Building societies offer financial services to members. They focus on mortgages and savings accounts. Members have a say in how the institution operates.

To find your roll number, check account statements.It may also be in original documentation. Contact customer service if you can’t find it.

Using the correct roll number ensures smooth transactions.It directs funds to the right account. Avoid errors by inputting it accurately.

Key Takeaways

- Building society roll numbers are unique identifiers for individual accounts.

- They are crucial for transactions like transfers or setting up direct debits.

- Locate your roll number on statements, contact your building society, or check online banking.

- Building societies, unlike banks, are owned by their members.

- They offer a narrower range of services, focusing on mortgages and savings accounts.

- Roll numbers ensure payments are directed to the correct account, vital for smooth transactions.

Understanding the Building Society Roll Number

When managing your finances, it’s vital to grasp the significance of the roll number. This unique code helps identify individual accounts and ensures smooth transactions. You can find your roll number on statements or by contacting your building society directly.

Building societies, unlike banks, are owned by members and focus on customer service. They offer a range of services, including mortgages and savings accounts. Utilizing your roll number correctly is crucial for payment processing accuracy.

Understanding the roll number’s role in payments prevents errors and ensures funds reach the correct account. It’s a key element in navigating the world of building societies and making informed financial decisions.

Where to Find Your Building Society Roll Number

To locate your roll number, check your account statements or original documentation. If not found, contact your building society’s customer service. You can also access your online banking app for the information.

Your roll number may be printed on your passbook if provided by the building society. Alternatively, it could be listed in any official correspondence you received. Ensure to keep these documents safe for reference.

If you’re still unable to find your roll number, reach out directly to your building society. Their customer service team will assist you in retrieving the necessary information.

Check Your Statements and Documentation

When managing your finances, it’s important to review your statements and documentation regularly. These documents provide valuable insights into your financial health. By checking them regularly, you can catch any errors or discrepancies early on.

Your statements contain detailed information about your transactions and account activity. They help you track your spending, monitor your balances, and identify any unauthorized charges. It’s essential to review them carefully to ensure everything is accurate.

Contact Your Building Society

Documentation provided by your financial institution, such as account agreements and terms of service, outlines important details about your account. It’s crucial to read and understand this information to know your rights and responsibilities as an account holder.

To get your building society roll number, reach out to your building society directly. Contact their customer service for assistance. They’ll help you find the information you need.

Alternatively, check your account statements or original documentation. Your roll number may be listed there. It’s essential to have this number for transactions.

Using your roll number ensures smooth processing of payments. Make sure to include it when making transactions. This helps avoid any errors or delays.

Online Account or Banking App

If you want to manage your finances online, consider using an online account or banking app. These tools offer convenience and accessibility, allowing you to check your balance, transfer funds, and pay bills from anywhere with an internet connection. Simply download the app or log in to your account to get started.

With an online account or banking app, you can avoid the hassle of visiting a physical branch. Everything you need is right at your fingertips, making it easy to stay on top of your finances on the go. Plus, many apps offer additional features like budgeting tools and transaction alerts to help you manage your money more effectively.

Whether you’re at home, at work, or on the move, an online account or banking app puts control of your finances right in your hands. Take advantage of these convenient tools to simplify your banking experience and stay connected to your money wherever life takes you.

Using the Building Society Roll Number

When managing your finances, understanding your unique account identifier is crucial. This alphanumeric code, known as the building society roll number, ensures smooth transactions. You can locate it on your account statements or by contacting your building society directly.

Using the roll number correctly is essential for directing funds accurately. It serves as a key to unlock your account details and facilitate payments. Remember to input it accurately to avoid any processing errors or delays.

In addition to account numbers and sort codes, the roll number is vital for identifying individual accounts. It distinguishes your account within the building society’s network. Utilize it wisely to ensure seamless financial transactions.

Why Do Building Societies Use Roll Numbers?

