In the rapidly evolving landscape of finance, the convergence of technology and traditional markets has given rise to a powerful force: FintechZoom.

As financial technology (fintech) continues to disrupt and reshape industries, its influence is reverberating throughout the prestigious CAC40 – France’s benchmark stock market index, comprising the 40 most significant companies listed on the Euronext Paris exchange.

This comprehensive article delves into the intricate relationship between FintechZoom and the CAC40, exploring how fintech innovations are redefining the very fabric of the index and its constituent companies.

Buckle up as we navigate through this transformative era, where the fusion of finance and technology is catalyzing unprecedented growth opportunities and reshaping market dynamics like never before.

Understanding the CAC40: A Primer on France’s Leading Stock Market Index

Before delving into the fintech revolution, let’s establish a solid foundation by understanding the CAC40 itself.

Criteria for Selecting Companies in the Index

The CAC40 is a selective index, meaning companies must meet stringent criteria to be included. Key eligibility requirements include:

- Market Capitalization: Companies must rank among the top 100 largest market caps on the Euronext Paris exchange.

- Trading Volume: Stocks must demonstrate sufficient liquidity, with a minimum trading volume threshold.

- Free-Float Capitalization: At least 20% of a company’s shares must be publicly traded (free float).

An independent committee oversees the process of adding or removing companies from the index, ensuring it remains a accurate representation of the French market’s top performers.

Composition of the CAC 40 Index

The CAC40 is a diverse index, encompassing industry giants from various sectors. Notable companies include:

- Finance: BNP Paribas, Society Generals, Credit Agricole

- Energy: TotalEnergies

- Luxury Goods: LVMH, Hermes, Kering

- Automotive: Renault, Stellantis

- Technology: Dassault Systèmes, Capgemini

This broad representation underscores the index significance as a barometer for the French economy’s performance across multiple industries.

Industry Breakdown of the CAC 40 Index

To illustrate the index’s sector diversification, here’s a breakdown of the CAC40’s industry weightings:

| Industry | Weighting |

|---|---|

| Consumer Discretionary | 16.3% |

| Industrials | 16.1% |

| Financials | 14.8% |

| Information Technology | 8.2% |

| Health Care | 7.9% |

| Consumer Staples | 7.2% |

| Energy | 6.7% |

| Materials | 6.7% |

| Utilities | 5.2% |

| Communication Services | 4.9% |

| Real Estate | 3.5% |

As evident from the table, the CAC40 provides exposure to a wide range of sectors, ensuring diversification for investors seeking broad market representation.

How is it Weighted?

The CAC40 is a free-float market capitalization-weighted index, meaning each company’s influence is proportional to its market value and the number of shares available for public trading. This approach ensures that larger, more liquid companies have a greater impact on the index’s performance.

15% Capping

To prevent any single company from exerting excessive dominance, the CAC40 imposes a 15% cap on the maximum weight of a constituent. This measure promotes diversification and mitigates concentration risk within the index.

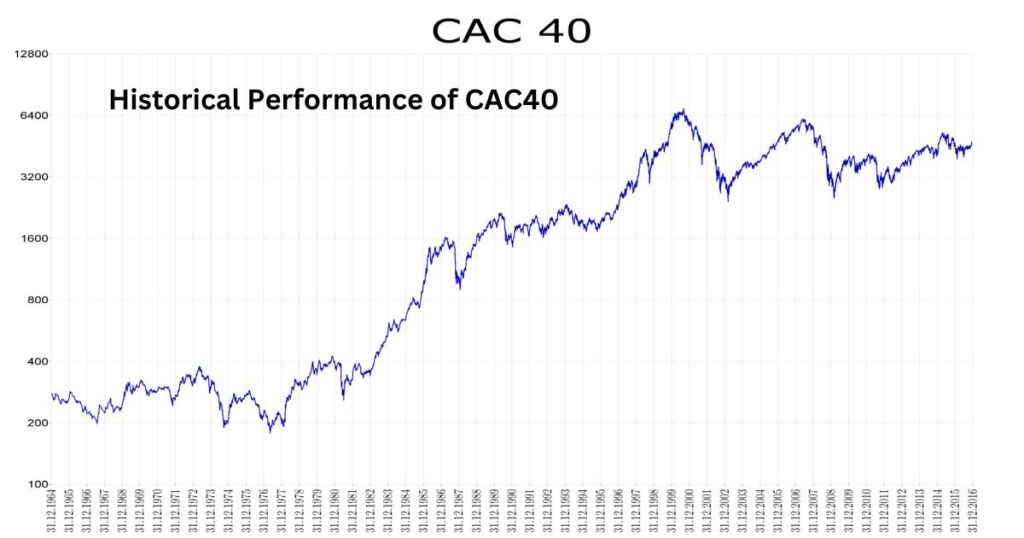

Historical Performance of CAC40

Despite periodic fluctuations, the CAC40 has demonstrated resilience and growth over the long term. Here’s a visual representation of its historical performance compared to other major global indices:

