In today’s volatile financial landscape, investors are constantly seeking reliable ways to protect and grow their wealth. The unpredictable nature of traditional markets has left many feeling uncertain about their financial future. Enter gold – a timeless asset that has weathered economic storms for centuries. But how can modern investors leverage this ancient treasure in the digital age? Enter Gold Price Fintechzoom, a cutting-edge platform that’s revolutionizing how we track and invest in gold.

By providing real-time data and advanced analytics, Fintechzoom empowers investors to make informed decisions in the fast-paced world of gold investments. This guide will explore how Fintechzoom is bridging the gap between traditional gold investing and modern financial technology, offering a solution to the pain points of outdated investment strategies.

What is Fintechzoom?

At its core, Fintechzoom is a financial technology company that specializes in providing accurate and timely information about various financial markets, with a particular focus on gold. The platform aggregates data from multiple sources, including major exchanges, bullion dealers, and financial institutions, to offer a comprehensive view of the gold market.

Fintechzoom’s user interface is designed with simplicity in mind, allowing even those new to gold investing to easily navigate through complex market data. The platform offers customizable dashboards, interactive charts, and detailed market analysis, all accessible from both desktop and mobile devices.

The Evolution of Gold Price Tracking

The journey of gold price tracking has come a long way from the days of ticker tapes and newspaper listings. In the early 20th century, gold prices were relatively stable due to the gold standard. However, as the world moved away from this system, the need for more dynamic tracking methods became apparent.

The advent of the internet in the 1990s brought about a revolution in financial data accessibility. Websites began offering daily gold price updates, but these were often delayed and lacked the depth of analysis needed for serious investors. Fintechzoom represents the latest evolution in this journey, offering not just real-time gold prices, but also sophisticated tools for analysis and prediction.

Gold as an Investment Asset

Gold has been a symbol of wealth and a store of value for thousands of years. In the modern investment landscape, it continues to play a crucial role as a safe haven asset. Understanding the unique properties of gold as an investment is key to leveraging platforms like Fintechzoom effectively.

The allure of gold lies in its ability to maintain value over long periods, often increasing in price during times of economic uncertainty. This makes it an essential component of many diversified investment portfolios, serving as a hedge against inflation and market volatility.

Historical Significance of Gold

Gold’s role in human civilization dates back to ancient times, where it was used for jewelry, religious artifacts, and as a medium of exchange. The introduction of the gold standard in the late 19th century solidified gold’s place in the global financial system, tying currency values directly to gold reserves.

While the gold standard was eventually abandoned in the 20th century, gold’s importance in the financial world remained. Today, central banks continue to hold significant gold reserves, and investors turn to gold during times of economic turmoil, reinforcing its status as a reliable store of value.

Benefits of Investing in Gold

Investing in gold offers several advantages that make it an attractive option for many investors:

- Hedge against inflation: Gold often maintains its value even as currencies lose purchasing power.

- Diversification: Gold’s price movements often have a low correlation with other assets like stocks and bonds.

- Liquidity: Gold can be easily bought and sold in various forms, from physical bullion to ETFs.

- Global acceptance: Gold is recognized and valued worldwide, making it a universal asset.

Live Gold Price Fintechzoom: Real-Time Tracking

One of Fintechzoom’s most powerful features is its ability to provide real-time gold prices. This up-to-the-minute data is crucial for investors looking to make timely decisions in the fast-moving gold market. Fintechzoom sources its data from multiple exchanges and dealers worldwide, ensuring accuracy and comprehensive market coverage.

The platform updates gold prices continuously throughout trading hours, reflecting changes in spot prices, futures contracts, and related financial instruments. This real-time tracking capability gives investors an edge, allowing them to react quickly to market movements and capitalize on short-term opportunities.

How to Access Live Gold Prices on Fintechzoom

Accessing live gold prices on Fintechzoom is straightforward and user-friendly. Here’s a quick guide:

- Visit the Fintechzoom website or open the mobile app.

- Navigate to the “Gold” section on the main dashboard.

- You’ll see the current gold price prominently displayed, typically in USD per ounce.

- Use the interactive chart to view price movements over different time frames.

- Set up price alerts to receive notifications when gold reaches specific price levels.

