On your card statement, “COMN CAP APY F1 AutoPay” means a payment made automatically to a specific credit card. Therefore, it’s linked to a bank named Comenity, often connected to store credit cards. This process ensures timely payments without manual intervention, helping you manage your finances efficiently.

Crack the code of “COMN CAP APY F1 AutoPay” on your statement. Understand its meaning as a simple, automatic payment method. Thus, this system ensures timely bill settlements, simplifying your financial tasks. Decode it for clearer insights into your transactions and better control over your finances.

Piece togather the meaning behind “COMN CAP APY F1 AutoPay” on your card statement. This code represents automatic payments to your credit card. Thus, it ensures timely bill settlement, streamlining your financial tasks. By unraveling this code, you gain clarity on your transactions and enhance financial control.

Cracking The Transaction Code: ACH-COMN-CAP-APY-F1

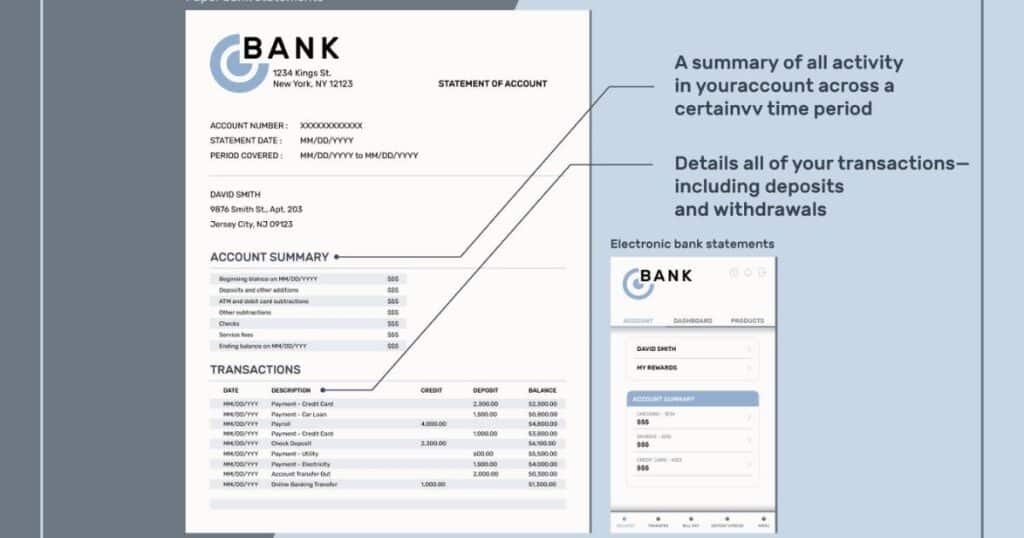

Cracking the Transaction Code: ACH-COMN-CAP-APY-F1 involves understanding an alphanumeric code on bank statements. It signifies an automatic payment to a credit card issued by Comenity Capital Bank. The code breakdown includes ACH for Automated Clearing House, COMN for Comenity Capital Bank, CAP for Capital, and APY for AutoPay.

Comenity Capital Bank partners with major retailers to offer store-specific credit cards, often with benefits like discounts and rewards. The ACH-COMN-CAP-APY-F1 code represents payments made through this system.

Understanding the code on your bank statement is crucial for financial clarity, ensuring you can recognize and track your transactions accurately. By deciphering these codes, you gain insight into your spending habits and financial activities.

What should I do if I find comn-cap apy f1 in my statement for credit cards?

If “COMN-CAP APY F1″ appears on your credit card statement, take action promptly. Contact your bank or card issuer to inquire about the charge. Provide details about the transaction and express your concerns.

Start by reviewing your recent transactions to understand the context of the charge. Look for any purchases or payments associated with “COMN-CAP APY F1.” This information will help you communicate effectively with your bank or card issuer.

Next, reach out to your bank or card issuer through their customer service channels. Inform them of the unfamiliar charge and request clarification. Be prepared to provide any necessary information or documentation to support your inquiry.

What is the reason for comn cap apy F1 appearing in my statement for credit cards?

When “COMN CAP APY F1” shows up on your credit card statement, it signifies an automated payment. This code represents transactions processed through Comenity Capital Bank. If you’ve set up auto-payments, you’ll see this code for bill settlements.

Transactions labeled “COMN CAP APY F1” indicate payments made through Comenity’s system. These automated payments ensure timely bill settlements without manual intervention. If you’ve authorized auto-payments, expect to see this code for your credit card transactions.

You’ll find “COMN CAP APY F1” on your statement if you’ve authorized auto payments with Comenity. These automatic transactions simplify bill payments by deducting funds directly from your account

Read as: Mobile App – ATT My Results

How can I get rid of the comn cap apy F1 on the credit card bill?R

To remove “COMN CAP APY F1” from your credit card bill, contact your bank or card issuer. Inform them of the unauthorized or unfamiliar charge. Provide detailed information about the transaction to initiate the dispute process.