Source: Trader-PDF.fr

As the chart illustrates, the CAC40 has consistently outperformed indices like the FTSE 100 and the DAX over an extended period, solidifying its reputation as a formidable investment destination.

With a solid grasp of the CAC40’s fundamentals, we can now delve into the transformative impact of FintechZoom on this prestigious index.

Exploring FintechZoom’s Impact on the CAC40: Trends and Analysis

The fintech revolution has swept across global markets, and the CAC40 is no exception. As financial services undergo rapid digitization, fintech companies are increasingly joining the ranks of the index, reshaping its composition and dynamics.

CAC40 FintechZoom Recent Trends

In recent years, several fintech disruptors have made their debut on the CAC40, signaling the index’s growing recognition of the sector’s importance. Notable additions include:

- Worldline: A leading provider of digital payment and transactional services, Worldline joined the CAC40 in 2020, reflecting the increasing prominence of digital payments.

- Ingenico: Acquired by Worldline in 2020, Ingenico is a pioneering player in the payment terminal industry, further strengthening the CAC40’s fintech representation.

These additions underscore the accelerating pace of fintech adoption and the industry’s rising influence within the French market and the broader CAC40 landscape.

“The integration of fintech companies into the CAC40 is a testament to the sector’s rapid growth and its pivotal role in driving innovation across the financial services industry,” remarked Marie Leenhardt, Head of Fintech Equity Research at Société Générale.

As the fintech ecosystem continues to evolve, we can expect more innovative companies to join the ranks of the CAC40, injecting fresh perspectives and propelling the index towards a more digitally-driven future.

The Role of Technology in Reshaping the CAC40: A FintechZoom Perspective

FintechZoom’s impact on the CAC40 extends far beyond the inclusion of fintech companies within the index. It represents a paradigm shift in how traditional businesses operate, challenging established norms and catalyzing widespread digital transformation.

FintechZoom’s Holistic Approach to CAC 40 Analysis

FintechZoom’s influence transcends the financial sector, permeating various industries represented within the CAC40. From streamlining supply chains and optimizing operations to enhancing customer experiences and unlocking new revenue streams, the applications of fintech span multiple domains. This holistic approach underscores the CAC40’s collective recognition of technology’s pivotal role in driving growth, efficiency, and competitiveness.

Areas where FintechZoom is making waves across the CAC40 include:

- Payments: Seamless digital payment solutions, mobile wallets, and contactless technologies are reshaping consumer experiences and B2B transactions alike.

- Lending: Innovative lending platforms, algorithmic underwriting, and alternative credit scoring models are democratizing access to finance.

- Investing: Robo-advisors, digital trading platforms, and blockchain-based solutions are revolutionizing investment management and asset tracking.

- Data Analytics: Advanced data analytics, machine learning, and AI are unlocking valuable insights, enabling data-driven decision-making across industries.

- Cybersecurity: Robust cybersecurity measures and fraud detection systems are paramount in safeguarding financial transactions and sensitive data.

As these fintech solutions permeate the CAC40 ecosystem, traditional companies are increasingly recognizing the imperative to embrace digital transformation and foster a culture of innovation to remain competitive.

Unveiling Fintech Innovations Driving CAC40 Companies’ Growth

FintechZoom’s influence on the CAC40 is tangible, with numerous fintech products and services fueling revenue growth and operational efficiencies for constituent companies across various sectors.

Here are some notable examples:

- Banking: BNP Paribas and Société Générale have embraced digital banking solutions, offering mobile apps and online platforms for seamless account management, lending, and investment services.

- Insurance: AXA has partnered with fintech startups to develop innovative products like parametric insurance and Usage-Based Insurance (UBI) solutions leveraging telematics data.

- Luxury Goods: LVMH and Hermès have integrated digital payment solutions and augmented reality (AR) technologies to enhance the in-store shopping experience and streamline checkout processes.