Fintechzoom also offers customizable widgets that allow users to embed live gold price data on their own websites or applications, making it a versatile tool for various financial professionals.

Interpreting Gold Price Data on Fintechzoom

Understanding how to interpret the wealth of data provided by Fintechzoom is key to making informed investment decisions. The platform offers various analytical tools to help users make sense of price movements:

- Technical indicators: Moving averages, RSI, and MACD can help identify trends and potential reversal points.

- Historical comparisons: Compare current prices to historical data to gauge relative value.

- Correlation analysis: See how gold prices move in relation to other assets or economic indicators.

- News integration: Relevant news articles are linked to price movements, providing context for market shifts.

Recent Shifts in Gold Prices

The gold market has seen significant volatility in recent years, influenced by a range of global economic and geopolitical factors. In 2020, gold prices reached an all-time high of over $2,000 per ounce, driven by economic uncertainty surrounding the COVID-19 pandemic. Since then, prices have fluctuated as investors balance concerns about inflation with the prospect of economic recovery.

Fintechzoom’s historical data shows that gold prices have generally trended upward over the past two decades, with notable spikes during periods of economic crisis. However, short-term price movements can be unpredictable, underscoring the importance of real-time tracking and analysis tools.

Impact of Global Events on Gold Prices

Global events have a significant impact on gold prices, often causing rapid fluctuations in the market. Some notable examples include:

- Economic crises: The 2008 financial crisis saw gold prices surge as investors sought safe havens.

- Geopolitical tensions: Conflicts and trade disputes often lead to increased gold demand.

- Monetary policy changes: Central bank decisions on interest rates can influence gold prices.

- Natural disasters: Major events can disrupt gold mining and supply chains, affecting prices.

Gold Price Fintechzoom: Historical Data Analysis

Fintechzoom’s historical data analysis tools allow investors to examine long-term trends in gold prices. By looking at data over extended periods, users can identify patterns and cycles in the gold market. This historical perspective is valuable for developing long-term investment strategies and understanding how gold performs under different economic conditions.

The platform offers various visualization options for historical data, including line charts, candlestick charts, and comparison tools that allow users to overlay gold prices with other economic indicators or asset prices.

Factors Influencing Gold Prices

Understanding the factors that drive gold prices is crucial for successful investing. Fintechzoom provides comprehensive analysis of these factors, helping investors anticipate market movements. Some key influences on gold prices include:

- Economic indicators: Inflation rates, GDP growth, and employment figures can all impact gold prices.

- Currency movements: Gold often moves inversely to the US dollar.

- Interest rates: Lower rates tend to boost gold prices as the opportunity cost of holding gold decreases.

- Supply and demand: Mining production, central bank purchases, and consumer demand all play a role.

Economic Factors

Economic conditions play a significant role in determining gold prices. During periods of economic uncertainty or high inflation, investors often turn to gold as a safe haven asset. Fintechzoom provides up-to-date economic data and analysis to help investors understand how these factors are influencing gold prices.

The platform offers tools to track key economic indicators such as inflation rates, GDP growth, and employment figures. By correlating these indicators with gold price movements, investors can gain insights into potential future trends.

Geopolitical Influences

Geopolitical events can have a profound impact on gold prices. Tensions between nations, changes in government policies, and global conflicts often lead investors to seek the perceived safety of gold. Fintechzoom’s news integration feature helps users stay informed about geopolitical developments that could affect the gold market.

The platform also provides historical data on how past geopolitical events have influenced gold prices, allowing investors to draw insights for future scenarios.

Supply and Demand Dynamics

The balance between gold supply and demand is a fundamental driver of prices. Fintechzoom offers data on global gold production, central bank purchases, and consumer demand trends. This information helps investors understand the underlying fundamentals of the gold market.

The platform also provides insights into factors that could affect future supply and demand, such as new mining technologies, changes in central bank policies, or shifts in consumer preferences for gold jewelry.

Investment Strategies for Gold Using Fintechzoom

Fintechzoom’s comprehensive tools and data allow investors to implement a variety of gold investment strategies. Whether you’re looking for short-term trading opportunities or long-term wealth preservation, the platform offers resources to support your approach.

