top choice for merchants.

Merchants appreciate HighRiskPay.com’s specialized services tailored to high-risk industries. The company’s 99% approval rate ensures businesses can start processing payments quickly. Plus, its fast approval guarantee means merchants can be up and running within days, not weeks.

HighRiskPay.com stands out for its low fees, flexibility, and commitment to security. With a history of excellence since 1997, it has earned a reputation as a trusted partner for businesses facing payment processing challenges.

Frequently Asked Questions

What exactly is a high-risk merchant account?

A high-risk merchant account is designed for businesses operating in industries prone to higher chargebacks, such as adult entertainment or online gambling.

Who really needs a high-risk merchant account?

Businesses in industries like CBD sales or e-cigarettes, facing difficulties obtaining standard merchant accounts, benefit from high-risk merchant accounts due to their tailored solutions.

Why should I choose HighRiskPay.com for my high-risk merchant account?

HighRiskPay.com offers specialized services, fast approval, and low fees, making it a reliable choice for businesses in need of high-risk payment solutions.

Are there any drawbacks to using a high-risk merchant account?

While high-risk merchant accounts offer benefits, they may come with slightly higher fees and stricter terms compared to traditional accounts, but they provide essential services for businesses in high-risk industries.

What is high-risk merchant payment?

High-risk merchant payment refers to processing credit card transactions for businesses operating in industries with elevated levels of chargebacks and fraud, requiring specialized payment solutions.

What is merchant payment solution?

A merchant payment solution provides businesses with the ability to accept credit card payments from customers, facilitating transactions securely and efficiently.

How do I secure my merchant account?

To secure a merchant account, businesses should adhere to security best practices, such as using encryption technology, implementing fraud detection measures, and regularly monitoring transactions for suspicious activity.

What is a merchant account method?

A merchant account method refers to the process of setting up an account that enables businesses to accept credit card payments from customers, typically through a payment processor or acquiring bank.

Final Thoughts

HighRiskPay.com offers specialized merchant accounts for high-risk businesses. With fast approval and low fees, it’s the ultimate solution for businesses facing challenges in obtaining standard merchant accounts.

Their tailored services cater to industries prone to chargebacks and fraud, ensuring secure payment processing. Choosing HighRiskPay.com means gaining access to reliable financial solutions designed to support business growth despite industry odds.

With 24/7 customer support and a focus on flexibility, security, and reliability, HighRiskPay.com stands out as a trusted partner for high-risk merchants. Say goodbye to payment processing hurdles and hello to seamless transactions with HighRiskPay.com.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.