In recent developments, progressive lawmakers and advocates have intensified their efforts to persuade the Biden administration to terminate its contract with MOHELA, a prominent Missouri-based student loan servicer.

This push comes amidst growing concerns about the company’s practices and its impact on millions of student borrowers across the United States.

The situation has brought to light significant issues within the student loan servicing industry, particularly focusing on MOHELA performance and its role in managing crucial federal student loan programs.

Background on MOHELA

MOHELA, which stands for the Higher Education Loan Authority of the State of Missouri, is a major player in the student loan servicing industry. Established as a non-profit organization, MOHELA has been entrusted with managing federal student loans for nearly 8 million borrowers.

In 2022, the company secured a significant contract to handle the U.S. Department of Education Public Service Loan Forgiveness (PSLF) program, a move that substantially expanded its influence in the sector.

As a student loan servicer, MOHELA’s responsibilities include:

- Processing loan payments

- Maintaining borrower accounts

- Providing customer service to borrowers

- Assisting with repayment plans and loan forgiveness programs

The company’s role is crucial in the lives of millions of Americans struggling with student debt, making its performance a matter of significant public interest.

Concerns Raised by Progressives

The push to cut ties with MOHELA stems from a series of allegations and concerns raised by progressive lawmakers and advocacy groups. These concerns paint a troubling picture of the servicer’s operations and its impact on borrowers:

- Predatory Practices: Critics argue that MOHELA engages in practices that prioritize profit over the well-being of borrowers.

- Administrative Failures: There are reports of widespread mismanagement and administrative errors affecting borrowers’ accounts.

- Customer Service Issues: Many borrowers have reported excessively long wait times, sometimes extending to several hours, when seeking assistance.

- Mishandling of Loan Forgiveness Programs: Particularly concerning are allegations of failures in processing applications for the Public Service Loan Forgiveness program.

These issues have reportedly led to significant hardships for borrowers, including delayed loan forgiveness, incorrect billing, and difficulties in accessing crucial information about their loans.

Key Figures Pushing for Change

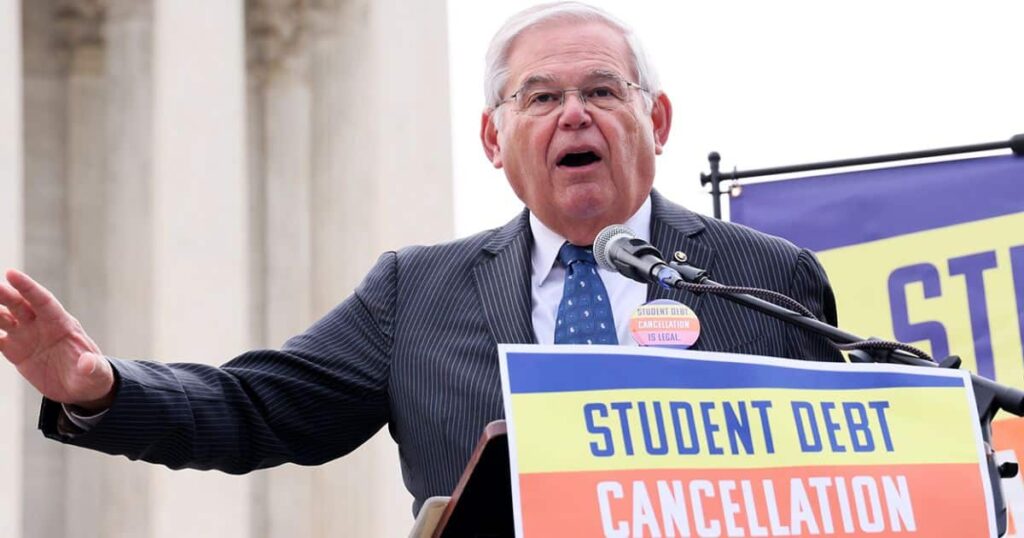

The movement to sever ties with the Missouri student loan servicer is spearheaded by several prominent progressive lawmakers and advocacy groups:

Lawmakers:

- Rep. Ilhan Omar (D-Minnesota)

- Rep. Ayanna Pressley (D-Massachusetts)

- Rep. Greg Casar (D-Texas)

- Sen. Ed Markey (D-Massachusetts)

Advocacy Groups:

- Debt Collective

- Student Borrower Protection Center

- American Federation of Teachers

These individuals and organizations have been vocal in their criticism of MOHELA, organizing press conferences and releasing reports to highlight the servicer’s alleged failures. Their collective efforts have brought national attention to the issues surrounding student loan servicing and have put pressure on the Biden administration to take action.

