Have you ever looked at your bank statement and been confused by terms like “POS debit” or “POS” next to certain transactions? Understanding these terms is crucial for both customers and businesses to avoid frustration, fraud claims, and costly chargebacks.

This comprehensive guide will demystify POS debit and point of sale charges, providing clarity on what they mean, how they work, and best practices for ensuring smooth transactions.

What is a POS (Point of Sale) Transaction?

A POS (Point of Sale) transaction refers to any sale made through a point-of-sale system. This could be a physical POS terminal in a store, an online ordering system, or even a mobile payment app.

Essentially, any purchase that involves a customer making a payment at the “point of sale” is considered a POS transaction.

Understanding POS Debit

POS debit is a specific type of POS transaction that involves the use of a debit card. When a customer pays with their debit card at the point of sale, whether it’s at a physical terminal or through an online checkout process, the transaction is classified as a POS debit.

POS debit transactions can occur in various scenarios, including:

- In-store purchases: Customers swipe, insert, or tap their debit card at the merchant’s POS terminal and enter their Personal Identification Number (PIN) to authenticate the transaction.

- Online purchases: Customers enter their debit card information on an e-commerce website and complete the purchase through an online POS system.

- ATM withdrawals: Customers use their debit card to withdraw cash from an ATM, which is also considered a POS debit transaction.

It’s important to note that some POS debit transactions may not require a PIN, such as contactless payments or certain online purchases. In these cases, the transaction may be described as a “DBT Purchase” (Debit Purchase) on the bank statement.

POS Debit vs Credit Card Transactions

While both debit and credit cards can be used for POS transactions, there are significant differences between the two:

| POS Debit | Credit Card |

| Funds are directly debited from the customer’s checking account | Funds are borrowed from the credit card network, and the customer must pay back the amount later |

| Lower transaction fees for merchants due to lower risk | Higher transaction fees for merchants due to the risk of non-payment |

| Fees are capped at 0.05% + $0.22 per transaction (Durbin Amendment) | No similar fee protections; rates can fluctuate |

For merchants, encouraging customers to use debit cards can be advantageous due to the lower processing fees and reduced risk of non-payment.

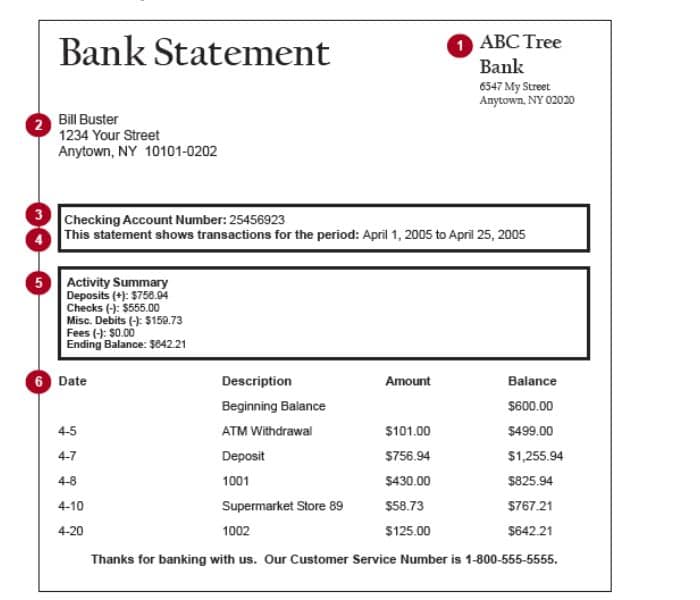

Typical Bank Statement Descriptions

When customers review their bank statements, they may encounter various terms related to POS transactions:

- POS: This generally indicates a transaction made through a point-of-sale system, regardless of the payment method used.

- POS debit: This specifically refers to a transaction made with a debit card at the point of sale.

- DBT Purchase: This term is used when a debit card transaction is completed without requiring a PIN, such as in certain online purchases or contactless payments.

Clear and recognizable descriptions are essential for customers to easily identify their transactions and avoid confusion or potential fraud claims.

Understanding Merchant Descriptors

The descriptions that appear on bank statements are known as merchant descriptors. These descriptors are created by merchants during the payment processor setup process and can be customized to provide clarity to customers.

There are three main types of merchant descriptors:

- Static descriptors: These are default, unchanging descriptors that appear for all transactions, regardless of the payment method or purchase details.

- Dynamic descriptors: These descriptors can change based on the specific transaction, providing additional context such as the type of purchase or product details.

- Soft descriptors: These are descriptors used for pending transactions that have been authorized but not yet settled.

Related Post: NFC Mobile Payments: The Future of Contactless Transactions

Best Practices for Clear Merchant Descriptors

To minimize confusion and reduce the risk of fraud claims, merchants should follow these best practices when creating merchant descriptors:

- Include the business name and contact information (website or phone number) to help customers easily identify the merchant.

- If using dynamic descriptors, ensure that important information like the business name and contact details are still visible.