CAC40 and FintechZoom: Navigating Market Dynamics in the Digital Era

As FintechZoom continues to disrupt traditional business models, CAC40 companies are actively adapting to the evolving market dynamics ushered in by the digital revolution. Embracing fintech solutions has become a strategic imperative for these industry leaders to future-proof their operations and maintain a competitive edge.

Companies within the CAC40 are leveraging FintechZoom to navigate the digital landscape through a multitude of strategies:

- Digital Transformation: Established players are undertaking comprehensive digital transformation initiatives to modernize their processes, enhance customer experiences, and streamline operations. This involves integrating cutting-edge fintech solutions into their core business models.

- Partnerships and Collaborations: Rather than attempting to develop proprietary fintech solutions from scratch, many CAC40 companies are opting for strategic partnerships with fintech startups and established players. This collaborative approach allows them to leverage external expertise and accelerate innovation cycles.

- Open Banking and APIs: The rise of open banking and application programming interfaces (APIs) has facilitated seamless integration of fintech services into traditional banking infrastructure. CAC40 banks like BNP Paribas and Société Générale are embracing this trend, fostering an ecosystem of third-party fintech providers.

- Venture Capital and Acquisitions: Several CAC40 companies have established corporate venture capital arms or acquired promising fintech startups outright. This strategy enables them to gain a competitive edge by absorbing emerging technologies and talent into their organizations.

By proactively navigating the digital era, CAC40 companies are positioning themselves to capitalize on the disruptive potential of FintechZoom, leveraging technology to drive innovation, enhance customer experiences, and solidify their market positions.

FintechZoom Disruption: How CAC40 Companies Are Adapting to Technological Shifts

While FintechZoom presents ample opportunities for growth and innovation, it also poses significant challenges for traditional CAC40 companies. Emerging fintech disruptors are rapidly reshaping industries, threatening to displace incumbents that fail to adapt swiftly.

To counter this disruption, CAC40 companies are actively pursuing strategies to embrace technological shifts and maintain their competitive advantage:

- Partnerships and Acquisitions: Many established companies are forming strategic partnerships with fintech startups or acquiring them outright. For instance, BNP Paribas partnered with Fintech startup Nickel to launch a digital banking service, while Société Générale acquired fintech firm Boursorama to bolster its digital offering.

- Internal Innovation Labs: Companies like AXA and Crédit Agricole have established internal innovation labs dedicated to developing cutting-edge fintech solutions. These labs foster a culture of experimentation and rapid prototyping, enabling companies to stay ahead of the curve.

- Talent Acquisition: To infuse their organizations with the necessary expertise, CAC40 companies are actively recruiting top fintech talent, either through direct hiring or by acquiring promising startups with skilled teams.

- Legacy Infrastructure Modernization: Recognizing the constraints posed by legacy systems, CAC40 firms are investing heavily in modernizing their technology infrastructure. This includes migrating to cloud-based platforms, adopting microservices architectures, and embracing agile development methodologies.

By embracing these strategies, CAC40 companies are actively future-proofing their operations, ensuring they remain agile and responsive to the rapid pace of fintech innovation.

FintechZoom’s Influence on CAC40: Challenges and Opportunities Ahead

While FintechZoom presents a plethora of opportunities for growth and innovation within the CAC40, it also introduces a set of challenges that companies must navigate carefully:

Challenges:

- Cybersecurity and Data Privacy: As financial transactions become increasingly digitized, ensuring robust cybersecurity measures and maintaining data privacy is paramount. CAC40 companies must prioritize secure infrastructure and adhere to stringent regulatory frameworks, such as GDPR and PSD2.

- Regulatory Uncertainty: The rapid evolution of fintech has often outpaced regulatory frameworks, leading to uncertainty and compliance challenges. CAC40 companies must actively engage with regulatory bodies to shape a conducive environment for innovation while maintaining consumer protection.

- Legacy Infrastructure Integration: Integrating new fintech solutions with legacy infrastructure can be a complex and costly endeavor. CAC40 firms must strike a balance between modernizing their systems and leveraging existing investments.

- Talent Acquisition and Retention: The fintech talent pool is highly competitive, with both established firms and startups vying for top talent. Attracting and retaining skilled professionals is crucial for CAC40 companies to drive their fintech initiatives.

Opportunities:

- New Revenue Streams: By embracing fintech, CAC40 companies can unlock new revenue streams and business models, such as offering financial services as a platform or developing innovative fintech products for commercial markets.