Building societies use roll numbers to identify individual accounts efficiently. These alphanumeric codes are unique to each account. They ensure that payments are allocated correctly.

Roll numbers simplify transaction processing for building societies. They serve as internal identifiers for account holders. Without roll numbers, payment processing could become cumbersome.

Overall, roll numbers streamline banking operations for both building societies and their members. They facilitate accurate and smooth fund transfers.

Historical Legacy

The roots of building societies trace back centuries, originating as cooperative initiatives to finance housing. Members pooled resources to purchase land and build homes.

Over time, building societies evolved into permanent institutions, offering a range of financial services to their members.

Today, building societies continue to play a significant role in the financial sector, managing substantial assets and contributing to local communities.

Internal Identification

Internal identification within building societies involves unique alphanumeric codes assigned to individual accounts. These codes facilitate efficient record-keeping and transaction processing. They are essential for ensuring accuracy and security in financial transactions.

These identification codes, often comprising letters and numbers, distinguish accounts within the building society’s network. They serve as keys to unlock account details and direct funds accurately. Utilizing these codes correctly is crucial for smooth financial operations.

Without proper use of internal identification codes, payment processing errors and security risks may arise. Therefore, it’s important to understand and utilize these alphanumeric references accurately.

Smooth Payment Processing

Smooth payment processing is essential for efficient financial transactions. Using the correct reference code ensures funds are allocated accurately. It’s crucial to follow the instructions provided by your financial institution

When making payments, ensure you input the required information correctly. Double-check account numbers and reference codes before finalizing transactions. Taking these steps helps prevent delays and errors in payment processing.

Utilizing online banking services can streamline the payment process. Access your account details and verify transaction information with ease. Online platforms provide convenient options for managing your finances effectively.

Member Identification

In the world of banking, member identification is crucial. When you become a member of a financial institution, you gain certain privileges. Members often have voting rights and a say in how the institution operates.

Being a member means you’re part of a community. You’re not just a customer; you’re invested in the success of the institution. This sense of belonging fosters trust and loyalty among members.

