In the world of accounting, understanding the difference between temporary and permanent accounts is crucial. This knowledge forms the foundation of accurate financial reporting and informed decision-making.

Today, we’re diving deep into the realm of accounts to answer the burning question: which is not a temporary account? By the end of this article, you’ll have a clear grasp of permanent accounts, their importance, and how they differ from their temporary counterparts.

Why Is It Important to Understand the Difference between a Temporary Account and a Permanent Account?

Knowing the distinction between temporary and permanent accounts is like having a superpower in the financial world. It’s not just about impressing your colleagues with accounting jargon; this knowledge has real-world implications for businesses of all sizes.

When you can confidently identify which accounts are permanent, you’re better equipped to analyze a company’s financial health, make strategic decisions, and ensure compliance with accounting standards.

Think of permanent accounts as the bedrock of your company’s financial structure. They provide a long-term view of your business’s financial position, allowing you to track growth and stability over time.

On the other hand, temporary accounts give you a snapshot of performance within a specific accounting period. By understanding both, you’re able to paint a complete picture of your organization’s financial landscape, enabling more accurate forecasting and better-informed strategic planning.

Understanding Temporary Accounts:

Before we delve into permanent accounts, let’s take a moment to understand their counterparts. Temporary accounts are like guests at a party – they come, they serve their purpose, and then they leave.

These accounts are used to record transactions that occur within a specific accounting period, typically a fiscal year. At the end of this period, they’re zeroed out and their balances are transferred to permanent accounts.

Common examples of temporary accounts include revenue accounts, expense accounts, and the income summary account. These accounts play a starring role in your profit and loss statement, providing a detailed look at your business’s performance over a given period.

They’re essential for calculating net income, which is then transferred to the retained earnings account – a permanent fixture on your balance sheet. Understanding the temporary nature of these accounts is key to grasping the concept of the accounting cycle and the process of closing entries.

Understanding Permanent Accounts:

Now, let’s shine a spotlight on permanent accounts – the unsung heroes of the balance sheet. Unlike their temporary counterparts, permanent accounts are in it for the long haul. They carry their balances from one accounting period to the next, providing a continuous record of a company’s financial position.

These accounts are the backbone of your financial statements, offering a snapshot of your business’s assets, liabilities, and equity at any given time.

Permanent accounts include asset accounts like cash, inventory, and equipment; liability accounts such as loans and accounts payable; and equity accounts like common stock and retained earnings.

These accounts don’t get closed out at the end of the accounting period. Instead, they continue to accumulate balances, painting a picture of your company’s financial health over time. This ongoing nature makes permanent accounts crucial for long-term financial analysis and decision-making.

Purpose of Permanent Accounts

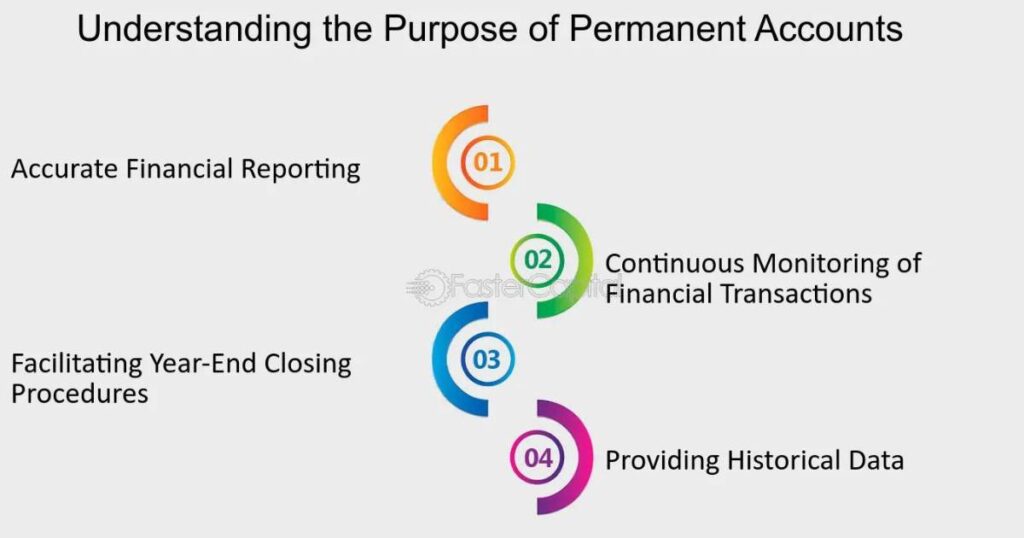

The purpose of permanent accounts extends far beyond simply keeping track of numbers. These accounts serve as the financial DNA of your business, providing a historical record of your company’s growth and financial position.

