Settlers Life Insurance offers various policies tailored to your needs.Whether you’re protecting your family’s future or planning for retirement, they’ve got you covered. With options like whole life, term life, and annuities, finding the right fit is easy.

Premiums are affordable and designed to fit your budget. Settlers Life Insurance understands that financial security shouldn’t break the bank. Plus, they offer flexible payment options to make managing your policy hassle-free.

Settlers Life Insurance offers a range of policies to suit your needs, from whole life to term life and annuities.Their coverage ensures your family’s financial security, providing peace of mind.Premiums with Settlers Life Insurance are affordable, fitting within your budget.

What does Settlers Life Insurance offer?

Settlers Life Insurance provides various coverage options tailored to your needs. Whether you’re looking for whole life, term life, or annuities, they have you covered.

Their policies ensure financial security for your family, offering peace of mind during uncertain times. With Settlers, you can trust that your loved ones will be taken care of.

In addition to coverage, Settlers Life Insurance offers flexible payment plans to suit your budget. Their dedicated customer service team is always ready to assist you with any inquiries or concerns.

How much is a Settlers life insurance policy?

When considering a Settlers life insurance policy, the cost varies based on factors like coverage amount, age, and health status. It’s essential to assess your needs and budget before selecting a policy.

Settlers offers competitive premiums designed to fit different financial situations, ensuring affordability for their policyholders. They provide transparent pricing structures, allowing you to make informed decisions about your coverage.

Settlers Life Insurance offers flexible payment options, making it easier to manage your policy premiums according to your financial capabilities. Their goal is to provide accessible and reliable coverage to meet your needs without breaking the bank.

Does Settlers have good ratings and reviews?

Settlers Life Insurance boasts favorable ratings and positive reviews from satisfied customers. Their commitment to quality service and reliable coverage has earned them recognition in the insurance industry.

Customers appreciate Settlers’ prompt and efficient claims processing, providing peace of mind during challenging times. Their dedication to customer satisfaction reflects in the glowing testimonials shared by policyholders.

Does Settlers have good ratings and reviews?

Settlers Life Insurance has garnered positive ratings and reviews from reputable sources in the insurance industry. These ratings reflect the company’s commitment to customer satisfaction and financial stability.

With high marks for reliability and customer service, Settlers has earned the trust of policyholders seeking dependable coverage and support. Their consistent performance speaks volumes about their dedication to meeting clients’ needs

Can a policy be altered?

Policyholders have the flexibility to alter their insurance policies with Settlers Life Insurance to better suit their evolving needs.

This adjustment capability allows customers to modify coverage levels, beneficiaries, and other policy details as their circumstances change over time.

Whether it’s increasing coverage to accommodate life changes or updating beneficiary information, Settlers offers policyholders the opportunity to make necessary alterations with ease.

Read as:CVS MINUTE CLINIC BILL PAY-ONLINE, PRICES & CUSTOMER SUPPORT

What happens if the policy document is lost

If the policy document is lost, it’s important to contact Settlers Life Insurance immediately to report the situation. They will guide you through the necessary steps to replace the lost document and ensure that your coverage remains valid.

You may need to provide certain information, such as your policy number and personal details, to expedite the process of replacing the lost document. Settlers’ customer service team is equipped to assist you promptly and efficiently in resolving this issue.

Once the lost policy document is replaced, it’s advisable to store the new document securely and keep a backup copy in case of future emergencies. This ensures that you always have access to the important details of your insurance coverage whenever you need them.

What is the maximum period in which a lapsed policy can be revived?

When a policy lapses, there’s typically a grace period during which it can be reinstated. The maximum period for reinstatement after a lapsed policy varies depending on the insurance provider and the terms of the policy.

During this grace period, policyholders may have the opportunity to reinstate their lapsed policy by paying any outstanding premiums and fees. This window of time allows individuals to rectify missed payments and maintain their coverage without losing the policy’s benefits.

However, it’s essential for policyholders to act promptly within the grace period to reinstate their lapsed policy, as the length of this period can vary and may not extend indefinitely. Taking swift action ensures that coverage is maintained and potential gaps in protection are avoided.

Can a life insurance policy be sold?

