In today’s increasingly digital world, electronic payment methods have become essential for simplifying billing and transferring money.

Two of the most popular options are Automated Clearing House (ACH) transfers and wire transfers. While both methods facilitate the movement of funds from one bank account to another, they have distinct differences that make them suitable for different situations.

In this article, we will explore the key aspects of ACH transfers and wire transfers, helping you determine which option best suits your needs.

What are ACH Transfers?

An ACH transfer involves the movement of funds between banks, credit unions, or other financial institutions through an electronic network. This type of transfer is commonly used for various purposes, such as:

- Direct deposit of paychecks and government benefits

- Recurring bill payments (e.g., utilities, credit card bills)

- Person-to-person (P2P) payments via apps like PayPal, Venmo, and Zelle

- Business-to-business (B2B) payments

- International payments

ACH transfers are often free or low-cost, making them an attractive option for consumers and businesses alike. In the second quarter of 2022 alone, approximately 7.7 billion same-day ACH payments totaling $19.7 trillion were processed.

How ACH Transfers Work?

When an ACH transfer is initiated, the originating financial institution batches the transaction with other ACH requests and sends them to an ACH operator at designated times throughout the day. The ACH operator then sorts the transactions and forwards them to the receiving financial institutions, which process the payments and credit or debit the appropriate accounts.

ACH transfers can take 1-3 business days to complete, depending on the type of transaction and the timing of the request. However, same-day ACH processing is becoming increasingly common, allowing for faster settlement of payments.

Related Post: What Is The Quick Card San Diego Charge on Your Bank Statement?

What are Wire Transfers?

A wire transfer is an electronic fund transfer that moves money directly from one bank account to another. When both the sending and receiving banks are located within the United States, it is known as a domestic wire transfer. If one of the banks is outside the U.S., it is referred to as an international wire transfer or a remittance transfer.

Wire transfers are typically used when there is a need to send large amounts of money quickly and securely. Common use cases include:

- Real estate transactions (e.g., down payments, closing costs)

- Car purchases

- Large business transactions

- International money transfers

Wire transfers can be initiated through banks, credit unions, or money transfer services like Western Union and MoneyGram.

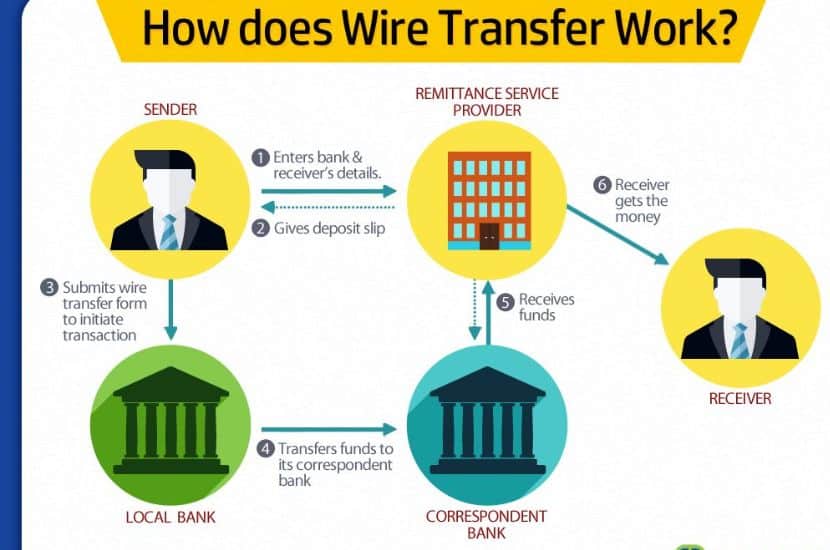

How Wire Transfers Work

To initiate a wire transfer, the sender provides their bank with the necessary information, including the recipient’s name, bank account details, and the amount to be transferred. The sending bank then communicates directly with the receiving bank to transfer the funds. Once the receiving bank accepts the transfer, the funds are credited to the recipient’s account.

Wire transfers are known for their speed, with funds often available in the recipient’s account within a few hours or on the same business day. However, this convenience comes at a cost, as wire transfer fees can range from $25 to $50 or more, depending on the bank and whether the transfer is domestic or international.

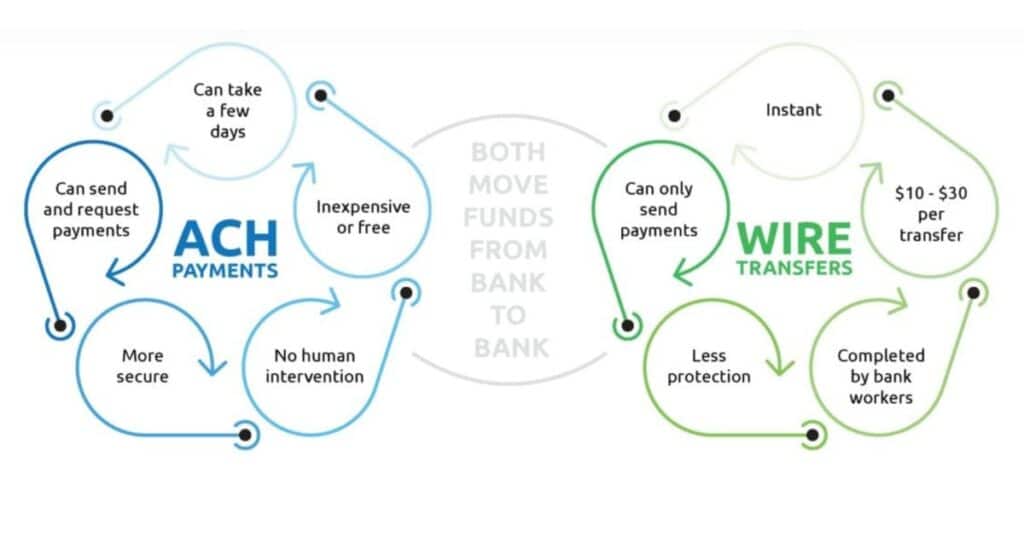

Key Differences Between ACH and Wire Transfers

Now that we have a basic understanding of ACH transfers and wire transfers, let’s explore their key differences in more detail.