They offer invaluable insights into your organization’s liquidity, solvency, and overall financial stability. By maintaining a continuous record, permanent accounts allow for year-over-year comparisons, trend analysis, and long-term financial planning.

Moreover, permanent accounts play a critical role in the preparation of financial statements. They form the basis of your balance sheet, which is a key document for investors, creditors, and other stakeholders.

The information contained in permanent accounts helps these parties assess the company’s financial health, make investment decisions, and evaluate creditworthiness. In essence, permanent accounts tell the ongoing story of your business’s financial journey, making them indispensable for both internal management and external reporting purposes.

Examples of Permanent Accounts:

To further clarify the concept of permanent accounts, let’s explore some common examples. These accounts are the pillars of your company’s financial structure, providing a lasting record of its financial position:

- Cash: This account represents the money your company has on hand or in the bank.

- Accounts Receivable: This tracks money owed to your business by customers or clients.

- Inventory: This account records the value of goods your company has on hand for sale.

- Property, Plant, and Equipment: These accounts represent long-term assets owned by the company.

- Accounts Payable: This tracks money your company owes to suppliers or vendors.

- Long-term Debt: This account represents loans or other long-term financial obligations.

- Common Stock: This account shows the ownership interest in the company.

- Retained Earnings: This represents the accumulated profits that haven’t been distributed to shareholders.

Each of these accounts tells a part of your company’s financial story. For instance, the cash account gives insight into your liquidity, while the inventory account provides information about your operational efficiency. The retained earnings account, a key permanent account, shows how much profit the company has reinvested over time, offering a glimpse into its growth strategy and financial health.

Ongoing Nature and Role in Financial Reporting:

The ongoing nature of permanent accounts is what sets them apart in the world of accounting. Unlike temporary accounts that reset to zero at the end of each accounting period, permanent accounts carry their balances forward indefinitely. This continuous record-keeping is crucial for maintaining an accurate picture of a company’s financial position over time. It allows for historical analysis, trend identification, and long-term financial planning.

In terms of financial reporting, permanent accounts are the stars of the balance sheet. They provide a snapshot of what a company owns (assets), owes (liabilities), and the residual interest of the owners (equity) at a specific point in time. This information is vital for various stakeholders, including investors, creditors, and management.

For example, a potential investor might analyze the trend in the company’s cash account over several years to assess its liquidity position. Similarly, a creditor might look at the long-term debt account to evaluate the company’s financial leverage. The ongoing nature of permanent accounts makes such analyses possible and meaningful.

Identifying Permanent Accounts:

Identifying permanent accounts becomes second nature once you understand their key characteristics. These accounts are the constants in your company’s financial equation, persisting from one accounting period to the next.

They’re not affected by the closing process at the end of the fiscal year, unlike their temporary counterparts. Instead, they maintain their balances, providing a continuous record of your company’s financial position.

One way to spot a permanent account is to ask yourself: “Does this account represent something the company owns, owes, or is owed?” If the answer is yes, you’re likely looking at a permanent account. Another telltale sign is the account’s presence on the balance sheet. All accounts that appear on this financial statement are permanent.

While the balances in these accounts may change due to transactions, the accounts themselves remain open indefinitely, ready to record the next chapter in your company’s financial story.

Common Characteristics of Permanent Accounts

Permanent accounts share several common characteristics that distinguish them from their temporary counterparts. Understanding these traits can help you quickly identify which accounts fall into this category:

- Continuous Existence: Permanent accounts don’t close at the end of the accounting period. They persist from one period to the next, maintaining their balances.