Yes, life insurance policies can be sold through a process known as life settlement or viatical settlement. In a life settlement, the policyholder sells their policy to a third party for a lump sum cash payment. This option provides immediate liquidity for policyholders who no longer need or can afford their insurance coverage.

The buyer of the policy becomes the new beneficiary and assumes responsibility for paying future premiums. Life settlements are typically sought by individuals who no longer need the coverage, have difficulty paying premiums, or require funds for medical expenses or other financial needs. This option allows policyholders to unlock the value of their life insurance while they are still alive.

What happens when a policy is lost?

When a policy is lost, it’s essential to take immediate action to ensure coverage isn’t compromised. Contacting the insurance provider promptly is the first step to address the situation and prevent any potential gaps in coverage.

Once notified, the insurance company will guide the policyholder through the necessary steps to replace the lost policy. This typically involves completing paperwork and providing relevant information to verify identity and ownership of the policy.

After the required procedures are followed, the insurance company will issue a new policy document to the policyholder, restoring their coverage and ensuring they remain protected against unforeseen events. It’s crucial to keep track of insurance documents to avoid future issues and maintain uninterrupted coverage.

Can a lapsed policy be revived?

If a policy has lapsed due to non-payment, it may be possible to revive it. Policyholders should contact their insurance provider to inquire about the specific requirements and procedures for reinstating a lapsed policy.

Typically, the insurer will require the payment of outstanding premiums along with any applicable fees or penalties. Additionally, some companies may request updated medical information or require a new application for reinstatement.

Once the necessary steps have been completed and any outstanding payments are made, the policy can be revived, providing the policyholder with continued coverage and protection. It’s essential to act promptly to avoid permanent loss of coverage and ensure financial security for the future.

How are premiums on life policies calculated?

Life insurance premiums are calculated based on various factors, including the policyholder’s age, health status, and lifestyle habits. Younger individuals typically pay lower premiums compared to older individuals due to the lower risk of mortality.

Furthermore, factors such as smoking status, occupation, and medical history can influence premium rates. Those with risky occupations or pre-existing health conditions may face higher premiums to offset the increased likelihood of a payout.

Is life insurance a saving instrument?

Life insurance serves primarily as a financial protection tool for your loved ones in case of your untimely demise. It is not designed as a savings instrument but rather as a means to provide a lump sum payment to beneficiaries upon the insured individual’s death.

Unlike savings accounts or investment options, life insurance policies do not accumulate substantial cash value over time. While some policies may offer a cash value component, it is typically minimal compared to dedicated savings or investment vehicles.

Therefore, individuals seeking to build wealth or save for specific goals may find other financial instruments more suitable, such as retirement accounts or investment portfolios. Life insurance should be viewed primarily as a risk management tool rather than a vehicle for saving or investing.

How is a life insurance policy useful?

A life insurance policy offers financial protection to your loved ones in the event of your death. It provides a lump sum payment, known as the death benefit, to your beneficiaries, ensuring they can maintain their financial stability after you’re gone.

What loans are available against life insurance policies?

With life insurance, you can cover various expenses such as mortgage payments, daily living costs, and educational expenses for your children. This financial support helps your family avoid financial hardships during a challenging time and allows them to maintain their quality of life.

Life insurance policies often offer the option for policyholders to take out loans against the cash value of their policies. These loans provide a convenient way for policyholders to access funds when needed, without surrendering their coverage.

The amount available for borrowing typically depends on the cash value accumulated within the policy over time. Policyholders can use these loans for various purposes, such as covering unexpected expenses, paying for education, or making home improvements.

Interest rates for these loans are generally lower than traditional bank loans, making them an attractive option for policyholders looking for financial flexibility. Repayment terms are flexible, allowing policyholders to repay the loan according to their financial situation and preferences.

Who is eligible for Policy Loan?

Policy loans are available to eligible policyholders who have built up sufficient cash value in their life insurance policy. These loans offer a convenient way for policyholders to access funds in times of need without surrendering their policy.

To be eligible for a policy loan, policyholders must meet certain criteria set by the insurance company, such as having a minimum cash value and maintaining their policy in good standing.Eligibility requirements may vary depending on the terms of the policy and the insurance provider.

