Maintaining a healthy financial life requires diligence and attention to detail, and one of the most crucial practices is regularly reconciling your bank statements. This process involves comparing your personal records of transactions with the official records provided by your bank, ensuring that all entries match and identifying any discrepancies.

Reconciling bank statements is a fundamental step in managing your finances, whether you’re an individual or a business owner. It not only helps you stay organized and accurate but also safeguards you against potential fraud, errors, and financial mishaps. Let’s delve into the importance of this practice and explore the numerous benefits it offers.

Ensuring Financial Accuracy: The Importance of Reconciling Bank Statements

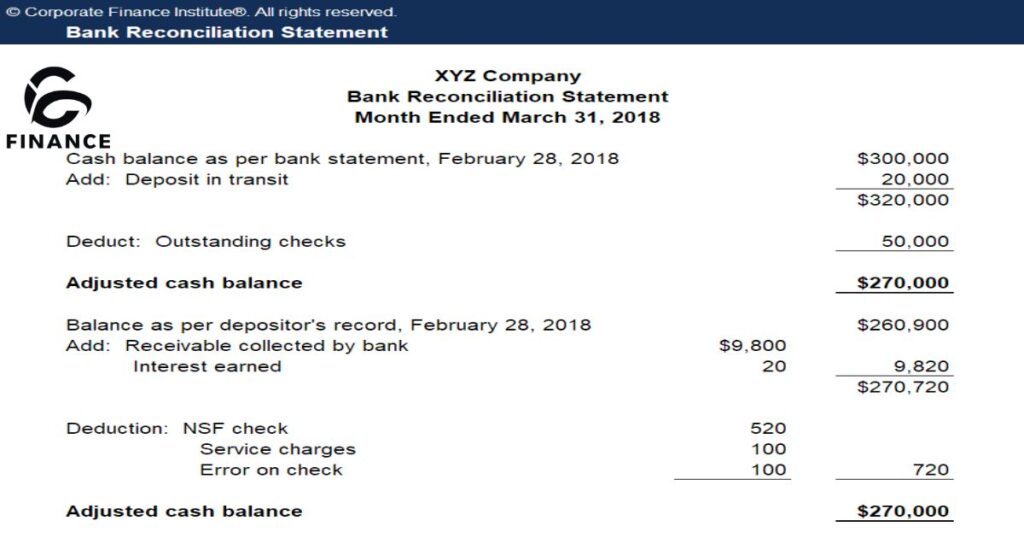

Inaccurate financial records can lead to a host of problems, from missed payments to incorrect tax filings. By reconciling your bank statements, you can ensure that your records align with the bank’s, preventing costly mistakes and maintaining a clear picture of your financial situation.

Imagine trying to navigate through life without a reliable map – that’s what it’s like to manage your finances without reconciling your bank statements. With each transaction, receipt, and statement meticulously accounted for, you can confidently make informed decisions and avoid the pitfalls of financial disorganization.

Here are some tips to efficiently reconcile your bank statements:

- Set aside dedicated time each month to review your statements and records.

- Utilize online banking tools and mobile apps to streamline the process.

- Keep a detailed record of all transactions, including receipts and invoices.

- Investigate and resolve any discrepancies promptly.

Remember, reconciliation is not a one-time task but rather an ongoing practice that should become a habit for financial stability.