Start by reaching out to your bank or card issuer immediately. Report the “COMN CAP APY F1” charge as unauthorized or suspicious. Be prepared to provide evidence or documentation supporting your claim.

Once you’ve reported the unauthorized charge, your bank or card issuer will investigate the issue. They’ll review the transaction details and may request additional information from you. Stay vigilant and monitor your account for updates on the dispute resolution process.

What should I do if I find comn-cap apy f1 in my statement for credit cards?

If “COMN-CAP APY F1″ appears on your credit card statement, take action promptly. Contact your bank or card issuer to inquire about the charge. Provide details about the transaction and express your concerns.

Start by reviewing your recent transactions to understand the context of the charge. Look for any purchases or payments associated with “COMN-CAP APY F1.” This information will help you communicate effectively with your bank or card issuer.

Next, reach out to your bank or card issuer through their customer service channels. Inform them of the unfamiliar charge and request clarification. Be prepared to provide any necessary information or documentation to support your inquiry.

What is the reason for comn cap apy F1 appearing in my statement for credit cards?

When “COMN CAP APY F1” shows up on your credit card statement, it signifies an automated payment. This code represents transactions processed through Comenity Capital Bank. If you’ve set up auto-payments, you’ll see this code for bill settlements.

Transactions labeled “COMN CAP APY F1” indicate payments made through Comenity’s system. These automated payments ensure timely bill settlements without manual intervention. If you’ve authorized auto-payments, expect to see this code for your credit card transactions.

You’ll find “COMN CAP APY F1” on your statement if you’ve authorized auto payments with Comenity. These automatic transactions simplify bill payments by deducting funds directly from your account

How can I get rid of the comn cap apy F1 on the credit card bill?

To remove “COMN CAP APY F1” from your credit card bill, contact your bank or card issuer. Inform them of the unauthorized or unfamiliar charge. Provide detailed information about the transaction to initiate the dispute process.

Start by reaching out to your bank or card issuer immediately. Report the “COMN CAP APY F1” charge as unauthorized or suspicious. Be prepared to provide evidence or documentation supporting your claim.

Once you’ve reported the unauthorized charge, your bank or card issuer will investigate the issue. They’ll review the transaction details and may request additional information from you. Stay vigilant and monitor your account for updates on the dispute resolution process.

Comenity Capital Bank and Its Role

Yes, you can dispute the charge with your bank or card issuer if you find it unfamiliar or unauthorized. Promptly contact them to initiate the dispute process, providing detailed information and expressing your concerns.

Partnering with major retailers, Comenity Capital Bank offers store-specific credit cards tailored to each brand. Customers enjoy perks like discounts and rewards, enhancing their shopping experience and loyalty.

Specializing in retail credit card services, the bank collaborates with businesses across industries to provide exclusive offers. This strengthens customer loyalty to the partnered brands and drives repeat business.

In the retail credit card market, Comenity Capital Bank facilitates convenient financing options for consumers. Their partnerships with retailers ensure added value for customers and foster long-term loyalty.

Brief Introduction to Comenity Capital

Comenity Capital Bank offers store specific credit cards for shoppers. They partner with various retailers to provide customized financing options. These cards often come with exclusive discounts and rewards.

With over 30 years of experience, Comenity Capital Bank is a trusted financial institution. They specialize in retail credit services, catering to consumer needs. Their expertise ensures seamless transactions for both retailers and customers.

Comenity Capital Bank is renowned for its flexible credit offerings. They empower consumers with convenient payment solutions. Through strategic partnerships, they continue to enhance the shopping experience.

The Bank’s Services and Role

Comenity Capital Bank specializes in providing store-specific credit cards. These cards are tailored to meet the needs of consumers shopping at partner retailers. They offer benefits such as discounts, rewards, and special financing options.

As a financial institution, Comenity Capital Bank plays a crucial role in facilitating retail transactions. They act as the issuer of store credit cards, enabling customers to make purchases conveniently. Their services enhance the shopping experience for consumers.

Comenity Capital Bank collaborates with a wide range of retailers across different industries. This enables them to offer a diverse array of store specific credit cards to consumers. Their partnerships contribute to increased customer loyalty and satisfaction.

Read as: FEATURES ATT MY RESULTS

Why Is This Code on My Bank Statement?

The code “COMN CAP APY F1 AutoPay” on your bank statement indicates an automatic payment. It’s processed through the Automated Clearing House network to a Comenity Capital Bank credit card.

If you’ve authorized payments through Comenity Capital Bank, you’ll see this code. It means automatic payments for your credit card account, ensuring timely bill settlements.

Transactions with a store specific credit card linked to Comenity Capital Bank can also show this code. Purchases at partnered retailers are processed through Comenity, leading to this code’s appearance.