Once eligible, policyholders can apply for a policy loan directly through their insurance company, typically with a simple application process and quick approval. These loans provide flexibility and financial security to policyholders, allowing them to access funds when unexpected expenses arise.

What is the procedure to get a Loan?

To obtain a loan, start by researching different lenders to find one that suits your needs and offers favorable terms. Once you’ve chosen a lender, you’ll need to complete an application form, providing details about your personal and financial situation.

After submitting your application, the lender will review it along with your credit history to assess your eligibility for the loan. They may also request additional documentation, such as proof of income or identification, to verify the information provided.

If your application is approved, the lender will present you with a loan offer detailing the terms and conditions, including the loan amount, interest rate, and repayment schedule. Review the offer carefully before accepting it, and once you agree, the funds will be disbursed to you according to the agreed-upon terms.

What is the rate of interest for the policy loan?

The rate of interest for policy loans with Settlers Life Insurance typically varies based on the terms of the policy and prevailing market conditions. It is essential to review your specific policy documents to determine the exact interest rate applicable to your loan.

Policyholders should consult with Settlers representatives or refer to their policy documentation to understand the terms and conditions associated with taking out a loan against their life insurance policy. This ensures clarity regarding the interest rate and any other relevant details before proceeding with a loan request.

Understanding the interest rate for policy loans is crucial for policyholders to make informed decisions about their financial options.

How to repay the loan amount?

To repay the loan amount, you can choose from various convenient options provided by Settlers Life Insurance. One common method is through regular monthly payments, allowing you to gradually pay off the loan over time.

Alternatively, you may opt for lump-sum payments if you prefer to settle the loan amount in one go. This approach offers the advantage of clearing the debt quickly, minimizing interest charges, and providing peace of mind.

Another option is to set up automatic deductions from your bank account, ensuring timely repayment without the hassle of manual transactions. This method helps you stay on track with your loan obligations and avoid potential late fees.

What happens if the loan is not repaid?

If the loan from Settlers Life Insurance is not repaid, it can impact the policy’s cash value and death benefit. Failure to repay the loan can lead to a reduction in the policy’s value over time.

Unpaid loans may also accrue interest, increasing the amount owed and potentially affecting the financial security of the policyholder’s beneficiaries. It’s essential to carefully manage and repay any loans taken against a life insurance policy to maintain its intended benefits.

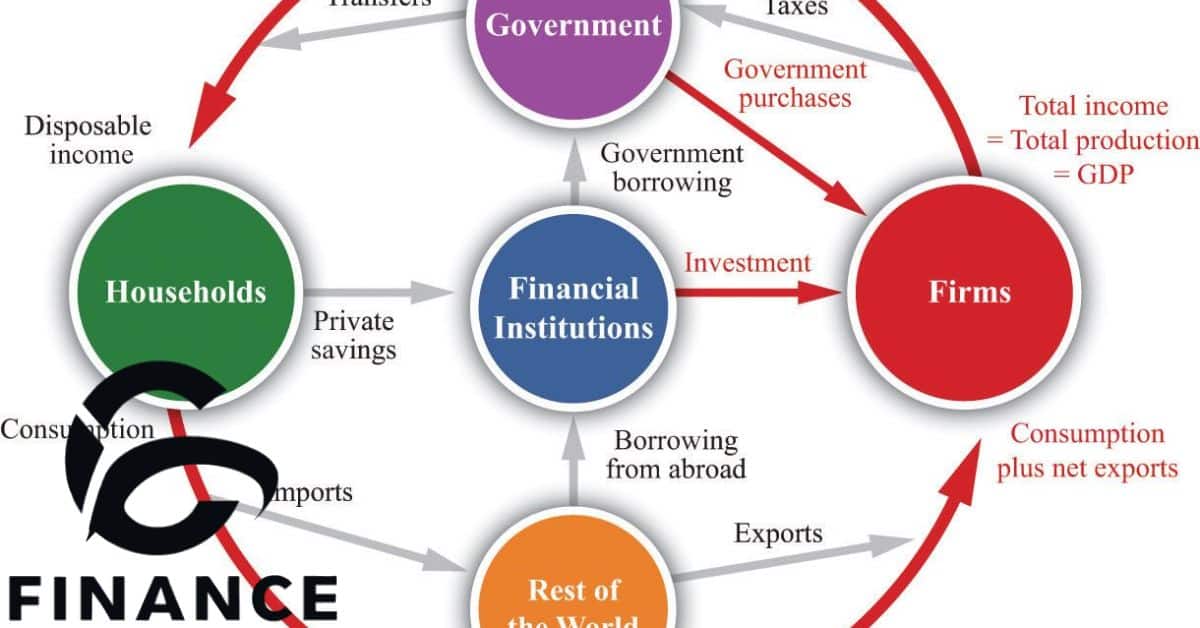

What is reinsurance?

