PNP Bill Payment is a charge on your bank statement. It signifies automated transactions through Plug’n Pay. It simplifies bill payments securely and conveniently. PNP Bill Payment represents payments made electronically. It covers various bills like utilities and taxes. It streamlines financial transactions for users.

PNP Bill Payment, though seemingly mundane, holds significant implications for your financial records. Understanding its essence is paramount to maintaining transparency and clarity in your banking affairs. So, let’s unravel the layers of this cryptic code to shed light on its significance.

When you see PNP Bill Payment, it indicates electronic payments. These transactions can include utility bills, taxes, and more. It’s essential to comprehend these entries for effective financial management. PNP Bill Payment simplifies the payment process for users. It ensures timely and secure transactions without manual intervention.

What is PNP-BILLPAYMENT?

PNP-BILLPAYMENT is not merely a cryptic entry on your bank statement but a gateway to understanding automated financial transactions. It serves as a digital footprint of payments made through this system, holding significance in managing your financial records effectively.

At first glance, PNP-BILLPAYMENT may seem like just another line item on your bank statement, easily overlooked. However, delving deeper reveals its role as a conduit for streamlined bill payments and financial transactions. Understanding its purpose is key to navigating the complexities of modern banking.

In the realm of banking and finance, PNP-BILLPAYMENT signifies more than just a transaction code. It represents convenience, security, and efficiency in managing your financial obligations. Embracing its significance empowers individuals to take control of their financial journey with clarity and confidence.

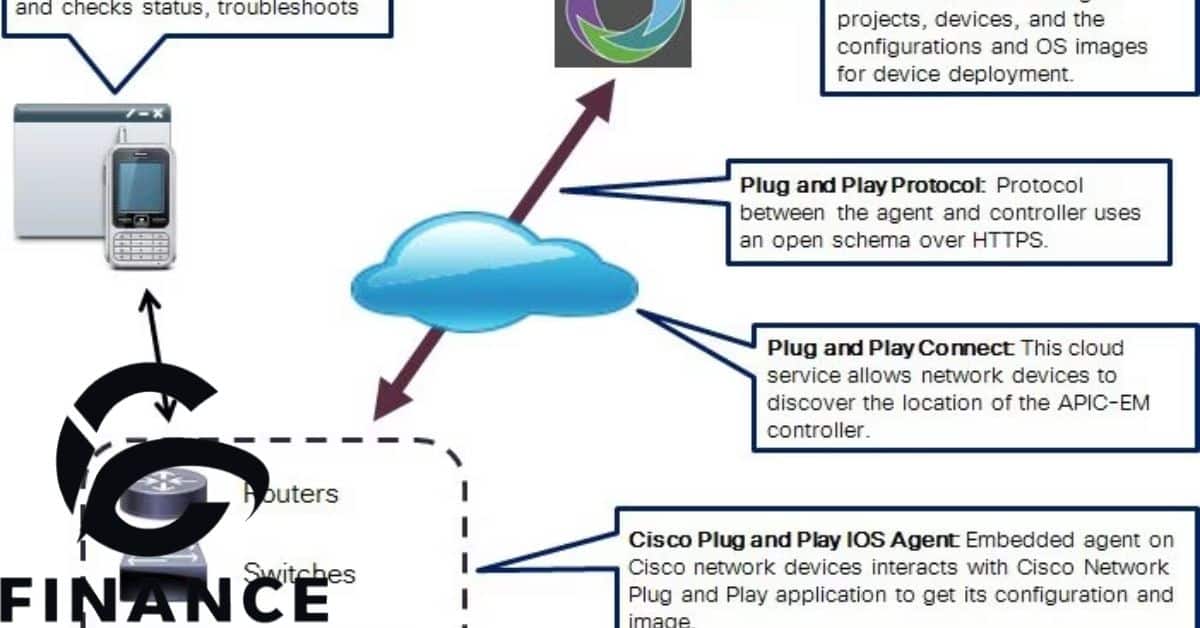

What is Plug’n Pay?

Plug’n Pay isn’t just another payment processor; it’s a trusted digital bridge connecting you to secure online transactions. With its user-friendly interface and robust security features, Plug’n Pay simplifies the process of making payments for various goods and services.

It acts as a reliable intermediary between customers and businesses, ensuring seamless transactions. Its versatility extends to processing credit card payments, electronic checks, and facilitating mobile payments, making it a comprehensive solution for modern financial transactions.

When you encounter Plug’n Pay on your bank statement, it signifies more than just a transaction; it represents a seamless journey through the digital payment landscape. Understanding its role empowers individuals to engage in secure and efficient online transactions with confidence.