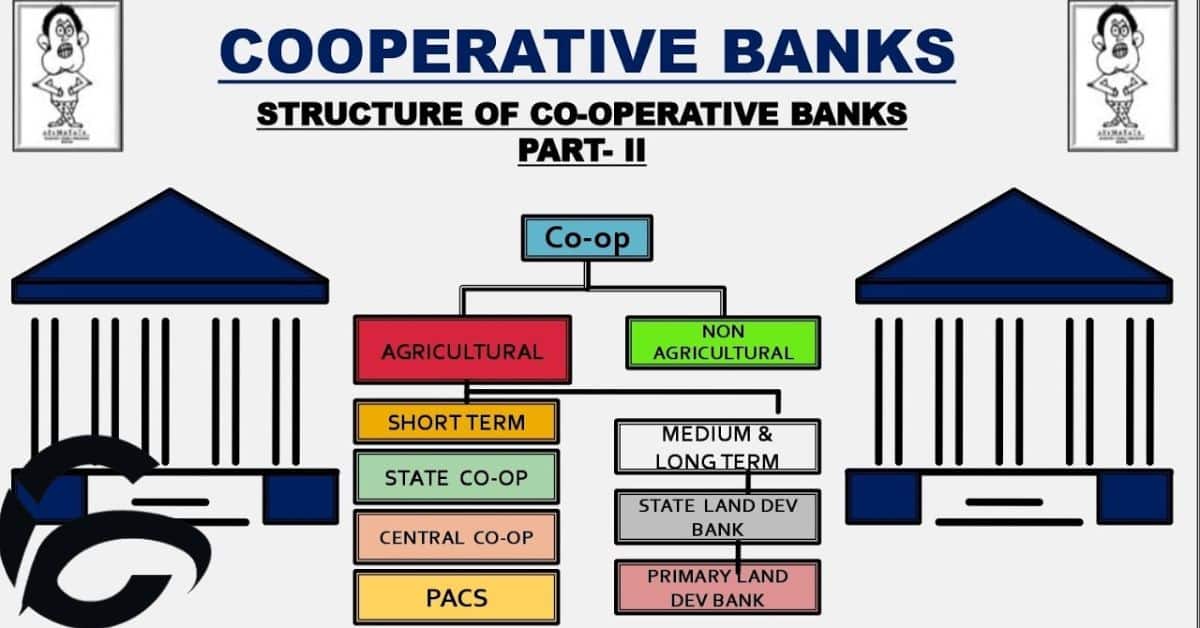

Building Societies vs. Banks: Key Differences

Building Societies

- Building societies are financial institutions owned by their members.

- They offer banking services like mortgages and savings accounts.

- Members have a say in how the institution is run.

- Building societies prioritize customer service and community involvement.

- They often provide competitive interest rates on savings accounts.

- Some building societies originated as cooperative initiatives to finance housing.

Banks

- Banks are financial institutions where you can store your money and access various services.

- They offer services like savings accounts, loans, and credit cards to help you manage your finances.

- You can find banks on high streets and online, making it convenient to handle your money.

- Banks provide a safe place to deposit your money and offer options for saving and investing.

- They also offer loans and mortgages to help you finance major purchases like homes or cars.

- With branches and online services, banks make it easy to manage your finances wherever you are.

Ownership Structure

In building societies, members own the institution. This means they have a say in how it operates. Profits are shared among members, not shareholders.

Building societies prioritize customer service. They offer a range of financial services. These include mortgages, savings accounts, and loans.

Compared to banks, building societies have a different structure. They focus on serving their members’ needs. This often leads to more personalized services.

Customer Focus

Customer focus is paramount in the world of banking. It ensures that clients receive personalized attention. Building strong relationships with customers is a priority for financial institutions.

Understanding the needs and preferences of clients is key. Providing excellent customer service builds trust and loyalty. Happy customers are more likely to stay and recommend the bank to others.

Tailoring products and services to meet individual needs is essential. Offering flexible solutions enhances customer satisfaction. Ultimately, prioritizing customers leads to long-term success for banks.

Product Offerings

Building societies offer a variety of financial products and services to their members. These include savings accounts, mortgages, personal loans, and insurance options. Members can also access traditional retail services like current accounts and credit cards.

In addition to mortgage lending and demand-deposit accounts, building societies provide specialized services. They prioritize customer service and often offer higher interest rates on savings accounts. Members have a say in how the institution is run and share in its profits.

Unlike traditional banks, building societies operate on the principle of mutuality. This means they are owned by their members, not shareholders. As a result, building societies focus on reinvesting profits to benefit their members.

Roll Number

Roll numbers are unique identifiers for individual accounts. They help ensure smooth payment processing. You can find your roll number on account statements or by contacting your institution.

Using your roll number correctly is crucial for transactions. It helps direct funds to the right account. Be sure to include it when making payments.

Research thoroughly to understand the importance of roll numbers. They play a key role in managing finances. Make sure you have yours handy for any banking transactions.

