A Chartered Professional Accountant (CPA) is a highly skilled financial professional. CPAs provide expertise in accounting, auditing, and taxation. They play a crucial role in helping businesses and individuals manage their finances effectively.

A Chartered Professional Accountant (CPA) ensures compliance with financial regulations. They analyze financial data to make informed decisions. CPAs also offer valuable advice on budgeting and financial planning.

Chartered Professional Accountants (CPAs) have diverse roles in various industries. They may serve as CFOs, auditors, or consultants. CPAs are essential for maintaining the financial health of organizations.

Duties and Responsibilities of Chartered Accountants (CAs)

Chartered Accountants (CAs) play vital roles in financial management. They handle diverse responsibilities, such as auditing, tax filing, and financial reporting. Their expertise ensures organizations meet regulatory standards and make sound financial decisions.

Financial Management

- Analyzing financial data to provide insights.

- Developing and managing budgets effectively.

- Ensuring compliance with accounting regulations.

Taxation and Compliance

- Advising clients on tax planning strategies.

- Preparing and filing tax returns accurately.

- Ensuring compliance with tax laws and regulations.

Auditing and Assurance

- Auditing financial statements for accuracy.

- Providing assurance on financial practices.

- Identifying and mitigating financial risks.

Consulting and Advisory Services

- Offering expert financial advice to clients.

- Providing guidance on investment decisions.

- Assisting with financial planning and management.

Continuous Professional Development

- Engaging in ongoing education and training.

- Staying updated on accounting standards and regulations.

- Maintaining ethical standards and professional integrity.

Job Outlook and Salary for CAs

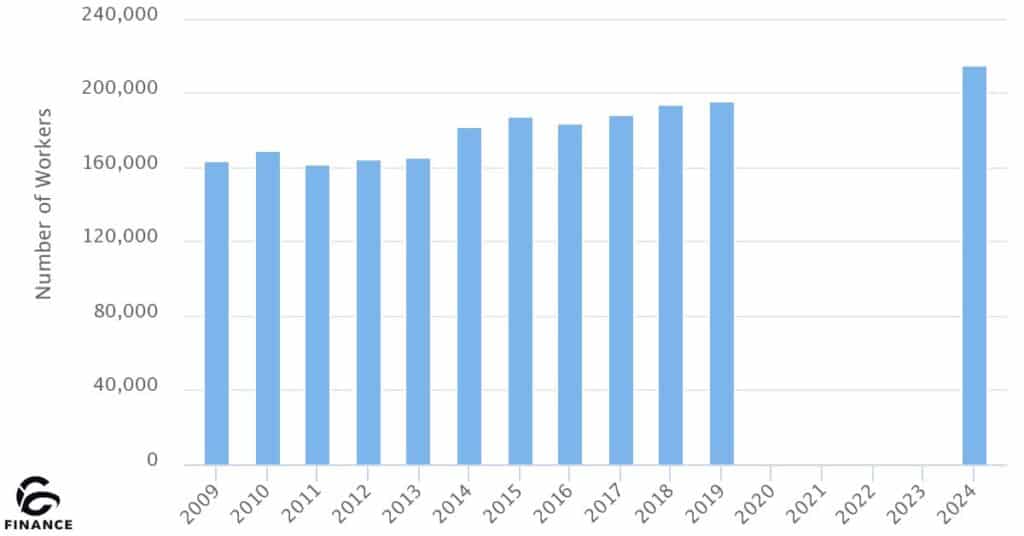

Job outlook for Chartered Accountants (CAs) remains robust, with strong demand across various sectors. The median hourly salary for CAs in Canada was $38.46 in 2021, showcasing favorable remuneration. Additionally, between 2022 and 2031, an estimated 88,000 new jobs are projected in this field, indicating promising career opportunities.

Job Outlook

With the demand for financial expertise steadily increasing, the job outlook for Chartered Professional Accountants (CPAs) remains promising.

- CPAs possess skills highly sought after in both national and international markets.

- The profession offers opportunities for continuous growth and career advancement.

- As businesses continue to rely on financial professionals for informed decision-making, CPAs can expect a steady stream of job opportunities.

In Canada, CPAs can anticipate a median salary of $67,805 per year, with potential for higher earnings based on experience, industry, and location. Moreover, the 2019 CPA Member Compensation Survey reveals a median compensation of $112,000, with experienced CPAs earning up to $130,000 after 25 years in the field.