Some popular strategies that can be executed using Fintechzoom include:

- Trend following: Use technical analysis tools to identify and ride gold price trends.

- Value investing: Compare current prices to historical averages to identify potential buying opportunities.

- Hedging: Use gold to hedge against risks in other parts of your investment portfolio.

- Dollar-cost averaging: Set up regular gold purchases to smooth out price fluctuations over time.

Long-term vs. Short-term Gold Investments

Fintechzoom caters to both long-term investors and short-term traders. For long-term investors, the platform offers tools to analyze historical trends, track fundamental factors, and monitor overall portfolio allocation to gold. These features support strategies focused on wealth preservation and steady growth over extended periods.

Short-term traders can leverage Fintechzoom’s real-time price data, technical analysis tools, and news feeds to identify quick profit opportunities. The platform’s customizable alerts and mobile app ensure that traders can stay on top of market movements even when they’re on the go.

Dollar-Cost Averaging with Gold

Dollar-cost averaging is a popular strategy for investing in gold, especially for those looking to build their holdings over time. This approach involves investing a fixed amount of money in gold at regular intervals, regardless of the current price.

Fintechzoom supports this strategy by allowing users to:

- Set up recurring investment reminders.

- Track the average purchase price of their gold investments over time.

- Analyze the performance of their dollar-cost averaging strategy compared to lump-sum investments.

This methodical approach can help investors mitigate the impact of short-term price volatility and potentially lower their average purchase price over time.

Diversification: Gold in a Balanced Portfolio

Gold plays a crucial role in portfolio diversification due to its low correlation with other asset classes. Fintechzoom provides tools to help investors understand how gold fits into their overall investment strategy and maintain an optimal portfolio balance.

The platform offers features such as:

- Portfolio analysis tools to assess gold’s correlation with other assets.

- Scenario testing to see how different gold allocations might affect overall portfolio performance.

- Comparative analysis of gold’s performance against other asset classes over various time periods.

These tools help investors make informed decisions about how much gold to include in their portfolios and when to rebalance their holdings.

Optimal Gold Allocation Percentages

The ideal percentage of gold in an investment portfolio varies depending on individual circumstances, risk tolerance, and market conditions. However, many financial advisors suggest allocating between 5% and 10% of a portfolio to gold.

Fintechzoom helps investors determine their optimal gold allocation by:

- Providing historical data on how different gold allocations have performed in various market conditions.

- Offering risk assessment tools to help investors understand their risk tolerance.

- Allowing users to simulate different portfolio allocations and see their potential outcomes.

By using these tools, investors can find a gold allocation that balances their need for stability with their growth objectives.

Rebalancing Your Portfolio with Fintechzoom

Regular portfolio rebalancing is essential to maintain your desired asset allocation as market conditions change. Fintechzoom offers features to help investors track their portfolio composition and determine when rebalancing is necessary.

The platform provides:

- Alerts when gold allocation deviates from target percentages.

- Tools to calculate the trades needed to bring the portfolio back into balance.

- Historical analysis of how different rebalancing frequencies have affected portfolio performance.

By leveraging these features, investors can maintain their desired exposure to gold while adapting to changing market conditions.

Fintechzoom Features for Gold Investors

Fintechzoom offers a range of features designed specifically for gold investors. These tools help users stay informed about market movements, analyze trends, and make data-driven investment decisions.

Key features include:

- Real-time price tracking for various gold products (spot, futures, ETFs).

- Technical analysis tools including moving averages, RSI, and MACD.

- News feeds and market commentary from industry experts.

- Portfolio tracking and performance analysis.

- Customizable alerts for price movements and market events.

These features combine to create a comprehensive platform for gold investing, suitable for both novice and experienced investors.

Price Alerts and Notifications

Fintechzoom’s alert system allows investors to stay on top of market movements without constantly monitoring the platform. Users can set up customized alerts for:

- Price thresholds: Get notified when gold reaches specific price levels.

- Percentage changes: Receive alerts for significant price movements.

- Technical indicators: Be informed when indicators suggest potential trend changes.

- News events: Stay updated on major news that could impact gold prices.

These alerts can be delivered via email, push notifications, or SMS, ensuring that investors never miss important market developments.

