Property, Plant, and Equipment (PP&E) are big things companies use to make money. These include buildings, machines, and trucks. PP&E is important because it shows how much a company has invested in its business. It helps people understand if a company is growing or not.

“PP&E Explained: Mastering Property, Plant, and Equipment for Business Success” will teach you all about PP&E. This guide is helpful for business owners, investors, and anyone interested in business money matters. You’ll learn how PP&E works and why it’s important for making smart business choices.

PP&E affects many parts of a business. It changes how financial reports look and how companies plan for the future. Understanding PP&E can help businesses use their assets better and make more money. This article will cover different types of PP&E, how to value them, and why they matter for business plans.

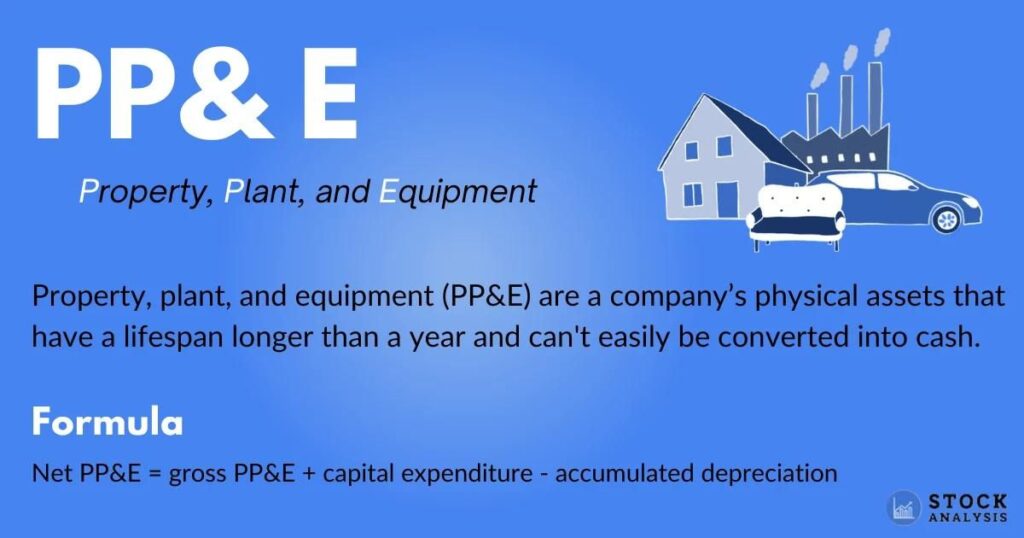

What Is Property, Plant, and Equipment (PP&E)?

Property, Plant, and Equipment, commonly abbreviated as PP&E, represents the long-term tangible assets a company uses in its operations to generate revenue. These fixed assets are expected to provide benefits for more than one year and are essential for the day-to-day functioning of a business.

PP&E items are typically the most substantial physical assets on a company’s balance sheet, reflecting significant capital investment.

The category of PP&E encompasses a wide range of assets, from buildings and land to machinery and vehicles. Unlike inventory or cash, which are considered current assets, PP&E falls under the noncurrent asset category due to its long-term nature.

Understanding the composition and valuation of PP&E is crucial for assessing a company’s operational capacity, financial health, and future growth potential.

What are Examples of PP&E?

PP&E can vary significantly across different industries, but some common examples include office buildings, manufacturing plants, warehouses, and retail stores. For a manufacturing company, PP&E might consist of production machinery, assembly lines, and quality control equipment. In the transportation sector, PP&E could include airplanes, trucks, or ships. Technology companies often have significant investments in data centers and network infrastructure as part of their PP&E.

It’s important to note that while PP&E items are tangible assets, they don’t include assets held for sale in the ordinary course of business.

For instance, a real estate company’s properties held for sale would be classified as inventory rather than PP&E. The key distinction lies in the asset’s intended use within the business operations.

PP&E Formula

The basic formula for calculating PP&E is straightforward but crucial for accurate financial reporting. The PP&E formula is:

Gross PP&E – Accumulated Depreciation = Net PP&E

Gross PP&E represents the total historical cost of all PP&E items, while accumulated depreciation is the sum of depreciation expenses recorded over time. Net PP&E, the figure typically reported on the balance sheet, reflects the current book value of these assets.