You’ve Authorized Payments Through Comenity Capital Bank

If you find “COMN CAP APY F1 AutoPay” on your bank statement, it indicates that you’ve given permission for automatic payments through Comenity Capital Bank. This authorization enables the bank to process recurring charges on your behalf.

Authorizing payments through Comenity Capital Bank streamlines your bill payment process. It eliminates the hassle of remembering due dates and manually initiating payments each month. This convenient feature helps you avoid late fees and ensures that your credit card bills are settled promptly.

Once you’ve authorized payments through Comenity Capital Bank, you can rest assured that your bills will be taken care of automatically. This allows you to focus on other aspects of your finances without worrying about missed payments

Might be You’ve Utilized a Store Card

You might encounter the “COMN CAP APY F1 AutoPay” code on your bank statement if you’ve used a store-specific credit card. Comenity Capital Bank provides credit card services for various retail brands. When you make purchases using these store cards, transactions are processed through Comenity.

Store specific credit cards offer benefits like discounts and rewards at partnered retailers. If you’ve utilized one of these cards for your purchases, the “COMN CAP APY F1 AutoPay” code may appear on your bank statement. These cards often come with exclusive offers and financing options tailored to specific stores.

Using a store card linked to Comenity Capital Bank can simplify your shopping experience. You can enjoy perks such as special financing and bonus rewards for your purchases. Keep track of these transactions to ensure accurate billing and monitor your spending habits effectively.

It’s an Auto-Payment

An “Auto-Payment” refers to a system where payments are automatically deducted from your account. Therefore, when you authorize auto payments, transactions such as bill payments are processed without manual intervention. This ensures that your bills are settled on time each month.

Auto payments streamline your financial tasks by eliminating the need for manual bill payments. Consequently, once set up, these payments occur automatically according to the schedule you’ve established. This convenience saves you time and effort in managing your finances.

With auto payments, you reduce the risk of missing payment deadlines and incurring late fees. Therefore, the system ensures that funds are deducted from your account promptly, preventing any potential disruptions in service.

Who Is This Comenity Capital Bank, Anyway?

Comenity Capital Bank specializes in retail credit services, collaborating with retailers to offer store-specific credit cards. Consequently, these cards, customized to each brand, provide benefits like discounts and rewards.

A key player in the market, Comenity Capital Bank facilitates consumer transactions by issuing branded credit cards. Therefore, this partnership fosters customer loyalty and boosts sales for retailers.

With three decades of experience, Comenity Capital Bank is a trusted name in retail credit solutions. Therefore, their consumer finance expertise ensures tailored credit options for customers, enhancing the shopping experience through strategic partnerships.

Can I Dispute This Charge?

Yes, you can dispute the “COMN CAP APY F1 AutoPay” charge if it seems unfamiliar or unauthorized. Promptly contact your bank or card issuer to start the dispute process, providing detailed information and expressing any concerns.

Prepare to share relevant details like the transaction date and supporting documentation. Your bank or card issuer will investigate the charge and aim to resolve the issue promptly, possibly requesting more information from you.

If the charge is found to be unauthorized or fraudulent, your bank or card issuer will take necessary action. This could involve reversing the charge and refunding your account. Keep a close eye on your account statements for updates on the dispute resolution progress.

Frequently Asked Questions

Why am I seeing this charge if I don’t have an account with Comenity Capital Bank?

This charge may appear if you’ve used a store specific credit card associated with Comenity at participating retailers.

How can I confirm if the ACH-COMN-CAP-APY-F1 charge is legitimate?

Review your recent purchases, check for store specific credit card usage, and cross reference with bills or statements.

Is Comenity Capital Bank a legitimate financial institution?

Yes, Comenity Capital Bank is a legitimate financial institution specializing in providing store specific credit cards through partnerships with various retailers and brands.

Can I opt out of automatic payments with Comenity Capital Bank?

Yes, you can contact Comenity Capital Bank or the respective retailer to disable automatic payments and choose manual payment options.

What should I do if I suspect fraudulent activity related to a Comenity Capital Bank charge?

If you suspect fraud, promptly contact your bank or card issuer to report the activity and take necessary steps to secure your account.

In Closing: Navigating the Financial Maze

As you conclude your journey through financial complexities, remember to stay vigilant. Keep monitoring your statements for any irregularities and address them promptly. By staying proactive, you ensure your financial well being.

Reflect on the knowledge gained from deciphering codes like “COMN CAP APY F1 AutoPay.” Understanding your financial transactions empowers you to make informed decisions. Utilize available resources and seek assistance when needed to navigate the financial maze effectively.

With each transaction, you enhance your financial literacy and strengthen your financial security. Take pride in your ability to manage your finances wisely.

In the ever evolving landscape of personal finance, remember that learning is a continuous process. Stay curious, stay informed, and keep adapting to new financial tools and strategies. With determination and perseverance, you can conquer the financial maze and achieve your goals.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.