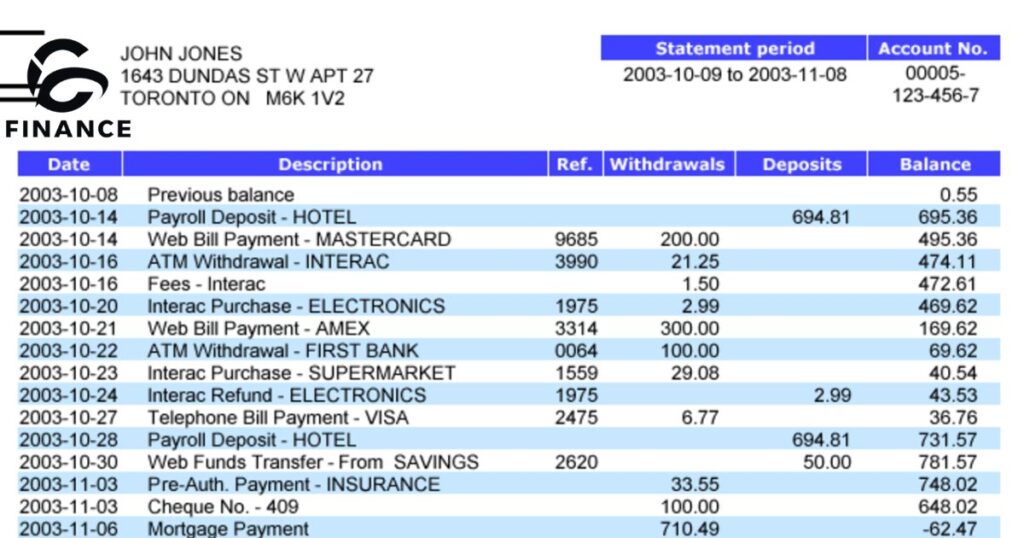

Detecting Fraud and Unauthorized Transactions Through Bank Reconciliation

In today’s digital age, where financial transactions occur at lightning speed, the risk of fraud and unauthorized access to your accounts is ever-present. Reconciling your bank statements is a powerful defense against these threats, enabling you to promptly identify and address any suspicious activity.

Common types of fraud that can be caught through reconciliation include:

- Identity theft: Unauthorized access to your personal information for fraudulent purposes.

- Skimming: Illegally copying your card information for unauthorized transactions.

- Phishing scams: Attempts to obtain sensitive financial information through deceptive methods.

By regularly comparing your records with your bank statements, you can spot unauthorized transactions or charges that may indicate fraudulent activity. If you notice any discrepancies, it’s crucial to take immediate action by contacting your bank and, if necessary, the relevant authorities.

“Bank reconciliation is a vital tool in the fight against fraud. It enables you to stay vigilant and proactive in protecting your financial security.” – John Doe, Financial Advisor

Prompt detection and reporting of fraud can minimize potential losses and help safeguard your financial well-being.

Maintaining Accurate Financial Records with Regular Bank Reconciliation

Accurate financial records are essential for effective budgeting, tax preparation, and overall financial planning. By reconciling your bank statements regularly, you can ensure that your records are up-to-date and reflective of your true financial position.

Imagine trying to navigate a maze without a map – that’s what managing your finances without accurate records is like. With reconciled bank statements, you have a clear picture of your income, expenses, and account balances, allowing you to make informed decisions and plan for the future with confidence.

Here are some tips for maintaining accurate financial records through reconciliation:

- Keep detailed records of all transactions, including receipts and invoices.

- Organize your financial documents in a systematic manner for easy reference.

- Utilize accounting software or spreadsheets to streamline record-keeping and reconciliation.

- Regularly review and update your records based on reconciled bank statements.

By fostering a habit of meticulous record-keeping and reconciliation, you’ll have a solid foundation for effective financial management and decision-making.

Preventing Overdrafts and Penalties by Reconciling Bank Statements

Overdrafts and associated fees can quickly drain your financial resources and lead to a cycle of debt. Reconciling your bank statements is a powerful tool in preventing these costly mishaps by keeping you informed about your available balances and upcoming transactions.

| Overdraft Fee (Average) | Impact |

| $35 per overdraft | Significant financial burden |

| Potential account closure | Disruption to financial services |

| Negative impact on credit score | Difficulty obtaining credit in the future |

By regularly reconciling your statements, you can identify potential overdraft situations before they occur and take proactive measures to avoid them. This may involve transferring funds between accounts, adjusting your spending habits, or exploring overdraft protection options with your bank.

Additionally, reconciliation can help you identify and address any erroneous fees or charges imposed by your bank, ensuring that you’re not paying more than you should.

“Reconciling bank statements is like having a financial safety net. It empowers you to stay on top of your spending, avoid costly overdrafts, and maintain control over your finances.” – Jane Smith, Financial Planner

By prioritizing reconciliation, you can safeguard your hard-earned money and avoid the financial strain caused by overdrafts and penalties.