What Charges Can Appear Under Plug’n Pay?

Under Plug’n Pay, various charges may appear on your bank statement, reflecting different types of transactions. These charges could include payments for online purchases, utility bills, subscription services, and more.

Plug’n Pay facilitates a wide range of transactions, covering everything from online purchases to recurring subscription payments. Its versatility makes it the go-to payment gateway for businesses and individuals alike.

Whether you’re settling your water bill or renewing a subscription, Plug’n Pay ensures the smooth processing of your payments. Its presence on your bank statement signifies the reliability and convenience of digital transactions facilitated by this trusted payment gateway.

Why Might You See a Plug’n Pay Charge on Your Card?

A Plug’n Pay charge on your card often indicates an online transaction with a business or municipality. These charges signify the smooth processing of your payments, whether it’s for settling utility bills or handling property taxes.

When you engage in online transactions, businesses may utilize Plug’n Pay as a secure payment gateway. This results in charges on your card statement, reflecting the seamless processing of your payments through this trusted platform.

Seeing a Plug’n Pay charge on your card statement is common when conducting various financial transactions online. It’s a testament to the reliability and efficiency of Plug’n Pay in securely processing your payments across different platforms.

The Importance… Strategic Planning

Various charges may appear on your bank statement when transactions are processed through Plug’n Pay. These charges represent payments made for a range of services or purchases facilitated by the Plug’n Pay platform.

The appearance of these charges indicates successful transactions conducted through a secure payment gateway. It reflects the utilization of Plug’n Pay by businesses and organizations to facilitate online payments, ensuring convenience and security for customers.

The charges that appear under Plug’n Pay on your bank statement is essential for managing your financial records effectively. It allows you to track your spending and identify transactions made through this payment platform with clarity and accuracy.

Analyzing George Herbert’s Poem “Love (III)”

George Herbert’s “Love (III)” delves into the complex nature of divine love, portraying it as both tender and demanding. The poem reflects Herbert’s deep spiritual insight, exploring themes of humility, surrender, and the transformative power of love. Through intricate metaphors and vivid imagery, Herbert invites readers to contemplate the profound mysteries of faith and devotion.

In George Herbert’s “Love (III),” the poet employs rich symbolism and religious allegory to convey profound spiritual truths. Through intricate language and poetic devices, Herbert explores the depths of human emotion and the transcendent nature of divine love. The poem serves as a meditation on the enduring power of love to heal, transform, and uplift the soul.

Reviewing the Taylor Swift Styled (Swiftie) Maker Market in Langley, BC

At the Taylor Swift Styled (Swiftie) Maker Market in Langley, BC, attendees immersed themselves in a vibrant celebration of all things Taylor Swift. The market offered a delightful array of Taylor Swift-themed merchandise, from handmade crafts to fan art and memorabilia.

The Taylor Swift Styled (Swiftie) Maker Market in Langley, BC, offers a unique blend of crafts, music, and fan culture. Attendees can expect an immersive experience celebrating the creativity and passion inspired by Taylor Swift’s music and aesthetic.

Visitors enjoyed the lively atmosphere, mingled with fellow Swifties, and indulged in their shared passion for the beloved pop icon. From handmade crafts to fan merchandise, the market showcases a diverse array of talents and products influenced by Swift’s iconic style.