Reinsurance is a risk management strategy used by insurance companies to transfer portions of their risk portfolios to other insurers, known as reinsurers.

In reinsurance agreements, the primary insurer (ceding company) pays a premium to the reinsurer in exchange for sharing the financial responsibility of potential claims.

This process helps insurance companies mitigate their exposure to large losses, ensuring financial stability and enabling them to underwrite more policies with confidence.

What is underwriting?

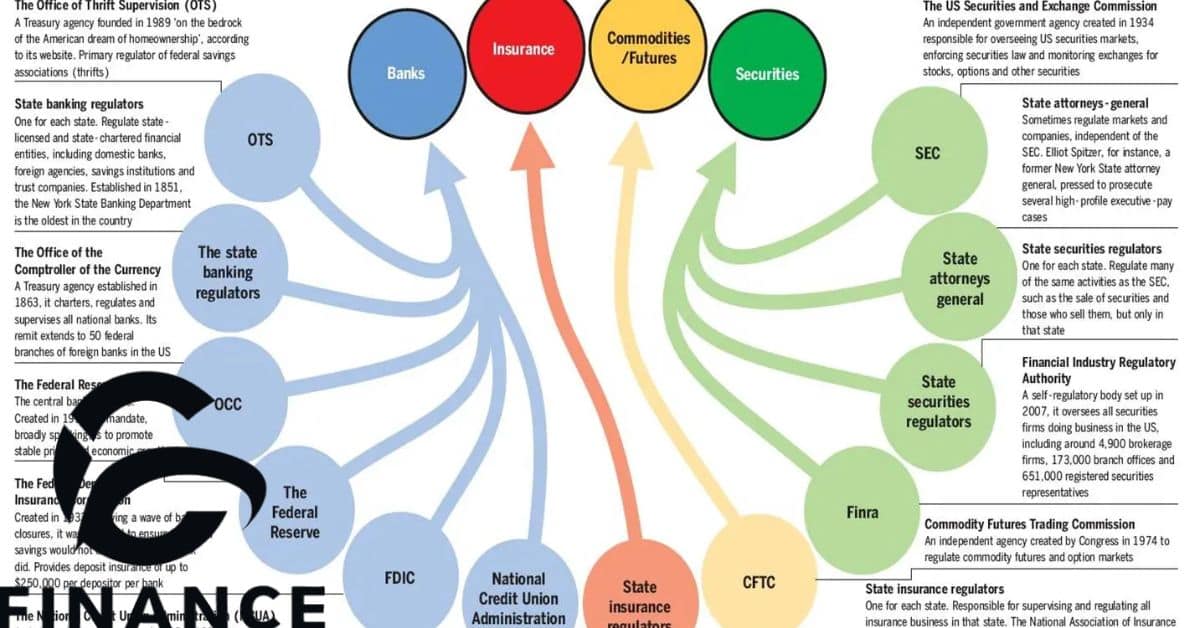

Underwriting in the context of insurance refers to the process of evaluating and assessing risks associated with insuring an individual or entity.

During underwriting, insurance companies analyze various factors such as age, health history, lifestyle, and occupation to determine the level of risk involved in providing coverage.

Based on this assessment, underwriters decide whether to approve the application for insurance, determine the premium rates, and establish the terms and conditions of the policy.

What are some of the factors that affect life insurance premium?

Several factors determine life insurance premiums. Age is crucial, with younger individuals usually paying less. Health status plays a significant role; poor health can lead to higher premiums. Lifestyle habits, like smoking, may also impact the premium amount.

