To the point answer: FID BKG SVC LLC Moneyline is a transaction description on your bank statement indicating a fund transfer or payment facilitated by Fidelity National Information Services (FIS), a leading provider of financial technology solutions.

This entry typically represents legitimate transactions like direct deposits, wire transfers, or online bill payments processed through FIS’s secure money transfer service called “Moneyline.“

What is FID BKG SVC LLC Moneyline on Your Bank Statement?

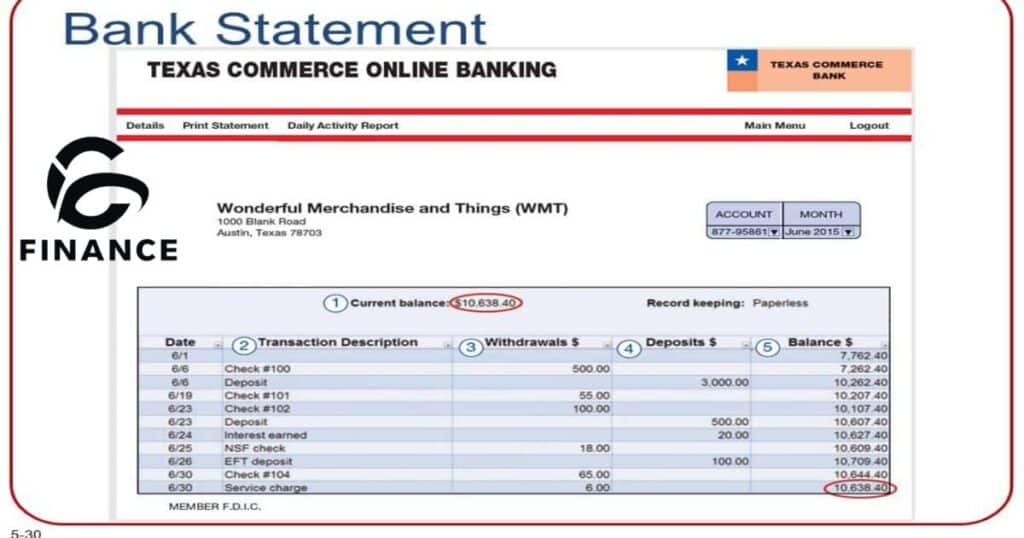

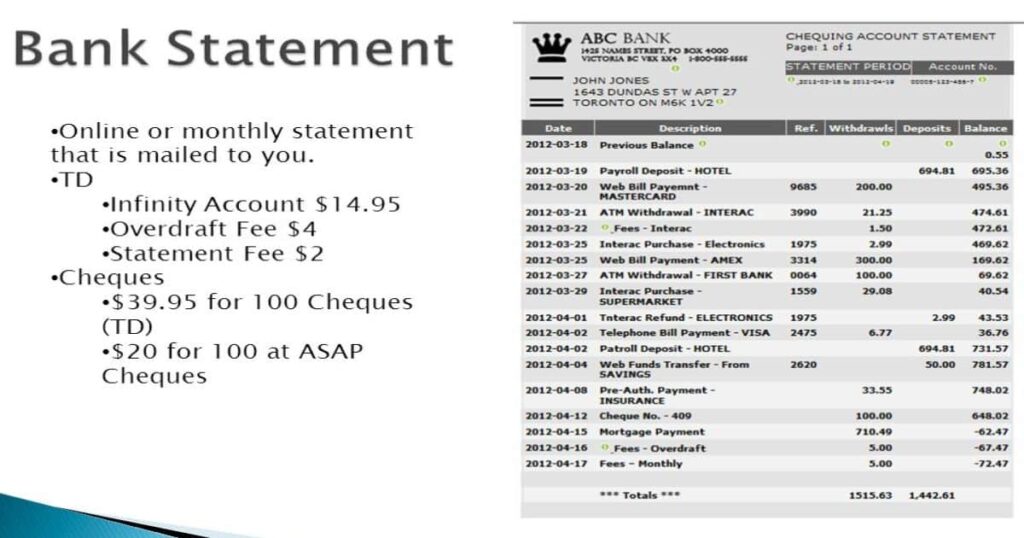

Introduction: Understanding Bank Statement Entries

Have you ever found yourself puzzled by cryptic entries on your bank statement? One such perplexing term that often catches people off guard is “FID BKG SVC LLC Moneyline.” While it may sound like a random jumble of letters and words, this entry actually holds valuable clues about the nature of the transaction.

In this comprehensive guide, we’ll demystify this term, explore its significance, and equip you with the knowledge to decipher similar entries on your bank statements confidently.

What is FID BKG SVC LLC?

FID BKG SVC LLC stands for Fidelity National Information Services (FIS) Banking Services, a renowned provider of technology solutions for banks and financial institutions worldwide. This company plays a pivotal role in facilitating various banking services, including payment processing, fraud detection, and risk management.

When you spot “FID BKG SVC LLC” on your statement, it typically signifies a transaction processed through FIS’s systems on behalf of your bank or the institutions involved in the transaction.

Decoding ‘Moneyline’ on Your Bank Statement

The term “Moneyline” refers to a specific service offered by FIS that enables real-time money transfers between banks and financial institutions. It serves as a secure channel for seamless fund transfers, often utilized for activities such as:

- Wire transfers

- Direct deposits (e.g., payroll)

- Online bill payments

- Account-to-account transfers

Seeing “Moneyline” alongside “FID BKG SVC LLC” indicates that the transaction involved the movement of funds through this particular service, facilitated by FIS’s technology.

Common Transactions Involving FID BKG SVC LLC Moneyline

Some typical transactions that may appear as “FID BKG SVC LLC Moneyline” on your statement include:

- Payroll direct deposits from your employer: Many companies use FIS’s services to seamlessly transfer employee paychecks directly into their bank accounts.