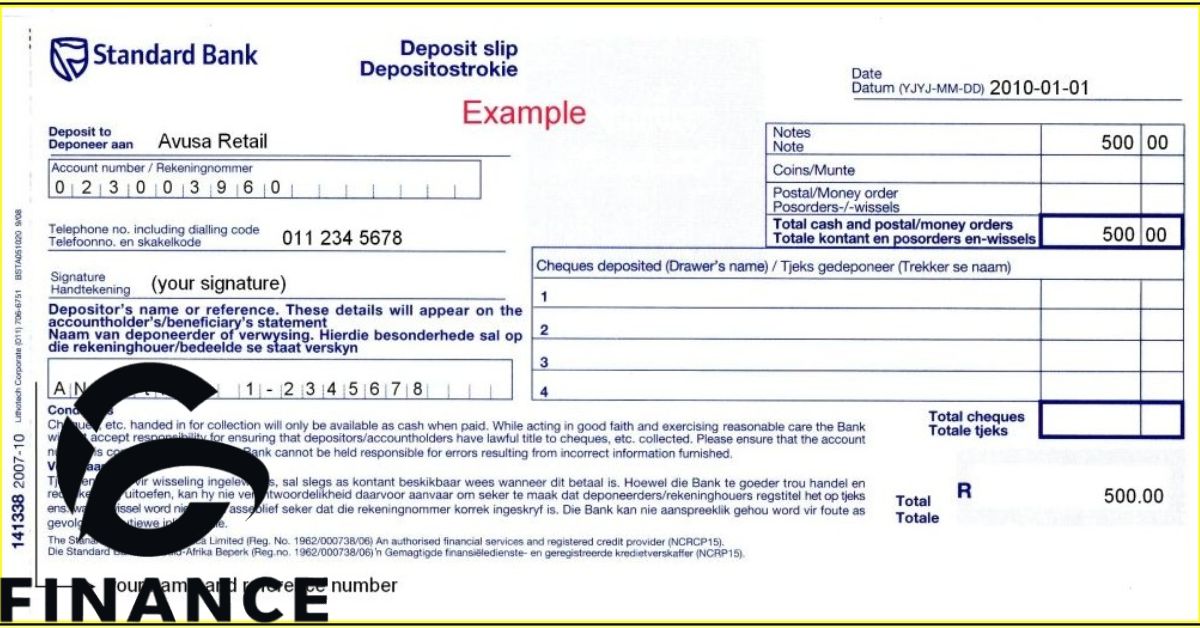

How does PNP Bill Payment appear on your bank statement?

PNP Bill Payment appears as a separate line item on your bank statement. The transaction details include the payment date, amount paid, and service or bill. This clear description helps you easily identify and understand the purpose of the charge.

PNP Bill Payment typically displays with a descriptor indicating the service or bill paid. The description may vary but commonly includes information such as the payment date and amount. This clear labeling ensures transparency and facilitates tracking of your financial transactions.

When you check your bank statement, you’ll likely see PNP Bill Payment listed as a separate entry. This entry includes details like the payment date, amount, and sometimes the name of the service or bill paid. Having this information readily available helps you easily identify and understand the purpose of the transaction.

Uses of Plug’ n Pay (PNP

Plug’n Pay (PNP) serves various purposes, making it a versatile payment platform. Businesses use Plug’n Pay for secure credit card processing and mobile online payment solutions. It facilitates transactions such as rent payments, utility bills, and property taxes efficiently.

Users can utilize Plug’n Pay for a wide range of transactions, including online purchases and bill payments. Whether it’s settling utility bills or paying for subscription services, Plug’n Pay ensures smooth and secure financial transactions.

Businesses and municipalities trust Plug’n Pay for its ability to process credit card and electronic check payments. From settling bills to managing online purchases, Plug’n Pay ensures a seamless and secure digital payment experience.

Contact point of Plug’ n Pay (PNP)

For inquiries or assistance, you can directly reach out to Plug’n Pay (PNP) through their official website. To recover your money or address any concerns, you may also contact your bank or credit card company. For efficient resolution of issues or queries related to transactions, contacting Plug’n Pay or your financial institution is recommended.

For any further assistance or clarification regarding Plug’n Pay (PNP), you can visit their official website. If you encounter any discrepancies or need support, reaching out to your bank or credit card provider is advisable. Feel free to contact Plug’n Pay directly or consult your financial institution for prompt resolution of any concerns.

For direct inquiries or assistance with Plug’n Pay (PNP), you may visit their website for contact information. In case of any issues or discrepancies, contacting your bank or credit card company is recommended. For swift resolution and support, reach out to Plug’n Pay directly or consult your financial institution.

How Pnp Bill Payment Works?

PNP Bill Payment works by automating the payment process for various services. Users authorize automated deductions from their bank accounts for bills like utilities and taxes. Once set up, PNP Bill Payment operates seamlessly, ensuring timely payments without manual intervention.

It simplifies bill payments by automating transactions from your bank account. Once authorized, it deducts funds for bills like utilities and taxes automatically. This seamless process ensures timely payments without manual interventio

Why You See A PNP Bill Payment Charge On Monthly Statement?

You might see a PNP Bill Payment charge on your monthly statement because it represents automated transactions for various services. These charges appear as part of the Flagstaff Bill Pay system, covering utility bills, taxes, and other city services. Monthly statements include these charges for transparent financial tracking and management.

You might find a PNP Bill Payment charge on your monthly statement as a result of using automated payment services. These charges indicate payments made through the Flagstaff Bill Pay platform for various services like utilities and taxes. Their presence on monthly statements ensures clarity and accountability in financial transactions.

How to Identify Legitimate PNP BILLPAYMENT Transactions?

To identify legitimate PNP BILLPAYMENT transactions, review your payment history on the Flagstaff Bill Pay platform.Cross reference transaction details with receipts or confirmation emails for verification. Legitimate transactions should align with actual services or products acquired, ensuring clarity and security.