Additionally, coverage amount and policy type influence premiums. Factors such as occupation, hobbies, and family medical history are considered as well. Understanding these factors helps in selecting the right insurance coverage.

What is a life insurance policy that has premiums fully paid up?

A life insurance policy with fully paid-up premiums means that the policyholder has completed all required premium payments. Once paid, the policy remains in force for the duration specified in the contract without the need for further payments.

This type of policy offers peace of mind, as the insured does not have to worry about future premium obligations. Fully paid-up policies often provide lifelong coverage and may include additional benefits such as cash value accumulation over time.

How long do you have to pay life insurance premiums?

Life insurance premiums typically need to be paid regularly for the duration of the policy. The payment period can vary based on the policy type and terms. Some policies require premiums to be paid until a certain age, such as 65 or 70. Others have fixed payment periods, like 10, 20, or 30 years.

Life insurance premiums are often tailored to suit the policyholder’s preferences and financial circumstances. They can be paid monthly, quarterly, semi-annually, or annually, offering flexibility in managing expenses. Choosing the right payment frequency can help ensure timely premium payments, maintaining the policy’s validity and providing financial security for loved ones in the long run.

Which of the following is the least expensive mode of premium payment?

Among the options available, annual premium payments are typically the least expensive. This mode requires a single payment annually, reducing administrative costs. On the other hand, semi-annual payments involve two payments per year, resulting in slightly higher overall costs due to increased administrative efforts.

The monthly premium payment mode tends to be the most expensive choice. It involves twelve payments per year, which can increase administrative costs significantly.

While it offers the convenience of spreading payments across the year, it may not be the most economical option for policyholders due to the higher frequency of transactions and associated administrative expenses.

Quarterly payments, requiring four payments annually, incur even more administrative expenses, making them pricier compared to annual payments.

What is Automatic Non-Forfeiture Options?

Automatic Non-Forfeiture Options are features included in life insurance policies that provide policyholders with alternatives if they stop paying premiums. These options ensure that policyholders receive some value from their policies even if they can no longer afford to pay.

One common Automatic Non-Forfeiture Option is the Reduced Paid-Up Insurance, where the policy continues with a reduced death benefit but no further premiums are required. This allows policyholders to maintain coverage without ongoing payments, albeit at a decreased benefit amount.

Another option is Extended Term Insurance, where the cash value of the policy is used to purchase term insurance for the same face amount as the original policy. This provides coverage for a specified period without additional premium payments, offering flexibility to policyholders facing financial challenges.

What Are the Different Life Insurance Policies?

Life insurance policies come in various types, each offering unique features and benefits tailored to different needs. Among the most common types are whole life, term life, and universal life insurance policies.

Whole life insurance provides coverage for the entirety of one’s life and includes a savings component, offering stability and long-term financial protection.