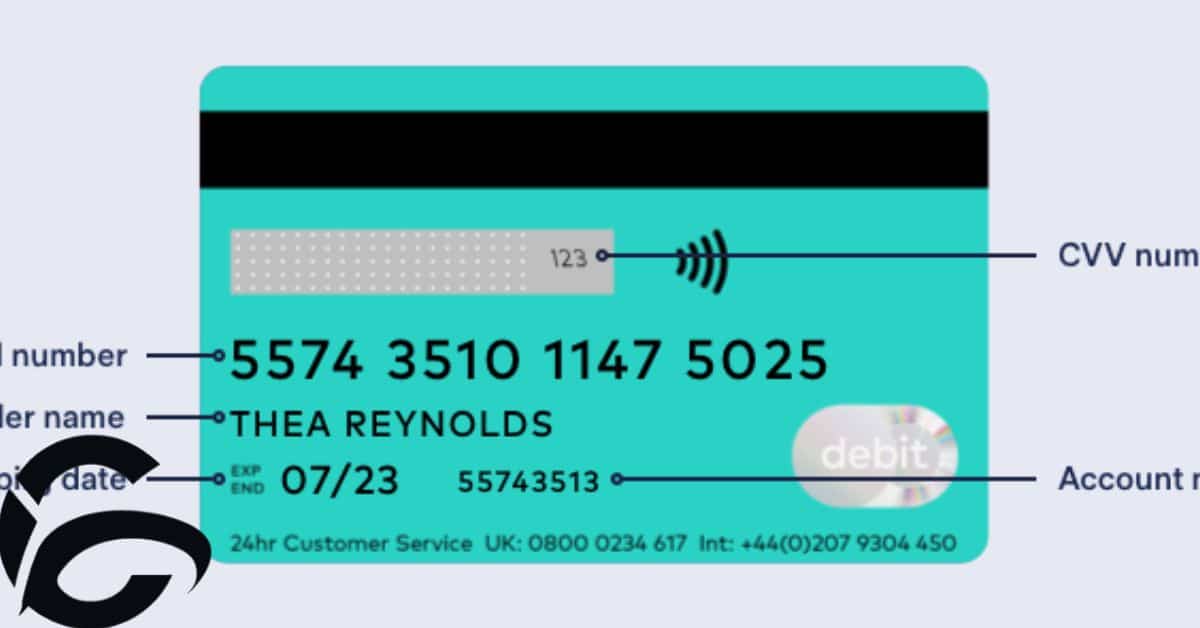

Is The Roll Number The Same As An Account Number?

A roll number is different from an account number. It’s a unique identifier for building society accounts. Roll numbers are shorter and may contain letters and numbers. They help ensure payments go to the right account.

When you open a building society account, you’ll get a roll number. You can find it on your statements or by contacting customer service. Using the roll number correctly is crucial for smooth transactions.

Remember, when making payments, use the roll number as the reference. Avoid errors and ensure your money reaches the intended account.

Account Number vs. Roll Num

Account Number

- Your account number is a unique identifier assigned to your individual account.

- It helps the bank or financial institution distinguish your account from others.

- You can usually find your account number on your bank statements or in your online banking portal.

- Remember, your account number is different from your building society roll number.

- While the roll number is specific to building societies, the account number is used by all banks.

- Make sure to keep your account number secure to protect your financial information.

- When making transactions or setting up direct debits, you’ll often need to provide your account number.

Roll Numbers

- Roll numbers are alphanumeric codes.

- They identify individual accounts.

- Essential for transactions and payments.

- Found on account statements or documentation.

- Contact the institution for assistance.

- Ensure smooth processing of transactions.

- Required for international money transfers.

Alternative Options for Sending Money

When sending money, consider alternative options beyond traditional methods. Digital wallets like PayPal offer convenient ways to transfer funds globally. Cash pickups through providers like RIA and XE allow recipients to collect money quickly.

Another option is balance transfers, which can be done through platforms like Wise. This method allows for seamless transfers between accounts with minimal fees involved. Additionally, consider utilizing card deposits through services like Moneygram and Paysend, offering a straightforward way to send money directly to a recipient’s account.

For those looking for even more flexibility, airtime top-ups can be a viable choice. Providers like WorldRemit offer this option, allowing you to send talk time or data directly to a recipient’s mobile phone account. Explore these alternative methods to find the best fit for your money transfer needs.

Revolut

Revolut is a British fintech company. It offers international money transfers. Users can send money with ease through its user-friendly app.

Revolut provides competitive exchange rates. It offers a 30-day free trial for viewing credit reports. Users can monitor their credit report regularly.

Monzo

Monzo, a UK-based digital bank, provides convenient mobile banking services. With its user-friendly app, managing finances is easy and accessible anytime, anywhere. From tracking spending to making payments, Monzo offers a seamless banking experience for its users.