To verify legitimate PNP BILLPAYMENT transactions, meticulously review your purchase history. Ensure the charge corresponds to recent online transactions and cross-reference it with receipts or confirmation emails. Legitimate transactions should align with services or products acquired, providing clarity and security in your financial records.

Tips For Avoiding Unnecessary PNP BILLPAYMENT Charges

Regularly review bank statements to spot any unfamiliar PNP BILLPAYMENT charges. Keep track of recurring payments and cancel services you no longer need. Exercise caution when sharing bank details online, opting for trusted payment platforms.

Carefully monitor your account activity to quickly detect any suspicious PNP BILLPAYMENT charges. Be cautious when authorizing automatic payments to avoid unexpected deductions. Consider using virtual credit cards or secure payment methods for added protection.

To minimize PNP BILLPAYMENT charges, be vigilant when signing up for automated payment services and carefully review the terms and conditions. Set up alerts on your bank account to receive notifications for any unexpected charges. Monitor your bank statements regularly to detect any irregularities and address them promptly.

Comparisons With Other Billing Codes

When comparing PNP BILLPAYMENT with other billing codes, observe variations in transaction descriptions on your bank statement. Different billing codes may signify distinct payment methods or services. Analyze the frequency and nature of each code to understand your financial transactions better.

In comparing PNP BILLPAYMENT with other billing codes, consider the context of each transaction. Each code may represent different types of payments or merchants. Understanding these distinctions helps in accurately tracking expenses and managing finances effectively.

In reviewing various billing codes alongside PNP BILLPAYMENT, it’s essential to note the diversity of platforms and services utilized by businesses.

Read as:What is COMN CAP APY F1 AutoPay mean on my card statement?

Common Issues And Concerns

Common issues and concerns may arise when dealing with PNP Bill Payment. These can include billing discrepancies, technical glitches, and security vulnerabilities. It’s important to address these challenges promptly to ensure a smooth and secure payment experience.

When addressing common issues and concerns, it’s important to consider various challenges that may arise. These challenges could include billing discrepancies, technical glitches, or security concerns.

When encountering PNP Bill Payment, be mindful of potential issues such as billing discrepancies and technical glitches. Addressing these promptly ensures a smooth payment experience.

Creating A Pnp Account

Create a PNP account, visit the official website and locate the registration section. Enter required details like email, password, and personal information.Verify your account through the confirmation email sent to your provided address.

What is PNP Bill Payment?

PNP Bill Payment is a service for automated transactions, facilitating bill payments directly from your bank account.

How does PNP Bill Payment appear on my bank statement?

PNP Bill Payment appears as a transaction entry on your bank statement, typically with a description indicating the payment made through the service.

What should I do if I see an unknown PNP Bill Payment charge on my bank statement?

If you notice an unfamiliar PNP Bill Payment charge, review your recent transactions and contact your bank for clarification and resolution.

How can I identify the source of the PNP Bill Payment charge?

To identify the source, review your recent transactions or contact the merchant associated with the charge.

What Is Bill Payment In Banking?

Bill payment in banking refers to the process of settling financial obligations through a designated banking platform, often involving utilities or subscriptions.

How Can I Resolve An Unrecognized PNP Bill Payment Charge?

To resolve an unrecognized charge, contact your bank promptly to investigate and potentially dispute the transaction for resolution.

Are There Alternative Payment Methods To PNP Bill Payment?

Yes, alternative methods include credit/debit cards or manual online payments as substitutes for the automated PNP Bill Payment system.

How Quickly Can I Expect PNP Bill Payment Deductions To Occur?

The timing of PNP Bill Payment deductions varies, typically occurring on predetermined dates agreed upon with the company.

Why Do Banks Want You To Use Bill Pay?

Banks promote bill pay for customer convenience, streamlining transactions, reducing paperwork, and ensuring timely payments, enhancing overall financial management.

Final Thoughts

comprehending the significance of PNP Bill Payment on your bank statement is crucial for managing your financial affairs effectively. By understanding that PNP Bill Payment represents automated transactions facilitated by the Pre Authorized Payment system, individuals can navigate their financial statements with confidence.

It signifies a seamless method for companies to withdraw funds for bill payments directly from your account, offering convenience but potentially accompanied by associated fees.Vigilance in reviewing statements and confirming the legitimacy of charges ensures transparency in financial transactions.

Embracing the convenience of automated bill payments while staying informed about associated charges empowers individuals to maintain control over their financial landscape

Overall, being well informed about PNP Bill Payment allows for smoother financial management and better decision making regarding automated transactions.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.