Understanding this formula is essential for investors and analysts as it provides insights into a company’s capital investments and asset management strategies.

A company with a high net PP&E value relative to its industry peers might indicate significant investment in operational capacity, potentially positioning it for future growth.

PP&E Calculator

While the PP&E formula is straightforward, calculating PP&E for a large company with numerous assets can be complex. Many businesses use specialized accounting software or PP&E calculators to manage this process efficiently. These tools help track individual assets, calculate depreciation, and generate reports for financial statements.

When using a PP&E calculator, it’s crucial to input accurate data, including the initial cost of each asset, its useful life, and the chosen depreciation method. Regular updates and reconciliations ensure that the PP&E figures reflect the true state of a company’s tangible assets, providing a reliable basis for financial analysis and decision-making.

Types of Assets

In the world of accounting and finance, assets are categorized in several ways to provide a clear picture of a company’s resources. The two main classifications are tangible vs. intangible assets and current vs. non-current assets. PP&E falls squarely into the categories of tangible and non-current assets, making it a significant component of a company’s long-term operational resources.

Tangible assets, like PP&E, have physical substance and can be touched or seen. They include items such as buildings, machinery, and vehicles. In contrast, intangible assets lack physical substance but still hold value for the company. Examples include patents, trademarks, and goodwill.

The distinction between current and non-current assets is based on the expected time frame of their use or conversion to cash. Current assets, like inventory and accounts receivable, are expected to be used or converted to cash within one year, while non-current assets, including PP&E, are held for longer periods.

Accounting for PP&E

Proper accounting for PP&E is crucial for accurate financial reporting and analysis. The process begins with the initial recognition and measurement of PP&E items. When a company acquires a PP&E asset, it’s recorded at its historical cost, which includes the purchase price and any directly attributable costs of bringing the asset to its intended use.

This approach, known as historical cost accounting, provides a consistent basis for valuing PP&E over time. Once an asset is in use, companies must account for its depreciation. Depreciation is the systematic allocation of an asset’s cost over its useful life, reflecting the gradual consumption of the asset’s economic benefits.

There are several depreciation methods, including straight-line, declining balance, and units of production. The choice of method can significantly impact a company’s reported earnings and asset values, making it an important consideration in financial analysis.

Example

Let’s consider a practical example to illustrate PP&E accounting. Imagine a manufacturing company, XYZ Corp, purchases a new piece of machinery for $100,000. The machine is expected to have a useful life of 10 years and a salvage value of $10,000 at the end of its life. Using the straight-line depreciation method, the annual depreciation expense would be:

($100,000 – $10,000) / 10 years = $9,000 per year

After 5 years, the balance sheet would show:

- Gross PP&E (Machinery): $100,000

- Accumulated Depreciation: $45,000 (5 years x $9,000)

- Net PP&E: $55,000

This example demonstrates how PP&E values change over time due to depreciation, affecting both the balance sheet and income statement.

What PP&E Value Means

The PP&E value reported on a company’s balance sheet provides valuable insights into its operational capacity and investment strategy. A high PP&E value relative to total assets suggests a capital-intensive business with significant investments in physical infrastructure.

This could indicate a company well-positioned for growth, but it also means higher fixed costs and potentially less flexibility in economic downturns. Conversely, a low PP&E value might suggest a less capital-intensive business model, such as a service-oriented company or one that relies heavily on leased assets.

When analyzing PP&E values, it’s essential to consider industry norms and the company’s specific business strategy. Changes in PP&E over time can also reveal important trends, such as expansion efforts or divestment of underperforming assets.

Why Should Investors Pay Attention to PP&E?

Investors should closely monitor PP&E figures as they offer crucial insights into a company’s operational health and future prospects. A company’s PP&E investments reflect its long-term strategy and commitment to growth. Significant increases in PP&E might indicate expansion plans or modernization efforts, potentially leading to increased productivity and revenue in the future.

However, investors should also be wary of excessive or inefficient PP&E investments. High PP&E values without corresponding revenue growth could suggest overcapacity or poor asset utilization. By comparing PP&E trends with revenue and profitability metrics, investors can gauge how effectively a company is using its capital investments to generate returns.

How Do the Values of Tangible and Intangible Assets Differ?