Salary for Chartered Accountants (CAs)

Chartered Accountants (CAs) command competitive salaries in various industries.

- CAs earn some of the highest salaries in accounting.

- Salaries vary based on experience, location, and industry.

- Median salary for CAs in Canada was $67,805 per year in 2019.

These professionals play a vital role in ensuring the financial health of organizations.

Chartered Accountant (CA) vs. Certified Public Accountant (CPA)

Chartered Accountant (CA) and Certified Public Accountant (CPA) are two prestigious designations in the field of accounting, each with its own unique characteristics and requirements.

Differences in Designation

- CA designation is recognized internationally, while CPA is specific to the United States.

- CA designation has a longer history, originating in Scotland nearly 200 years ago.

- CPA designation was created in 2014 in Canada by consolidating three previous designations.

Educational Requirements

- CA designation typically requires a university degree in accounting or finance.

- CPA designation may have varying educational requirements depending on the jurisdiction.

- Both designations require passing rigorous examinations to demonstrate proficiency in accounting principles.

Professional Opportunities

- CAs often hold positions such as CFO, controller, or consultant.

- CPAs can also work in various roles, including public accounting, corporate finance, or government agencies.

- Both designations offer opportunities for career advancement and specialization in different areas of accounting.

What’s the Difference Between a Chartered Accountant and a Certified Public Accountant?

Distinguishing Chartered Accountants from Certified Public Accountants

Chartered Accountants (CAs) and Certified Public Accountants (CPAs) are two prestigious titles in the field of accounting, each with its own distinct features. Understanding the differences between these designations is crucial for those navigating the financial realm.

Key Differences

- Designation Origins: CAs trace their roots back to Scotland in the 19th century, while CPAs are primarily associated with the United States.

- International Recognition: While CAs are recognized globally, CPAs hold significance mainly within the United States.

- Professional Bodies: CAs may belong to various organizations worldwide, such as the Institute of Chartered Accountants in England and Wales, whereas CPAs are governed by state-specific boards within the U.S.

- Reciprocity Agreements: Some CA institutions have reciprocity agreements with the U.S., allowing CAs to work as CPAs after passing specific exams.

- Educational Paths: The pathways to becoming a CA or CPA may differ based on the country’s regulations and educational requirements.

How Do I Become a Chartered Accountant?

Becoming a Chartered Accountant is a rewarding journey that requires dedication and perseverance. Here are five essential steps to kickstart your path to becoming a Chartered Accountant

- Obtain a relevant undergraduate degree in accounting, finance, or a related field.

- Enroll in the CPA Professional Education Program (PEP), which includes completing six core modules, two elective modules, and two capstone modules.

- Gain practical experience through a recognized training program or relevant work experience.

- Prepare for and pass the CPA Common Final Examination (CFE), a comprehensive three-day examination.

- Apply for your CPA designation once you’ve completed all requirements and passed the examination.

Embarking on this journey will open up opportunities for a fulfilling career in accounting and finance, where you can make a significant impact in various industries and sectors.

What Is the Job Outlook for Accountants and How Much Do They Earn?

Job Outlook and Salary for Accountants

In the ever-evolving landscape of accounting, professionals can expect a promising job outlook. With a projected 6% growth between 2021 and 2031, the field offers steady opportunities for employment.

Salary prospects for accountants are also noteworthy. In 2021, the median annual salary for accountants and auditors was $77,250 in the United States, reflecting a competitive compensation package for those in the industry.

Key Points

- Strong Job Growth: The accounting field is expected to see a 6% increase in job opportunities from 2021 to 2031.

- Competitive Salary: Accountants and auditors earned a median annual salary of $77,250 in 2021, indicating favorable compensation prospects.

- Steady Demand: The demand for accounting professionals remains steady, offering stability and growth potential in the industry.

- Diverse Opportunities: Accountants have opportunities in various sectors, including public accounting, corporate finance, government agencies, and non-profit organizations.

- Continuous Learning: To stay competitive, accountants should prioritize continuous learning and skill development to adapt to changing industry trends and regulations.

How to become a CPA

Becoming a CPA is a rewarding journey that opens doors to various opportunities in the financial world. This prestigious designation signifies expertise in accounting, auditing, and taxation. To embark on this path, aspiring CPAs must fulfill specific educational, experiential, and examination requirements.

Education:Obtain an undergraduate degree in a relevant field such as accounting, finance, or business administration.

CPA Professional Education Program (PEP):Enroll in and complete the CPA PEP, a graduate-level program designed to equip candidates with essential skills and knowledge.