Speed

One of the most significant differences between ACH transfers and wire transfers is the speed at which funds are processed and made available to the recipient.

- Wire transfers are generally faster, with funds often available in the recipient’s account on the same day or within a few hours of initiation.

- ACH transfers can take 1-3 business days to complete, although same-day processing is becoming more common.

Cost

Another important factor to consider when choosing between ACH transfers and wire transfers is the cost associated with each method.

- ACH transfers are usually free or come with low fees, making them a more cost-effective option for frequent or recurring payments.

- Wire transfers typically involve higher fees, ranging from $25 to $50 or more, depending on the bank and whether the transfer is domestic or international.

Transfer Limits

Financial institutions may impose different limits on ACH transfers and wire transfers, which can impact your decision when moving large sums of money.

- Wire transfers generally have higher transfer limits, making them suitable for large transactions such as real estate purchases or business payments.

- ACH transfers may have lower limits, depending on the type of transaction and the policies of the financial institutions involved.

Security

Both ACH transfers and wire transfers are secure methods of moving money electronically, but they are not immune to fraud and scams.

- ACH transfers have become a more common target for fraud in recent years, as scammers attempt to exploit the growing popularity of this payment method.

- Wire transfers have historically been a target for scammers, particularly in the context of real estate transactions and other high-value payments.

It is essential for both consumers and businesses to be vigilant and follow best practices when using either method, such as verifying the recipient’s information and being cautious of unsolicited payment requests.

Reversibility

In the event of an error or fraud, the ability to reverse or cancel a transaction can be a critical factor in choosing between ACH transfers and wire transfers.

- Wire transfers are generally difficult or impossible to reverse once the funds have been sent and accepted by the receiving bank.

- ACH transfers can be stopped, reversed, or canceled under certain circumstances, such as when a payment is unauthorized or processed in error.

| Feature | ACH Transfers | Wire Transfers |

| Speed | 1-3 business days; same-day processing becoming more common | Same day or within a few hours |

| Cost | Often free or low fees | Higher fees ($25-$50 or more) |

| Transfer Limits | May have lower limits | Generally higher limits |

| Security | Increasingly targeted by scammers | Historically a target for fraud |

| Reversibility | Can be stopped, reversed, or canceled under certain circumstances | Difficult or impossible to reverse once sent and accepted |

When to Use ACH vs Wire Transfers

Choosing between ACH transfers and wire transfers depends on your specific needs and priorities. Here are some general guidelines to help you make an informed decision:

ACH Transfers are Ideal for:

- Recurring payments, such as bills or direct deposit of paychecks

- Domestic transactions that don’t require immediate processing

- Situations where cost is a primary concern

Wire Transfers are Best for:

- Time-sensitive, large-sum transactions, such as real estate closings or car purchases

- International money transfers

- Situations where speed and security are top priorities

Related Post: What is an eCheck and How Does eCheck Payment Work?

The Future of Electronic Payment Methods

As technology continues to advance, electronic payment methods like ACH transfers and wire transfers will likely evolve to meet the changing needs of consumers and businesses. New technologies and payment platforms may emerge, offering even faster, more secure, and more convenient ways to move money.

Staying informed about these developments and understanding the differences between various payment methods will be crucial for effective financial management in the years to come.

FAQ’s

Which is better, ACH or wire transfer?

The choice between ACH and wire transfer depends on your specific needs. ACH transfers are generally cheaper and suitable for domestic, non-urgent transactions, while wire transfers are faster, more expensive, and better for large, time-sensitive, or international payments.

What does ACH transfer mean?

ACH (Automated Clearing House) transfer is an electronic fund transfer processed through the ACH network, which connects financial institutions across the United States. It facilitates the movement of money between banks, credit unions, and other participating institutions.

Are ACH transactions only domestic?

ACH transactions are primarily used for domestic transfers within the United States. However, some international ACH transactions (IATs) may be possible depending on your bank or the destination country.

What is the difference between SWIFT ACH and wire transfer?

SWIFT is a global messaging system used for international wire transfers, while ACH is a US-based electronic network for processing domestic transactions. Wire transfers are generally faster and more expensive than ACH transfers.

Is IBAN the same as ACH?

No, IBAN (International Bank Account Number) is a standardized format for identifying bank accounts across national borders, primarily used in Europe. ACH is a US-based electronic network for processing domestic transactions.

Can you use ACH for international payments?

While ACH is primarily used for domestic transactions within the US, some banks may offer international ACH services for certain countries. However, wire transfers or other methods like SWIFT are more commonly used for international payments.

Conclusion

ACH transfers and wire transfers are both valuable tools in the world of electronic payments, each with its own strengths and weaknesses. By understanding the key differences between these two methods, including speed, cost, transfer limits, security, and reversibility, you can make informed decisions about which option best suits your needs.

Whether you’re a consumer looking to streamline your personal finances or a business seeking efficient payment solutions, knowing when to use ACH transfers or wire transfers can help you save time, money, and potential headaches down the road.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.