- Balance Sheet Presence: These accounts are always found on the balance sheet, representing the company’s assets, liabilities, and equity.

- Cumulative Nature: The balances in permanent accounts accumulate over time, reflecting the company’s financial history.

- No Direct Impact on Net Income: Unlike temporary accounts, permanent accounts don’t directly affect the calculation of net income for the period.

- Subject to Adjustments: While permanent accounts don’t close, they can be adjusted for accuracy through processes like depreciation or revaluation.

- Integral to Financial Position: These accounts provide a snapshot of the company’s financial standing at any given time.

- Long-term Focus: Permanent accounts are crucial for long-term financial analysis and decision-making.

- Basis for Financial Ratios: Many important financial ratios, such as the current ratio or debt-to-equity ratio, are calculated using permanent account balances.

Understanding these characteristics helps in grasping the role of permanent accounts in the broader context of financial reporting and analysis. They form the foundation of a company’s financial structure, providing stability and continuity in financial records.

Key Differences from Temporary Accounts:

Understanding the key differences between permanent and temporary accounts is crucial for accurate financial reporting and analysis. Here’s a comparison table to highlight these differences:

| Aspect | Permanent Accounts | Temporary Accounts |

| Duration | Ongoing, carry balances forward | Reset to zero at period end |

| Financial Statement | Balance Sheet | Income Statement |

| Closing Process | Not closed at period end | Closed to Income Summary |

| Impact on Net Income | Indirect impact | Direct impact |

| Examples | Cash, Equipment, Accounts Payable | Revenue, Expenses, Dividends |

| Purpose | Show financial position | Show periodic performance |

| Accumulation | Balances accumulate over time | Represent activity within a period |

| Reporting Period | Reflect balances at a point in time | Show activity over a period |

These differences underscore the distinct roles that permanent and temporary accounts play in financial reporting. While temporary accounts provide insights into a company’s performance over a specific period, permanent accounts offer a long-term view of its financial health and stability.

Specific Accounts Analysis

Now that we’ve covered the general characteristics of permanent and temporary accounts, let’s dive into some specific accounts and determine their classification. This analysis will help solidify your understanding and provide practical examples of how to apply this knowledge.

Is Interest Income a Temporary Account?

Interest income is indeed a temporary account. It represents the money earned from investments or lending activities during a specific accounting period. As a revenue account, it contributes to the company’s net income for the period and is closed out at the end of the accounting cycle. The balance of the interest income account is transferred to the income summary account and ultimately to retained earnings, which is a permanent account.

Is Salaries Expense a Temporary Account?

Salaries expense is another example of a temporary account. It records the amount paid to employees during an accounting period. Like all expense accounts, salaries expense is closed out at the end of the period.

Its balance is transferred to the income summary account, affecting the calculation of net income. The closing process resets the salaries expense account to zero, ready to track expenses in the new accounting period.

Is Service Revenue a Temporary Account?

Service revenue is indeed a temporary account. It records the income earned from providing services to customers during a specific accounting period. As a revenue account, it directly impacts the company’s net income and is closed out at the end of the accounting cycle.

The balance is transferred to the income summary account and ultimately to retained earnings, which is a permanent account on the balance sheet.

Are Dividends a Temporary Account?

Dividends are considered a temporary account, despite their connection to the permanent account of retained earnings. Dividend accounts track distributions to shareholders during a specific period.

At the end of the accounting cycle, the dividends account is closed directly to retained earnings, reducing the balance of this permanent account. This process reflects the outflow of company profits to its shareholders.

Is Common Stock a Permanent Account?

Common stock is a prime example of a permanent account. It represents the par value of the stock issued by a corporation and is a key component of the owner’s equity section on the balance sheet.

The common stock account maintains its balance from one period to the next, providing a continuous record of the company’s issued stock. It’s not affected by the closing process and continues to reflect the company’s capital structure over time.

Is Service Revenue a Permanent Account?

As mentioned earlier, service revenue is not a permanent account. It’s a temporary account that records income from services provided during a specific period. While the impact of service revenue ultimately affects the permanent account of retained earnings, the service revenue account itself is closed out at the end of each accounting period. This closure ensures that each period’s performance can be accurately measured and compared.