While PP&E represents tangible assets, many companies also hold significant intangible assets like patents, trademarks, and brand value. The valuation and accounting treatment of these asset types differ considerably. Tangible assets like PP&E are typically valued at historical cost minus depreciation, providing a relatively straightforward (though not always accurate) measure of their worth.

Intangible assets, on the other hand, can be more challenging to value. Some intangibles, like purchased patents, are recorded at cost and amortized over time. Others, like internally developed brands or customer relationships, may not appear on the balance sheet at all due to accounting rules. This discrepancy can lead to significant differences between a company’s book value and its market value, especially for businesses with strong brand recognition or innovative technologies.

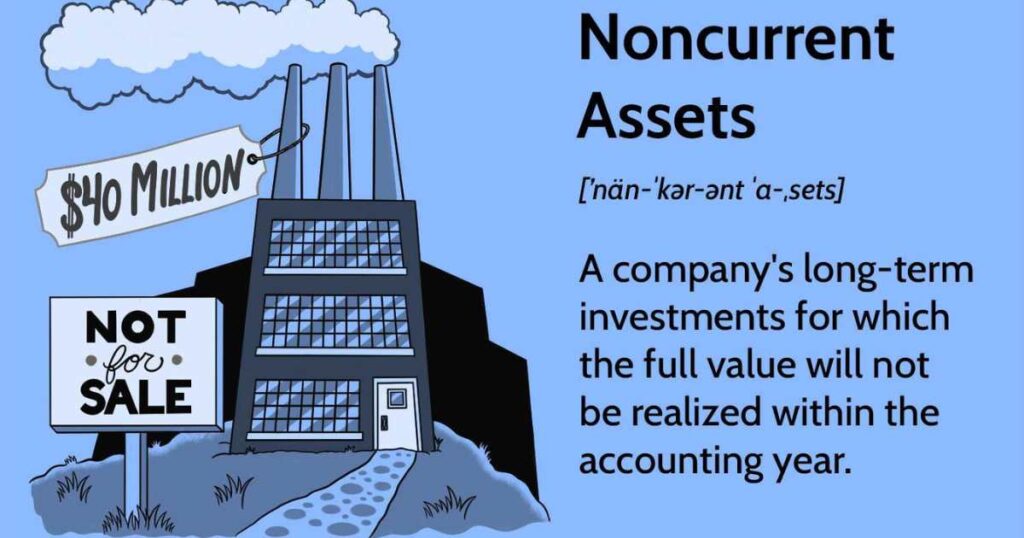

What Are Noncurrent Assets?

Noncurrent assets, also known as long-term assets, are resources a company expects to use for more than one year. PP&E is a primary component of noncurrent assets, but this category also includes long-term investments, intangible assets, and deferred tax assets. The common thread among noncurrent assets is their long-term nature and their role in supporting the company’s operations over an extended period.

Understanding the composition of a company’s noncurrent assets can provide insights into its long-term strategy and revenue-generating capacity. For instance, a high proportion of PP&E among noncurrent assets might indicate a capital-intensive business model, while a significant intangible asset base could suggest a focus on innovation or brand value.

Analyzing the mix of noncurrent assets and their trends over time can help investors and analysts assess a company’s risk profile and growth potential.

The Bottom Line

Mastering the concepts of Property, Plant, and Equipment is essential for anyone looking to gain a deeper understanding of business operations and financial health. PP&E represents the backbone of many companies, providing the necessary infrastructure for producing goods and services.

By carefully analyzing PP&E figures and trends, investors, managers, and financial professionals can gain valuable insights into a company’s operational capacity, investment strategy, and future prospects. Remember that while PP&E is a crucial aspect of financial analysis, it should always be considered in conjunction with other financial metrics and industry-specific factors.

A holistic approach to financial analysis, incorporating PP&E alongside other balance sheet items, income statement figures, and cash flow metrics, will provide the most comprehensive view of a company’s financial health and potential for success.

Conclusion

Whether you’re assessing investment opportunities, managing a business, or simply seeking to enhance your financial literacy, a solid grasp of PP&E concepts will serve you well. By understanding the role of these tangible assets in business operations and financial reporting, you’ll be better equipped to make informed decisions and contribute to business success.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.