Have you ever reviewed your bank statement only to be puzzled by unfamiliar charges like “PAI ISO“? If so, you’re not alone. Many people find these cryptic line items confusing and even concerning at first glance.

But fear not! In this comprehensive guide, we’ll demystify the common PAI ISO charge and explain what it means for your account.

Understanding the PAI ISO Charge on Your Bank Statement

If you’ve ever spotted “PAI ISO” on your bank statement, you might have wondered what those letters stand for and why they’re there. It’s understandable to be cautious about unknown charges, but rest assured, PAI ISO is nothing to worry about. In fact, it’s a routine part of modern banking that reflects legitimate transactions, not fraud or fees.

What is PAI ISO?

PAI ISO is an abbreviation that stands for “PAID ISO another bank.” In simple terms, it represents an electronic transfer of funds between banks. These transfers often involve payments like:

- Direct deposits from your employer

- Online bill payments to utilities or credit cards

- Transferring money between your own accounts at different banks

So when you see PAI ISO on your statement, it’s just a record of an electronic payment or deposit that involved another financial institution.

Why is PAI ISO on my bank statement?

PAI ISO appears on your bank statement when a transaction involves a transfer of funds from another bank. This could be because:

- Your employer deposited your paycheck directly into your account

- You paid a bill online using your bank’s bill pay service

- You transferred money from an account at another bank into this one

In each case, your bank received funds electronically from another institution, and PAI ISO is how they record that transfer on your statement.

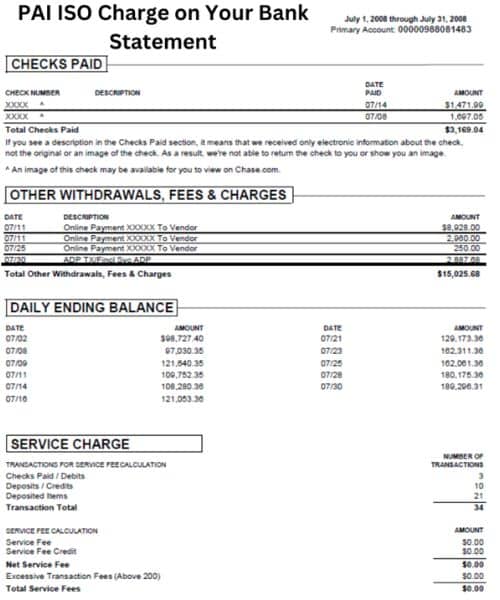

What Does the PAI ISO Charge Mean on Your Bank Statement?

When you see a PAI ISO line item on your bank statement, it’s important to understand that it’s not actually a charge or fee. Instead, the amount listed next to PAI ISO represents the total of the deposit or payment that was transferred electronically.

For example, let’s say your statement shows:

PAI ISO DEPOSIT JPMORGAN CHASE 0123 $1,500.00This means your bank received an electronic deposit of $1,500 from JPMorgan Chase bank. The “0123” likely represents the last four digits of Chase’s routing number, which is just a way for your bank to keep track of where the money came from.

Read More Related Post: Why Reconciling Your Bank Statements is Crucial for Financial Health

Decoding the PAI ISO Charge: A Comprehensive Guide

To better understand how PAI ISO works, let’s break down the typical line item you might see on your statement.

Here’s what each part means:

- TYPE: This will usually say “DEPOSIT” or “PAYMENT” to indicate the nature of the transfer

- OTHER BANK: The name of the bank that sent the funds, like “JPMORGAN CHASE” or “BANK OF AMERICA”

- ROUTING NUMBER: The last 4 digits of the other bank’s routing number, used for identification purposes

- AMOUNT: The total amount of the electronic transfer

It’s important to note that the date listed next to the PAI ISO item is the date your bank processed the transfer, which may be different from the date you initiated the payment or the date it was deducted from the other account.

PAI ISO Charges Explained: What You Need to Know

While PAI ISO might look like a charge at first glance, it’s really just an informational record of an electronic funds transfer. Here are a few key things to understand:

- PAI ISO doesn’t represent a charge or fee to your account

- You’ll still see separate line items for bill payments or direct deposits that correspond to the PAI ISO amount

- PAI ISO doesn’t reflect any pending transactions or holds on your account, only completed transfers

So if you see a PAI ISO for a bill payment, for example, you’ll also see a separate line item for that payment with the name of the company you paid.