Technical Analysis Tools on Fintechzoom

For investors who rely on technical analysis, Fintechzoom offers a suite of advanced charting and analytical tools. These include:

- Interactive charts with multiple timeframes and chart types.

- A wide range of technical indicators and oscillators.

- Drawing tools for trendlines, Fibonacci retracements, and more.

- Backtesting capabilities to evaluate trading strategies.

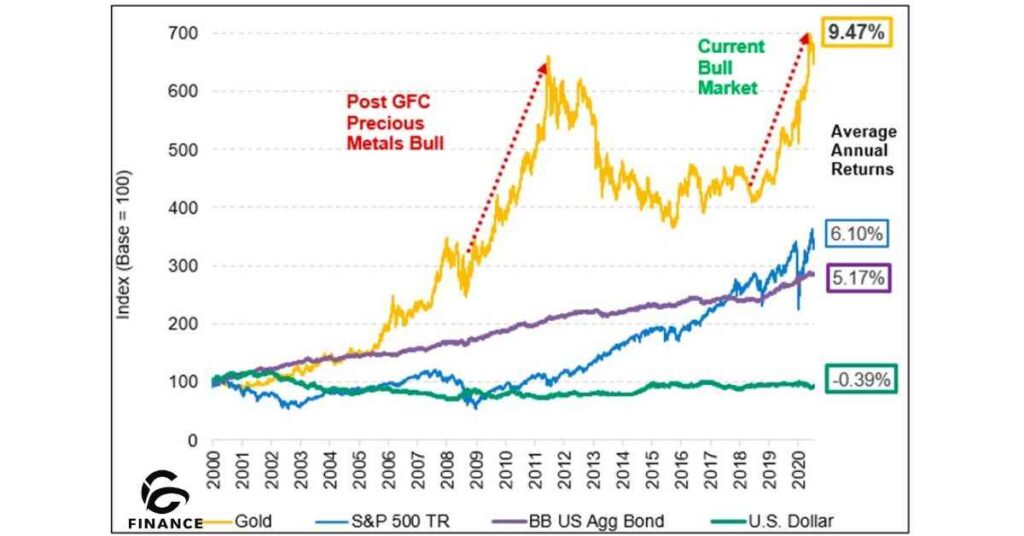

Comparative Analysis: Gold vs Other Investments

Understanding how gold performs relative to other asset classes is crucial for effective portfolio management. Fintechzoom provides tools for comparative analysis, allowing investors to assess gold’s performance against stocks, bonds, real estate, and other investments.

The platform offers:

- Side-by-side performance comparisons over various time periods.

- Correlation analysis to understand how gold moves in relation to other assets.

- Risk-adjusted return metrics to compare investments on a level playing field.

This comparative data helps investors make informed decisions about asset allocation and understand gold’s role in their overall investment strategy.

Gold vs. Stocks: Risk and Return

Gold and stocks often exhibit different risk and return profiles. Fintechzoom allows investors to compare these two asset classes across various metrics:

- Historical returns over different time periods.

- Volatility and risk measures such as standard deviation and Sharpe ratio.

- Performance during specific market conditions (e.g., economic recessions, bull markets).

Gold vs. Cryptocurrencies: The Digital Gold Debate

The rise of cryptocurrencies, particularly Bitcoin, has led to debates about their role as a potential “digital gold.” Fintechzoom provides data and analysis to help investors compare gold with cryptocurrencies:

- Price performance and volatility comparisons.

- Correlation analysis between gold and major cryptocurrencies.

- Adoption trends and market capitalization comparisons.

- Analysis of factors influencing both gold and cryptocurrency prices.

Fintechzoom’s Role in Monitoring Gold Prices

Fintechzoom plays a crucial role in the gold price monitoring ecosystem. By aggregating data from multiple sources and providing advanced analytical tools, the platform helps increase market transparency and efficiency. This benefits not only individual investors but also contributes to the overall health of the gold market.

The platform’s real-time updates and comprehensive market coverage ensure that users have access to the most current and relevant information. This level of transparency can help reduce information asymmetry and promote fairer pricing in the gold market.