Practical Experience:Gain 30 months of practical experience in accounting under the guidance of a CPA mentor.

Common Final Examination (CFE):Successfully pass the rigorous three-day CFE, which tests candidates’ proficiency in various accounting competencies.

CPA Designation:Upon fulfilling all requirements, earn the coveted CPA designation, signifying expertise and professionalism in the accounting field.

Read As:HOW MUCH DOES AN ACCOUNTANT COST?

Research CPA requirements in your regio

Understanding the CPA requirements in your region is crucial for aspiring accountants. Researching these criteria ensures you’re on the right path to becoming a Chartered Professional Accountant (CPA). Below are five key points to consider when navigating the CPA journey in your area:

Educational Prerequisites

- Determine the specific educational requirements needed to pursue the CPA designation.

- Identify any prerequisite undergraduate degrees or coursework necessary for admission to the CPA Professional Education Program (PEP).

CPA Professional Education Program (PEP)

- Learn about the structure and components of the CPA PEP, the graduate-level program for CPA candidates.

- Explore the various modules, including core, elective, and capstone modules, required for completion.

Practical Experience Requirements (PER)

- Understand the importance of gaining practical experience as part of the CPA certification process.

- Discover the duration and nature of the practical experience required to qualify for the CPA designation.

Common Final Examination (CFE)

- Prepare for the CPA Common Final Examination (CFE), a comprehensive three-day exam assessing candidates’ accounting knowledge and skills.

- Learn about the format, content, and expectations of the CFE to effectively study and succeed in the examination.

Application Process

- Familiarize yourself with the application process for obtaining the CPA designation in your region.

- Ensure you meet all eligibility requirements and submit the necessary documentation accurately and timely.”

Understanding these key points will help you navigate the path to becoming a Chartered Professional Accountant in your region effectively.

Earn a bachelor’s degree and master’s degree

Becoming a Chartered Professional Accountant

To embark on the journey of becoming a Chartered Professional Accountant (CPA), the first step is to earn a bachelor’s degree in a relevant field such as accounting, finance, or business administration.

Following the completion of your undergraduate studies, you can pursue a master’s degree to further enhance your knowledge and expertise in accounting principles and practices.

Once your academic foundation is established, you can apply for admission to the CPA Professional Education Program (PEP), where you will undergo rigorous training and education to prepare for the CPA designation.

CPA Professional Education Program (PEP)

The CPA Professional Education Program (PEP) is a comprehensive graduate-level program designed to equip aspiring accountants with the necessary skills and knowledge to excel in the field of accounting.

Through a series of core modules, elective modules, and capstone modules, candidates enrolled in the PEP gain practical experience and theoretical understanding in various aspects of accounting, auditing, and taxation.

Upon successful completion of the PEP and meeting the Practical Experience Requirements (PER), candidates are eligible to sit for the Common Final Examination (CFE), the final step in obtaining the prestigious CPA designation.

Key Points

- Earn a bachelor’s degree in accounting, finance, or business administration.

- Pursue a master’s degree to further enhance your expertise.

- Apply for admission to the CPA Professional Education Program (PEP).

- Complete core modules, elective modules, and capstone modules.

- Sit for the Common Final Examination (CFE) to obtain the CPA designation.

Complete experience requirements

Becoming a Chartered Professional Accountant (CPA) involves fulfilling experience requirements, ensuring proficiency in various accounting tasks.

Experience Requirements

- Gain practical experience through hands-on accounting work.

- Complete internships or co-op programs to gain real-world exposure.

- Obtain experience in areas such as financial reporting, audit, taxation, and management accounting.

- Work under the supervision of experienced CPAs to develop skills and knowledge.

- Fulfill specific requirements set by CPA Canada to meet experience criteria.

Meeting experience requirements is essential for aspiring CPAs to gain the necessary skills and expertise in accounting practice. It prepares them for the challenges and responsibilities they will face in their professional careers.

Gather crucial skills

Becoming a Chartered Professional Accountant (CPA) involves acquiring crucial skills that are essential for success in the field. Here are five key skills that aspiring CPAs need to develop:

Technical Expertise: CPAs must have a strong understanding of accounting principles, tax regulations, and financial reporting standards.

Analytical Skills: They need to analyze complex financial data, identify trends, and make informed decisions based on their findings.

Communication Skills: CPAs must be able to effectively communicate financial information to clients, colleagues, and stakeholders in a clear and concise manner.