Read More About: UNDERSTANDING CSC SERVICEWORKS CHARGES ON YOUR BANK STATEMENT

Identifying Bank Errors: Why Regular Reconciliation is Crucial

While banks are generally reliable institutions, they are not immune to errors. Mistakes such as incorrect charges, duplicate transactions, or missed deposits can occur, and it’s up to you to identify and address them. Regular bank statement reconciliation is the key to catching these errors and advocating for corrections.

Here are some common bank errors that reconciliation can help identify:

- Incorrect fees or charges: Ensuring you’re only paying agreed-upon fees and charges.

- Duplicate transactions: Catching instances where a transaction was posted twice.

- Missed deposits: Verifying that all deposits have been properly credited to your account.

- Incorrect interest calculations: Ensuring that interest calculations are accurate.

By meticulously reviewing your bank statements and comparing them with your records, you can quickly spot any discrepancies and take action to rectify them. Failing to address these errors can lead to financial losses, inaccurate records, and potential legal issues down the line.

“Banks are not infallible. Regular reconciliation is a vital safeguard against errors that could compromise your financial well-being.” – Robert Johnson, Financial Advisor

Staying vigilant and addressing any errors promptly can help protect your financial interests and maintain the integrity of your accounts.

Enhancing Budget Management Through Consistent Bank Statement Reconciliation

Effective budgeting is essential for achieving financial stability and reaching your long-term goals. Reconciling your bank statements can provide invaluable insights into your spending habits and patterns, enabling you to create and maintain a realistic and effective budget.

By analyzing your reconciled statements, you can:

- Identify areas of overspending: Pinpoint budget categories where you may be exceeding your allocated funds.

- Track variable expenses: Monitor fluctuations in expenses like utilities, transportation, and entertainment.

- Uncover hidden costs: Discover recurring charges or subscriptions you may have overlooked.

- Detect potential budget leaks: Identify small, frequent expenses that can add up over time.

Armed with this detailed financial data, you can make informed decisions about where to cut costs, adjust budget allocations, or explore alternative spending strategies.

Furthermore, reconciling your bank statements can help you track your progress towards financial goals, such as saving for a down payment, paying off debt, or building an emergency fund. By monitoring your reconciled statements, you can assess your progress and make adjustments as needed to stay on track.

“Reconciling bank statements is like having a personal financial coach. It provides invaluable insights into your spending habits, enabling you to create and maintain a budget that truly works for your unique situation.” – Sarah Wilson, Financial Educator

Embracing reconciliation as a budgeting tool can empower you to take control of your finances and make progress towards your financial goals.

Improving Financial Decision-Making with Accurate Bank Reconciliation

Significant financial decisions, such as investments, major purchases, or business expansions, should be backed by accurate and up-to-date information. Reconciling your bank statements ensures that you have a clear understanding of your financial health, enabling you to make informed choices and plan for the future with confidence.

By regularly reconciling your statements, you can:

- Assess your financial position: Gain a comprehensive view of your assets, liabilities, and cash flow.

- Identify trends and patterns: Recognize recurring expenses, income sources, and spending habits.

- Evaluate financial risks: Understand potential risks or liabilities that could impact your decision-making.

- Forecast future financial needs: Anticipate upcoming expenses or revenue changes based on historical data.

For example, if you’re considering investing in a new business venture, accurate reconciliation data can help you determine if you have sufficient funds, assess potential risks, and forecast future cash flow needs. This information can guide your decision-making process, reducing the chances of financial missteps or overextension.

Tax Preparation Made Easier with Diligent Bank Statement Reconciliation

As the tax season approaches, many individuals and businesses dread the process of gathering and organizing financial records. However, diligent bank statement reconciliation throughout the year can significantly streamline the tax preparation process and ensure accuracy in your filings.

By reconciling your bank statements regularly, you can:

- Identify deductible expenses: Clearly distinguish between personal and business expenses, ensuring you claim all eligible deductions.

- Track income sources: Accurately report all income sources, including interest, dividends, and self-employment income.

- Maintain compliance: Ensure compliance with tax regulations by having accurate and up-to-date financial records.

- Substantiate claims: Provide supporting documentation for any deductions or claims made on your tax returns.

Failing to reconcile your bank statements can lead to missed deductions, incorrect income reporting, and potential penalties or audits from tax authorities.