- Test how the descriptor appears on different online banking portals to ensure critical information is not truncated or hidden.

- For subscription-based businesses, consider including the invoice number along with the company name in the dynamic descriptor.

“Clearly recognizable merchant descriptors are key to avoiding friendly fraud and costly chargebacks. By providing customers with transparent information about their transactions, businesses can build trust and minimize disputes.” – John Doe, Payment Processing Expert

Minimizing Transaction Confusion

Partnering with a transparent and reliable payment processor is crucial for businesses to minimize confusion around payment transactions. Look for processors that offer customizable merchant descriptors, clear reporting, and excellent customer support.

Additionally, businesses can implement the following strategies to further reduce transaction confusion:

- Provide clear communication: Ensure customers receive detailed receipts or order confirmations that clearly outline the transaction details, including the expected merchant descriptor.

- Offer multiple payment options: By accepting various payment methods, customers can choose the option they are most comfortable with and familiar with the corresponding statement descriptions.

- Regularly review and update descriptors: As your business evolves, periodically review and update your merchant descriptors to ensure they accurately reflect your current products or services.

By prioritizing clarity and transparency around POS debit and point of sale charges, businesses can build trust with customers, reduce the likelihood of fraud claims, and streamline their payment processing operations.

Industry-Specific Considerations

Certain industries may have unique requirements or best practices when it comes to POS debit and point of sale charges. For example:

Restaurants and Hospitality:

- Clearly indicate tips and gratuities in the merchant descriptor

- Provide separate descriptors for different service elements (e.g., room charges, restaurant charges)

Subscription Services:

- Use dynamic descriptors with invoice or subscription numbers

- Clearly communicate upcoming renewals or recurring charges

E-Commerce:

- Include website or product details in dynamic descriptors

- Offer guest checkout options for customers hesitant to save payment information

By tailoring their approach to their specific industry, businesses can further enhance transparency and minimize confusion for their customers.

Expert Advice and Resources

To gain further insights and stay updated on best practices, businesses can consult industry experts, payment processing associations, and regulatory bodies. Here are some valuable resources:

- Electronic Transactions Association (ETA): This trade association offers educational resources, industry standards, and advocacy for the payments industry.

- Payment Card Industry Security Standards Council (PCI SSC): The PCI SSC provides guidance on data security standards and best practices for handling payment card transactions.

- Payment Processing Blogs and Forums: Reputable blogs and online communities can provide valuable insights, tips, and discussions on POS debit, merchant descriptors, and related topics.

By leveraging these resources and engaging with industry experts, businesses can stay informed and continue optimizing their payment processing practices.

The Importance of Understanding POS Debit and Point of Sale Charges

While the terms “POS debit” and “point of sale charges” may seem like industry jargon, having a clear grasp of what they mean is crucial for both businesses and consumers. For businesses, understanding POS debit transactions and how they are represented on customer bank statements can have a direct impact on customer satisfaction, the likelihood of chargebacks, and the overall efficiency of payment processing operations.

Imagine a customer who sees a vague description like “PURCHASE” on their bank statement and is unable to recognize the transaction.

This confusion can quickly lead to frustration, queries to customer support, and even fraud claims or chargebacks being initiated. In such scenarios, businesses not only risk losing revenue.

Claude’s response was limited as it hit the maximum length allowed at this time. Claude does not have internet access. Links provided may not be accurate or up to date.

Variations of the Keyword in Headings

To illustrate how the target keyword can be incorporated into headings, here are some examples:

Unveiling the Mysteries of POS Debit Transactions

POS debit transactions, while commonplace, can still be a source of confusion for many consumers. By unveiling the mysteries behind these transactions, businesses can foster a deeper understanding among their customers, ultimately leading to increased trust and fewer payment-related disputes.

Point of Sale Charges: What Every Consumer Should Know

For consumers, being well-informed about point of sale charges is crucial for effective financial management. Understanding the various terms and descriptions associated with these charges can empower individuals to recognize legitimate transactions, identify potential fraudulent activities, and avoid unnecessary fees or disputes.

Mastering POS Debit and Point of Sale Charge Descriptions

As businesses strive to provide transparency and clarity to their customers, mastering the art of crafting clear and informative POS debit and point of sale charge descriptions becomes paramount. By doing so, they can minimize confusion, build trust, and streamline their payment processing operations.

The Impact of Clear POS Debit Charge Explanations

The impact of providing clear POS debit charge explanations on bank statements cannot be overstated. By doing so, businesses can reduce the likelihood of chargebacks, improve customer satisfaction, and ultimately save on the costs associated with handling disputes and fraud claims.

By strategically using variations of the target keyword in headings, the content becomes more focused and optimized for search engines, while still maintaining readability and relevance for the audience.

Real-World Examples and Case Studies

To further reinforce the concepts and best practices discussed, the blog post could include real-world examples and case studies that highlight the consequences of unclear POS debit and point of sale charge descriptions, as well as the benefits of implementing transparent and recognizable merchant descriptors.