PayPal

PayPal is a widely-used digital wallet. It allows users to send and receive money securely. You can link your PayPal account to your bank account or credit card.

Sending money with PayPal is simple. You just need the recipient’s email address or phone number. PayPal also offers buyer protection for online purchases.

With PayPal, you can easily shop online or send money to friends and family. It’s a convenient and trusted way to handle your finances.

TransferWise (now Wise)

Sure, here are three short paragraphs about TransferWise (now Wise)

Wise, formerly known as TransferWise, is a popular financial technology company.

It offers international money transfer services with competitive exchange rates.

Users can send money to other Wise users instantly using just their email address or phone number.

Building Society Roll Number Misuse

Misusing your building society roll number can lead to serious financial consequences. Incorrect input could result in unexpected charges or even loss of funds. Always double-check your roll number before making any transactions.

It’s essential to understand how to use your building society roll number correctly. Avoid adding extra characters or information when referencing it in payments. Using it accurately ensures your funds are allocated to the correct account.

Building Society Roll Number Barclays

Barclays, a prominent British bank, doesn’t use a building society roll number. Instead, they rely on account numbers and sort codes for identification. These numbers ensure smooth transactions within the Barclays banking system.

When sending money to a Barclays account, focus on the account number and sort code. These details are crucial for directing funds accurately. Double-check the recipient’s information to avoid any errors in the transfer process.

Building Society Roll Number Santander

Santander, like other banks, doesn’t use a building society roll number. They rely on sort codes and account numbers for transactions. You won’t find a roll number field when sending money to a Santander account.

In the UK, building societies and banks have distinct structures and services. Building societies are owned by members, focusing on mortgages and savings. Santander, being a bank, operates differently and doesn’t utilize roll numbers.

Read as:WHAT IS THE ACCOUNT NAME FOR A BANK ACCOUNT?

How do I pay money into my building society?

To pay money into your building society account, you’ll need to gather your account details. This includes your account number and sort code. You can usually find this information on your account statements or online banking portal.

Once you have your account details, you can use them to set up a payment from your bank account. Simply log in to your online banking or visit your bank’s branch to initiate the transfer. Be sure to double-check the details before confirming the payment to ensure accuracy.

History of building societies

Building societies have a long history dating back centuries. They originated as cooperative initiatives aimed at financing housing for members. Initially, these societies pooled resources to purchase land and build homes.

Over time, building societies evolved into permanent institutions providing various financial services. By the mid-19th century, many had transitioned from terminating organizations to permanent fixtures in the financial landscape.

Frequently Asked Questions

What is a building society?

A building society is a financial institution that provides various banking services, primarily mortgages, savings accounts, and loans, often owned by its members who have a stake in its operations.

Do I need my building society roll number to make an international money transfer?

Yes, typically, you need your building society roll number to make an international money transfer. The roll number serves as a unique identifier for your account, ensuring that the funds are directed to the correct recipient.

How to use roll numbers to send money to a building society account?

To send money to a building society account using roll numbers, provide the recipient’s roll number along with their account number and sort code. Enter the correct roll number in the payment reference field to allocate funds correctly.

How to use roll numbers to receive money in a building society account?

To receive money in a building society account using roll numbers, provide your roll number to the sender along with your account number and sort code. Ensure the sender includes your roll number in the payment reference for accurate allocation.

Final Thoughts

Understanding the significance of a building society roll number is crucial for smooth financial transactions. It serves as a unique identifier for individual accounts within building societies. To find your roll number, check statements or contact customer service.

Always use the roll number when making payments to ensure accurate allocation. Building societies differ from banks in ownership and focus on member benefits. Roll numbers facilitate payment processing and member identification.

Utilize online banking or customer service to access your roll number if needed. Remember, accuracy with the roll number is paramount to avoid errors in transactions. With this knowledge, you can navigate building society transactions confidently and efficiently.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.