- Operational Efficiencies: Leveraging fintech solutions can streamline operations, reduce costs, and improve overall efficiency through process automation, data-driven decision-making, and optimized resource allocation.

- Enhanced Customer Experiences: Fintech enables CAC40 companies to deliver superior customer experiences through personalized services, seamless digital interactions, and tailored product offerings driven by data analytics.

- Competitive Advantage: Early adopters of fintech solutions gain a significant competitive edge, positioning themselves as industry leaders and attracting a tech-savvy customer base.

By proactively addressing these challenges and capitalizing on the opportunities presented by FintechZoom, CAC40 companies can cement their position as trailblazers in the digital age, driving innovation and shaping the future of finance and beyond.

Leveraging FintechZoom for Enhanced Performance in the CAC40 Index

As FintechZoom continues to gain traction, investors are increasingly seeking exposure to this high-growth sector within the CAC40 index. Fortunately, several strategies exist for investors to capitalize on the fintech revolution:

- Fintech ETFs: Exchange-Traded Funds (ETFs) focused specifically on the fintech sector provide diversified exposure to leading fintech companies, including those listed on the CAC40. Examples include the ARKK Fintech Innovation ETF and the Global X Fintech ETF.

- Direct Stock Investments: Investors can directly invest in individual CAC40 companies with significant fintech exposure, such as Worldline, BNP Paribas, and Société Générale, which are actively embracing fintech innovations.

- Thematic Investing: Certain investment firms offer thematic investment products centered around fintech and digital transformation trends, allowing investors to gain exposure to CAC40 companies at the forefront of these developments.

- Venture Capital Funds: For investors seeking early-stage fintech exposure, venture capital funds focused on the French or European fintech ecosystem can provide access to promising startups with the potential to disrupt established CAC40 players or become future index constituents.

By carefully evaluating these investment strategies and conducting thorough due diligence, investors can position themselves to benefit from the growth opportunities presented by FintechZoom’s influence on the CAC40 index.

“The integration of fintech companies into the CAC40 is a testament to the sector’s rapid growth and its pivotal role in driving innovation across the financial services industry,” remarked Marie Leenhardt, Head of Fintech Equity Research at Société Générale.

Strategies for Integrating Fintech Solutions in CAC40 Businesses

As CAC40 companies navigate the fintech revolution, developing a comprehensive strategy for integrating fintech solutions is crucial for long-term success. Here are some best practices that leading firms are adopting:

- Establish a Clear Fintech Vision: Defining a clear vision and roadmap for fintech adoption is essential. This vision should align with the company’s overall digital transformation goals and be championed by top leadership.

- Embrace an Agile and Iterative Approach: Fintech solutions evolve rapidly, necessitating an agile and iterative approach to integration. Companies should adopt methodologies like Agile and DevOps to foster a culture of continuous improvement and rapid iteration.

- Foster Collaborative Ecosystems: Successful fintech integration often requires collaboration with external partners, such as fintech startups, technology providers, and regulatory bodies. Building a collaborative ecosystem can accelerate innovation and ensure compliance.

- Prioritize Talent Development: Upskilling existing employees and attracting top fintech talent is crucial. Companies should invest in training programs, hackathons, and initiatives to foster a culture of continuous learning and innovation.

- Leverage Emerging Technologies: Emerging technologies like artificial intelligence, blockchain, and the Internet of Things (IoT) are reshaping the fintech landscape. CAC40 companies should actively explore and integrate these technologies to gain a competitive edge.

- Prioritize Cybersecurity and Data Privacy: As fintech solutions handle sensitive financial data, robust cybersecurity measures and data privacy protocols are paramount. Companies should implement industry-leading security practices and adhere to strict regulatory compliance standards.

- Leverage Cloud Computing: Cloud computing offers scalability, flexibility, and cost efficiencies for fintech solutions. CAC40 companies should explore cloud migration strategies and leverage cloud-native technologies to accelerate innovation cycles.

- Continuously Monitor and Adapt: The fintech landscape is rapidly evolving, necessitating continuous monitoring of emerging trends, technologies, and market dynamics. Companies should establish dedicated teams or partnerships to stay ahead of the curve and adapt their strategies accordingly.

By adopting these strategies, CAC40 companies can effectively integrate fintech solutions into their operations, fostering innovation, enhancing customer experiences, and gaining a competitive edge in the digital age.