Ethical Integrity: Integrity and ethical behavior are paramount for CPAs, as they handle sensitive financial information and must adhere to professional standards and regulations.

Problem-Solving Abilities: CPAs encounter various challenges in their work, and they must be able to develop creative solutions to solve problems and meet the needs of their clients.

Are you considering taking the CPA exam?

It’s a crucial step towards becoming a Chartered Professional Accountant (CPA) in Canada. This exam is a rigorous assessment designed to test your knowledge, skills, and readiness for the accounting profession.

Here are five key points to know about the CPA exam

Exam Structure: The CPA exam consists of multiple parts, covering various accounting and finance topics.

Preparation: Success on the CPA exam requires thorough preparation, including studying textbooks, taking practice tests, and attending review courses.

Testing Centers: The exam is administered at designated testing centers across Canada, providing a convenient and controlled environment for candidates.

Time Management: Managing your time effectively during the exam is essential, as each section has a strict time limit.

Passing Criteria: To pass the CPA exam, candidates must achieve a minimum score on each section, demonstrating proficiency in accounting principles and practices.

Receive and maintain certification

Essential Steps to Becoming a Chartered Professional Accountan

Earning the prestigious Chartered Professional Accountant (CPA) designation involves completing a rigorous process that demonstrates your expertise in accounting, auditing, and taxation.

To embark on this journey, aspiring CPAs must first obtain the prerequisite undergraduate degree in a relevant field and then apply for admission to the CPA Professional Education Program (PEP).

Throughout the process, candidates will undergo comprehensive education, gain practical experience, and ultimately pass the CPA Common Final Examination (CFE) to receive their certification and embark on a rewarding career in accounting.

What Is a CPA License?

CPA License Explained

A CPA license is a professional designation that signifies expertise in accounting, auditing, and taxation.To earn a CPA license, individuals must fulfill education, experience, and examination requirements set by relevant authorities.

Key requirements for obtaining a CPA license include completing a bachelor’s degree, passing the CPA exam, and gaining practical experience.

Key Benefits of Holding a CPA License

- Demonstrates expertise in accounting, auditing, and taxation.

- Opens up career opportunities in various industries and sectors.

- Provides credibility and trustworthiness to clients and employers.

- Allows for the signing of tax returns and audit reports.

- Requires ongoing professional development to maintain licensure.

Understanding CPA Salaries: What You Need to Know

Wondering about the salary potential for Certified Professional Accountants (CPAs)? Let’s dive into the numbers.

CPAs command competitive salaries in today’s job market, with earnings varying based on factors like experience, location, and industry.The median annual salary for CPAs in Canada is reported to be $67,805, with figures influenced by diverse factors such as years of experience and specific job roles.

Beyond the median, CPAs with significant experience or specialized expertise can earn substantially higher salaries, often reaching six-figure sums. It’s a profession with lucrative potential for those willing to invest in their education and skills.

key points

- Salary variations influenced by factors like experience, location, and industry

- Median annual salary for CPAs in Canada reported at $67,805

- Potential for higher earnings with significant experience or specialized expertise

- Lucrative opportunities available for CPAs willing to invest in education and skills

- CPAs command competitive salaries in today’s job market

Is Insurance Mandatory for CPAs in Canada

Insurance Requirements for CPAs in Canada

CPAs in Canada are required to have professional liability insurance, also known as errors and omissions (E&O) insurance. This insurance safeguards against lawsuits arising from negligence or failure to provide services as promised.

Key Points Regarding Insurance for CPAs

- Professional liability insurance, or E&O insurance, is mandatory for CPAs engaged in public accounting services.

- Minimum prescribed amounts of insurance may vary, but typically range from $1 million per claim for a single CPA to $2 million for firms with four or more CPAs.

- CPAs or their firms are responsible for providing proof of coverage to the CPA organization in their province.

- Failure to provide proof of coverage can result in suspension or deregistration of the firm and revocation of membership for the firm representative.

- CPAs must ensure their insurance coverage meets regulatory requirements and protects against potential liabilities.

How to Get Accountant Insurance in Canada?

Getting accountant insurance in Canada is crucial for safeguarding against potential liabilities. Here’s a quick guide to help you navigate the process:

Key Steps to Obtain Accountant Insurance in Canada

- Research insurance providers and coverage options.

- Compare quotes and policies to find the best fit for your needs.

- Consider factors like coverage limits, deductibles, and additional protections.