Why Is There a PAI ISO Charge on My Bank Statement?

The reason PAI ISO appears on your bank statement is to represent the behind-the-scenes process of transferring money electronically between banks. It’s a way for your bank to reconcile these types of transactions and ensure their records match up with the other institution.

This system, known as the Automated Clearing House (ACH) network, is used by all banks in the US to process electronic payments. So whether you’re receiving your paycheck via direct deposit or paying your credit card bill online, PAI ISO is just a routine part of that process.

Everything You Need to Know About PAI ISO Charges

By now, you hopefully have a clearer picture of what PAI ISO means on your bank statement. To recap:

- PAI ISO stands for “PAID ISO another bank” and represents electronic funds transfers

- The amount listed is not a charge or fee, but the total of the transfer itself

- PAI ISO is an informational record, not a pending or held transaction

It’s also worth noting that you may see multiple PAI ISO line items on a single statement, especially if you have a lot of electronic transactions. And the amounts may not always match up perfectly with your deposits or payments, particularly if there were multiple transactions to or from the same bank.

The Mystery of PAI ISO Charges: Explained

If you were initially confused by PAI ISO on your statement, you’re certainly not the only one! These charges can seem mysterious at first, especially with all the codes and abbreviations banks use.

However, once you understand that PAI ISO is just a normal part of modern electronic banking, it becomes much less alarming. In fact, you might even appreciate the level of detail your bank provides in tracking these transfers.

If you’re ever unsure about a particular PAI ISO item, you can always cross-reference it with your own records of deposits and payments. And if something doesn’t seem right, don’t hesitate to contact your bank for clarification.

How to Identify and Understand PAI ISO Charges on Your Bank Statement

Spotting PAI ISO on your bank statement is actually quite simple once you know what to look for. Here’s a quick step-by-step guide:

- Review your statement for any line items that include “PAI ISO”

- Note the amount listed and whether it’s labeled as a deposit or payment

- Check the date the transfer was processed

- Look for a corresponding deposit or payment line item with a matching amount

- If you’re unsure, cross-reference with your own records of electronic transactions

If everything matches up, then the PAI ISO charge is likely accurate and nothing to be concerned about. However, if you notice any discrepancies, it’s always a good idea to contact your bank’s customer service for assistance.

Read More Related Post: Understanding CSC Service Works Charges on Your Bank Statement

A Guide to PAI ISO Charges: What They Are and Why They Appear

To sum it up, PAI ISO charges on your bank statement represent routine electronic transfers of funds between banks. This could include:

- Payroll direct deposits from your employer

- Electronic bill payments you made through your bank

- Transfers you initiated from an external bank account

The amount listed next to PAI ISO is not a charge or fee to your account, but rather the total of the electronic transfer itself.

So if you see “PAI ISO DEPOSIT YOURCOMPANY PAYROLL,” for instance, that means your employer’s bank electronically transferred your paycheck to your account. The PAI ISO is essentially just a confirmation of that deposit.

What does PAI ISO mean for my bank account?

In practical terms, PAI ISO itself doesn’t really affect your bank account balance. It’s simply a record of electronic transfers that have already occurred.

However, it’s still important to review your PAI ISO line items carefully, just as you would any other part of your bank statement. Make sure the amounts and dates align with your records of deposits, payments, and transfers.

If something seems off, don’t panic! It could be a simple discrepancy or timing issue. But it’s always best to investigate by contacting your bank directly. They can help clarify any confusion and ensure your account is accurate.

Case Study: Sarah’s Mysterious PAI ISO Charge

To illustrate why understanding PAI ISO is important, let’s look at a real-world example. Sarah was reviewing her bank statement when she noticed a line that said:

PAI ISO PAYMENT CAPITAL ONE 7890 $532.12At first, Sarah was concerned. She didn’t recognize the charge and worried that someone had fraudulently used her account. However, upon closer inspection, she realized that $532.12 was the exact amount of her Capital One credit card bill that month.