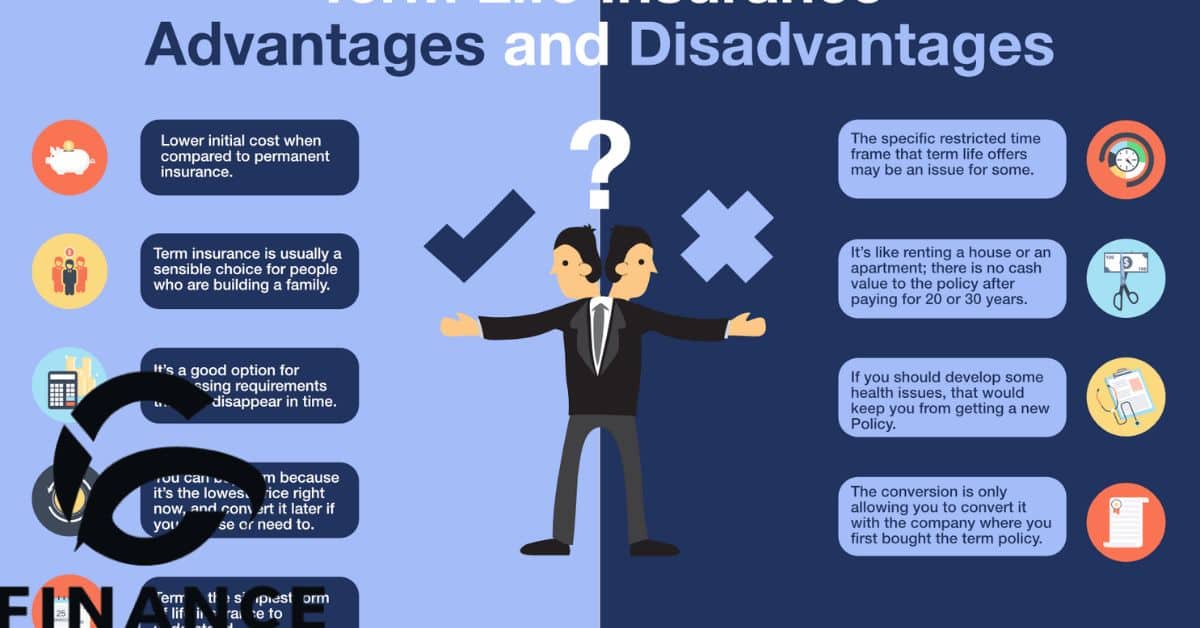

Term life insurance, on the other hand, offers coverage for a specified period, typically ranging from one to 30 years, providing affordable protection for temporary needs such as mortgages or children’s education.

What is Whole Life Insurance?

Whole Life Insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a death benefit as well as a cash value component that accumulates over time.

The premiums for Whole Life Insurance are typically fixed, meaning they remain consistent throughout the life of the policy. This stability provides policyholders with predictability and peace of mind regarding their coverage and financial planning.

One of the key features of Whole Life Insurance is its cash value component, which grows tax-deferred over time. This cash value can be accessed by the policyholder through loans or withdrawals, offering a source of financial flexibility and potential additional funds for various needs.

What is Universal Life Insurance?

Universal Life Insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. Policyholders can adjust their coverage and premium payments based on their financial needs and goals.

Unlike term life insurance, which covers a specific period, universal life insurance provides coverage for the policyholder’s entire life, as long as premiums are paid. This makes it a suitable option for long-term financial planning and protection.

With Universal Life Insurance, a portion of the premium payments goes into a cash value account, which earns interest over time. This cash value can be accessed by the policyholder during their lifetime for various financial needs, such as emergencies or supplemental income.

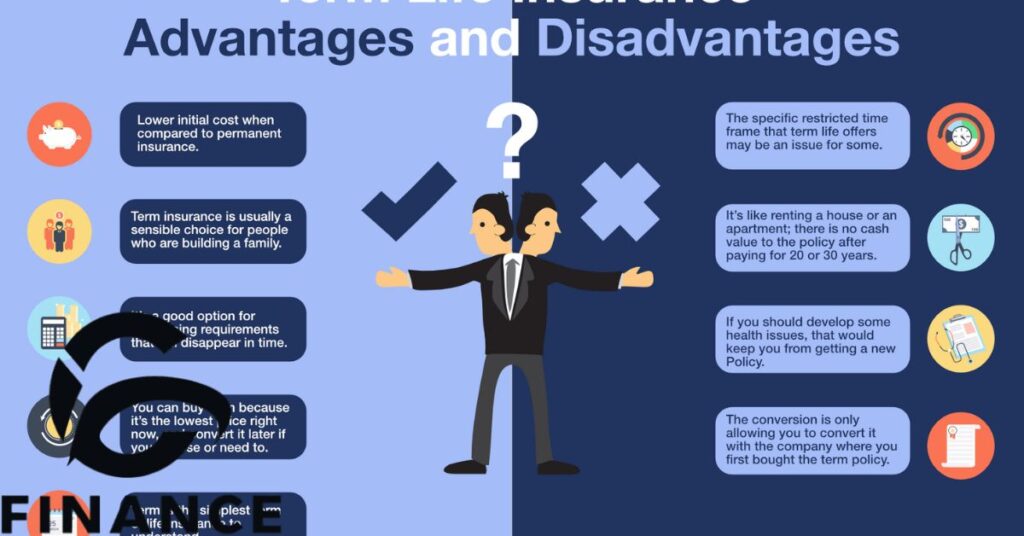

What is Term Life Insurance?

Term life insurance provides coverage for a specific period, typically ranging from one to 30 years. During this term, if the policyholder passes away, their beneficiaries receive a death benefit.