- Ensure the policy meets regulatory requirements and protects against professional liabilities.

- Complete the application process, including providing necessary information and paying premiums.

- Remember, accountant insurance provides essential protection for your practice, so it’s essential to choose the right coverage for peace of mind.

What is chartered professional accountant course?

Becoming a Chartered Professional Accountant (CPA) opens doors to a rewarding career in finance and accounting. This comprehensive course equips individuals with the knowledge and skills needed to excel in various accounting roles. Let’s explore the key aspects of the CPA course.

Course Overview

Rigorous Training: The CPA course offers rigorous training in accounting principles, financial analysis, taxation, and auditing.

Professional Accreditation: Upon completion, graduates earn professional accreditation, enhancing their credibility in the industry.

Diverse Career Opportunities: CPAs have access to diverse career opportunities, ranging from public accounting firms to corporate finance departments.

Prestigious Designation: Attaining the CPA designation is a mark of excellence, signifying expertise and commitment to the highest professional standards.

Career Advancement:

Competitive Edge: CPAs gain a competitive edge in the job market, with employers valuing their expertise and accreditation.

Leadership Roles: Graduates are prepared for leadership roles, such as CFO, controller, or financial consultant.

Global Recognition: The CPA designation is globally recognized, offering opportunities for international career advancement.

Continuous Learning: CPAs engage in continuous learning to stay updated with evolving industry trends and regulations.

By embarking on the Chartered Professional Accountant course, individuals pave the way for a successful and fulfilling career in accounting and finance.

What is chartered professional accountant job description?

The job description of a Chartered Professional Accountant (CPA) encompasses diverse financial roles essential for business success. From financial statement auditing to strategic financial planning, CPAs play a pivotal role in ensuring fiscal integrity and informed decision-making.

Roles and Responsibilities

Financial Statement Auditing

- Ensuring accuracy and compliance with regulations.

- Identifying discrepancies and recommending corrective actions.

Strategic Financial Planning

- Developing long-term financial strategies.

- Allocating resources effectively to meet organizational goals.

Tax Planning and Compliance

- Minimizing tax liabilities for individuals and businesses.

- Ensuring compliance with tax laws and regulations.

Management Accounting

- Analyzing financial data to support managerial decision-making.

- Budgeting, forecasting, and monitoring financial performance.

Advisory Services

- Providing expert financial advice to clients.

- Assisting in investment decisions and risk management strategies.

Frequently Asked Questions

What is better CA or CPA?

The choice between CA and CPA depends on career goals and geographical preferences, with both designations offering unique opportunities and recognition in different regions.

What is the difference between CPA and CGA?

The main difference lies in the focus of the designations, with CPA encompassing broader accounting skills while CGA traditionally emphasizes management accounting and strategic financial planning.

What is CGA qualification?

The CGA (Certified General Accountant) qualification was a designation in the accounting field in Canada, focusing on management accounting and strategic financial planning. However, it has been merged into the CPA designation.

Is CPA equal to CA in Canada?

Yes, the CPA designation in Canada is equivalent to the CA (Chartered Accountant) designation, as it has absorbed the CA qualification under the unified CPA designation.

Is CPA Canada difficult?

Obtaining the CPA designation in Canada requires dedication and commitment due to rigorous education, examination, and experience requirements. However, with proper preparation and perseverance, it is achievable.

Can CPAs work internationally?

Yes, CPAs have the flexibility to work internationally due to the global recognition of the designation. However, specific licensing requirements may vary depending on the country of practice.

Does Canada accept CPA?

Yes, Canada recognizes the CPA (Chartered Professional Accountant) designation, which has become the unified accounting designation replacing previous qualifications such as CA, CGA, and CMA.

Final Thoughts

A Chartered Professional Accountant (CPA) is a highly skilled financial expert who plays a crucial role in various aspects of accounting and financial management. With expertise in areas such as auditing, taxation, financial planning, and advisory services, CPAs contribute significantly to the success and integrity of businesses and organizations.

Their rigorous training and commitment to ethical standards ensure that they provide valuable insights and guidance to clients, helping them navigate complex financial landscapes with confidence. Whether it’s preparing financial statements, analyzing data, or offering strategic advice, CPAs are trusted professionals who uphold the highest standards of professionalism and integrity in their work.

Overall, the role of a Chartered Professional Accountant is indispensable in today’s dynamic and competitive business environment, making them essential partners in financial decision-making and organizational success.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.