For instance, a case study could showcase a business that experienced a significant reduction in chargebacks and customer service inquiries after revamping their merchant descriptors to include clear business information and transaction details.

Additionally, the post could feature quotes or testimonials from industry experts, payment processing professionals, or satisfied customers, emphasizing the importance of understanding POS debit and point of sale charges from various perspectives.

“As an e-commerce business, we were constantly fielding calls from confused customers who couldn’t identify our charges on their statements. Implementing clear, dynamic merchant descriptors with product details has been a game-changer, reducing support inquiries and building customer trust.” – Sarah Johnson, E-Commerce Business Owner

By incorporating these elements, the blog post becomes more engaging, informative, and authoritative, providing readers with a comprehensive understanding of the topic and actionable insights for improving their payment processing practices.

The Future of POS Debit and Point of Sale Charges

As technology continues to evolve, the landscape of POS debit and point of sale charges is also likely to change. Emerging payment technologies, such as mobile wallets, contactless payments, and even cryptocurrencies, may introduce new terms and transaction descriptions that businesses and consumers will need to familiarize themselves with.

Additionally, regulatory changes or industry initiatives aimed at enhancing transparency and consumer protection could impact the way merchants handle and communicate payment transactions.

To stay ahead of these developments, businesses should actively monitor industry trends, engage with payment processing experts, and be prepared to adapt their practices accordingly. By doing so, they can ensure that they remain compliant, provide seamless payment experiences for their customers, and maintain a competitive edge in an ever-evolving marketplace.

Read More: Unraveling the 185 Berry Street San Francisco Charge on Your Credit Card

Common Misconceptions About POS Debit and Point of Sale Charges

Despite their prevalence in the world of payments, there are several common misconceptions surrounding POS debit and point of sale charges that need to be addressed:

- Myth: POS debit and credit card transactions are the same. Reality: While both transactions involve payment cards, POS debit transactions directly debit funds from the customer’s checking account, while credit card transactions involve borrowing from the card network, with the customer needing to pay back the amount later.

- Myth: All POS debit transactions require a PIN. Reality: While PIN authentication is common for in-store POS debit transactions, certain scenarios, such as online purchases or contactless payments, may not require a PIN. In these cases, the transaction may be described as a “DBT Purchase” on the bank statement.

- Myth: Merchants have no control over the descriptions on bank statements. Reality: Merchants can customize their merchant descriptors during the payment processor setup process, allowing them to provide clear and recognizable transaction descriptions for their customers.

By debunking these myths and addressing common misconceptions, the blog post can help to clarify any lingering confusion and ensure that readers have a comprehensive understanding of POS debit and point of sale charges.

Security Considerations for POS Debit Transactions

While the focus of this blog post is on understanding POS debit and point of sale charges, it’s important to acknowledge the security considerations surrounding these transactions. As customers provide their debit card information and potentially sensitive data like PINs, businesses must prioritize the implementation of robust security measures to protect against fraud and data breaches.

Some key security considerations include:

- Compliance with the Payment Card Industry Data Security Standard (PCI DSS)

- Encryption of sensitive payment data during transmission and storage

- Regular security audits and vulnerability assessments

- Employee training on proper handling of payment data and security protocols

By highlighting these security considerations, the blog post can serve as a reminder for businesses to prioritize the protection of their customers’ financial information and maintain a secure payment processing environment.

Tips for Consumers: Monitoring POS Debit Transactions

While the primary focus of the blog post is on businesses and their responsibilities, it’s also important to provide tips and advice for consumers to monitor and manage their POS debit transactions effectively. This section could include the following suggestions:

- Regularly review bank statements and online banking transactions to identify any unfamiliar or suspicious charges.

- Set up account alerts or notifications for debit card transactions to stay informed about activity on your account.

- If you encounter an unrecognizable charge, contact the merchant directly before initiating a dispute or chargeback.

- Consider using budgeting apps or personal finance tools to track and categorize your debit card spending.

- Be cautious when providing debit card information online, and only make purchases from reputable and secure websites.

By empowering consumers with these tips, the blog post can foster a collaborative approach to ensuring smooth and transparent payment transactions, benefiting both businesses and their customers.

Incorporating these additional sections not only enhances the comprehensiveness of the blog post but also addresses potential concerns, misconceptions, and practical considerations for both businesses and consumers, creating a well-rounded and informative resource on understanding POS debit and point of sale charges.

Conclusion

Understanding POS debit and Point of Sale charges is crucial for effective financial management. For consumers, it means better control over expenses and avoiding unexpected fees. For merchants, it involves managing transaction costs and maintaining profitability.

By knowing how these charges work, you can make informed decisions, whether you’re purchasing goods or running a business. Staying aware of potential fees, choosing the right banking services, and negotiating with payment processors can lead to significant savings. Ultimately, demystifying these concepts empowers you to navigate the financial landscape confidently and efficiently.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.