She then found another line item that said:

CAPITAL ONE ONLINE PMT $532.12Sarah realized the PAI ISO charge was simply reflecting the electronic payment she had made to her Capital One card through her bank’s online bill pay system. The “7890” was likely just the last four digits of Capital One’s routing number.

By understanding what PAI ISO meant, Sarah was able to quickly resolve her concerns and confirm that her account activity was accurate. This knowledge gave her greater peace of mind and confidence in managing her finances.

Why is it important to understand PAI ISO charges?

While PAI ISO charges may seem like just another confusing part of your bank statement, taking the time to understand them can actually provide some valuable benefits:

- Demystifies your statement: Knowing what PAI ISO means can help reduce anxiety or confusion when reviewing your account activity.

- Helps you track payments: By understanding which electronic transfers correspond to which PAI ISO charges, you can more easily verify that payments and deposits are being processed correctly.

- Gives a clearer financial picture: Being able to decipher PAI ISO charges provides a more complete view of your cash flow and account activity.

Plus, if you ever do need to dispute a particular charge or transaction, having a solid grasp of how PAI ISO works can help you communicate more effectively with your bank to resolve the issue.

How can I avoid PAI ISO charges?

You might be wondering if there’s a way to prevent PAI ISO charges from appearing on your statement in the first place. But the truth is, there’s really no need to avoid them!

Remember, PAI ISO is not actually a charge or fee to your account. It’s simply an informational record of electronic funds transfers. So there’s no financial benefit to eliminating them.

That said, if you really wanted to minimize the number of PAI ISO line items on your statement, you could limit your use of electronic transfers in favor of other payment methods like cash, paper checks, or money orders.

However, this would likely be quite inconvenient and impractical in today’s digital age. Electronic banking offers a lot of benefits in terms of speed, security, and ease of use. And PAI ISO is just a normal byproduct of that system.

PAI ISO Charges on Bank Statements: An In-Depth Look

For a more technical understanding of how PAI ISO charges work, let’s dive a little deeper into the electronic funds transfer process.

When you make an electronic payment or receive a direct deposit, the funds are transferred through the Automated Clearing House (ACH) network. This is a secure, batch-processing system that banks use to send and receive electronic transfers.

Here’s a simplified overview of how it works:

- The originating bank (e.g., your employer’s payroll bank) creates an ACH entry with the payment details

- The ACH entry is batched with other entries and sent to an ACH operator

- The ACH operator sorts the entries and sends them to the receiving banks (e.g., your bank)

- The receiving banks process the entries and credit or debit the appropriate accounts

- The receiving banks send a confirmation back through the ACH network

PAI ISO is essentially your bank’s way of recording their side of this process on your statement. It reflects the moment when they received the electronic transfer and credited your account accordingly.

So while PAI ISO might seem like an unnecessary bit of banking jargon, it’s actually a key part of the complex system that allows for seamless, reliable electronic payments and deposits.

Read More Related Post: What Is AGI TMO Service Fees Charge On Bank Statement?

Fun Facts About ACH and Electronic Funds Transfers

- The ACH network processed over 29 billion electronic payments in 2021, with a total value of more than $72 trillion.

- Direct deposit was first introduced in the 1970s, but didn’t become widely used until the 1980s and 90s as employers looked for ways to reduce payroll costs.

- The first electronic money transfer occurred in 1871, over 100 years before the ACH system was created. It was a telegraph-based system used by Western Union.

- In 2001, the Federal Reserve passed a law called “Check 21” that allowed banks to process checks electronically as images, rather than physically transporting paper checks. This greatly sped up processing times.

Conclusion

Understanding PAI ISO charges on your bank statement is an important part of managing your finances in the modern world. While these cryptic line items can initially seem confusing or even alarming, they are simply a routine part of the electronic funds transfer process.

PAI ISO represents legitimate transactions like direct deposits, bill payments, and account transfers, not fraudulent charges or fees. By learning to identify and interpret these charges, you can gain a clearer picture of your account activity, track your payments more effectively, and resolve any discrepancies with confidence.

Embracing this knowledge is a key step in taking control of your financial health and making informed decisions about your money.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.