Data Sources and Accuracy

Fintechzoom prides itself on the accuracy and reliability of its gold price data. The platform sources information from a wide range of reputable providers, including:

- Major gold exchanges worldwide

- Leading bullion dealers

- Financial institutions and banks

- Government and regulatory bodies

User Experience and Accessibility

Fintechzoom’s user interface is designed with accessibility in mind, catering to both novice and experienced investors. Key features of the platform’s user experience include:

- Intuitive navigation and clear data presentation

- Customizable dashboards to suit individual preferences

- Mobile-responsive design for on-the-go access

- Educational resources to help users understand market data

Read This Blog: Unveiling Jynxzi’s Net Worth: The Streaming Sensation’s Financial Journey

Forecasting Gold Prices with Fintechzoom

While no one can predict the future with certainty, Fintechzoom provides tools to help investors make informed projections about gold prices. The platform combines historical data analysis, technical indicators, and fundamental factors to offer insights into potential future price movements.

Fintechzoom’s forecasting tools include:

- Trend analysis and projection models

- Seasonality studies to identify recurring patterns

- Sentiment indicators based on market data and news analysis

- Expert commentary and gold price forecast from industry analysts

Short-term Price Predictions

For short-term traders and investors, Fintechzoom offers a range of tools for making near-term price predictions:

- Real-time technical indicators for identifying potential breakouts or reversals

- Sentiment analysis based on news flow and social media trends

- Short-term supply and demand data, including futures market positioning

Long-term Gold Price Projections

Long-term gold price projections require a different approach, focusing more on fundamental factors and macroeconomic trends. Fintechzoom supports long-term analysis through:

- Historical trend analysis over extended periods

- Correlation studies with long-term economic indicators

- Scenario modeling for different economic and geopolitical outcomes

- Analysis of long-term supply and demand projections

These tools help investors develop a broader perspective on the gold market and make more informed decisions about long-term investment strategies.

Also Read: Ballistic Beats Net Worth: Unveiling the Fortune of a Hip-Hop Maverick

Mitigating Risk in Gold Investments

While gold is often seen as a safe-haven asset, it’s not without risks. Fintechzoom provides resources to help investors understand and mitigate these risks:

- Volatility analysis to assess potential price swings

- Correlation studies to understand how gold might behave in different market conditions

- Risk assessment tools for evaluating different gold investment products

By leveraging these tools, investors can develop strategies to manage risk while still benefiting from gold’s potential advantages.

Hedging Strategies Using Gold

Gold can be an effective hedging tool, helping to protect portfolios against various risks. Fintechzoom offers insights into different hedging strategies:

- Using gold to hedge against currency fluctuations

- Protecting against inflation risk with gold investments

- Balancing portfolio risk with strategic gold allocations

Combining Gold with Other Safe-Haven Assets

While gold is a popular safe-haven asset, it’s often beneficial to combine it with other defensive investments. Fintechzoom provides comparative analysis tools to help investors understand how gold interacts with other safe-haven assets such as:

- Government bonds

- Defensive stocks (e.g., utilities, consumer staples)

- Other precious metals like silver and platinum

FAQ

How often does Fintechzoom update gold prices?

Fintechzoom updates gold prices in real-time during market hours. For most major gold markets, this means updates occur every few seconds, ensuring that users always have access to the most current price information.

Is Fintechzoom reliable for gold price information?

Yes, Fintechzoom is considered a reliable source for gold price information. The platform sources data from multiple reputable providers and employs rigorous verification processes to ensure accuracy. However, as with any financial data, it’s always wise to cross-reference with other sources for critical investment decisions.

How can I start investing in gold using Fintechzoom?

To start investing in gold using Fintechzoom:

- Sign up for a Fintechzoom account

- Familiarize yourself with the platform’s tools and features

- Use the educational resources to understand gold investing basics

- Set up price alerts for potential entry points

- Start with small investments and gradually increase as you gain experience

Conclusion

Gold Price Fintechzoom offers a comprehensive suite of tools for tracking, analyzing, and investing in gold. By leveraging the platform’s real-time data, advanced analytics, and user-friendly interface, investors can make more informed decisions in the dynamic world of gold investing.

Whether you’re a seasoned trader or new to precious metals, Fintechzoom provides the resources needed to navigate the gold market effectively in 2024 and beyond.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.