Evidence Supporting Progressives Claims

The push to cut ties with MOHELA is not based on mere speculation. Several pieces of evidence have been presented to support the claims against the servicer:

- Class-Action Lawsuits: MOHELA is currently facing two class-action lawsuits. These legal actions accuse the company of failing to process applications for the Public Service Loan Forgiveness program in a timely manner, potentially denying borrowers the debt relief they are entitled to.

- Damning Report: A February 2024 report jointly released by the Student Borrower Protection Center and the American Federation of Teachers provided damaging statistics:

- Over 40% of borrowers serviced by MOHELA reportedly experienced a servicing failure since loan payments resumed in September 2023.

- The report detailed instances of lost paperwork, misinformation, and systemic obstacles that jeopardized borrowers’ financial stability.

- Personal Testimonies: Numerous borrowers have come forward with personal accounts of their struggles with MOHELA. For instance, Shamell Bell, a member of the Debt Collective, described her interactions with the servicer as “nothing short of a nightmare,” citing a labyrinth of false information and promises.

These pieces of evidence collectively paint a picture of a loan servicer that is failing to meet its obligations to borrowers, leading to calls for the Biden administration to take decisive action.

Also Read: Everything You Need to Know About Silver Dollar City Tickets & Season Passes

MOHELA Response

In the face of these allegations, MOHELA has not remained silent. The company has taken several steps to defend its reputation and practices:

- Cease and Desist Letter: In March 2024, MOHELA sent a cease and desist letter to the Student Borrower Protection Center, accusing the organization of making “false, misleading and sensationalized claims” about its business activities.

- Public Statement: A spokesperson for MOHELA released a statement asserting the company’s commitment to providing “the highest quality of customer service to the borrowers that we serve.”

- Dispute of Claims: MOHELA has consistently disputed the claims made against it, arguing that spreading false information does not benefit borrowers.

Despite these efforts, the controversy surrounding MOHELA continues to grow, placing increased pressure on both the company and the Department of Education to address the concerns raised by progressives and borrowers.

Broader Context of Student Loan Issues

The push to cut ties with MOHELA is set against a backdrop of broader efforts to address the student debt crisis in the United States. The Biden administration has taken several steps to provide relief to borrowers:

| Date | Action | Impact |

| May 2024 | Announcement of additional debt relief | $7.7 billion for 160,500 borrowers |

| Cumulative | Total loan forgiveness approved | $167 billion for 4.75 million Americans |

These actions demonstrate the administration’s commitment to addressing the student debt crisis. However, critics argue that more comprehensive reforms are needed, particularly in the area of loan servicing.

Read Also: What Is A Plan 1 Or Plan 2 Student Loan?

Potential Implications of Cutting Ties with MOHELA

If the Biden administration were to heed the calls of progressives and terminate its contract with MOHELA, the implications would be significant:

- Impact on Current Borrowers: Millions of borrowers would need to be transitioned to a new servicer, potentially causing short-term disruptions.

- Transition Challenges: The Department of Education would face the complex task of transferring millions of accounts to a new servicer or servicers.

- Opportunity for Improvement: A change in servicers could provide an opportunity to implement stronger oversight and improved practices in loan servicing.

The Push for Reform in Student Loan Servicing

The controversy surrounding MOHELA has reignited calls for comprehensive reform in the student loan servicing industry. Advocates are pushing for:

- Increased Accountability: Stricter oversight of loan servicers to ensure they are acting in the best interests of borrowers.

- Improved Customer Service: Mandates for faster response times and more accurate information for borrowers.

- Streamlined Forgiveness Programs: Simplification of the application and approval process for loan forgiveness programs.

- Enhanced Department of Education Oversight: Calls for the Department to take a more active role in monitoring and regulating loan servicers.

These proposed reforms aim to address the systemic issues that have led to the current situation with MOHELA and other loan servicers.

Conclusion

The push by progressives for the Biden administration to cut ties with MOHELA, the Missouri student loan servicer, highlights the ongoing challenges in the student loan system. As millions of Americans struggle with student debt, the performance of loan servicers like MOHELA has come under intense scrutiny. The allegations of mismanagement, poor customer service, and failures in processing loan forgiveness applications have led to calls for significant changes in how student loans are serviced.

As this debate continues, it’s clear that the issues surrounding student loan servicing will remain a critical part of the broader conversation about higher education affordability and accessibility in the United States. The outcome of this push could have far-reaching implications for millions of student loan borrowers and may set the stage for more comprehensive reforms in the future.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.