- Transfers between your accounts at different banks: If you have accounts at multiple financial institutions, FIS’s Moneyline service can facilitate secure transfers between them.

- Online bill payments to utility companies, creditors, or service providers: When you pay bills online through your bank’s portal, the funds may be transferred using FIS’s Moneyline system.

- Wire transfers sent or received from domestic or international sources: FIS’s technology enables wire transfers, both within the country and across borders, which can appear as “FID BKG SVC LLC Moneyline” on your statement.

Read More About: WHY RECONCILING YOUR BANK STATEMENTS IS CRUCIAL FOR FINANCIAL HEALTH

Is FID BKG SVC LLC Moneyline a Cause for Concern?

In most cases, no. These entries simply reflect legitimate financial transactions facilitated by FIS’s services on behalf of your bank or the institutions involved. However, it’s always a wise practice to review your statements carefully and verify any unfamiliar or suspicious charges.

Here’s a table to help you better understand when “FID BKG SVC LLC Moneyline” entries are typically legitimate:

| Transaction Type | Legitimate Reasons |

|---|---|

| Direct Deposits | Payroll, government benefits, tax refunds |

| Online Bill Payments | Utility bills, loan payments, subscriptions |

| Wire Transfers | Personal or business fund transfers |

| Account Transfers | Moving money between your own accounts |

If you’re ever unsure about a specific transaction, don’t hesitate to contact your bank or the merchant involved for clarification.

How to Verify Legitimate Transactions?

If you come across an “FID BKG SVC LLC Moneyline” entry that you don’t recognize, here are some steps you can take to verify its legitimacy:

- Check the transaction date and amount against your records or expected payments.

- Contact the merchant or payee directly to confirm the transaction details.

- Review your recent activities, such as online purchases, bill payments, or transfers.

- Consult your bank’s online banking portal or mobile app for additional transaction details.

- Look for any accompanying notes or descriptions that may provide context for the transaction.

By cross-referencing the information on your statement with your records and expected activities, you can often determine whether a transaction is legitimate or potentially fraudulent.

Steps to Take If You Suspect Fraud

If, after thorough investigation, you still cannot identify the source of an “FID BKG SVC LLC Moneyline” charge, it’s crucial to act quickly to prevent further unauthorized transactions:

- Contact your bank immediately and report the suspicious activity. Most banks have dedicated fraud prevention departments that can assist you.

- Request a temporary freeze or block on your account to prevent additional charges. This can help mitigate potential losses while the situation is being resolved.

- Monitor your statements closely for any other unauthorized transactions. Prompt action can help minimize the impact of fraudulent activities.

- Consider placing a fraud alert or security freeze on your credit report. This added layer of protection can help safeguard your credit from potential misuse.

“An ounce of prevention is worth a pound of cure.” – Benjamin Franklin

By being proactive and vigilant, you can protect yourself from the consequences of potential fraud or identity theft.

Contacting Your Bank for Clarification

If you’re still unsure about a particular “FID BKG SVC LLC Moneyline” entry, don’t hesitate to reach out to your bank’s customer service department. They have access to detailed records and can provide you with a more comprehensive explanation of the transaction.

Here’s a case study illustrating the importance of contacting your bank:

Case Study: Sarah’s Mysterious Charge

Sarah noticed a charge of $125.00 labeled “FID BKG SVC LLC Moneyline” on her bank statement. She didn’t recognize the transaction and couldn’t find any corresponding purchase or payment in her records. Concerned, she called her bank’s customer service line.

After providing some identifying information, the representative was able to pull up the details of the transaction. It turned out to be a legitimate payment Sarah had made to her internet service provider through her bank’s online bill payment system. The charge was processed through FIS’s Moneyline service, hence the description on her statement.

With the representative’s assistance, Sarah could match the charge to her records, and her concerns were alleviated.

Read More About: UNDERSTANDING CSC SERVICEWORKS CHARGES ON YOUR BANK STATEMENT

Preventing Unrecognized Transactions in the Future

To minimize the occurrence of unfamiliar transactions on your bank statement, consider the following proactive measures:

- Regularly review your statements and account activity. This habit can help you catch any discrepancies or unauthorized charges early on.

- Set up transaction alerts or notifications from your bank. Many banks offer the option to receive real-time alerts for various account activities, keeping you informed of any transactions as they occur.

- Use strong, unique passwords for your online banking accounts. Weak or reused passwords can make you vulnerable to account compromises and unauthorized access.

- Avoid sharing sensitive financial information over unsecured channels. Be cautious when providing account details, especially over the phone, email, or public Wi-Fi networks.

- Keep your contact information up-to-date with your bank for prompt notifications. Ensure your bank has your current mailing address, email, and phone number on file for timely communication.

By implementing these proactive measures, you can stay ahead of potential issues and maintain a better grasp on your financial transactions.

Conclusion: Staying Vigilant with Your Bank Statements

While entries like “FID BKG SVC LLC Moneyline” may seem puzzling at first, they are often perfectly legitimate transactions facilitated by financial services providers like FIS. However, it’s always wise to remain vigilant and take the necessary steps to verify any unfamiliar charges or activities on your bank statement.

By staying informed, asking questions, and following best practices for account security, you can effectively manage your finances and protect yourself from potential fraud or unauthorized transactions. Remember, knowledge is power, and understanding the intricacies of your bank statements is a valuable tool in safeguarding your financial well-being.”Confused by ‘FID BKG SVC LLC Moneyline’ on your bank statement? Uncover the meaning behind this entry and learn how to verify legitimate transactions securely.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.