Unlike whole life insurance, term life policies do not accumulate cash value over time. Instead, they offer straightforward coverage at affordable rates, making them an attractive option for many individuals.

Term life insurance is often chosen by those who want to ensure financial protection for their loved ones during critical periods, such as while paying off a mortgage or supporting dependents through their education.

What are Annuities?

Annuities are financial products designed to provide a steady income stream during retirement years. They function as investment contracts, offering benefits for outliving your financial assets and ensuring financial security in old age.

Individuals pay into annuities over time, with funds earning interest, either fixed or variable, tax-deferred. These earnings can provide ongoing income, acting as a form of retirement pension.

Upon death, annuities can provide a death benefit to beneficiaries, ensuring financial support even after the annuitant’s passing. These features make annuities a popular choice for individuals seeking long-term financial stability.

Final Thoughts

Settlers Life Insurance offers a range of policy options tailored to individual needs. Their coverage includes term, whole, and universal life insurance, providing flexibility for diverse financial situations.

Policyholders appreciate Settlers‘ competitive premiums and customizable coverage, making it accessible for various budgets and preferences. With straightforward terms and transparent pricing, customers can easily understand their policies.

Moreover, Settlers prioritizes customer satisfaction, offering responsive support and hassle-free claims processing. Their commitment to reliability and service excellence sets them apart in the insurance industry, earning trust and loyalty from clients.

Frequently Asked Questions

Who can buy a life insurance policy?

Anyone over the age of 18 can typically purchase a life insurance policy, provided they meet the insurer’s health and eligibility criteria.

What is a Whole Life Policy?

A whole life policy offers coverage for the entire lifetime of the insured, with guaranteed premiums and a cash value component that accumulates over time.

What is an Endowment policy?

An endowment policy provides both life insurance coverage and a savings component, offering a lump sum payout at the end of a specified term or upon the insured’s death, whichever comes first.

What is a Three Payment Plan?

A Three Payment Plan is a life insurance policy that allows premiums to be paid over three installments, providing flexibility in payment options while maintaining coverage.

What is an Annuity Scheme?

An annuity scheme is a financial product that provides regular payments to the annuitant over a specified period, typically used as retirement income.

What are Medical and Non-Medical Schemes?

Medical schemes require a health evaluation for approval, while non-medical schemes offer coverage without the need for a medical examination, albeit with certain limitations.

What are the policies available for kids below the age of one year?

Policies like child plans or education plans are available for infants, ensuring financial security and future planning from an early age.

Is there any policy where the insured gets no money at the time of maturity?

Yes, term life insurance policies provide coverage only for a specific period, offering no payout if the insured survives beyond the policy term.

What is Bonus?

Bonus refers to additional benefits provided by insurance companies to policyholders, often as a share of the company’s profits, enhancing the policy’s overall value.

What are Survival Benefits?

Survival benefits are periodic payouts or benefits provided to the policyholder during the policy term, usually in the form of bonuses or dividends, based on the terms of the policy.

What are the various modes of payment for premium?

Premiums can typically be paid through modes such as online payment, bank transfer, cheque, or cash deposit at authorized centers, offering flexibility to policyholders.

What is Surrender Value?

Surrender value is the amount payable to the policyholder upon premature termination of the policy before its maturity, often less than the total premiums paid, accounting for administrative charges.

Whom is a death claim payable?

A death claim is payable to the nominee or beneficiary nominated by the policyholder, ensuring the seamless transfer of benefits to the intended recipient.

What is Nomination/ Assignment of a Policy?

Nomination is the process of appointing a person to receive policy benefits in the event of the policyholder’s death, while assignment involves transferring policy rights to another individual or entity.

How do you effect a change of address and transfer of policy records?

Policyholders can request changes to their address or transfer of policy records by submitting a written request along with supporting documents, ensuring accurate communication and record-keeping.

When does a policy lapse?

A policy lapses when the premium payment is not made within the grace period specified by the insurance company, resulting in the termination of coverage and forfeiture of benefits.

Howdy, editor at FinanceEon.com, brings over a decade of financial journalism experience. He ensures accuracy and insightful analysis, guiding a team on market trends and investment strategies.