Future Outlook: FintechZoom’s Role in Shaping the CAC40 Landscape

As we look ahead, the influence of FintechZoom on the CAC40 index is poised to grow exponentially. Industry experts and analysts predict a future where fintech will be deeply ingrained in the fabric of the French financial market, reshaping the composition and dynamics of the index.

- Increased Fintech Representation: Experts anticipate a surge in fintech companies joining the ranks of the CAC40, reflecting the sector’s rapid growth and its pivotal role in driving innovation across various industries.

- Convergence of Finance and Technology: The lines between traditional financial institutions and technology companies will continue to blur, with CAC40 companies embracing a hybrid model that seamlessly integrates fintech solutions into their core offerings.

- Emergence of Fintech Unicorns: As the French fintech ecosystem matures, analysts predict the rise of homegrown fintech unicorns (startups valued at over $1 billion), potentially positioning themselves for inclusion in the CAC40 index.

- Regulatory Evolution: Regulators are expected to play a crucial role in shaping the future of fintech within the CAC40. Ongoing collaboration between industry stakeholders and policymakers will be essential to foster an environment conducive to innovation while maintaining consumer protection and financial stability.

- Talent Wars: The demand for fintech talent will intensify, leading to fierce competition among CAC40 companies and startups alike. Companies that prioritize talent acquisition and development strategies will gain a significant competitive advantage.

- International Expansion: As French fintech companies gain global recognition, their international footprint is likely to expand, potentially influencing the composition of other major indices worldwide.

- Sustainability and ESG Integration: The integration of fintech solutions with sustainable finance principles and environmental, social, and governance (ESG) criteria is expected to gain momentum, shaping the future of responsible investing within the CAC40.

As the fintech revolution continues to unfold, the CAC40 index will undoubtedly evolve to reflect these transformative trends, positioning itself as a global benchmark for the intersection of finance and technology.

FAQ’s

Q: What is a fintech?

A: Fintech, short for financial technology, refers to the integration of technology into financial services and products. It encompasses a wide range of innovations, including mobile banking, digital payments, peer-to-peer lending, cryptocurrency, and more.

Q: How is FintechZoom reshaping the CAC40 index?

A: FintechZoom is driving significant changes within the CAC40 index. Fintech companies are increasingly being added to the index, reflecting the sector’s growth and importance. Additionally, traditional CAC40 companies are adopting fintech solutions to enhance their offerings, operations, and customer experiences.

Q: What are some examples of fintech companies in the CAC40?

A: Notable fintech companies currently included in the CAC40 index are Worldline, a leading provider of digital payment and transactional services, and Ingenico, a pioneer in payment terminals (acquired by Worldline in 2020).

Q: How can investors gain exposure to fintech within the CAC40?

A: Investors can gain exposure to fintech within the CAC40 through various strategies, including investing in fintech-focused ETFs, directly purchasing stocks of CAC40 companies with significant fintech exposure (e.g., Worldline, BNP Paribas, Société Générale), or exploring thematic investing products centered around fintech and digital transformation trends.

Q: What challenges do CAC40 companies face in integrating fintech solutions?

A: Key challenges include cybersecurity and data privacy concerns, regulatory uncertainty, integrating new solutions with legacy infrastructure, and attracting and retaining top fintech talent.

Q: How are CAC40 companies adapting to the fintech disruption?

A: CAC40 companies are adopting various strategies, such as forming partnerships and acquiring fintech startups, establishing internal innovation labs, modernizing legacy infrastructure, and prioritizing talent acquisition and development.

By addressing these common questions, we aim to provide clarity and insight into the transformative impact of FintechZoom on the CAC40 index and its constituent companies.

Conclusion

The convergence of FintechZoom and the CAC40 index represents a pivotal moment in the evolution of the French financial market. As fintech continues to disrupt traditional business models and catalyze innovation, the CAC40 is poised to undergo a profound transformation, reflecting the industry’s embrace of cutting-edge technologies and digital solutions.

From the inclusion of fintech disruptors within the index to the widespread adoption of fintech solutions by established companies, the CAC40 is experiencing a seismic shift. Traditional players are actively navigating this digital era, forging strategic partnerships, investing in innovation labs, and prioritizing talent acquisition to remain competitive.

As we look ahead, the influence of FintechZoom on the CAC40 is set to deepen, with experts predicting an increased fintech representation, the convergence of finance and technology, and the emergence of homegrown fintech unicorns. Regulatory bodies will play a pivotal role in shaping a conducive environment for innovation while safeguarding consumer interests.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.