Practical Application in Accounting

Understanding the distinction between permanent and temporary accounts isn’t just theoretical – it has real-world implications for accounting practices and financial management. This knowledge is essential for maintaining accurate books, preparing financial statements, and making informed business decisions. Let’s explore how this understanding applies in practical accounting scenarios.

One of the most significant applications is in the closing process at the end of an accounting period. Temporary accounts, such as revenues and expenses, are closed out to the income summary account, which is then closed to retained earnings. This process ensures that these accounts start each new period with a zero balance, allowing for clear performance tracking.

Permanent accounts, on the other hand, retain their balances, providing a continuous record of the company’s financial position. This distinction is crucial for maintaining the integrity of financial records and enabling meaningful period-to-period comparisons.

The Impact of Account Classification on Financial Statements and Business Decision-Making

The classification of accounts as permanent or temporary has a profound impact on financial statements and, consequently, on business decision-making. Permanent accounts form the backbone of the balance sheet, providing a snapshot of the company’s financial position at a specific point in time.

This information is crucial for assessing the company’s liquidity, solvency, and overall financial health. For instance, a strong balance sheet with significant assets and minimal liabilities can instill confidence in investors and creditors.

Temporary accounts, while not appearing on the balance sheet, play a vital role in the income statement. They provide a detailed view of the company’s performance over a specific period, showing how efficiently the business generates revenue and manages expenses.

This information is invaluable for evaluating operational efficiency, identifying areas for cost-cutting, and making pricing decisions. The net income figure, derived from these temporary accounts, ultimately impacts the retained earnings – a permanent account – thus linking the income statement to the balance sheet.

Closing Temporary Accounts and Transferring to Permanent Accounts

The process of closing temporary accounts and transferring their balances to permanent accounts is a crucial step in the accounting cycle. This procedure, known as the closing process, ensures that temporary accounts start each new period with a clean slate, while permanent accounts carry forward the cumulative financial history of the business. Here’s a step-by-step breakdown of this process:

- Close Revenue Accounts: Transfer the balance of all revenue accounts to the Income Summary account.

- Close Expense Accounts: Transfer the balance of all expense accounts to the Income Summary account.

- Close Income Summary: Transfer the net balance of the Income Summary account to Retained Earnings.

- Close Dividends: If applicable, close the Dividends account directly to Retained Earnings.

This process effectively transfers the net income or loss for the period to the Retained Earnings account, a permanent account on the balance sheet. It’s through this mechanism that the performance captured in temporary accounts ultimately impacts the company’s long-term financial position reflected in permanent accounts.

FAQs

What is the main difference between permanent and temporary accounts?

Permanent accounts carry their balances forward indefinitely, while temporary accounts are closed out at the end of each accounting period.

Can a permanent account ever be closed?

While rare, permanent accounts can be closed in specific situations, such as when a company is liquidated or undergoes a major restructuring.

How do permanent accounts impact financial analysis?

Permanent accounts provide historical data for trend analysis and are crucial for calculating many financial ratios used in assessing a company’s health.

Are all balance sheet accounts permanent?

Yes, all accounts that appear on the balance sheet are permanent accounts.

How often are permanent account balances updated?

Permanent account balances are updated with each transaction that affects them, providing a real-time view of the company’s financial position.

Conclusion

In the intricate world of accounting, understanding which accounts are not temporary is key to maintaining accurate financial records and making informed business decisions. Permanent accounts, including assets, liabilities, and equity accounts, form the bedrock of a company’s financial structure. They provide a continuous record of financial position, carrying their balances forward from one period to the next.

Throughout this article, we’ve explored the characteristics of permanent accounts, their role in financial reporting, and how they differ from temporary accounts. We’ve seen that accounts like cash, inventory, accounts payable, and common stock are all examples of permanent accounts. These accounts tell the ongoing story of a company’s financial journey, providing valuable insights for stakeholders both inside and outside the organization.

Remember, while temporary accounts like revenue and expenses are crucial for measuring periodic performance, it’s the permanent accounts that provide the long-term view of a company’s financial health. By mastering the distinction between these account types, you’re equipping yourself with a powerful tool for financial analysis and decision-making.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.