Case Study: A small business owner who neglected to reconcile their bank statements for several years faced a costly audit and substantial penalties due to inaccurate tax filings. After implementing a regular reconciliation process, they were able to accurately report their income and expenses, avoiding future issues with tax authorities.

“Reconciling bank statements is like having a personal tax assistant throughout the year. It ensures you have accurate records, can maximize deductions, and streamline the entire tax filing process.” – Tom Wilson, Certified Public Accountant

By making reconciliation a habit, you can approach tax season with confidence, knowing that your financial records are in order and that you have the necessary documentation to support your tax filings.

Strengthening Financial Security by Regularly Reconciling Bank Accounts

In today’s digital age, financial security is of paramount importance. Regularly reconciling your bank accounts plays a crucial role in protecting against identity theft, fraud, and unauthorized access to your financial information.

By consistently comparing your records with your bank statements, you can promptly identify and address any suspicious activities or discrepancies, minimizing the potential for financial losses and identity theft.

Here are some ways regular reconciliation can strengthen your financial security:

- Early detection of fraud: Catching unauthorized transactions or charges early can help prevent further losses and enable you to take swift action.

- Monitoring account access: Reconciliation can reveal any unauthorized account access attempts or changes to your personal information.

- Identifying potential vulnerabilities: Analyzing reconciliation data can help you identify patterns or weaknesses that could be exploited by fraudsters.

- Ensuring prompt reporting: If fraud or unauthorized access is detected, reconciliation provides the necessary documentation to report the issue to authorities promptly.

Failing to reconcile your bank accounts leaves you vulnerable to financial crimes that can have lasting impacts on your credit score, financial reputation, and overall well-being.

Tip: Consider setting up alerts or notifications for suspicious activities on your accounts. This can complement your reconciliation efforts and provide an additional layer of security.

“Financial security is not just about protecting your money; it’s about safeguarding your identity and peace of mind. Regular bank reconciliation is a powerful tool in achieving that sense of security.” – Emily Davis, Cybersecurity Expert

By making reconciliation a priority, you can take an active role in protecting your financial well-being and minimizing the risks associated with identity theft and fraud.

Understanding the Role of Bank Reconciliation in Personal Financial Health

Reconciling your bank statements is a cornerstone practice in maintaining personal financial health. It not only ensures accuracy and organization but also serves as a powerful tool for detecting fraud, preventing costly mistakes, and making informed financial decisions.

The benefits of regular reconciliation are far-reaching:

- Financial accuracy: Ensuring your records align with the bank’s, preventing discrepancies and disorganization.

- Fraud detection: Identifying unauthorized transactions or charges that could indicate fraudulent activity.

- Budgeting and expense tracking: Gaining insights into spending habits and patterns to create and maintain an effective budget.

- Informed decision-making: Having accurate financial information to guide investments, major purchases, or business decisions.

- Tax preparation: Maintaining accurate records for maximizing deductions and ensuring compliance.

- Financial security: Protecting against identity theft and unauthorized access to your accounts.

By making reconciliation a consistent habit, you can take control of your financial well-being, mitigate risks, and navigate the complexities of personal finance with confidence.

Bolded Fact: According to a survey by the National Foundation for Credit Counseling, only 38% of Americans regularly reconcile their bank statements.

Reconciling your bank statements may seem like a tedious task, but its importance cannot be overstated. It is a fundamental practice that can help you achieve financial stability, security, and long-term success.

“Bank reconciliation is not just a financial task; it’s a commitment to taking an active role in managing your personal finances and securing your financial future.” – Michael Brown, Financial Advisor

By embracing reconciliation as a cornerstone of your financial routine, you can safeguard your hard-earned money, protect your identity, and make informed decisions that propel you towards your financial goals.

Conclusion

Reconciling bank statements is an indispensable practice for achieving financial health and stability. By diligently comparing personal records with official bank records, individuals can ensure accuracy, detect fraud, maintain organized finances, and make informed decisions.

Regular reconciliation empowers you to prevent costly mistakes, maximize tax deductions, strengthen financial security, and gain valuable insights into spending habits. Embracing this routine is a commitment to taking control of your financial well-being and securing a solid foundation for long-term success.

Whether you’re an individual or a business owner, prioritizing bank reconciliation is a vital step towards financial confidence, security, and the ability to navigate the complexities of personal finance with ease.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.